Commencez Votre Parcours De Signature électronique : Prêt Par Signature En Ligne

- Démarrage rapide

- Facile à utiliser

- Support 24/7

Les entreprises qui pensent à l'avance dans le monde entier font confiance à airSlate pour le moment

Guide rapide sur la façon d'utiliser la fonctionnalité de prêt par signature en ligne

Votre entreprise est-elle prête à réduire les inefficacités de trois quarts ou plus ? Avec airSlate SignNow eSignature, des semaines de négociation de contrat deviennent des jours, et des heures de collecte de signatures deviennent quelques minutes. Vous n'aurez pas besoin d'apprendre tout depuis le début grâce à l'interface intuitive et aux guides faciles à suivre.

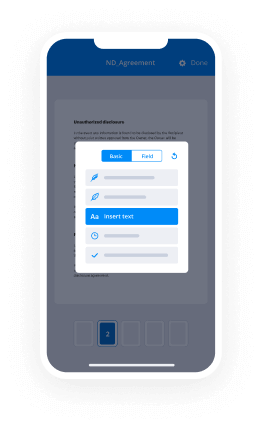

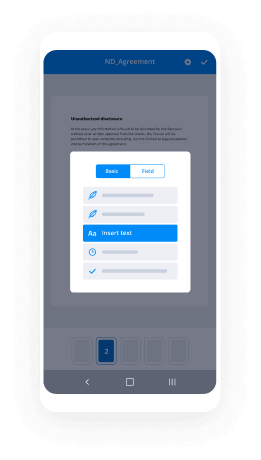

Suivez les étapes suivantes énumérées ci-dessous pour utiliser la fonctionnalité de prêt par signature en ligne en quelques minutes :

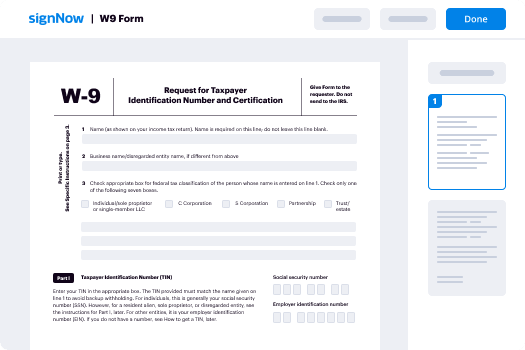

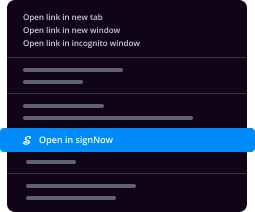

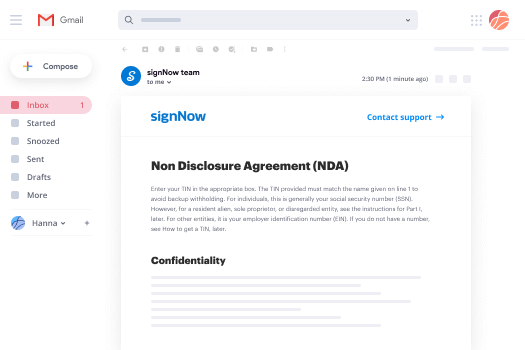

- Ouvrez votre navigateur et visitez signnow.com.

- Abonnez-vous pour un essai gratuit ou connectez-vous en utilisant votre adresse électronique ou vos identifiants Google/Facebook.

- Sélectionnez Avatar Utilisateur -> Mon Compte dans le coin supérieur droit de la page.

- Personnalisez votre Profil Utilisateur en ajoutant des données personnelles et en modifiant les configurations.

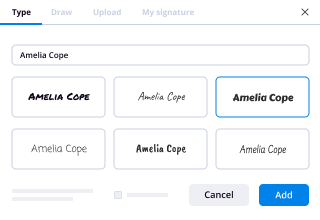

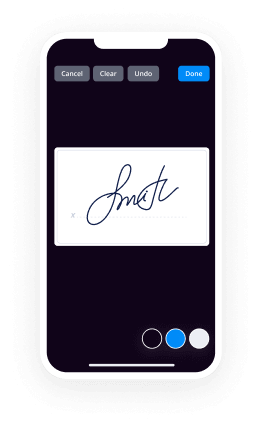

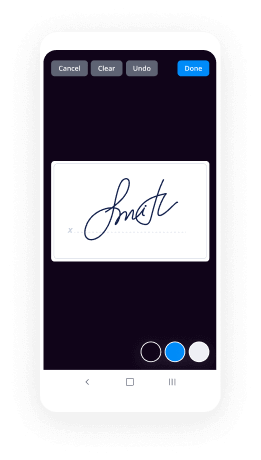

- Créez et gérez votre (vos) Signature(s) par Défaut.

- Retournez à la page du tableau de bord.

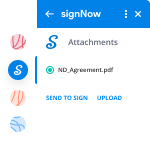

- Survolez le bouton Télécharger et Créer et sélectionnez l'option nécessaire.

- Cliquez sur l'option Préparer et Envoyer à côté du nom du document.

- Entrez le nom et l'adresse e-mail de tous les signataires dans la fenêtre contextuelle qui s'ouvre.

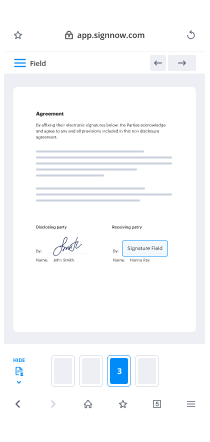

- Utilisez l'option Commencer à ajouter des champs pour procéder à l'édition du document et le signer vous-même.

- Cliquez sur ENREGISTRER ET INVITER lorsque vous avez terminé.

- Continuez à configurer votre flux de travail eSignature en utilisant des fonctionnalités avancées.

Il n'a jamais été aussi facile d'utiliser la fonctionnalité de prêt par signature en ligne. Elle est également disponible sur vos appareils mobiles. Installez l'application airSlate SignNow pour iOS ou Android et gérez vos flux de travail eSignature personnalisés même en déplacement. Évitez l'impression et la numérisation, le remplissage chronophage et l'expédition de documents coûteux.

Comment ça marche

Évaluez votre expérience

What is the signature loan online

A signature loan online is a type of personal loan that does not require collateral. Instead, it relies on the borrower's creditworthiness and signature as a promise to repay the loan. This makes it a convenient option for individuals seeking quick access to funds without the need to secure the loan with assets such as property or vehicles. Typically, these loans are used for various purposes, including debt consolidation, medical expenses, or unexpected financial needs.

How to use the signature loan online

Using a signature loan online involves several straightforward steps. First, individuals can visit a lender's website to explore their loan options. After selecting a suitable loan amount and terms, users will fill out an online application form, providing necessary personal and financial information. Once the application is submitted, the lender will review it and may request additional documentation. If approved, the borrower will receive the loan agreement, which they can eSign using airSlate SignNow for a quick and secure process.

Steps to complete the signature loan online

Completing a signature loan online typically involves the following steps:

- Research: Compare different lenders and their loan terms to find the best fit for your needs.

- Application: Fill out the online application form with accurate personal and financial details.

- Documentation: Submit any required documents, such as proof of income or identification.

- Review: Wait for the lender to review your application and provide a loan decision.

- Agreement: If approved, review the loan agreement carefully before eSigning it using airSlate SignNow.

- Receive Funds: Once the agreement is signed, the funds will be disbursed to your bank account.

Legal use of the signature loan online

Signature loans online are governed by various federal and state regulations to ensure consumer protection. It is essential for borrowers to understand the terms of the loan, including interest rates, repayment schedules, and any associated fees. The eSigning process through airSlate SignNow complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic signatures are legally binding and recognized in the same manner as traditional handwritten signatures.

Security & Compliance Guidelines

When using airSlate SignNow for eSigning a signature loan online, security and compliance are paramount. airSlate SignNow employs advanced encryption protocols to protect sensitive information during transmission and storage. Users should ensure they are accessing the platform through secure networks and take necessary precautions, such as using strong passwords and enabling two-factor authentication. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is also maintained to safeguard user privacy.

Timeframes & Processing Delays

The timeframe for obtaining a signature loan online can vary based on the lender's processing speed and the completeness of the application. Generally, once the application is submitted, borrowers may receive a decision within a few hours to a couple of days. After eSigning the loan agreement, funds can be disbursed as quickly as the next business day. However, delays may occur if additional documentation is needed or if there are discrepancies in the application.

Documents You Can Sign

Using airSlate SignNow, borrowers can eSign various documents related to the signature loan online process. These may include the loan application, loan agreement, and any additional disclosures required by the lender. The ability to electronically sign these documents streamlines the process, allowing for quick completion and submission without the need for printing or mailing physical copies.

Obtenez dès maintenant des signatures juridiquement contraignantes !

-

Meilleur ROI. Nos clients obtiennent un ROI 7 fois en moyenne au cours des six premiers mois.

-

Échelle avec vos cas d'utilisation. De SMB à moyen marché, airSlate SignNow fournit des résultats pour les entreprises de toutes tailles.

-

Interface utilisateur intuitive et API. Signez et envoyez des documents depuis vos applications en quelques minutes.

Signature en ligne de la FAQ

-

What is a signature loan online?

A signature loan online is a type of personal loan that does not require collateral, allowing borrowers to secure funds based solely on their signature and creditworthiness. This makes it a convenient option for those in need of quick financing without the hassle of asset evaluation. -

How can I apply for a signature loan online?

To apply for a signature loan online, simply visit our website and fill out the application form. You'll need to provide some personal and financial information, which will be reviewed quickly to determine your eligibility for the loan. -

What are the benefits of using airSlate SignNow for signature loans online?

Using airSlate SignNow for signature loans online streamlines the document signing process, making it faster and more efficient. Our platform ensures that all documents are securely signed and stored, providing peace of mind and easy access to your loan agreements. -

Are there any fees associated with signature loans online?

Yes, there may be fees associated with signature loans online, such as origination fees or late payment penalties. It's important to review the terms and conditions carefully to understand all potential costs before proceeding with your loan application. -

How quickly can I receive funds from a signature loan online?

Once your application for a signature loan online is approved, you can typically receive funds within one to three business days. The speed of funding may vary based on your bank and the time of approval, but our process is designed to be as quick as possible. -

Can I use a signature loan online for any purpose?

Yes, a signature loan online can be used for various purposes, including debt consolidation, home improvements, or unexpected expenses. The flexibility of these loans allows borrowers to address their financial needs without restrictions on usage. -

What documents do I need to provide for a signature loan online?

When applying for a signature loan online, you typically need to provide identification, proof of income, and possibly your credit history. These documents help lenders assess your financial situation and determine your eligibility for the loan.

Votre guide complet

Rejoignez plus de 28 millions d'utilisateurs airSlate

Obtenir plus

- Découvrez les fonctionnalités populaires de la ...

- Commencez votre parcours de signature électronique : ...

- Déverrouillez le pouvoir de la signature électronique ...

- Déverrouillez le pouvoir de l'eSignature : site ...

- Explorez votre signature numérique – Questions ...

- Explorez votre signature numérique – Questions ...

- Déverrouillez le pouvoir de l'eSignature : créateur ...

- Découvrez les fonctionnalités populaires de la ...