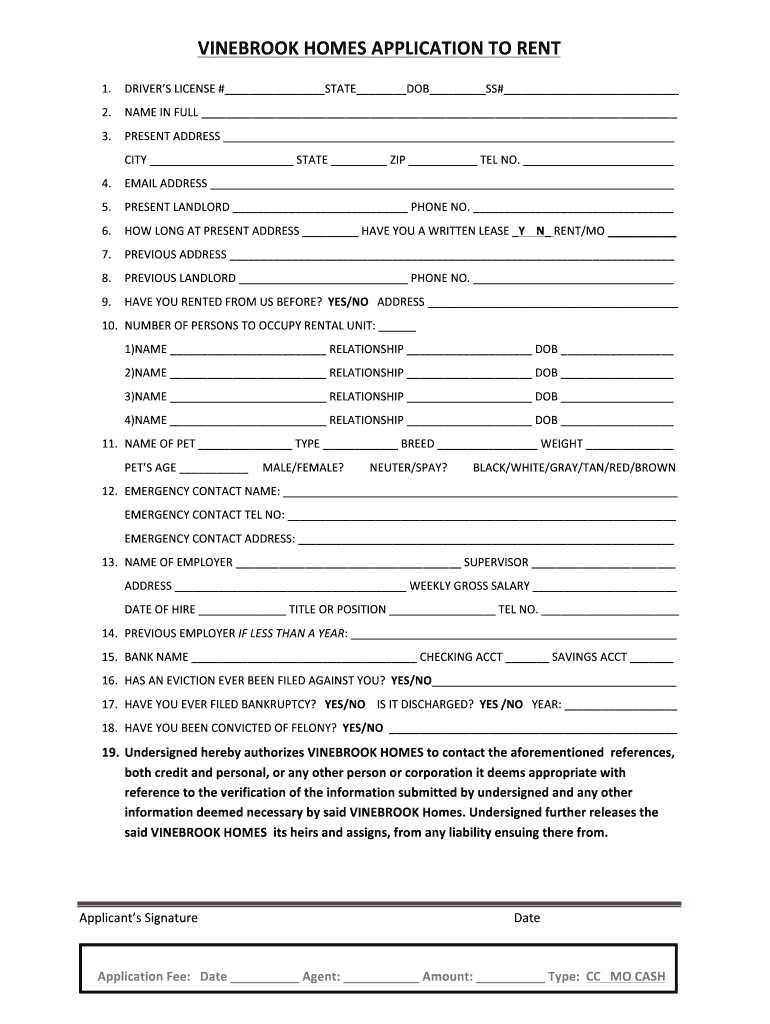

Fill and Sign the Vinebrook Homes Rental Application Form

Useful Suggestions for Finishing Your ‘Vinebrook Homes Rental Application’ Online

Are you fed up with the inconvenience of handling documentation? Search no further than airSlate SignNow, the leading eSignature solution for individuals and small to medium-sized businesses. Say farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign forms online. Utilize the robust features embedded in this user-friendly and cost-effective platform and transform your strategy for document administration. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow takes care of it all seamlessly, requiring only a few clicks.

Follow these detailed instructions:

- Sign in to your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Launch your ‘Vinebrook Homes Rental Application’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

Don’t be concerned if you want to collaborate with your colleagues on your Vinebrook Homes Rental Application or send it for notarization—our platform provides all you need to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to a new standard!

FAQs

-

What is the Vinebrook Homes Rental Application process?

The Vinebrook Homes Rental Application process allows prospective tenants to submit their rental applications online easily. By utilizing airSlate SignNow, applicants can fill out and eSign their Vinebrook Homes Rental Application securely, ensuring a streamlined experience from start to finish.

-

How much does the Vinebrook Homes Rental Application cost?

The cost of the Vinebrook Homes Rental Application varies depending on the specific rental property and any associated fees. However, using airSlate SignNow offers a cost-effective solution to streamline the application process, saving both time and money for applicants and property managers alike.

-

What features are included in the Vinebrook Homes Rental Application?

The Vinebrook Homes Rental Application includes features such as customizable templates, secure eSignature capabilities, and real-time document tracking. With airSlate SignNow, these features enhance the application experience, making it easier for tenants to apply for their desired rental properties.

-

What are the benefits of using airSlate SignNow for the Vinebrook Homes Rental Application?

Using airSlate SignNow for the Vinebrook Homes Rental Application provides numerous benefits, including increased efficiency and reduced paperwork. With its user-friendly interface, applicants can complete the process quickly, while landlords can manage applications more effectively.

-

Can I track my Vinebrook Homes Rental Application status?

Yes, applicants can easily track the status of their Vinebrook Homes Rental Application through airSlate SignNow’s real-time document tracking feature. This transparency allows you to stay informed about your application progress and any actions required on your part.

-

Is the Vinebrook Homes Rental Application mobile-friendly?

Absolutely! The Vinebrook Homes Rental Application is designed to be mobile-friendly, allowing applicants to complete their forms on any device. With airSlate SignNow, you can fill out and eSign your application from the convenience of your smartphone or tablet.

-

What integrations does airSlate SignNow offer for the Vinebrook Homes Rental Application?

airSlate SignNow offers various integrations that enhance the Vinebrook Homes Rental Application experience, including CRM systems and cloud storage solutions. These integrations help streamline the application process and improve document management for landlords and renters.

Find out other vinebrook homes rental application form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles