airSlate SignNow forms catalog

Tax Forms

Choose a better solution

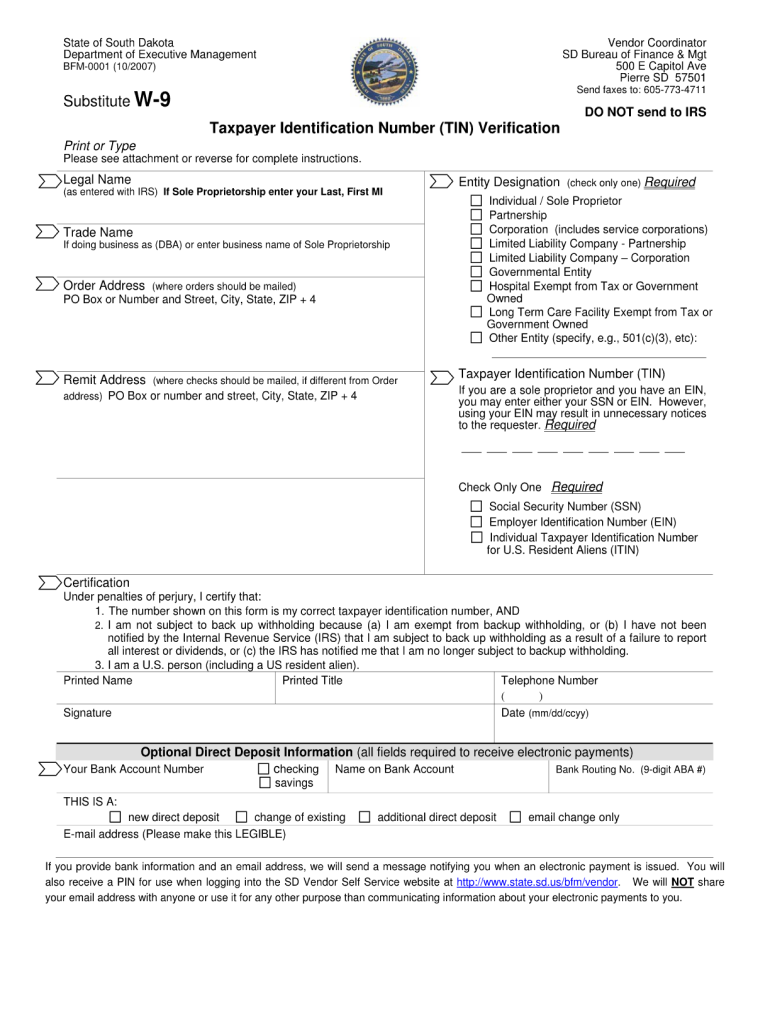

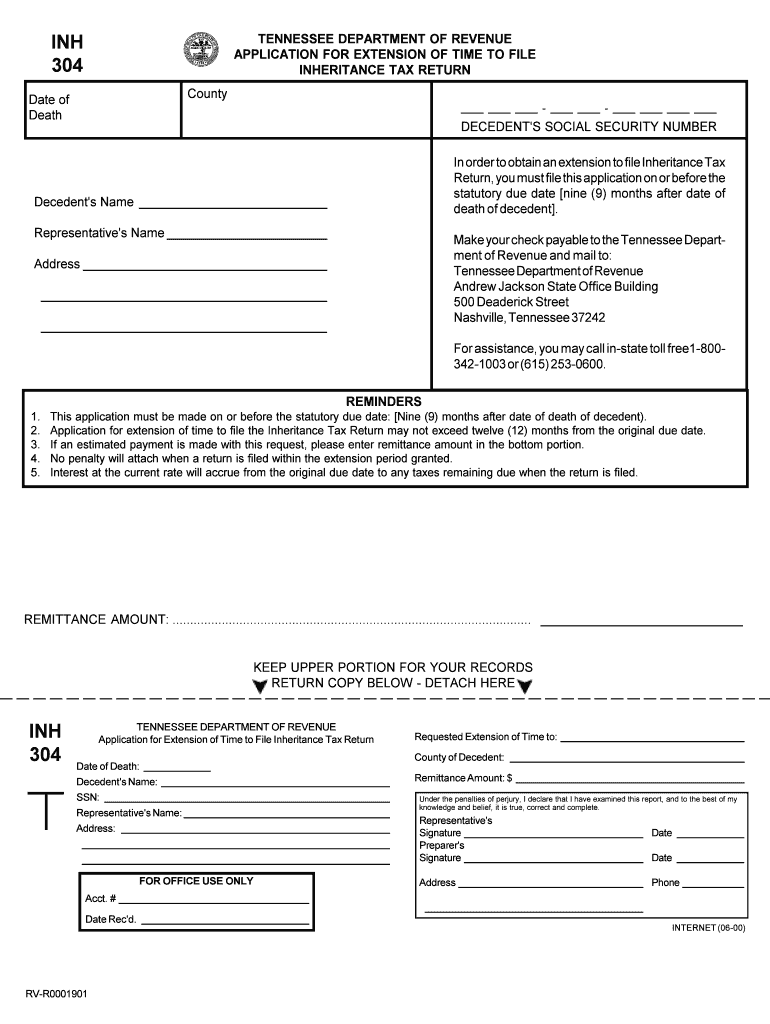

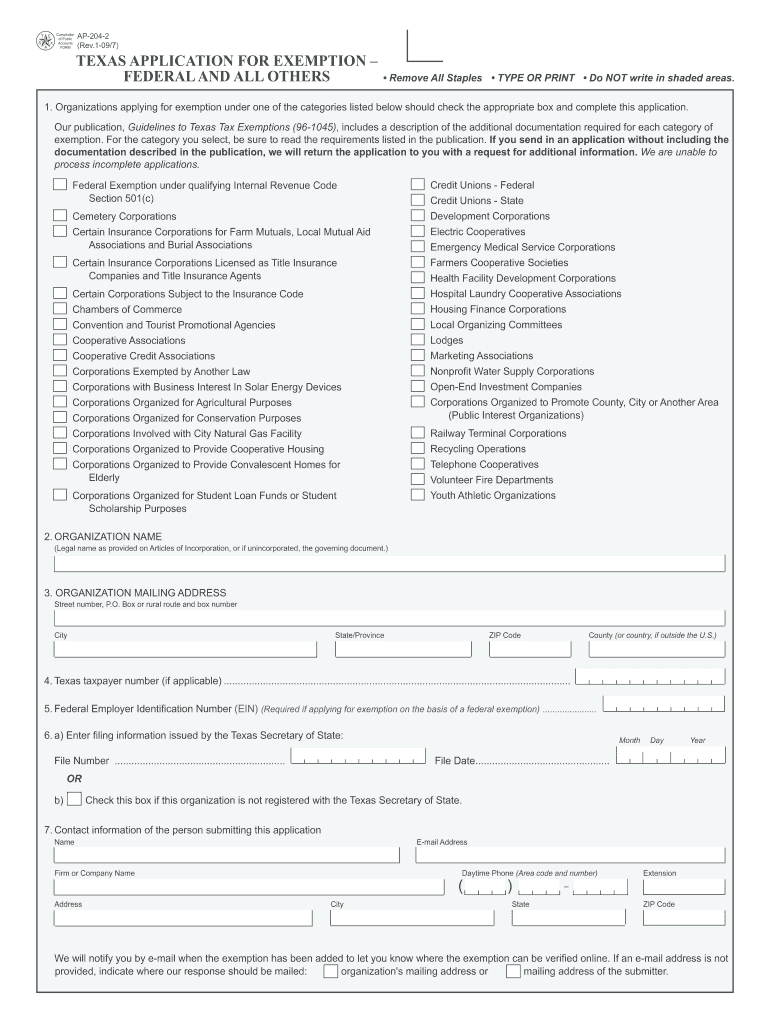

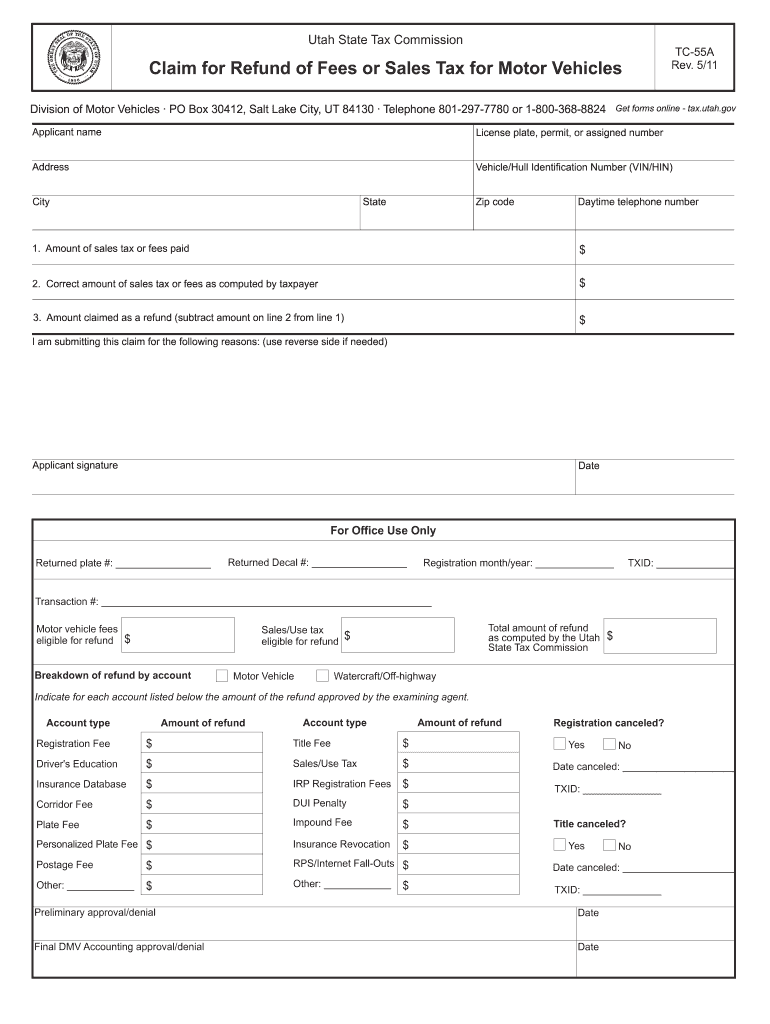

Tax forms

Can I sign IRS forms electronically?

The more complicated your form of business is, the more forms you will need to submit. While forms for federal income tax returns are the same for all US citizens, state income tax forms are state-specific. The IRS has imposed strict requirements on how each form should be submitted and whether the form can or cannot be signed electronically. Although the list of forms allowed to be eSigned increased due to COVID-19 measures, many forms still must be printed and signed by hand. Check the IRS’s requirements for the form you are interested in before filing it.

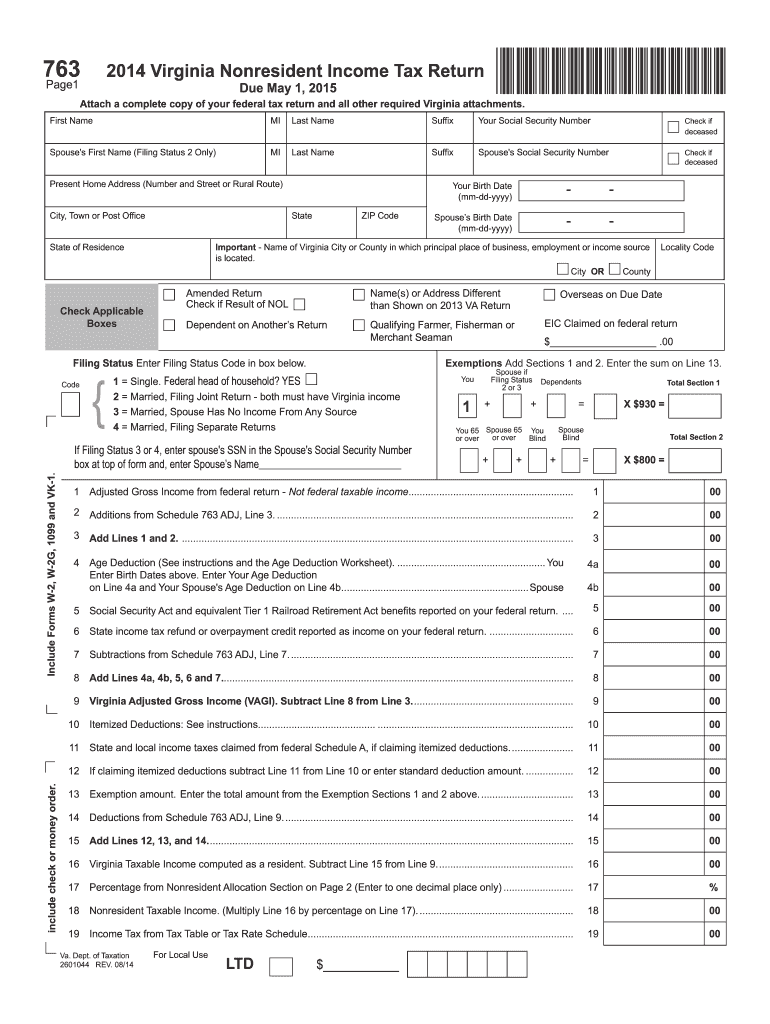

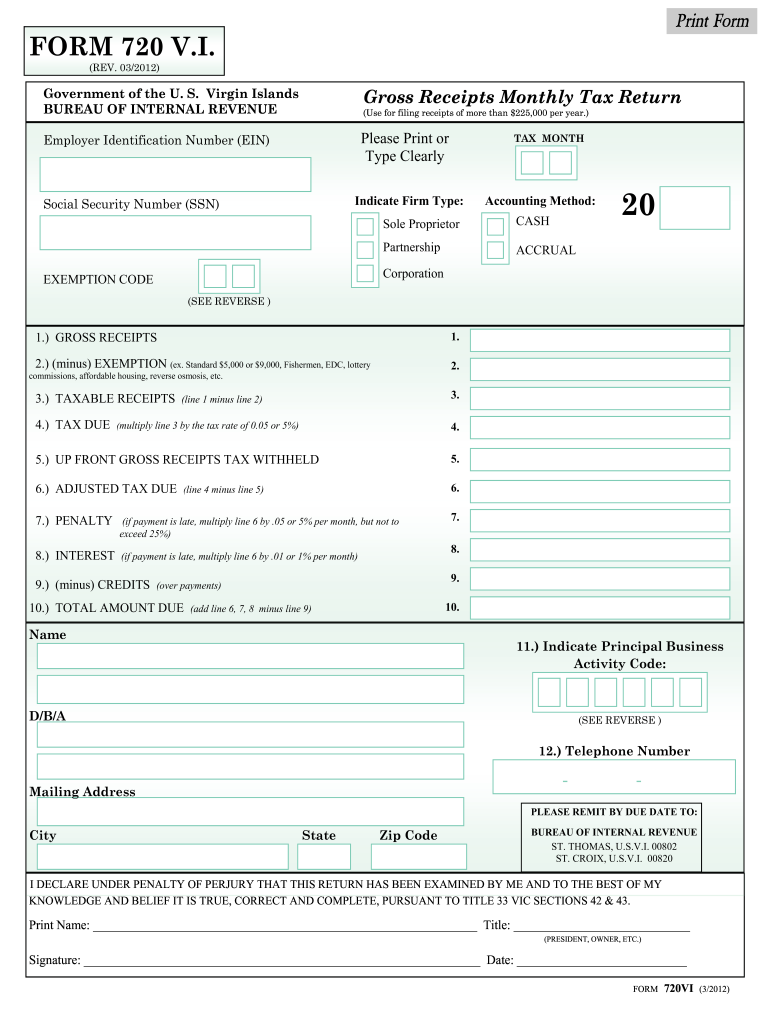

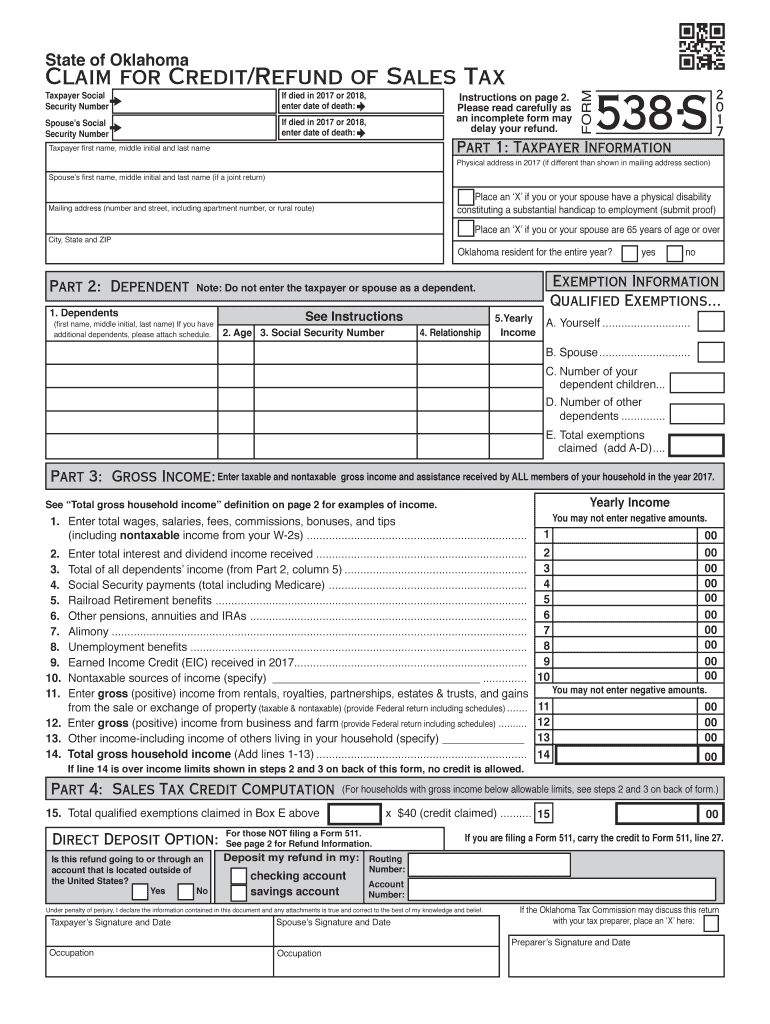

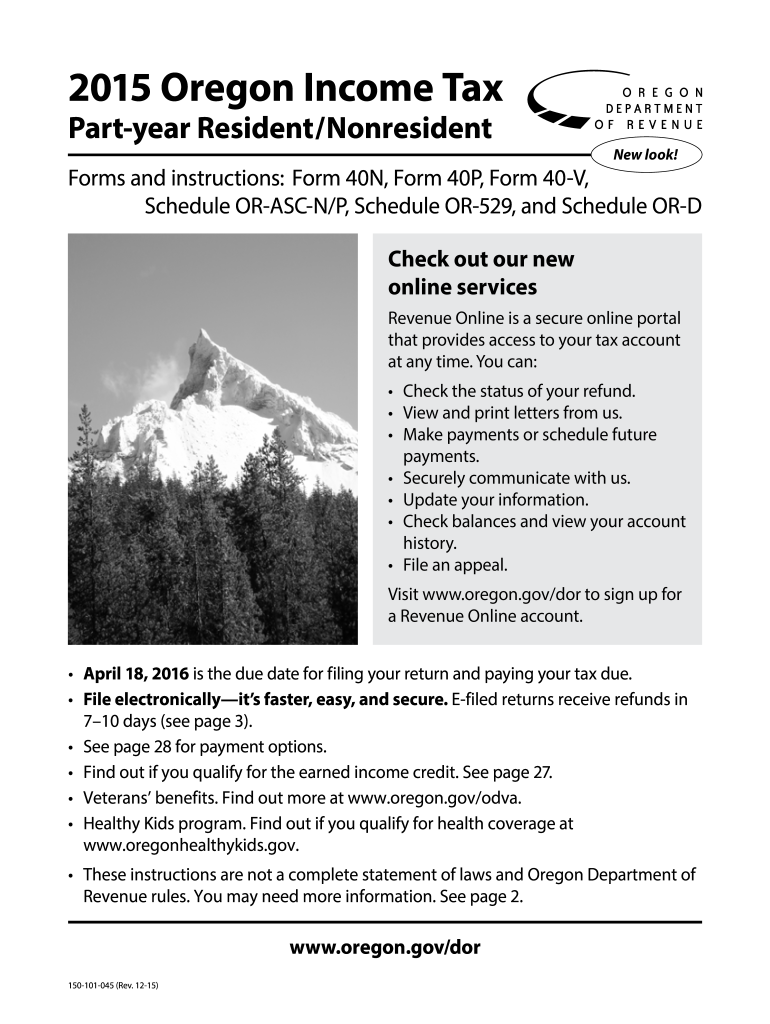

Here are a few examples of common tax forms:

The W2 form is a form an employer sends to its employees. It contains employees’ gross wages, withheld federal taxes, and healthcare benefits paid on their behalf (Box 12). Both employer and employee sign the W2 form.

The 1099 form is a similar form for freelancers and contractors, with the exception that it doesn’t include any withheld federal taxes. The form is signed by the payer and the contractor/freelancer.

The 1040 form, U.S. Individual Income Tax Return or 1040-SR, U.S. Tax Return for Seniors and Schedule C, Profit or Loss from Business, is an essential income tax form for sole proprietors. The taxpayer signs the form if filing alone, while both spouses sign if they choose to file a joint return.

Form 1065, U.S. Return of Partnership Income, is a similar form for partnership organizations. Although partnerships do not have corporate tax status, partners are obliged to report income or loss on their personal tax returns.

Where to get tax forms

You may find updated tax templates on the IRS website along with instructions on how to complete and file each form properly. The rules for filing tax returns change regularly, so it is important to stay updated on the changes for the forms your or your organization is required to file. The best way to do this is to check with IRS’s official website and resources.

You can also search for required state-specific tax templates in airSlate SignNow’s form library and fill them out using a convenient PDF editor.

How to sign tax forms electronically

Fill out and sign your tax forms electronically using a convenient eSignature solution. The IRS accepts documents signed using third-party software, given they meet its strict requirements for eSignature.

Sign your tax form in a few clicks with airSlate SignNow:

- Upload a form to your airSlate SignNow account.

- Open the file and fill out all necessary fields.

- Click on the signature field to add your signature.

- Click Done.

Five reasons to use airSlate SignNow for eSigning tax returns

-

It is easy to use.

airSlate SignNow’s convenient, self-explanatory interface allows you to fill out and eSign tax forms in practically no time. Sign and submit your tax forms from anywhere you happen to be during the tax season, even if you only have your phone with you. (You can take advantage of airSlate SignNow’s mobile app!)

-

It offers access to a comprehensive form library.

Search through the list of popular US tax templates, fill them out in our PDF editor and send them directly to the relevant authorities.

-

It’s eSignature complies with the IRS regulations.

airSlate SignNow employs multi-factor authentication for the eSignature process, checking the signer’s identity through full name, email address, SMS code or voicemail verification, and fingerprint login verification.

-

It adheres to the highest security standards.

airSlate SignNow follows the industry’s best practices to ensure the full protection of user data. The service complies with EU and US regulations that outline the requirements for the security of personal data when using eSignature technologies.

-

It keeps a record of all changes made to a document.

You can review the history of edits, the date and time of the eSigned document, the IP address, and the identity verification in the Audit Trail. You can also download Audit Trail data for each of your files or review a document's history in the web or mobile app.