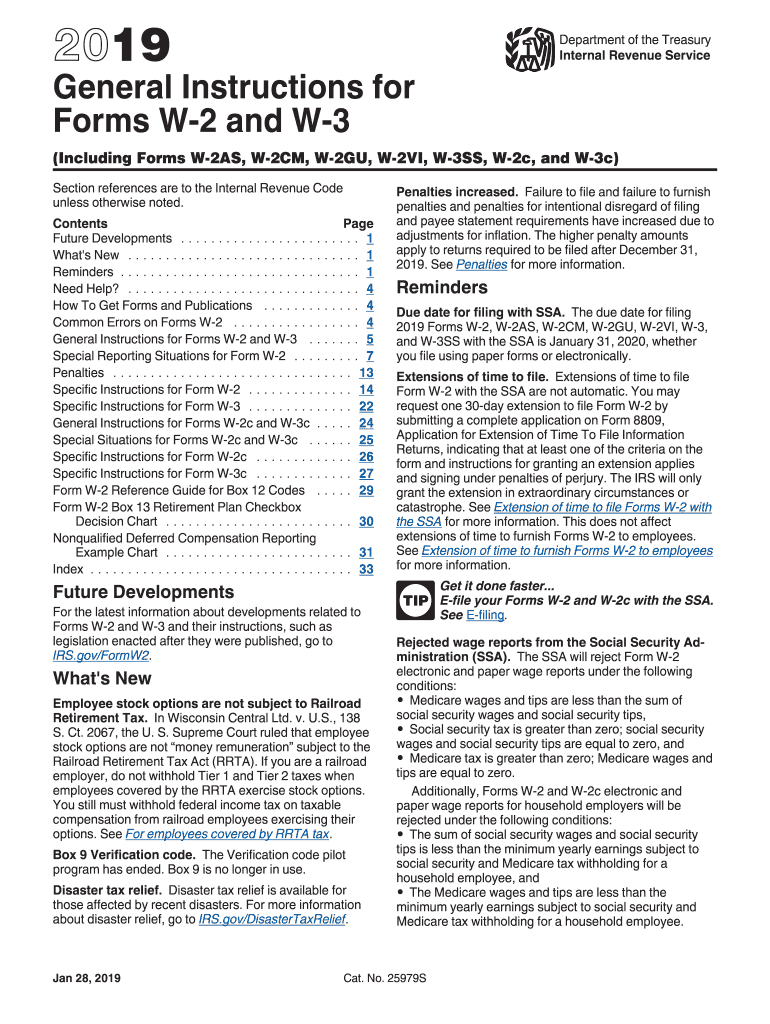

Fill and Sign the 2019 General Instructions for Forms W 2 and W 3 General Instructions for Forms W 2 and W 3 Including Forms W 2as W 2cm W 2gu W

Valuable advice on finishing your ‘2019 General Instructions For Forms W 2 And W 3 General Instructions For Forms W 2 And W 3 Including Forms W 2as W 2cm W 2gu W’ online

Are you fatigued by the complications of managing documents? Look no further than airSlate SignNow, the premier eSignature solution for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and sign documents online. Take advantage of the powerful features embedded in this user-friendly and budget-friendly platform and transform your method of document management. Whether you need to authorize forms or gather signatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Follow this comprehensive guide:

- Access your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘2019 General Instructions For Forms W 2 And W 3 General Instructions For Forms W 2 And W 3 Including Forms W 2as W 2cm W 2gu W’ in the editor.

- Click Me (Fill Out Now) to finalize the form on your part.

- Add and designate fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No worries if you need to work with your associates on your 2019 General Instructions For Forms W 2 And W 3 General Instructions For Forms W 2 And W 3 Including Forms W 2as W 2cm W 2gu W or send it for notarization—our platform equips you with everything you require to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is the Irs W 3 Wage And Tax Statement?

The Irs W 3 Wage And Tax Statement is a vital form used by employers to summarize their employees' income and withholding taxes for the year. It is submitted to the IRS along with the W-2 forms, providing a comprehensive overview of total wages paid and taxes withheld. Understanding the Irs W 3 is essential for accurate tax filing and compliance.

-

How can airSlate SignNow help with the Irs W 3 Wage And Tax Statement?

airSlate SignNow streamlines the process of sending and eSigning the Irs W 3 Wage And Tax Statement. With its user-friendly interface, businesses can easily prepare, sign, and submit this essential document electronically, ensuring quick and efficient handling of tax documentation. This reduces the risk of errors and saves valuable time during tax season.

-

Is airSlate SignNow cost-effective for handling the Irs W 3 Wage And Tax Statement?

Yes, airSlate SignNow offers a cost-effective solution for managing the Irs W 3 Wage And Tax Statement. With affordable pricing plans, businesses can manage all their document signing needs without breaking the bank. This makes it an ideal choice for companies looking to streamline their tax documentation processes while staying within budget.

-

What features does airSlate SignNow offer for the Irs W 3 Wage And Tax Statement?

airSlate SignNow provides several features tailored for the Irs W 3 Wage And Tax Statement, including templates, electronic signatures, and document tracking. These features help ensure that your tax forms are completed accurately and efficiently. Additionally, the platform allows for secure storage and easy retrieval of documents when needed.

-

Does airSlate SignNow integrate with other payroll software for the Irs W 3 Wage And Tax Statement?

Yes, airSlate SignNow integrates seamlessly with various payroll software solutions, making it easier to manage the Irs W 3 Wage And Tax Statement alongside your payroll processes. This integration ensures that all data is synchronized, allowing for accurate reporting and compliance. Businesses can automate their workflow, saving time and reducing errors.

-

What are the benefits of using airSlate SignNow for tax documentation like the Irs W 3 Wage And Tax Statement?

Using airSlate SignNow for tax documentation such as the Irs W 3 Wage And Tax Statement offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced compliance. The eSignature process eliminates the need for physical signatures, speeding up the review and approval process. Moreover, the platform provides a secure environment for sensitive tax information.

-

Can I customize the Irs W 3 Wage And Tax Statement with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the Irs W 3 Wage And Tax Statement to meet your specific business needs. You can add your branding, adjust fields, and ensure that all necessary information is included. This flexibility helps to present a professional image while making sure all data is correct and compliant.

Find out other 2019 general instructions for forms w 2 and w 3 general instructions for forms w 2 and w 3 including forms w 2as w 2cm w 2gu w

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles