Aumenta El Cumplimiento Con eSignatures: Ejemplo De Escritura Hipotecaria Firmada

- Rápido para iniciar

- Fácil de usar

- Soporte 24/7

Las empresas con visión de futuro de todo el mundo confían en SignNow

Acelera tus flujos de trabajo de documentos con eSignature de airSlate SignNow

Aprovecha al máximo las eSignatures legalmente vinculantes

Crea órdenes de firma

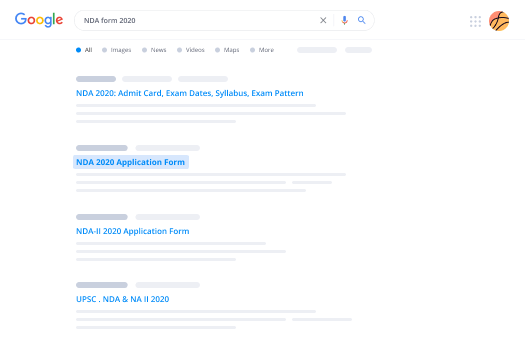

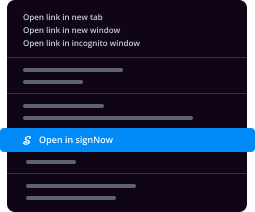

Usa eSignatures fuera de airSlate SignNow

Mejora tu trabajo en equipo

Ejemplo de escritura hipotecaria firmada profesionalmente

Ahorra tiempo con enlaces compartibles

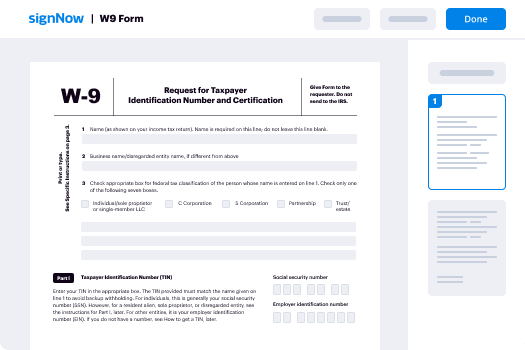

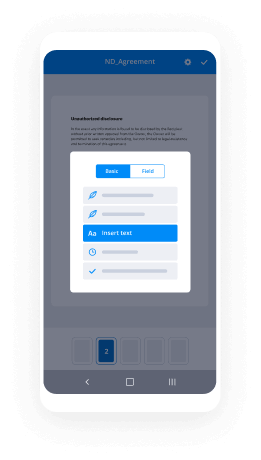

Guía rápida sobre cómo firmar un ejemplo de escritura hipotecaria

Cada empresa necesita firmas, y cada empresa quiere mejorar el proceso de recopilarlas. Obtén gestión de documentos profesional con airSlate SignNow. Puedes firmar un ejemplo de escritura hipotecaria, crear plantillas web rellenables, configurar invitaciones de firma electrónica, enviar enlaces de firma, colaborar en equipos y mucho más. Descubre cómo mejorar la recopilación de firmas electrónicamente.

Sigue los pasos a continuación para firmar un ejemplo de escritura hipotecaria en cuestión de minutos:

- Inicia tu navegador web y ve a signnow.com.

- Regístrate para una prueba gratuita o inicia sesión usando tu correo electrónico o credenciales de Google/Facebook.

- Haz clic en Avatar de Usuario -> Mi Cuenta en la parte superior derecha de la página web.

- Modifica tu Perfil de Usuario con tus datos personales y ajusta la configuración.

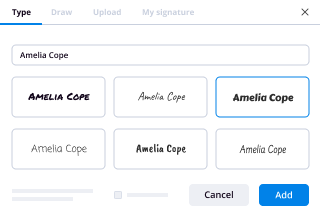

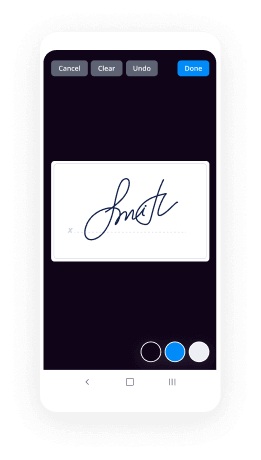

- Crea y gestiona tu(s) Firma Predeterminada(s).

- Regresa a la página del panel de control.

- Pasa el cursor sobre el botón Subir y Crear y elige la opción necesaria.

- Haz clic en la tecla Preparar y Enviar junto al título del documento.

- Escribe la dirección de correo electrónico y el nombre de todos los firmantes en la ventana emergente que se abre.

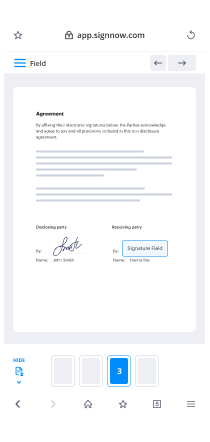

- Utiliza la opción Comenzar a agregar campos para proceder a editar el archivo y firmarlo tú mismo.

- Haz clic en GUARDAR E INVITAR cuando hayas terminado.

- Continúa personalizando tu flujo de trabajo de firma electrónica utilizando más funciones.

