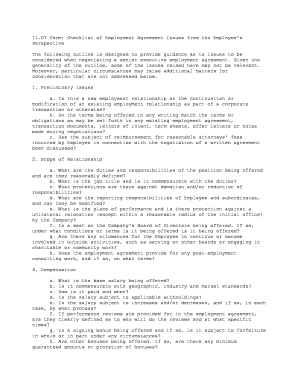

11.07 Form: Checklist of Employment Agreement Issues from the Employee's Perspective

The following outline is designed to provide guidance as to issues to be

considered when negotiating a senior executive employment agreement. Given the

generality of the outline, some of the issues raised here may not be relevant.

Moreover, particular circumstances may raise additional matters for

consideration that are not addressed below.

1. Preliminary Issuesa. Is this a new employment relationship or the continuation or

modification of an existing employment relationship as part of a corporate

transaction or otherwise? b. Do the terms being offered in any writing match the terms or

obligations as may be set forth in any existing employment agreement,

transaction documents, letters of intent, term sheets, offer letters or notes

made during negotiations? c. Has the subject of reimbursement for reasonable attorneys' fees

incurred by Employee in connection with the negotiation of a written agreement

been discussed?

2. Scope of Relationship

a. What are the duties and responsibilities of the position being offered

and are they reasonably defined? b. What is the job title and is it commensurate with the duties?

c. What protections are there against demotion and/or reduction of

responsibilities? d. What are the reporting responsibilities of Employee and subordinates,

and can they be modified?

e. What is the place of performance and is there protection against a

unilateral relocation (except within a reasonable radius of the initial office)

by the Company? f. Is a seat on the Company's Board of Directors being offered. If so,

under what conditions or terms is it being offered is it being offered? g. Are there any allowances for the Employee to continue or become

involved in outside activities, such as serving on other boards or engaging in

charitable or community work? h. Does the employment agreement provide for any post-employment

consulting work, and if so, on what terms?

3. Compensation

a. What is the base salary being offered?

b. Is it commensurate with geographic, industry and market standards?

c. How is it paid and when?

d. Is the salary subject to applicable withholdings?

e. Is the salary subject to increases and/or decreases, and if so, in each

case, by what process?

f. If performance reviews are provided for in the employment agreement,

are they clearly defined as to who will do the reviews and at what specific times? g. Is a signing bonus being offered and if so, is it subject to forfeiture

in whole or in part under any circumstances? h. Are other bonuses being offered. If so, are there any minimum

guaranteed amounts or proration of bonuses?

i. Are any performance-based bonuses being offered, and if so, are the

performance criteria sufficiently objective? j. Is the Employee required to be employed as of a specific date to

qualify for a bonus? k. Are any perks being offered, such as a Company vehicle, membership in

professional clubs or organizations, gym membership, etc. If so, is the Company

responsible for any tax issues related thereto?

l. If a loan is provided and forgiveness is contemplated, are the terms

detailed so as to avoid complication under the Sarbanes-Oxley Act if the Company

subsequently completes a public offering?

4. Stock Options and Grants

a. Is the Employee entitled to stock option grants upon commencement of

employment?

b. Under what conditions will the Employee be entitled to option grants

after commencement of employment? For example, are options granted annually, at

the discretion of the stock option committee, or otherwise? c. What are the basic terms of the options? The basic terms generally

include the number of shares subject to the option, the exercise price, the

vesting schedule and the term of the option. When will the Board determine the

exercise price and on what basis? d. May the option be exercised after termination of employment? For how

long? Can the option be forfeited? If so, under what conditions (e.g.,

termination for cause)? e. May the option be exercised prior to vesting (commonly known as "early

exercise")? f. Under what conditions will vesting be accelerated (e.g., upon a change

in control)? Is acceleration mandatory or discretionary? What acceleration

rights, if any, has been provided to the other officers? g. Is vesting contingent upon realization of performance objectives or

milestones? If so, is the criteria for realization sufficiently clear? h. If an initial public offering is contemplated, what assurance is there

as to the ability of the Company to complete the offering within the time and at

the price contemplated?

i. Do the terms in the option grant and option plan agree with the terms

in the offer letter or employment agreement?

j. What is the exercise price of the option relative to the most recent

price per share of the preferred stock or historical trading prices of the

common stock? How does the exercise price compare to the price of other

officers' options? k. What percentage of the fully-diluted capitalization does the option

represent? How does this compare to the percentage offered other officers? l. If the Company is private, are the preferences of the existing

preferred stock so large as to render value to the common stock unlikely upon an acquisition?

5. Benefits and Expenses

a. What are the benefits being offered (e.g., medical and dental

insurance, dependent coverage, disability and life insurance, pension plans,

401(k) plans, other savings plans) and are they commensurate with the Employee's

position as well as geographic, industry and market standards? b. Are there any loan arrangements, special or general?

c. Are the benefits specifically set forth or noted with reference to the

Company's policies?

d. Are the benefits subject to decrease or elimination in the Company's

sole discretion? e. Does the employment agreement provide for the automatic participation

of the Employee in any relevant new benefit plans that the Company may establish

during the term of the employment agreement? f. If the Employee is transferring employment to an acquiror or successor

as the result of a corporate transaction, is the Employee receiving credited

service with the prior employer for eligibility and related benefit purposes? g. How much vacation is being offered, how does it accrue (e.g., annually,

quarterly, monthly)? How much time may the Employee carry over if not used in a

given year? h. Is accrued but unused vacation payable upon termination of employment?

i. What other paid time off is provided (e.g., sick time, personal days,

pregnancy leaves, child-rearing leaves, etc.), and is unpaid time off available? j. Must the Employee receive approval before incurring reimbursable

expenses? Does the employment agreement provide for reasonably prompt

reimbursement of business expenses? k. In the case of a relocation, is the Employee entitled to any cost-of-

living increases or differentials, temporary housing allowances, moving and

storage expenses, and related relocation expenses, such as the purchase of an

existing home?

6. Term and Termination

a. Is the term of employment at-will, or for a specified period?

b. Does the agreement contain an "evergreen" clause, meaning that it can

be automatically extended for additional specified periods unless notice is

given by either party of an intent not to renew the agreement within a specified

period before the expiration of any current term? c. Under what circumstances and subject to what limitations may the

Employee terminate employment with the Company?

d. Under what circumstances and subject to what limitations limitations

may the Company terminate the Employee's employment? e. Must notice, written or otherwise, be given in connection with a

termination of employment? When does any termination of employment become effective? f. If the employment agreement may be terminated in the case of death or

disability, how is disability defined? In the event of death, what are the

entitlements of the Employee's heirs or estate? g. If the Company may terminate the Employee's employment "for Cause," how

is it defined? For example, may the Employee be terminated for cause only for

specified misconduct, such as conviction of a felony, acts of theft, fraud or

dishonesty which are materially injurious to the Company, or willful and

continued refusal to perform assigned duties? Vague or open-ended definitions of

"Cause" may allow the Company too much latitude. Moreover, if "Cause" includes a

violation of the Company's policies and procedures, the Employee should ask to

see such policies and procedures prior to signing the employment agreement. h. Does the Employee have a reasonable opportunity to cure any alleged

misconduct that is curable and might otherwise result in termination? i. May the Employee terminate employment for "Good Reason," meaning, for

example, a material reduction in responsibilities or job title, a material

reduction or decrease in salary, bonus or benefits, or an unreasonable (e.g.,

more than thirty-five miles from the current office location) relocation of the

Employee's work site? Does the Company have the right to cure any actions that

might otherwise constitute "Good Reason?" j. What compensation is payable upon termination of employment? How does

it vary by circumstances of termination?

k. Is the Employee entitled to a severance payment, and if so, how much

and under what circumstances? For example, is the Employee required to sign a

release waiving claims against the Company in order to receive severance? If so,

what is the form of the release? l. Is the Employee entitled to any post-employment benefits, such as

continuation of health coverage, career counseling, temporary use of an office

or phone, reference letters, relocation allowance, continued indemnification,

and the like? m. Are any post-employment obligations imposed on the Employee, such as

confidentiality, noncompetition, nonsolicitation, and if so, for how long and

are they enforceable in all jurisdictions? (See also, Restrictive Covenants below.)

7. Employee Liability Protection

a. Does the Company maintain Directors' and Officers' insurance coverage?

b. What indemnification protections does the Company provide for its

officers under the Company's bylaws?

c. Does the employment agreement provide for indemnification of the

Employee for actions taken in the course of employment or for claims made

against the Employee by prior employers by reason of the Employees employment

with the Company? d. Does any indemnification provision in the employment agreement require

the Employee to use Company-appointed counsel, and are legal fees advanced or reimbursed? e. Is the liability of officers limited to the maximum extent allowed by

law under the Company's articles of incorporation?

8. Change in Control

a. Is the Employee provided any protection in the event of a change in

control at the Company? For example, is the Employee provided with an enhanced

severance package if the Employee is terminated within six months of a change in control? b. How is a "change in control" defined within the employment agreement?

Is the definition consistent with other related documents, such as a stock

option plan or agreement? c. Is the Employee entitled to a "golden parachute" payment (e.g., a

payment of two to three times annual salary) in connection with a termination of employment? d. If the Employee becomes subject to the "golden parachute" excise tax,

is the Employee protected from the tax? Common protections are accomplished

through (1) a gross-up payment to cover the excise tax, (2) a reduction in

benefits such that the Employee is below the excise tax threshold or (3) a

reduction in benefits only if the reduction leaves the Employee in a better

after-tax position than if the Employee received the full benefits and paid the

excise tax.

