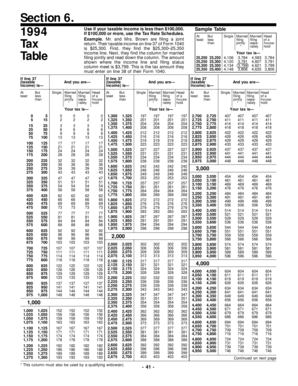

Tax Table If Line 37 Taxable Income is at Least but Less Than Use If Your Taxable Income is Less Than $100,000 Form

What makes the 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form legally binding?

As the world takes a step away from office working conditions, the execution of paperwork increasingly occurs electronically. The 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form isn’t an any different. Dealing with it using digital tools is different from doing so in the physical world.

An eDocument can be regarded as legally binding on condition that specific needs are fulfilled. They are especially crucial when it comes to stipulations and signatures associated with them. Entering your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it performed. You need a trustworthy tool, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form when completing it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make document execution legitimate and secure. Furthermore, it gives a lot of possibilities for smooth completion security wise. Let's rapidly run through them so that you can be certain that your 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Dual-factor authentication: provides an extra layer of protection and validates other parties' identities via additional means, like an SMS or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information safely to the servers.

Completing the 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form with airSlate SignNow will give better confidence that the output template will be legally binding and safeguarded.

Complete 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form easily on any device

How to edit and eSign 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form without breaking a sweat

- Find 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form and click Get Form to get started.

- Use the tools we provide to fill out your document.

- Highlight relevant paragraphs of your documents or blackout sensitive data with tools that airSlate SignNow gives specifically for that function.

- Create your signature with the Sign tool, which takes seconds and holds the same legal weight as a traditional wet ink signature.

- Double-check the information and click on the Done button to preserve your changes.

- Choose how you want to deliver your form, by email, SMS, or invitation link, or download it to your PC.

Forget about missing or misplaced files, tiresome form browsing, or mistakes that need printing out new document copies. airSlate SignNow addresses your needs in document administration in a few clicks from a device of your choice. Modify and eSign 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721 form and ensure exceptional communication at any point of your form preparation process with airSlate SignNow.

Related searches to Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

Create this form in 5 minutes!

How to create an eSignature for the 1994 tax table if line 37 taxable income is at least but less than use if your taxable income is less than 100000 1650721

How to create an signature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 1650721 online

How to generate an signature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 1650721 in Chrome

How to generate an signature for signing the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 1650721 in Gmail

How to generate an electronic signature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 1650721 right from your mobile device

How to generate an signature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 1650721 on iOS

How to create an electronic signature for the 1994 Tax Table If Line 37 Taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than 100000 1650721 on Android

Get more for Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

- May 998 form

- Client information bank register and non bank client

- Banking market liberalization and bank performance deep blue deepblue lib umich

- Form 2416 schedule of included controlled foreign corporations cfc california form 2416

- Syphilis recognition description and diagnosispdf form

- L i n g u i s t i c m i n o r i t i e s i n s l o v a k i a pitt form

- The evolution and development of cranial form in homo sapiens fas harvard

- Title random numbers in cryptography abstract randomness ipam ipam ucla form

Find out other Tax Table If Line 37 taxable Income Is At Least But Less Than Use If Your Taxable Income Is Less Than $100,000

- How Do I Electronic signature Georgia Legal PPT

- Can I Electronic signature Georgia Legal PPT

- Help Me With Electronic signature Georgia Legal PPT

- How Can I Electronic signature Georgia Legal PPT

- Can I Electronic signature Georgia Legal PPT

- How To Electronic signature Georgia Legal PPT

- How Do I Electronic signature Georgia Legal PPT

- How To Electronic signature Georgia Legal Presentation

- Help Me With Electronic signature Georgia Legal PPT

- How Can I Electronic signature Georgia Legal PPT

- How Do I Electronic signature Georgia Legal Presentation

- Can I Electronic signature Georgia Legal PPT

- How To Electronic signature Georgia Legal Presentation

- Help Me With Electronic signature Georgia Legal Presentation

- How To Electronic signature Georgia Legal Presentation

- How Do I Electronic signature Georgia Legal Presentation

- How Do I Electronic signature Georgia Legal Presentation

- How Can I Electronic signature Georgia Legal Presentation

- Help Me With Electronic signature Georgia Legal Presentation

- How Can I Electronic signature Georgia Legal Presentation