Fill and Sign the 2000 Instructions for W 2 and W 3 2000 Instructions for W 2 and W 3 Wage and Tax Statement Form

Useful Advice on Finalizing Your ‘2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement’ Remotely

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Leverage the extensive tools included in this user-friendly and cost-effective platform to transform your method of paperwork handling. Whether you need to endorse documents or gather electronic signatures, airSlate SignNow simplifies the entire process, requiring just a few clicks.

Follow this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template repository.

- Open your ‘2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement’ in the editor.

- Select Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for other participants (if required).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Download, print your copy, or convert it into a multi-usable template.

Don’t fret if you need to collaborate with others on your 2000 Instructions For W 2 And W 3 2000 Instructions For W 2 And W 3 Wage And Tax Statement or send it for notarization—our platform provides everything necessary to accomplish these tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

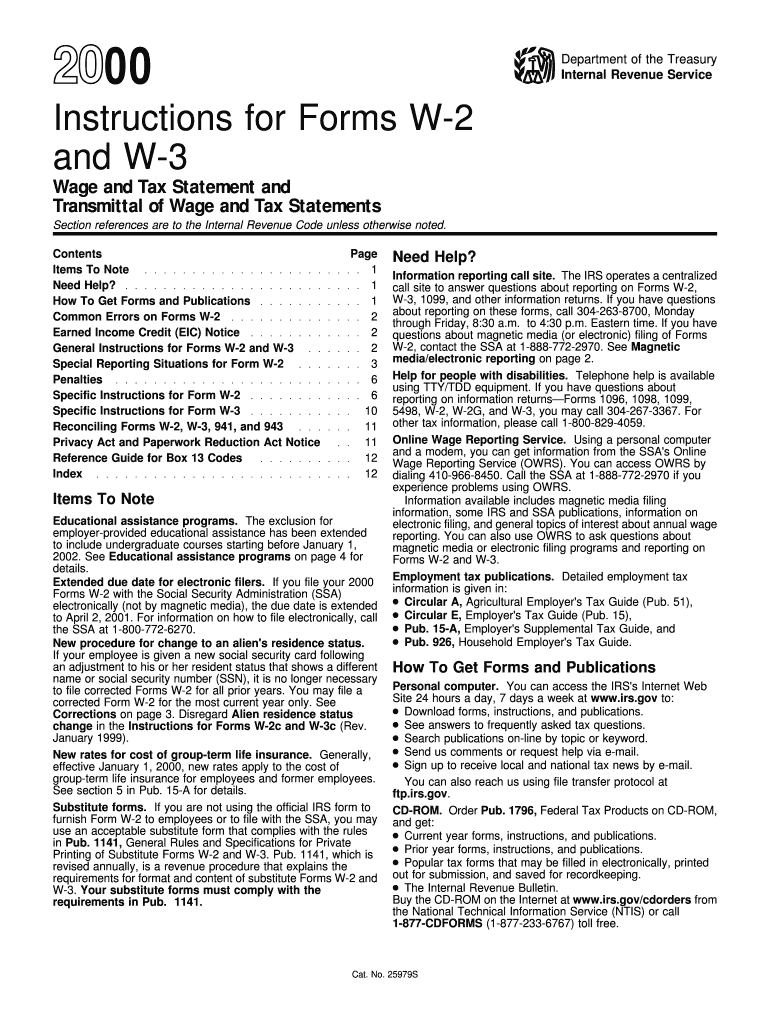

What are the Instructions For W 2 And W 3, Wage And Tax Statement?

The Instructions For W 2 And W 3, Wage And Tax Statement provide essential guidelines on how to correctly fill out these forms for reporting employee earnings and taxes. Understanding these instructions is crucial for compliance with IRS regulations and ensuring accurate tax filings.

-

How does airSlate SignNow simplify the process of preparing W 2 and W 3 forms?

airSlate SignNow streamlines the process of preparing W 2 and W 3 forms by allowing users to easily eSign and send documents electronically. This not only saves time but also ensures that all necessary signatures are captured efficiently, following the Instructions For W 2 And W 3, Wage And Tax Statement.

-

What features does airSlate SignNow offer for managing W 2 and W 3 forms?

With airSlate SignNow, users get access to features such as customizable templates, secure eSigning, and automated reminders for document completion. These features make it easier to adhere to the Instructions For W 2 And W 3, Wage And Tax Statement while improving your workflow.

-

Is there a cost associated with using airSlate SignNow for W 2 and W 3 forms?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs, including options for handling W 2 and W 3 forms. By investing in this cost-effective solution, you can ensure compliance with the Instructions For W 2 And W 3, Wage And Tax Statement while enhancing your document management process.

-

Can I integrate airSlate SignNow with other software for payroll processing?

Absolutely! airSlate SignNow integrates seamlessly with various payroll and accounting software, allowing for a smoother process in managing W 2 and W 3 forms. This integration helps ensure that you are following the Instructions For W 2 And W 3, Wage And Tax Statement efficiently and effectively.

-

What are the benefits of using airSlate SignNow for eSigning W 2 and W 3 forms?

Using airSlate SignNow for eSigning W 2 and W 3 forms offers numerous benefits, including enhanced security, quick turnaround times, and reduced paper usage. These advantages align with the Instructions For W 2 And W 3, Wage And Tax Statement, making it a practical choice for businesses.

-

How secure is the information shared through airSlate SignNow?

airSlate SignNow prioritizes the security of your documents with top-notch encryption and compliance with industry standards. This ensures that all information related to your W 2 and W 3 forms remains confidential and protected, in accordance with the Instructions For W 2 And W 3, Wage And Tax Statement.

Find out other 2000 instructions for w 2 and w 3 2000 instructions for w 2 and w 3 wage and tax statement form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles