Approved OMB No. 1651-0055

Exp. 03/31/2015

1. Identifying Number

DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

HARBOR MAINTENANCE FEE

AMENDED QUARTERLY SUMMARY REPORT

19 CFR 24.24

4. Identifying Number on Original Report

EIN or IRS Number

CBP Number

EIN or IRS

Number

CBP

Number

SSN

2. Name of Company or Individual

3. Complete Mailing Address

SSN

5. Reporting Period of Original Report

Year

6.

(One Quarter Only)

Reason for Amended Report

A.

Correction of Items 1-4

1

B.

2

3

4

C.

Request for a Refund, because:

(1) Calculation/Clerical Error

(2) Duplication of Payment

(3) Misinterpretation of Exemptions

(4) Overvaluation of Shipments

(5) Other (Please Specify)

AMENDED PAYMENT CALCULATIONS

8.

Value of Shipments

7.

Type of Shipment

With

Class Code

A. Domestic Movements

503

B. FTZ Admissions

505

C. Passengers

504

Remit a Supplement Payment, because:

(1) Calculation/Clerical Error

(2) Omission of Shipments

(3) Misinterpretation of Exemptions

(4) Overvaluation of Shipments

(5) Other (Please Specify)

9.

10.

11.

Value of Exemptions

Net Value

HMF Due

(from corresponding

(column 8 less column 9) (multiply the amounts in

col. 10 by appropriate rate)

columns A-D of line 20)

D. Total Values (Total Column 8, 9, & 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

12. Total HMF Due (Total of Lines 11A through 11C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

13. Previous HMF Paid for this Reporting Period for this type Movement . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

14. A.

B.

Supplemental Payment, If line 12 is greater than line 13, enter difference . . . . . . . . . . . . . . . . . . .

Remit Payment to: CBP, Office of Finance, Revenue Division, 6650 Telecom Drive, Indianapolis, IN 46278

Refund Due. If line 13 is greater than line 12, enter difference. Mail refund request to: CBP, HMF . . . .

Refunds, 6650 Telecom Drive, Suite 100, Indianapolis, IN 46278

ITEMIZATION OF EXEMPTIONS

A. Domestics

B. FTZ(s)

$

$

C. Passengers

D. Total

15. Exempt Port

16. Inland Waterway Fuel Tax

17. Intraport

18. U.S. Mainland/State/Possession/

Territory

19. Other

20. TOTALS (Also enter amounts in

19A thru 15C in 9A thru 9C above.)

$

$

$

$

21. CERTIFICATION

I hereby certify under penalties provided by law that the above information regarding the Harbor Maintenance Fee is complete and accurate to the best

of my knowledge.

Please Sign Here

22. Type or print name of person who prepared this report (if same as block 2,

write "SAME".)

Date

23. Telephone Number

PRIVACY ACT NOTICE: The following information is given pursuant of the Privacy Act of 1974 (Pub. L. 93-579). The disclosure of the social security number is mandatory when

an Internal Revenue Service number is not disclosed whenever an identification number is requested. Identification numbers are solicited under the authority of Excecutive Order

9397 and Pub. L. 99-662. The identification number provides unique identification of the party liable for the payment of the Harbor Maintenance Fee. The number will be used to

compare on this form with information submitted to the Government on other forms required in the course of shipping, exporting, or importing merchandise, which contain the

identification number, e.g., the SED, Vessel Operation Report, to verify that the information submitted is accurate and current. Failure to disclose an identification number may

cause a penalty pursuant to 19 CFR 24.24(h).

PAPERWORK REDUCTION ACT NOTICE: This request is in accordance with the Paperwork Reduction Act. We ask for the information in order to carry out the Harbor

Maintenance Revenue provisions of the Water Resources Development Act of 1988. We need it to ensure that the trade community is complying with this Act, and to allow CBP to

determine if the correct amount of Harbor Maintenance Fee (HMF) is collected. It is mandatory. The estimated average burden associated with this collection of information is 30

minutes per respondent plus 10 minutes recordkeeping depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for

reducing this burden should be directed to U.S. Customs and Border Protection, Asset Management, Washington, DC 20229, and to the Office of Management and Budget,

Paperwork Reduction Project (1651-0055), Washington, DC 20503.

CBP Form 350 (03/09)

�FORM INSTRUCTIONS

(Refer to Customs Publication No. 548, "Preparation of Harbor Maintenence Fee

Forms" for additional instructions; and 19 CFR 24.24.)

The following are specific instructions for most of the items on the form. Items

that have no instructions are self-explanatory. Domestic movements, foreign

trade zone (FTZ) admissions, passengers, or any combination of these, may be

declared on one form provided the name of the company and identifying number

are the same for all movements declared.

Item 1. Identifying Number -Individual summary reports may contain only one

identifying number. This does not preclude filing more than one summary report for

one identifying number. The identifying number must correspond to Item 2, Name

of Company or Individual. Check the appropriate box to indicate the kind of

identifying number being used. Enter the following information:

•

•

•

Domestic Movements - Shipper's Internal Revenue Service (IRS) Number

listed on the Vessel Operator Report (U.S. Army Corps of Engineers Form

3925).

FTZ Admissions - Applicant for Admission to a Foreign Trade Zone's Internal Revenue Service (IRS) Employer Identification Number (EIN).

Passengers--Vessel Operator's Internal Revenue Service (IRS) Employer

Identification Number (EIN).

Item 2. Name of Company or Individual - Enter the following information:

•

•

•

Domestic Movements--Shipper listed on the Vessel Operator Report (U.S.

Army Corps of Engineers Form 3925).

Foreign Trade Zone Admission and/or Status Designation (CBP Form

214 Box 24).

Passengers--Operator of the Passenger Carrying Vessel.

Item 3. Address- Street Address or P.O. Box number, city, state, and zip code

where company or individual may be contacted.

Item 4. Identifying Number Used on the Original Report Previously

Filed-IRS/EIN/SSN - Number used on CBP 349. Check appropriate box to

indicate the kind of identifying number being used.

Item 5. Reporting Period of Original Report Year - Enter the year and

Item 14A. Supplemental Payment Due - If two types of shipments were included

on the CBP 349 being amended, include only the value and fee for the movement

type being amended. Attach copies of the original support documents that support

the increase. Remit a check or money order payable to the Bureau of Customs and

Border Protection.

Item 14B. Refund Due - If two types of shipments were included on the CBP 349

being amended, include only the value and fee for the type of movement being

amended. Attach a copy of the CBP 349 and the support documentation for the

CBP-349 plus the documents to support the decrease.

ITEMIZATION OF EXEMPTIONS - Only one exemption per movement may be

claimed. (See definition of "movement" in Item 5 of the General Instructions in

Customs Publication No. 548.) Figures inserted in Items 15 through 20 shall

represent quarterly totals.

Item 15. Exempt Port - Total value of shipments, for each type of movement (e.g.,

domestics, FTZ admissions, etc.), loaded and/or unloaded at an exempt port. See

Customs Publication No. 548 "Preparation of Harbor Maintenance Fee Forms" for

list of non-exempt ports.

Item 16. Inland Waterway Fuel Tax - Total value of shipments transported

by vessels using fuel subject to the Inland Waterway Fuel Tax. Applies only to

domestic movements.

Item 17. Intraport - Total value of cargo moved within a single CBP port.

Applies only to domestic movements.

Item 18. U.S. Mainland-State/Possession/Territory - Total value of the

following:

•

Cargo, other than Alaskan crude oil, loaded on a vessel in Hawaii, Alaska, or

Puerto Rico, and unloaded in the state or territory in which loaded.

•

Cargo, other than Alaskan crude oil, transported from the U.S. mainland to

Alaska, Hawaii, Puerto Rico, or the U.S. possessions for ultimate use or

consumption: and/or

Cargo, other than Alaskan crude oil, transported from Alaska, Hawaii, or any

U.S. possession to the U.S. mainland, Alaska, Hawaii, or such possession

for ultimate use or consumption in the mainland, Alaska, Hawaii, or such

possession.

U.S. mainland includes the 48 contiguous states and the District of

Columbia.

The U.S. possessions and territories include the following:

American Samoa

Jarvis Island

Baker Island

Johnston Atoll

Guam

Kingman Reef

Howland Island

Midway

Northern Marianna Islands including:

Rota

Agrihan

Aguijan

Saipan

Guguan

Tinian

Pagan

Palmyra Island

Puerto Rico

U.S. Virgin Islands

Wake Island

•

quarter used on CBP 349.

Item 6. Reason for Amended Report - Check appropriate box A, B, or C

and if B or C, the appropriate number under B or C.

Item 7. Type of Shipment with Class Code - Box D, enter total of columns

•

•

8, 9, and 10.

AMENDED PAYMENT CALCULATIONS

Column 8. Value of Shipment - Figures inserted in items 8A through 8C

shall represent quartery total.

•

•

•

(8A) Domestic Movements - Total Value at the time of loading. (Free

Alongside Ship (FAS) value, which includes selling price, inland freight,

insurance, and all other charges to transport the cargo to the dock alongside

the vessel.)

(8B) FTZ Admissions - Total entered value listed on the Application for

Foreign Trade Zone Admission and/or Status Designation (CBP Form 214,

total of Block 21).

(8C) Passengers - Actual charge for transportation paid by the passengers

or the prevailing charge for comparable service if no actual charge is paid.

The HMF is paid only once per journey for each passenger. Crewmembers

are not subject to the HMF.

Column 9. VALUES OF EXEMPTIONS - Exemptions are to be itemized in Items

15 through 20. Totals shall be inserted in Items 9A through 9C.

Column 10. Net Value--Net value shall be calculated by subtracting Items 9A

through 9C from Items 8A through 8C. Enter the total net value in Column 10, Line

D.

Column 11. HMF Due - To calculate the HMF, multiply the amount on Lines

10A, 10B and 10C times the rate in effect for the period being reported. The rate is

0.0004 (.04%) through December 31, 1990 and 0.00125 (.125%) beginning

January 1, 1991.

Item 19. Other - The total value of cargo, for each type of movement, subject to the

following exemptions:

•

Cargo entering the U.S. in-bond for transportation and direct exportation to a

foreign country. (Does not include cargo for which a formal entry or

warehouse entry is filed, or cargo which is admitted into a foreign trade

zone).

•

Fish and other aquatic animal life caught by a vessel, and not previously

landed on shore, regardless of the extent to which it has been processed.

•

Passengers transported on ferries. Ferries are defined as vessels engaged

primarily in the transport of passengers and their vehicles between ports in

the U.S. or between ports in the U.S. and ports in Canada or Mexico. The

vessel must arrive in the U.S. on a regular schedule during its operating

season.

Item 21. CERTIFICATION - Insert signature of shipper, application for FTZ

admission, or operator of passenger carrying vessel.

Item 12. Total HMF Due - Total of Column 11, A through C.

Item 13. Previously Paid Amount - Original amount paid in quarter being

amended.

CBP Form 350 (03/09)

�

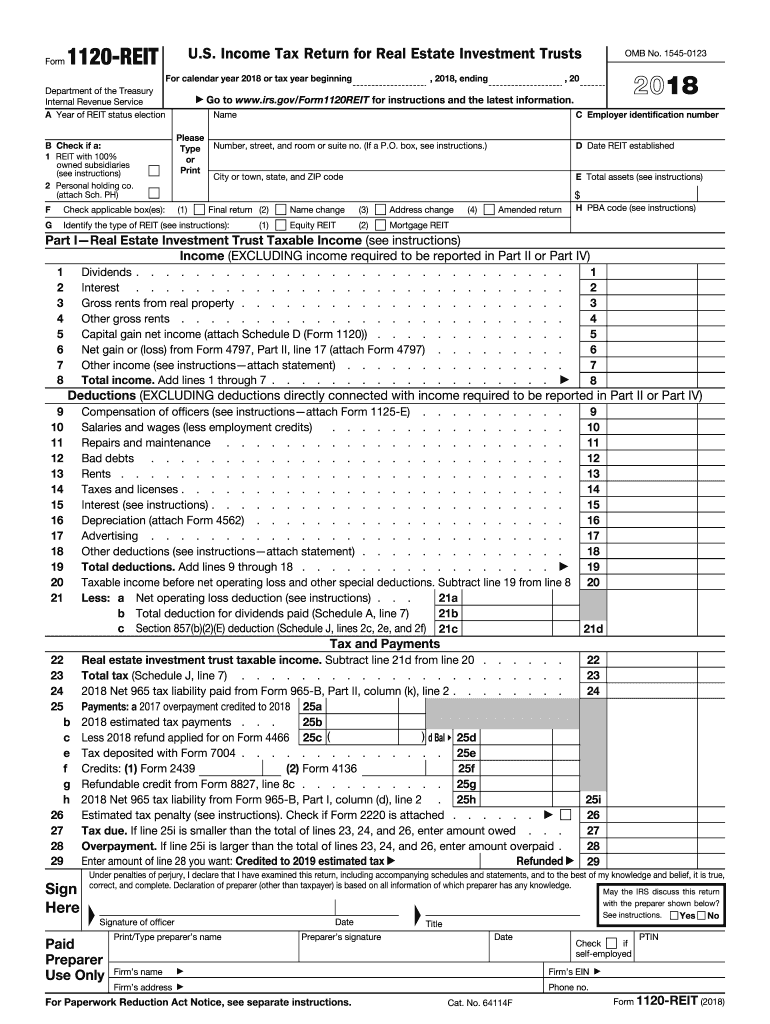

Practical advice on preparing your ‘2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts’ online

Are you exhausted from the burden of dealing with paperwork? Look no further than airSlate SignNow, the leading digital signature solution for individuals and small-to-medium businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and authorize paperwork online. Take advantage of the extensive features bundled into this user-friendly and affordable platform and transform your method of document management. Whether you need to endorse forms or collect digital signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Log in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t fret if you need to collaborate with others on your 2018 Form 1120 Reit Us Income Tax Return For Real Estate Investment Trusts or send it for notarization—our solution provides everything required to accomplish those tasks. Establish an account with airSlate SignNow today and elevate your document management to a new level!