Fill and Sign the 3372 Michigan Sales and Use Tax Certificate of State of Michigan Mi Form

Practical advice on finishing your ‘3372 Michigan Sales And Use Tax Certificate Of State Of Michigan Mi’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature option for individuals and businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can easily complete and sign forms online. Take advantage of the powerful tools included in this user-friendly and cost-effective platform and transform your method of document handling. Whether you need to approve documents or collect eSignatures, airSlate SignNow manages it all effortlessly, needing just a few clicks.

Follow this detailed procedure:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘3372 Michigan Sales And Use Tax Certificate Of State Of Michigan Mi’ in the editor.

- Select Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don’t be concerned if you need to work together with others on your 3372 Michigan Sales And Use Tax Certificate Of State Of Michigan Mi or send it for notarization—our solution provides you with everything required to accomplish such tasks. Register with airSlate SignNow today and upgrade your document management to a higher standard!

FAQs

-

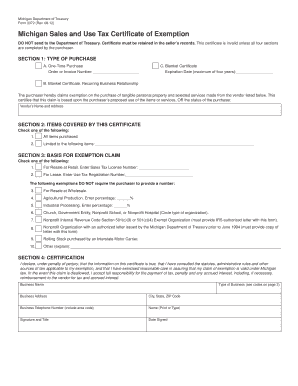

What is the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi?

The 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi is a document that allows businesses in Michigan to purchase goods without paying sales tax. This certificate is essential for businesses that are tax-exempt or for those who resell goods. By utilizing this certificate, businesses can efficiently manage their tax obligations.

-

How can airSlate SignNow help me with the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi?

airSlate SignNow simplifies the process of managing your 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi by providing a seamless e-signature solution. You can quickly send, receive, and e-sign this important document, ensuring that your transactions are both efficient and legally compliant. Our platform is designed to cater to your business's document needs.

-

What are the pricing options for airSlate SignNow when managing the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi?

airSlate SignNow offers flexible pricing plans tailored to your business needs. Our plans allow you to manage documents like the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi at competitive rates, ensuring you get the best value for your e-signature needs. You can choose from monthly or annual subscriptions based on your usage.

-

Is airSlate SignNow secure for handling the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi. Our platform employs advanced encryption and security measures to protect your sensitive information, ensuring that your documents remain confidential and secure.

-

What features does airSlate SignNow offer for managing the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi?

With airSlate SignNow, you get a comprehensive suite of features to manage the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi effectively. These include easy document sharing, customizable templates, automated reminders, and tracking options that enhance your workflow. Our user-friendly interface makes it simple to navigate and manage your documents.

-

Can I integrate airSlate SignNow with other software for handling the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi?

Yes, airSlate SignNow supports numerous integrations with popular software solutions, allowing you to streamline your workflow for the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi. Whether you're using CRM systems or accounting software, our platform can easily connect to enhance your document management processes.

-

What are the benefits of using airSlate SignNow for the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi?

Using airSlate SignNow for the 3372, Michigan Sales And Use Tax Certificate Of State Of Michigan Mi provides numerous benefits, including time savings, enhanced efficiency, and improved compliance. Our electronic signature solution speeds up the signing process, reduces paperwork, and ensures that your tax certificate is processed correctly and promptly.

Find out other 3372 michigan sales and use tax certificate of state of michigan mi form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles