Comience Su Viaje De Firma Electrónica: Firma En Línea Para Préstamos Con Prestamistas Directos

- Rápido para iniciar

- Fácil de usar

- Soporte 24/7

Las empresas con visión de futuro de todo el mundo confían en SignNow

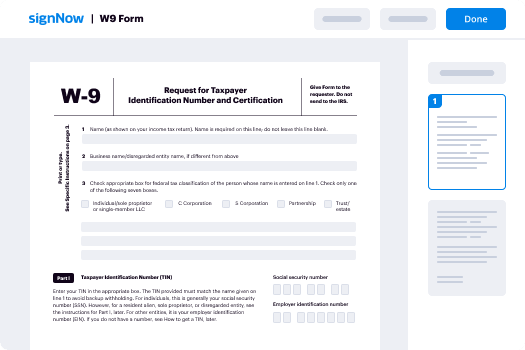

Guía rápida sobre cómo usar la firma en línea para préstamos con la función de prestamistas directos

¿Está su negocio dispuesto a eliminar ineficiencias en aproximadamente tres cuartas partes o más? Con airSlate SignNow eSignature, semanas de aprobación de contratos se convierten en días, y horas de recolección de firmas se vuelven minutos. No necesitará aprender todo desde cero gracias a la interfaz intuitiva y las instrucciones paso a paso.

Siga los siguientes pasos a continuación para usar la firma en línea para préstamos con la funcionalidad de prestamistas directos en cuestión de minutos:

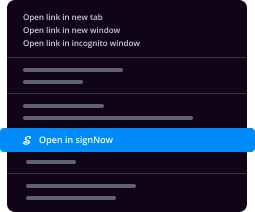

- Abra su navegador web y visite signnow.com.

- Suscríbase para una prueba gratuita o inicie sesión utilizando su correo electrónico o credenciales de Google/Facebook.

- Haga clic en Avatar de Usuario -> Mi Cuenta en la esquina superior derecha de la página web.

- Personalice su Perfil de Usuario agregando datos personales y ajustando configuraciones.

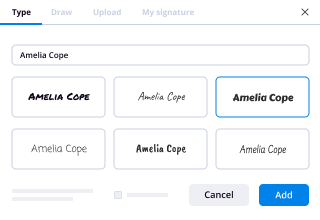

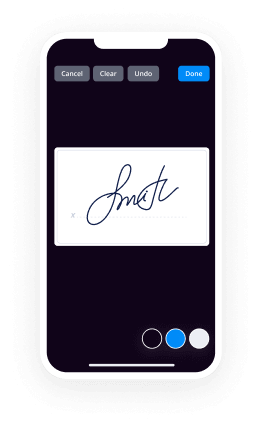

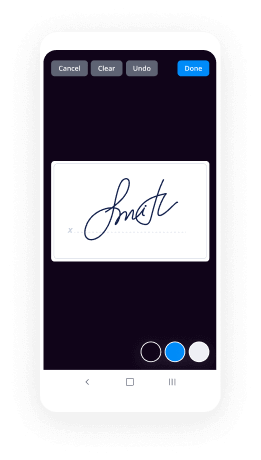

- Diseñe y gestione su(s) Firma(s) Predeterminada(s).

- Regrese a la página del panel de control.

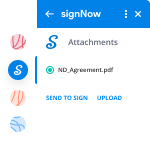

- Desplace el cursor sobre el botón Cargar y Crear y seleccione la opción adecuada.

- Haga clic en el botón Preparar y Enviar junto al título del documento.

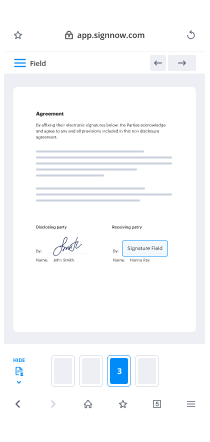

- Ingrese el nombre y la dirección de correo electrónico de todos los firmantes en la ventana emergente que se abre.

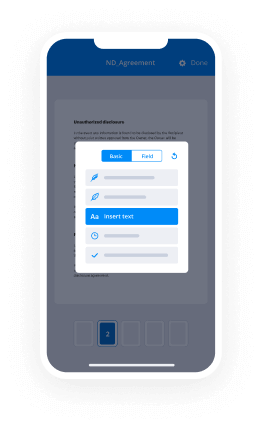

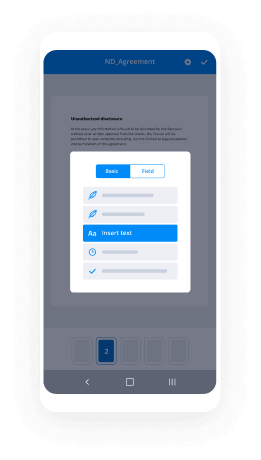

- Utilice la opción Comenzar a agregar campos para comenzar a editar el documento y firmarlo usted mismo.

- Haga clic en GUARDAR E INVITAR cuando haya terminado.

- Continúe personalizando su flujo de trabajo de eSignature utilizando funciones avanzadas.

No puede ser más simple usar la firma en línea para préstamos con la función de prestamistas directos. También está disponible en sus teléfonos móviles. Instale la aplicación airSlate SignNow para iOS o Android y ejecute sus flujos de trabajo de eSignature personalizados incluso mientras está en movimiento. Olvídese de imprimir y escanear, de enviar formularios que consumen tiempo y de la costosa entrega de documentos.

