Augmentez La Conformité Avec Les eSignatures : Exemple D'acte Hypothécaire Signé

- Démarrage rapide

- Facile à utiliser

- Support 24/7

Les entreprises qui pensent à l'avance dans le monde entier font confiance à airSlate pour le moment

Accélérez vos flux de travail documentaires avec eSignature par airSlate SignNow

Profitez pleinement des eSignatures légalement contraignantes

Créez des ordres de signature

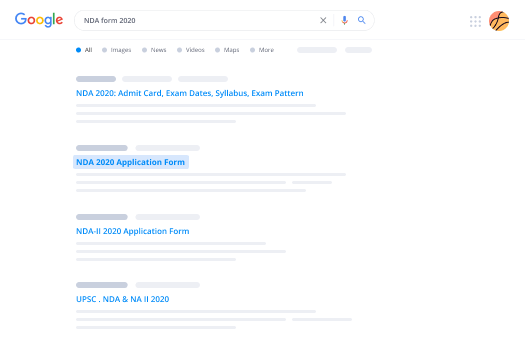

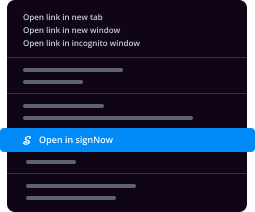

Utilisez des eSignatures en dehors d'airSlate SignNow

Améliorez votre travail d'équipe

Exemple d'acte hypothécaire signé professionnellement

Gagnez du temps avec des liens partageables

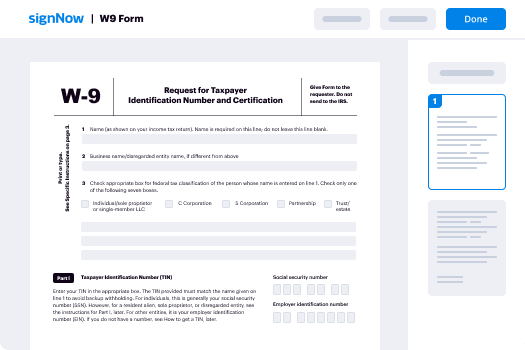

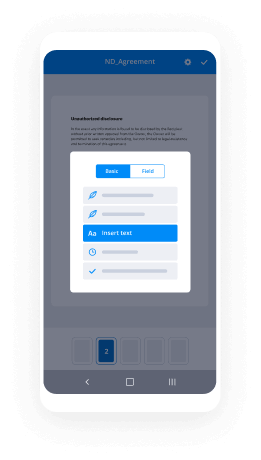

Guide rapide sur comment signer un exemple d'acte hypothécaire

Toute entreprise a besoin de signatures, et chaque entreprise souhaite améliorer le processus de collecte de celles-ci. Obtenez une gestion professionnelle des documents avec airSlate SignNow. Vous pouvez signer un exemple d'acte hypothécaire, créer des modèles web remplissables, configurer des invitations à la signature, envoyer des liens de signature, collaborer en équipe, et bien plus encore. Découvrez comment améliorer la collecte des signatures électroniquement.

Suivez les étapes ci-dessous pour signer un exemple d'acte hypothécaire en quelques minutes :

- Lancez votre navigateur web et allez sur signnow.com.

- Inscrivez-vous pour un essai gratuit ou connectez-vous en utilisant votre adresse électronique ou vos identifiants Google/Facebook.

- Cliquez sur Avatar de l'utilisateur -> Mon compte dans le coin supérieur droit de la page web.

- Modifiez votre Profil utilisateur avec vos données personnelles et modifiez les paramètres.

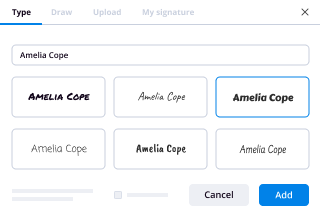

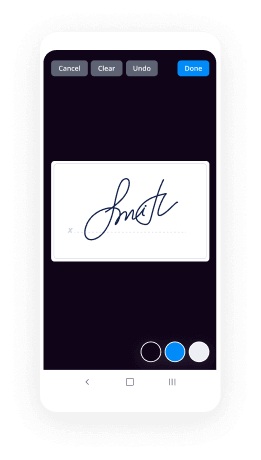

- Créez et gérez votre (vos) Signature(s) par défaut.

- Retournez à la page du tableau de bord.

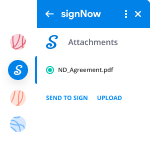

- Survolez le bouton Télécharger et créer et choisissez l'option nécessaire.

- Cliquez sur la touche Préparer et envoyer à côté du titre du document.

- Entrez l'adresse e-mail et le nom de tous les signataires dans la fenêtre contextuelle qui s'ouvre.

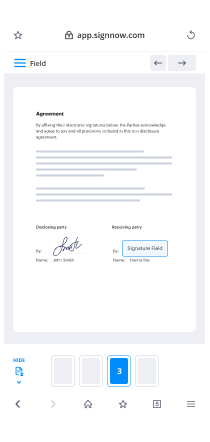

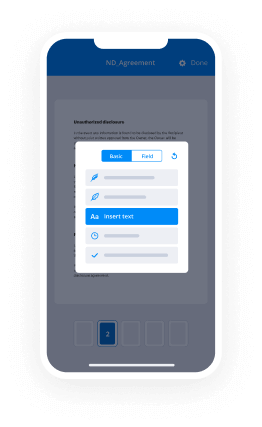

- Utilisez l'option Commencer à ajouter des champs pour continuer à modifier le fichier et le signer vous-même.

- Cliquez sur ENREGISTRER ET INVITER une fois terminé.

- Continuez à personnaliser votre flux de travail de signature électronique en utilisant plus de fonctionnalités.

Il n'y a pas plus simple que de signer un exemple d'acte hypothécaire que cela. De plus, vous pouvez installer l'application gratuite airSlate SignNow sur votre appareil mobile et accéder à votre profil de n'importe où sans être lié à votre ordinateur ou à votre lieu de travail. Passez au numérique et commencez à signer des contrats en ligne.

Comment ça marche

Évaluez votre expérience

What is the signed mortgage deed example

A signed mortgage deed example is a legal document that outlines the terms and conditions under which a borrower pledges property as security for a loan. This document is essential in the mortgage process, as it establishes the lender's rights to the property in case of default. The signed mortgage deed typically includes details such as the names of the parties involved, the property description, the loan amount, and the repayment terms. Understanding this document is crucial for both borrowers and lenders to ensure clarity and compliance with legal requirements.

How to use the signed mortgage deed example

Using a signed mortgage deed example involves filling out the necessary information accurately and ensuring all parties understand the terms. With airSlate SignNow, users can easily complete the document online by entering the required details in designated fields. Once filled out, the document can be sent for electronic signatures. This process ensures that all parties can review and sign the mortgage deed conveniently, streamlining the entire transaction.

Steps to complete the signed mortgage deed example

Completing a signed mortgage deed example involves several key steps:

- Access the document through airSlate SignNow and select the signed mortgage deed template.

- Fill in the necessary information, including borrower and lender details, property description, and loan terms.

- Review the document for accuracy to ensure all information is correct.

- Send the document for signature to all parties involved using airSlate SignNow's eSignature feature.

- Once all signatures are obtained, securely store the completed document for future reference.

Key elements of the signed mortgage deed example

Several key elements must be included in a signed mortgage deed example to ensure its validity:

- Parties involved: Clearly identify the borrower and lender.

- Property description: Provide a detailed description of the property being mortgaged.

- Loan amount: Specify the total amount of the loan.

- Repayment terms: Outline the repayment schedule, including interest rates and payment frequency.

- Signatures: Ensure that all parties sign the document to validate the agreement.

Legal use of the signed mortgage deed example

The signed mortgage deed example serves as a legally binding agreement between the borrower and lender. It is essential to comply with state-specific laws governing mortgage agreements, as these can vary significantly. By using airSlate SignNow to complete and eSign the document, users can ensure that the mortgage deed is executed in accordance with legal requirements, providing protection for both parties involved in the transaction.

Security & Compliance Guidelines

When handling a signed mortgage deed, security and compliance are paramount. Using airSlate SignNow ensures that the document is stored securely and that all electronic signatures are legally recognized. The platform adheres to industry standards for data protection and privacy, ensuring that sensitive information is safeguarded. Users should also familiarize themselves with relevant laws and regulations regarding electronic signatures to ensure compliance throughout the signing process.

Obtenez dès maintenant des signatures juridiquement contraignantes !

-

Meilleur ROI. Nos clients obtiennent un ROI 7 fois en moyenne au cours des six premiers mois.

-

Échelle avec vos cas d'utilisation. De SMB à moyen marché, airSlate SignNow fournit des résultats pour les entreprises de toutes tailles.

-

Interface utilisateur intuitive et API. Signez et envoyez des documents depuis vos applications en quelques minutes.

Signature en ligne de la FAQ

-

What is a signed mortgage deed example?

A signed mortgage deed example is a document that outlines the terms of a mortgage agreement between a borrower and a lender. It serves as proof that the borrower has agreed to the mortgage terms and has legally committed to repaying the loan. Understanding this example can help you navigate your own mortgage process more effectively. -

How does airSlate SignNow help with signed mortgage deed examples?

airSlate SignNow simplifies the process of creating and signing mortgage deeds by providing templates and easy eSigning options. Users can quickly generate a signed mortgage deed example tailored to their specific needs, ensuring compliance and accuracy. This streamlines the documentation process, saving time and reducing errors. -

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, starting with a free trial. Each plan includes features that support the creation and management of signed mortgage deed examples, making it a cost-effective solution for businesses of all sizes. You can choose a plan that best fits your budget and requirements. -

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This includes popular tools like Google Drive, Salesforce, and more, allowing you to manage signed mortgage deed examples alongside your existing systems. These integrations help streamline document management and improve efficiency. -

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your signed mortgage deed examples are handled efficiently and securely. Additionally, you can collaborate with team members and clients easily through the platform. -

Is airSlate SignNow secure for signing mortgage deeds?

Absolutely, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. When you use airSlate SignNow for signed mortgage deed examples, you can trust that your documents are protected. This ensures that sensitive information remains confidential and secure throughout the signing process. -

How can I create a signed mortgage deed example using airSlate SignNow?

Creating a signed mortgage deed example with airSlate SignNow is straightforward. Simply choose a template, fill in the necessary details, and send it for eSignature. The platform guides you through each step, making it easy to generate legally binding documents quickly.

Votre guide complet

Rejoignez plus de 28 millions d'utilisateurs airSlate

Obtenir plus

- Get Started with eSignature: premium signature services

- Commencez avec eSignature : services de documents pro ...

- Commencez votre parcours de signature électronique : ...

- Commencez avec eSignature : source de signature ...

- Profitez de flux de travail eSignature flexibles : ...

- Essayez les eSignatures sans effort : mettre une ...

- Trouvez tout ce que vous devez savoir : mettre une ...

- Commencez votre parcours de signature électronique : ...