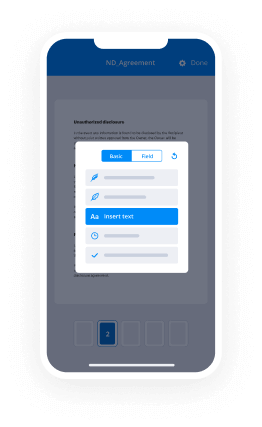

No puede ser más simple firmar un ejemplo de escritura hipotecaria que eso. Además, puedes instalar la aplicación gratuita airSlate SignNow en tu dispositivo móvil y acceder a tu perfil desde cualquier lugar sin estar atado a tu computadora o lugar de trabajo. Ve sin papel y comienza a firmar contratos en línea.

Cómo funciona

Califica tu experiencia

What is the signed mortgage deed example

A signed mortgage deed example is a legal document that outlines the terms and conditions under which a borrower pledges property as security for a loan. This document is essential in the mortgage process, as it establishes the lender's rights to the property in case of default. The signed mortgage deed typically includes details such as the names of the parties involved, the property description, the loan amount, and the repayment terms. Understanding this document is crucial for both borrowers and lenders to ensure clarity and compliance with legal requirements.

How to use the signed mortgage deed example

Using a signed mortgage deed example involves filling out the necessary information accurately and ensuring all parties understand the terms. With airSlate SignNow, users can easily complete the document online by entering the required details in designated fields. Once filled out, the document can be sent for electronic signatures. This process ensures that all parties can review and sign the mortgage deed conveniently, streamlining the entire transaction.

Steps to complete the signed mortgage deed example

Completing a signed mortgage deed example involves several key steps:

- Access the document through airSlate SignNow and select the signed mortgage deed template.

- Fill in the necessary information, including borrower and lender details, property description, and loan terms.

- Review the document for accuracy to ensure all information is correct.

- Send the document for signature to all parties involved using airSlate SignNow's eSignature feature.

- Once all signatures are obtained, securely store the completed document for future reference.

Key elements of the signed mortgage deed example

Several key elements must be included in a signed mortgage deed example to ensure its validity:

- Parties involved: Clearly identify the borrower and lender.

- Property description: Provide a detailed description of the property being mortgaged.

- Loan amount: Specify the total amount of the loan.

- Repayment terms: Outline the repayment schedule, including interest rates and payment frequency.

- Signatures: Ensure that all parties sign the document to validate the agreement.

Legal use of the signed mortgage deed example

The signed mortgage deed example serves as a legally binding agreement between the borrower and lender. It is essential to comply with state-specific laws governing mortgage agreements, as these can vary significantly. By using airSlate SignNow to complete and eSign the document, users can ensure that the mortgage deed is executed in accordance with legal requirements, providing protection for both parties involved in the transaction.

Security & Compliance Guidelines

When handling a signed mortgage deed, security and compliance are paramount. Using airSlate SignNow ensures that the document is stored securely and that all electronic signatures are legally recognized. The platform adheres to industry standards for data protection and privacy, ensuring that sensitive information is safeguarded. Users should also familiarize themselves with relevant laws and regulations regarding electronic signatures to ensure compliance throughout the signing process.

¡Obtenga ahora firmas vinculantes desde el punto de vista jurídico!

-

Mejor ROI. Nuestros clientes logran un promedio de 7x ROI en los primeros seis meses.

-

Se adapta a sus casos de uso. De las PYMES al mercado medio, airSlate SignNow ofrece resultados para empresas de todos los tamaños.

-

Interfaz de usuario intuitiva y API. Firma y envía documentos desde tus aplicaciones en minutos.

Firma en línea FAQs

-

What is a signed mortgage deed example?

A signed mortgage deed example is a document that outlines the terms of a mortgage agreement between a borrower and a lender. It serves as proof that the borrower has agreed to the mortgage terms and has legally committed to repaying the loan. Understanding this example can help you navigate your own mortgage process more effectively. -

How does airSlate SignNow help with signed mortgage deed examples?

airSlate SignNow simplifies the process of creating and signing mortgage deeds by providing templates and easy eSigning options. Users can quickly generate a signed mortgage deed example tailored to their specific needs, ensuring compliance and accuracy. This streamlines the documentation process, saving time and reducing errors. -

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, starting with a free trial. Each plan includes features that support the creation and management of signed mortgage deed examples, making it a cost-effective solution for businesses of all sizes. You can choose a plan that best fits your budget and requirements. -

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This includes popular tools like Google Drive, Salesforce, and more, allowing you to manage signed mortgage deed examples alongside your existing systems. These integrations help streamline document management and improve efficiency. -

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your signed mortgage deed examples are handled efficiently and securely. Additionally, you can collaborate with team members and clients easily through the platform. -

Is airSlate SignNow secure for signing mortgage deeds?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When you use airSlate SignNow for signed mortgage deed examples, you can trust that your documents are protected. This ensures that sensitive information remains confidential and secure throughout the signing process. -

How can I create a signed mortgage deed example using airSlate SignNow?

Creating a signed mortgage deed example with airSlate SignNow is straightforward. Simply choose a template, fill in the necessary details, and send it for eSignature. The platform guides you through each step, making it easy to generate legally binding documents quickly.

Tu guía completa de cómo hacerlo

Únase a más de 28 millones de usuarios de airSlate SignNow

Obtener más

- Comience con eSignature: servicios de firma premium

- Comienza con eSignature: servicios de documentos pro ...

- Comience su viaje de eSignature: firmas profesionales

- Comienza con eSignature: fuente de firma profesional

- Disfruta de flujos de trabajo de eSignature flexibles: ...

- Prueba las eFirmas Sin Costuras: poner una firma en ...

- Encuentra todo lo que necesitas saber: poner una firma ...

- Comienza tu viaje de eSignature: firma remota