9. Intellectual Property

a. Is the Employee required to assign to the Company all patents,

inventions, creations and ideas generally, or only those items that relate to

the Company's business and were developed during Company time? b. Is the Employee required to grant the Company a power of attorney or

assist the Company in the perfection of the Company's title to any patents or

other intellectual property, even post-employment?

c. Do the assignments comply with relevant law, such as California's Labor

Code Section 2870?

10. Restrictive Covenants

a. Is the Employee bound by any restrictive covenants, such as a

noncompetition, nonsolicitation of employees, noninterference with customers,

and/or a confidentiality agreement with a former employer that might impede the

Employee's performance with the new Company? b. Will the Employee be bound by any such restrictive covenants during the

term of employment with the Company and/or for any post-employment period? How

long will such restrictions last? c. As to a noncompetition restriction, is it reasonable in time and

geographic scope, and is it enforceable under applicable law? (Generally, a

post-employment noncompetition agreement is not enforceable by a California

employer against a California resident unless the agreement falls within narrow

statutory exceptions. A few other states also impose statutory restrictions on

noncompetition agreements.) d. If a post-employment nonsolicitation of employees restriction includes

a prohibition on hiring of employees even though they were not solicited, the

agreement may be construed as an unlawful noncompetition agreement in California. e. If the agreement includes a noninterference with customers restriction,

is it broadly drafted or limited only to inducing customers to terminate

existing relationships with the Company? f. What is the scope of the Employee's responsibility as to

confidentiality of Company information? For example, does it only apply to trade

secrets or information that the Company endeavors to protect from public

disclosure? Is information excepted that has been made publicly available

through no wrongful action of the Employee, or information the Employee

possessed prior to working for the Company? g. Is the Employee permitted to disclose otherwise confidential

information that the Employee might be required to disclose by law or under

whistle-blower statutes? If the Employee is required by law to disclose any such

information, must the Employee first notify the Company before such disclosure? h. How long is the Employee required to maintain confidentiality of

Company information post-employment?

i. Does the employment agreement purport to entitle the Company to

remedies out of proportion to any breach by the Employee of a restrictive

covenant? For example, can the Company assert a right to reclaim all of a large

severance payment if the Employee allegedly breaches a restrictive covenant,

even on the day that such covenant expires?

11. Dispute Resolution

a. How are disputes as to the employment relationship and termination

thereof handled?

b. Is the right to injunctive relief mutual and an exception to any

requirement to arbitrate disputes? c. Are arbitration or court proceedings required to be brought in a

specified location (venue)? d. Does the employment agreement provide for the arbitration of disputes?

If so, is the arbitration required to be conducted under the auspices and in

accordance with the rules of any organization, such as the American Arbitration

Association or JAMS? e. Does the arbitration provision, if one is included, conform with

developing legal precedent, which generally requires an employer to bear

administrative costs, such as the arbitrator's fees and filing fees, such that

the Employee's costs would exceed the cost of a court proceeding?f. If an arbitration provision is included, does it provide for adequate

discovery and the availability of remedies identical to those available in a

court proceeding? g. Does the arbitration provision require a reasoned written opinion?

h. Does the arbitration provision provide for the entry of the arbitration

award as a judgment? i. Is the prevailing party in any arbitration or litigation entitled to

recover reasonable attorneys' fees and costs?

12. "Boilerplate"

a. Does the employment agreement contain standard "boilerplate" language,

such as:

i. Modification in Writing - requiring that the employment agreement

cannot be modified except in a writing signed by the Employee and an authorized

Company representative.

ii. Entire Agreement - providing that the employment agreement

represents the entire agreement between the parties and supersedes all previous

agreements, oral or written.

iii. No Waivers - providing that the failure of one party to enforce

any provision of the employment agreement shall not be construed as a waiver of

the right of that party to later enforce a provision of the employment agreement. iv. Choice of Law - providing for which state's law will govern the

interpretation of the employment agreement. This clause should not be overlooked

because a state other than the Employee's residence may hold unpleasant

surprises for the Employee, especially when it comes to the enforceability of

certain terms. In the event a dispute arises, the Employee, in a foreign forum

will have to find counsel familiar with the governing state's law.

v. Severability - providing that if one or more parts of the

employment agreement are declared unlawful, they will be deemed "severed" from

the agreement and the rest of the agreement will remain enforceable without the

severed parts. vi. Notices - providing contact information as to where required

notices are to be sent and the means by which such notice may be made (e.g.,

mail, fax, e-mail, etc.). vii. Counterparts - allowing the employment agreement to be executed

in counterparts, which together will constitute a single executed copy.

b. An Employee should be cautious about other "boilerplate" the Company

may seek to include, such as:

i. Each Party the Drafter - An important principle of contract

interpretation is that any ambiguities are construed against the drafter. By

including this kind of provision, a Company may avoid that consequence,

sometimes to the detriment of the Employee. ii. Assignment - The Company may want the unilateral right to assign

the employment agreement. An Employee should seek restrictions on the Company's

ability to assign its rights and delegate its obligations to another, to ensure

that the assignee/delegate is not undercapitalized or otherwise unable to

perform the Company's obligations.