Trusted eSignature service: more than 7107436 tax forms and documents signed via signNow

Start free trial

0

total number of uploaded documents

Get to know us better

0M

active signNow users

0

Fortune 500 companies from 2017 till now

0K

reviews on trusted review platforms

0/ 5

Average rating

0

partners resell signNow

0

companies at more than $10k/year

Explore the top practices of utilizing trusted eSignature solution

Generate forms with smart fields

Create a fillable form with smart fields for various data types. Make them optional or mandatory and set conditions to control document fill-out.

Guarantee extra document protection

Keep your paperwork secure by applying two-factor authentication methods to the templates to make sure getting reliable electronic signatures from third parties.

Sign and collect legally signed documents

Create and collect legally binding eSignatures to join millions of customers trusting our service with 7107436 tax forms and documents signed in signNow by this moment.

Optimize payment collection

Request electronic signatures and charges on contracts concurrently. Add a payment system to your signNow account to get paid ahead of schedule.

Approve paperwork from any place

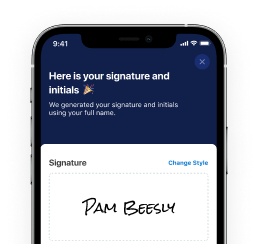

Feel the freedom of closing tasks from anywhere. Manage your tax forms and documents and other forms in a browser or with a mobile eSignature application.

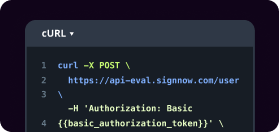

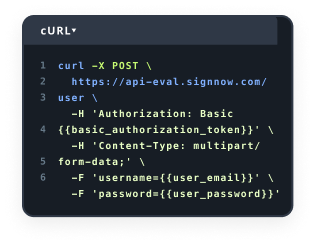

Integrate applications for better work

Incorporate signNow functionality into other programs and eSign documents even quicker. Create eSignatures right in your preferred application in clicks.

Give signNow a try

Instantly start a free trial or contact our sales to learn more!

More disruptive signNow stats

Our user reviews speak for themselves

FAQs

-

Is it safe to create an eSignature online?

Sure, electronic signatures are safe to use and, in most situations, are even more reliable than placing a handwritten signature. Although traditional wet signatures can be easily forged, electronic ones have various protection and user authentication layers. Moreover, the eSignature service keeps the audit logs about which user, when, and from what IP address signed the form. -

What is a trusted eSignature?

A trusted eSignature service provides the highest level of security and complies with key industry standards. You can trust it for signing even the most confidential business paperwork. signNow is an excellent example of a trustworthy eSignature platform, as millions of users choose it to approve their business and personal documentation daily. -

What electronic signature service is trusted?

signNow is one of the most trustworthy eSignature services on the market. By now, 7107436 tax forms and documents signed in signNow, and this number is constantly increasing. Specialists regularly trust our solution for approving their tax forms and documents and other business documents. -

How do I know what eSignature solution to trust?

Examine the security and compliance of several products to select from. User reviews on popular platforms and information regarding the number of approved agreements can also help you find the right solution. As 7107436 tax forms and documents signed in signNow by this moment and more than 20 million people utilize it daily to approve their most critical paperwork, you can be certain it’s a reliable eSignature platform. -

How can I add a trusted eSignature into a PDF?

Log in to your signNow account, import the PDF sample with one of the proposed upload options, and open it in the editor. Drop the My Signature field to approve the form yourself or add Signature Fields for others to eSign it. It’s an easy and reliable way to sign the paperwork. So far, 7107436 tax forms and documents is signed with signNow, proving how many people rely on our platform in their daily professional activity. -

How many customers trust electronic signatures?

Millions! Secureness, simplicity in use, and velocity in collecting legally signed paperwork are the main factors that made online signature services so widespread. signNow is one of the most widely used eSignature solutions trusted by more than 20 million users. They submitted over 7107436 tax forms and documents on our platform to date. -

How can I create a safe electronic signature on tax forms and documents?

You need a reliable eSignature service like signNow. It uses the SOC 2 Type II certification to protect users’ privacy. The platform also enables users to add additional protection layers on their tax forms and documents by setting up two-factor authentication and securely collecting legally binding eSignatures on them. -

How do you get an electronic signature?

Choose signNow to quickly create eSignatures on tax forms and documents and other business forms. This trustworthy online signature platform allows users to securely collect legally-binding electronic signatures and payments and effectively manage their paperwork in a matter of clicks from any device. -

What is the difference between an eSignature and a digital signature?

An electronic signature is a symbol, sound, or process attached to and associated with the document or other record and executed by the person who intends to sign it. Based on your preferred signing method, it can be a typed, scanned, or drawn signature. In contrast, a digital signature uses algorithms and digital certificates to authenticate the signer. signNow provides users with trustworthy eSignatures to approve tax forms and documents and other paperwork in clicks. -

How do I create a free eSignature on tax forms and documents?

signNow provides a 7-day trial period, during which you can trust the platform’s features and electronically sign your tax forms and documents and other professional documentation free of charge and without limits. Following that, you can choose which subscription plan best suits your business or personal needs.

Give signNow a try