Cómo funciona

Califica tu experiencia

What is the signature loans online

Signature loans online are unsecured personal loans that do not require collateral. They are based on the borrower's creditworthiness and are typically used for various purposes, such as debt consolidation, home improvements, or unexpected expenses. The application process is streamlined, allowing users to apply, receive approval, and access funds quickly through online platforms.

How to use the signature loans online

Using signature loans online involves several straightforward steps. First, borrowers can fill out an online application form, providing necessary personal and financial information. Once submitted, lenders review the application and perform a credit check. If approved, the borrower receives a loan offer, which they can accept electronically. Funds are then disbursed directly to the borrower's bank account, often within one to three business days.

Steps to complete the signature loans online

Completing a signature loan online typically involves the following steps:

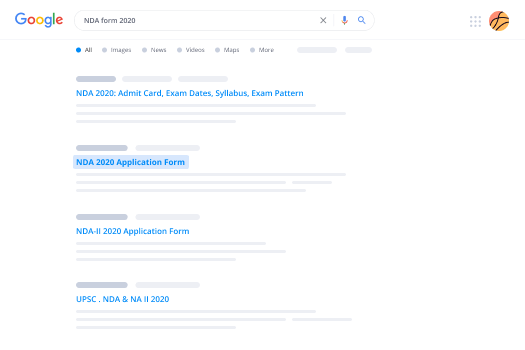

- Visit the lender's website and locate the application form.

- Fill out the form with accurate personal and financial details.

- Submit the application for review.

- Receive a loan offer if approved, detailing the terms and conditions.

- Review and electronically sign the agreement using an eSignature tool.

- Receive the funds directly into your bank account.

Legal use of the signature loans online

Signature loans online are legally binding agreements. When borrowers electronically sign the loan documents, they are agreeing to the terms set forth by the lender. It is essential for users to understand their rights and obligations under the loan agreement, including repayment terms and interest rates. Electronic signatures are recognized under U.S. law, making them valid for loan agreements.

Security & Compliance Guidelines

Security is paramount when handling signature loans online. Lenders must comply with regulations such as the Gramm-Leach-Bliley Act, which protects consumers' personal information. Users should ensure that the platform they use employs encryption technology to safeguard their data. Additionally, verifying that the lender is licensed and regulated in their state can provide an extra layer of security.

Eligibility and Access to signature loans online

Eligibility for signature loans online typically depends on factors such as credit score, income, and employment status. Most lenders require a minimum credit score for approval, but options may exist for borrowers with bad credit through direct lenders specializing in these loans. It is advisable for potential borrowers to check their credit reports and ensure they meet the lender's criteria before applying.

¡Obtenga ahora firmas vinculantes desde el punto de vista jurídico!

-

Mejor ROI. Nuestros clientes logran un promedio de 7x ROI en los primeros seis meses.

-

Se adapta a sus casos de uso. De las PYMES al mercado medio, airSlate SignNow ofrece resultados para empresas de todos los tamaños.

-

Interfaz de usuario intuitiva y API. Firma y envía documentos desde tus aplicaciones en minutos.

Firma en línea FAQs

-

What are signature loans online?

Signature loans online are unsecured personal loans that require only your signature as collateral. They are typically used for various purposes, such as debt consolidation or unexpected expenses. With airSlate SignNow, you can easily manage your loan documents electronically. -

How do I apply for signature loans online?

Applying for signature loans online is a straightforward process. You can fill out an application form on our website, providing necessary information about your financial situation. Once submitted, you can eSign your documents using airSlate SignNow for a quick and efficient approval process. -

What are the benefits of using airSlate SignNow for signature loans online?

Using airSlate SignNow for signature loans online offers numerous benefits, including a user-friendly interface and secure document management. You can track your loan application status in real-time and receive notifications when documents are signed. This streamlines the entire process, making it hassle-free. -

Are there any fees associated with signature loans online?

Yes, there may be fees associated with signature loans online, such as origination fees or late payment penalties. It's essential to review the terms and conditions before signing any documents. With airSlate SignNow, you can easily access and understand all associated costs before proceeding. -

How quickly can I receive funds from signature loans online?

The speed at which you receive funds from signature loans online can vary based on the lender's processing times. Typically, once your application is approved and documents are signed via airSlate SignNow, you can expect to receive funds within a few business days. This quick turnaround is one of the advantages of online loans. -

Can I manage my signature loans online through airSlate SignNow?

Absolutely! airSlate SignNow allows you to manage all your signature loans online efficiently. You can track your loan status, access documents, and eSign any necessary paperwork from anywhere, making it convenient and accessible. -

What types of documents do I need for signature loans online?

To apply for signature loans online, you typically need to provide identification, proof of income, and possibly credit history. airSlate SignNow simplifies the document submission process, allowing you to upload and eSign required documents securely and quickly.

Tu guía completa de cómo hacerlo

Únase a más de 28 millones de usuarios de airSlate SignNow

Obtener más

- Descubra Cómo Cambiar Su Nombre en la Firma de Correo ...

- Descubre el secreto para cambiar tu firma en el correo ...

- Descubre cómo cambiar la firma en Outlook 365 con ...

- Descubre cómo cambiar la firma en PDF sin esfuerzo con ...

- Cómo cambiar la contraseña de su firma digital en ...

- Descubre cómo cambiar tu firma de correo electrónico ...

- Desbloquee el potencial: cambie su pie de página de ...

- Aprende a cambiar tu firma de correo electrónico en ...