Fill and Sign the 3 D Cell Project Rubric Edwardsville High School Ecusd7 Form

Helpful advice on getting your ‘3 D Cell Project Rubric Edwardsville High School Ecusd7’ ready online

Are you exhausted by the burden of dealing with documentation? Look no further than airSlate SignNow, the leading eSignature service for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can conveniently finish and sign documents online. Utilize the powerful features included in this user-friendly and cost-effective platform and transform your method of document management. Whether you need to sign documents or gather eSignatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Adhere to this detailed guide:

- Log into your account or register for a free trial with our platform.

- Click +Create to upload a file from your device, cloud, or our template library.

- Access your ‘3 D Cell Project Rubric Edwardsville High School Ecusd7’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and allocate fillable fields for others (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t fret if you need to collaborate with your teammates on your 3 D Cell Project Rubric Edwardsville High School Ecusd7 or send it for notarization—our service offers everything necessary to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

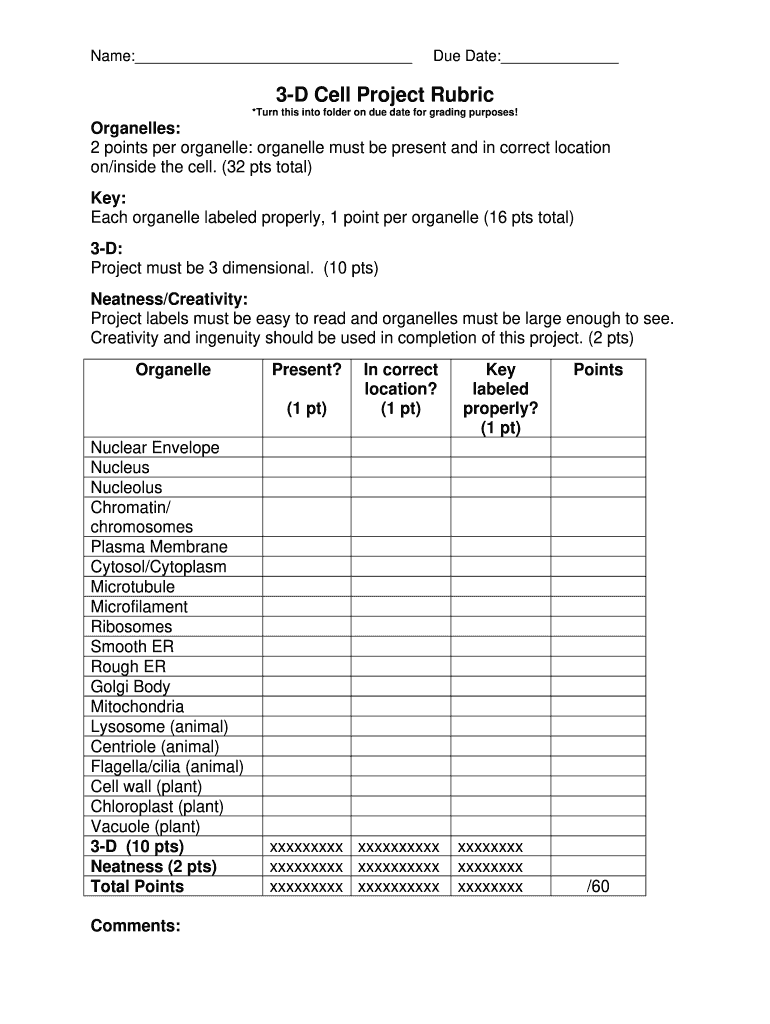

What is the 3 D Cell Project Rubric for Edwardsville High School Ecusd7?

The 3 D Cell Project Rubric for Edwardsville High School Ecusd7 outlines the criteria for evaluating student projects focused on cell biology. This rubric provides clear guidelines on expectations for creativity, scientific accuracy, and presentation, helping students understand how their work will be assessed.

-

How can airSlate SignNow help in managing the 3 D Cell Project Rubric for Edwardsville High School Ecusd7?

airSlate SignNow can streamline the management of the 3 D Cell Project Rubric for Edwardsville High School Ecusd7 by allowing teachers to easily distribute, eSign, and collect feedback on project submissions. This digital solution simplifies the entire process, ensuring that all project evaluations are organized and accessible.

-

Is there a cost associated with using airSlate SignNow for the 3 D Cell Project Rubric at Edwardsville High School Ecusd7?

Yes, airSlate SignNow offers flexible pricing plans that can accommodate the needs of Edwardsville High School Ecusd7 for managing the 3 D Cell Project Rubric. Pricing is competitive and provides a cost-effective solution for schools looking to enhance their document management and eSigning processes.

-

What features of airSlate SignNow can support the 3 D Cell Project Rubric for Edwardsville High School Ecusd7?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and secure eSigning that can signNowly enhance the use of the 3 D Cell Project Rubric for Edwardsville High School Ecusd7. These features enable teachers to provide instant feedback and ensure that all project submissions are handled efficiently.

-

Can I integrate airSlate SignNow with other tools used at Edwardsville High School Ecusd7?

Absolutely! airSlate SignNow supports integrations with a variety of tools commonly used in educational settings, allowing for seamless management of the 3 D Cell Project Rubric for Edwardsville High School Ecusd7. This flexibility ensures that all your essential applications work together smoothly.

-

What are the benefits of using airSlate SignNow for the 3 D Cell Project Rubric at Edwardsville High School Ecusd7?

Using airSlate SignNow for the 3 D Cell Project Rubric at Edwardsville High School Ecusd7 provides numerous benefits, including improved efficiency in document handling and enhanced communication between teachers and students. The platform also ensures that feedback is given promptly, fostering a better learning environment.

-

How can airSlate SignNow enhance student engagement with the 3 D Cell Project Rubric at Edwardsville High School Ecusd7?

By utilizing airSlate SignNow, students at Edwardsville High School Ecusd7 can engage more actively with the 3 D Cell Project Rubric through interactive feedback and easy access to resources. This platform encourages students to take ownership of their projects, leading to a more involved and motivated learning experience.

Find out other 3 d cell project rubric edwardsville high school ecusd7 form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles