Fill and Sign the Ups Scs Customer Cargo Claim Form

Convenient instructions for setting up your ‘Ups Scs Customer Cargo Claim Form’ online

Are you fed up with the burden of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and companies. Bid farewell to the monotonous routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign documents online. Take advantage of the robust features integrated into this user-friendly and budget-friendly platform and transform your approach to document handling. Whether you need to sign forms or collect signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Open your ‘Ups Scs Customer Cargo Claim Form’ in the editor.

- Click Me (Fill Out Now) to work on the document on your end.

- Add and designate fillable fields for additional participants (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you require collaboration with others on your Ups Scs Customer Cargo Claim Form or need to send it for notarization—our platform has you equipped with everything you need to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

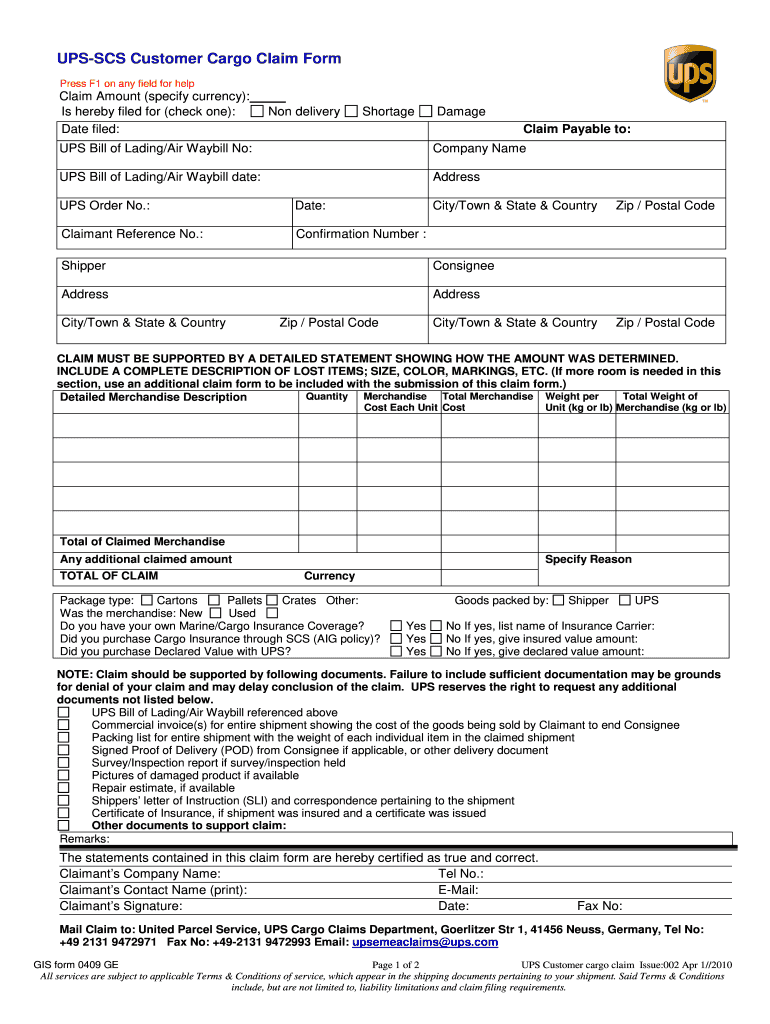

What is the Ups Claim Form and how can airSlate SignNow assist with it?

The Ups Claim Form is a document used by customers to file claims for lost or damaged packages. airSlate SignNow streamlines this process by allowing users to easily create, send, and eSign their Ups Claim Form digitally, ensuring quicker submission and processing.

-

How does airSlate SignNow simplify the completion of the Ups Claim Form?

With airSlate SignNow, users can fill out the Ups Claim Form online, eliminating the need for printing and scanning. The platform’s intuitive interface allows for quick data entry, and the eSignature feature enables users to sign the document effortlessly.

-

Is airSlate SignNow a cost-effective solution for managing the Ups Claim Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective solution for managing the Ups Claim Form. By digitizing your claims process, you can save on paper costs and reduce administrative overhead.

-

Can I integrate airSlate SignNow with other tools to manage my Ups Claim Form?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Dropbox. This integration capability allows you to manage your Ups Claim Form and related documents more efficiently, centralizing your workflow.

-

What features does airSlate SignNow offer for the Ups Claim Form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the Ups Claim Form. These features enhance user experience and ensure that your claims are processed swiftly and securely.

-

Is it easy to track the status of my Ups Claim Form with airSlate SignNow?

Absolutely! airSlate SignNow includes real-time tracking features that allow you to monitor the status of your Ups Claim Form. You’ll receive notifications when the document is viewed, signed, or completed, keeping you informed throughout the process.

-

What benefits can I expect from using airSlate SignNow for the Ups Claim Form?

Using airSlate SignNow for the Ups Claim Form provides numerous benefits, including increased efficiency, reduced processing time, and enhanced security. By digitizing the claims process, you can expedite submissions and minimize errors.

Find out other ups scs customer cargo claim form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles