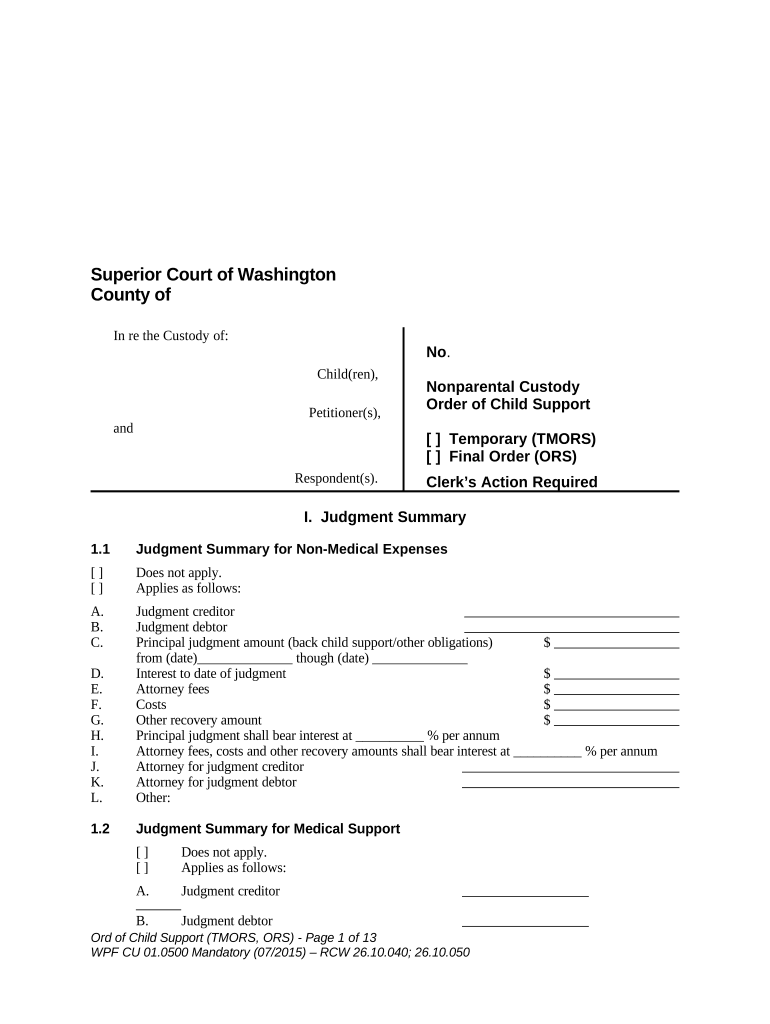

Superior Court of Washington

County of

In re the Custody of:

Child(ren),

Petitioner(s),

and

Respondent(s). No .

Nonparental Custody

Order of Child Support

[ ] Temporary (TMORS)

[ ] Final Order (ORS)

Clerk’s Action Required

I. Judgment Summary

1.1 Judgment Summary for Non-Medical Expenses

[ ] Does not apply.

[ ] Applies as follows:

A. Judgment creditor

B. Judgment debtor

C. Principal judgment amount (back child support/other obligations) $

from (date)______________ though (date) ______________

D. Interest to date of judgment $

E. Attorney fees $

F. Costs $

G. Other recovery amount $

H. Principal judgment shall bear interest at __________ % per annum

I. Attorney fees, costs and other recovery amounts shall bear interest at __________ % per annum

J. Attorney for judgment creditor

K. Attorney for judgment debtor

L. Other:

1.2 Judgment Summary for Medical Support

[ ] Does not apply.

[ ] Applies as follows:

A. Judgment creditor

B. Judgment debtor

Ord of Child Support (TMORS, ORS) - Page 1 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

C. Judgment for medical support $

from (date) ______________ through (date) ______________

D. Interest to date of judgment $

E. Attorney fees $

F. Costs $

G. Principal judgment shall bear interest at __________ % per annum

H. Attorney fees, costs and other recovery amounts shall bear interest at ______ % per annum

I. Attorney for judgment creditor

J. Attorney for judgment debtor

K. Other:

II. Basis

2.1 Type of Proceeding

This order is entered under a nonparental custody petition:

[ ] nonparental custody decree.

[ ] order for modification of child support.

[ ] hearing for temporary child support.

[ ] order of adjustment.

[ ] order for modification of a custody decree or residential schedule.

[ ] other:

2.2 Child Support Worksheet

The child support worksheet which has been approved by the court is attached to this order and is

incorporated by reference or has been initialed and filed separately and is incorporated by reference.

2.3 Other

III. Findings and Order

It is Ordered :

3.1 Child(ren) for Whom Support is Required

Name (first/last ) Age

3.2 Person Paying Support (Obligor)

Ord of Child Support (TMORS, ORS) - Page 2 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

Name (first/last):

Birth date:

Service Address: (You may list an address that is not your residential address where you agree to

accept legal documents .)

The obligor parent must immediately file with the court and the

Washington State Child Support Registry, and update as necessary, the

Confidential Information Form required by RCW 26.23.050 .

The obligor parent shall update the information required by paragraph 3.2

promptly after any change in the information. The duty to update the

information continues as long as any monthly support remains due or any

unpaid support debt remains due under this order .

For purposes of this Order of Child Support, the support obligation is based upon the following

income:

A. [ ] Actual Monthly Net Income: $ _______________.

OR

B. [ ] Monthly net income after exclusion requiring findings:

Actual monthly gross income $ _______________ from which the court

excludes $ _______________ because the court finds that the obligor earned that

income from overtime or from second jobs beyond 40 hours per week averaged

over a 12-month period to:

[ ] provide for a current family’s needs; or

[ ] retire past relationship debts; or

[ ] retire child support debt; and

that the income will cease when the obligor has paid off his or her debts.

Monthly net income after allowed exclusion: $_________________.

OR

C. [ ] The net income of the obligor is imputed at $ _______________ because:

[ ] the obligor’s income is unknown.

[ ] the obligor is voluntarily unemployed.

[ ] the obligor is voluntarily underemployed.

The amount of imputed income is based on the following information in order of

priority. The court has used the first option for which there is information:

[ ] current rate of pay;

[ ] reliable historical rate of pay information;

[ ] past earnings when there is incomplete or sporadic information of the

parent’s past earnings;

Ord of Child Support (TMORS, ORS) - Page 3 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

[ ] minimum wage in the jurisdiction where the parent lives at full-time

earnings because the parent:

[ ] has a recent history of minimum wage jobs,

[ ] recently came off public assistance, general assistance-

unemployable, supplemental security income, or disability

[ ] was recently released from incarceration, or

[ ] is a high school student.

[ ] Median Net Monthly Income Table.

[ ] Other:

3.3 Person Receiving Support (Nonparental Custody Obligee)

Name (first/last):

Birth date:

Service Address: (you may list an address that is not your residential address where you agree to

accept legal documents .)

The obligee must immediately file with the court and the Washington State

Child Support Registry, and update as necessary, the Confidential

Information Form Required by RCW 26.23.050 .

The obligee shall update the information required by paragraph 3.3

promptly after any change in the information. The duty to update the

information continues as long as any monthly support remains due or any

unpaid support debt remains due under this order .

The obligor may be able to seek reimbursement for day care or special child rearing expenses not

actually incurred. RCW 26.19.080.

3.4 Service of Process

Service of process on the obligor at the address required by the paragraph

3.2 or any updated address, or on the obligee at the address required by

paragraph 3.3. or any updated address, may be allowed or accepted as

adequate in any proceeding to establish, enforce or modify a child support

order between the parties by delivery of written notice to the obligor or

obligee at the last address provided .

3.5 Transfer Payment

The obligor parent shall pay the following amounts per month for the following child(ren):

Name Amount

$

Ord of Child Support (TMORS, ORS) - Page 4 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

$

$

$

Total Monthly Transfer Amount $

[ ] The parents’ combined monthly net income exceeds $12,000 and the court sets child

support in excess of the presumptive amount for $12,000 because:

[ ] The court finds that the obligor’s child support obligations owed for all his or her

biological or legal children exceed 45% of his or her net income and it is [ ] just

[ ] unjust to apply the 45% limitation based upon the best interests of the child(ren) and

the circumstances of each parent as follows:

[ ] If one of the children changes age brackets, the child support shall be as follows:

[ ] This is a downward modification that has caused an overpayment of $ ______________.

This amount shall be repaid or credited as follows:

[ ] This is an upward modification that has caused an underpayment of $_______________.

This amount shall be paid as follows:

[ ] Other :

The obligor’s privileges to obtain or maintain a license, certificate,

registration, permit, approval, or other similar document issued by a

licensing entity evidencing admission to or granting authority to engage in

a profession, occupation, business, industry, recreational pursuit, or the

operation of a motor vehicle may be denied or may be suspended in the

obligor parent is not in compliance with this support order as provided in

Chapter 74.20A Revised Code of Washington .

3.6 Standard Calculation

$ per month. (See Worksheet line 17.)

3.7 Reasons for Deviation From Standard Calculation

Ord of Child Support (TMORS, ORS) - Page 5 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

[ ] The child support amount ordered in paragraph 3.5 does not deviate from the standard

calculation.

[ ] The child support amount ordered in paragraph 3.5 deviates from the standard calculation for

the following reasons:

[ ] Income of a new spouse or domestic partner of the party requesting a deviation for other

reasons;

[ ] Income of other adults in the household of the party requesting a deviation for other

reasons;

[ ] Child support actually paid or received for other child(ren) from other relationships;

[ ] Gifts;

[ ] Prizes;

[ ] Possession of wealth;

[ ] Extraordinary income of the child(ren);

[ ] Tax planning which results in greater benefit to the child(ren);

[ ] Income from overtime or second jobs that was excluded from income of the parent

requesting a deviation for other reasons;

[ ] A nonrecurring source of income;

[ ] Extraordinary debt not voluntarily incurred;

[ ] A significant disparity in the living costs of the parties due to conditions beyond their

control;

[ ] Special needs of disabled child(ren);

[ ] Special medical, educational, or psychological needs of the child(ren);

[ ] The child(ren) spend(s) a significant amount of time with the party who is obligated to

make a support transfer payment. The deviation does not result in insufficient funds in

the nonparental custodian’s household to meet the basic needs of the child(ren). The

child(ren) do(es) not receive public assistance;

[ ] Child(ren) from other relationships;

[ ] Costs incurred or anticipated to be incurred by the parties in compliance with court-

ordered reunification efforts or under a voluntary placement agreement with an agency

supervising the child(ren);

[ ] The obligor has established that it is unjust or inappropriate to apply the presumptive

minimum payment of $50.00 per child.

[ ] The obligee has established that it is unjust to apply the self-support reserve.

[ ] Other reason(s) for deviation:

The factual basis for these reasons is as follows:

3.8 Reasons Why Request for Deviation Was Denied

[ ] Does not apply. A deviation was ordered.

[ ] A deviation was not requested.

[ ] The deviation sought by the [ ] obligor [ ] obligee was denied because:

[ ] no good reason exists to justify deviation.

[ ] other:

3.9 Starting Date and Day to Be Paid

Ord of Child Support (TMORS, ORS) - Page 6 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

Starting date: ________________________

Day(s) of the month support is due: ________________________

3.10 Incremental Payments

[ ] Does not apply.

[ ] This is a modification of child support. Pursuant to RCW 26.09.170(9)(a) and (c), the

obligation has been modified by more than 30 percent and the change would cause

significant hardship. The increase in the child support obligation set forth in Paragraph

3.5 shall be implemented in two equal increments, one at the time of this order and the

second on (date) _______________ six months from the entry of this order.

3.11 Making Support Payments

Select Enforcement and Collection, Payment Processing Only, or Direct Payment :

[ ] Enforcement and collection: The Division of Child Support (DCS) provides support

enforcement services for this case because: [ ] This is a public assistance case, [ ] this is

a case in which a party has requested services from DCS, [ ] a party has signed the

application for services from DCS on the last page of this support order . (Check all

that apply.) Support payments shall be made to:

Washington State Support Registry

P. O. Box 45868

Olympia, WA 98504

Phone: 1-800-922-4306 or

1-800-442-5437

[ ] Payment services only: The Division of Child Support will process and keep a record of

all payments but will not take any collection action. Support payments shall be made

to:

Washington State Support Registry

P. O. Box 45868

Olympia, WA 98504

Phone: 1-800-922-4306 or

1-800-442-5437

[ ] Direct Payment: Support payments shall be made directly to:

Name

Mailing Address

________________________________________

A party required to make payments to the Washington State Support Registry will not receive

credit for a payment made to any other party or entity. The obligor shall keep the registry

informed whether he or she has access to health insurance coverage at reasonable cost and, if so,

to provide the health insurance policy information.

Any time the Division of Child Support is providing support enforcement services under

RCW 26.23.045, or if a party is applying for support enforcement services by signing the

application form on the bottom of the support order, the receiving parent might be required to

submit an accounting of how the support, including any cash medical support, is being spent to

benefit the child(ren).

Ord of Child Support (TMORS, ORS) - Page 7 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

3.12 Wage Withholding Action

Withholding action may be taken against wages, earnings, assets, or benefits, and liens enforced

against real and personal property under the child support statutes of this or any other state,

without further notice to the obligor at any time after entry of this order unless an alternative

provision is made below:

[If the court orders immediate wage withholding in a case where Division of Child Support does

not provide support enforcement services, a mandatory wage assignment under Chapter 26.18

RCW must be entered and support payments must be made to the Support Registry.]

[ ] Wage withholding, by notice of payroll deduction or other income withholding action

under Chapter 26.18 RCW or Chapter 74.20A RCW, without further notice to the

obligor, is delayed until a payment is past due, because:

[ ] the parties have reached a written agreement which the court approves that

provides for an alternate arrangement.

[ ] The Division of Child Support provides support enforcement services for this

case [see 3.11] and there is good cause (as stated below under "Good Cause") not

to require immediate income withholding which is in the best interests of the

child and, in modification cases, previously ordered child support has been

timely paid.

[ ] The Division of Child Support does not provide support enforcement services for

this case (see 3.11) and there is good cause (as stated below under "Good

Cause") not to require immediate income withholding.

Good Cause:

3.13 Termination of Support

Support shall be paid:

[ ] provided that this is a temporary order, until a subsequent child support order is entered

by this court.

[ ] until the child(ren) reach(es) the age of 18 or as long as the child(ren) remain(s) enrolled

in high school, whichever occurs last, except as otherwise provided below in Paragraph

3.14.

[ ] until the child(ren) reach(es) the age of 18, except as otherwise provided below in

Paragraph 3.14.

[ ] after the age of 18 for (name) ______________________________ who is a dependent

adult child, until the child is capable of self-support and the necessity for support ceases.

[ ] until the obligation for post secondary support set forth in Paragraph 3.14 begins for the

child(ren).

[ ] other:

3.14 Post Secondary Educational Support

[ ] The right to request post secondary support is reserved, provided that the right is

exercised before support terminates as set forth in paragraph 3.13.

Ord of Child Support (TMORS, ORS) - Page 8 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

[ ] The parties shall pay for the post secondary educational support of the child(ren). Post

secondary support provisions will be decided by agreement or by the court.

[ ] No post secondary educational support shall be required.

[ ] Other:

3.15 Payment for Expenses not Included in the Transfer Payment

[ ] Does not apply because all payments, except medical, are included in the transfer

payment.

[ ] Respondent (name) _________________________ shall pay __________% and

respondent (name) ________________________ shall pay __________ % (each parent’s

proportional share of income from the Child Support Schedule Worksheet, line 6) of the

following expenses incurred on behalf of the child(ren) listed in Paragraph 3.1:

[ ] day care.

[ ] educational expenses.

[ ] long distance transportation expenses.

[ ] other:

Payments shall be made to [ ] the provider of the service [ ] the nonparental custodians.

[ ] The obligor shall pay the following amounts each month the expense is incurred on

behalf of the child(ren) listed in Paragraph 3.1:

[ ] day care: $ _______________ payable to the [ ] day care provider [ ] nonparental

custodians;

[ ] educational expenses: $ _______________ payable to the [ ] educational

provider [ ] nonparental custodians;

[ ] long distance transportation: $ ______________ payable to the [ ] transportation

provider [ ] nonparental custodians.

[ ] other:

3.16 Periodic Adjustment

[ ] Does not apply.

[ ] Child support shall be adjusted periodically as follows:

[ ] Other:

3.17 Income Tax Exemptions

[ ] Does not apply.

[ ] Tax exemptions for the child(ren) shall be allocated as follows:

[ ] The parties shall sign the federal income tax dependency exemption waiver.

[ ] Other:

Ord of Child Support (TMORS, ORS) - Page 9 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

Under federal law, the parent who claims the income tax exemption for the child may

be subject to a tax penalty if the child does not have medical insurance coverage.

3.18 Medical Support - Health Insurance

Both parents shall be responsible for ensuring the child(ren) listed in paragraph 3.1 are covered

by health insurance coverage, as follows:

3.18.1 Health Insurance

[ ] The court has insufficient evidence to decide how insurance coverage for the children

should be provided. The parents’ medical support obligations may be enforced by the

Division of Child Support, the custodian or the other parent under RCW 26.18.170 as

described in paragraph 3.18.2, below.

OR

[ ] ___________________________ shall pay the health insurance premium because the

court has considered the needs of the child, the cost and extent of coverage, and the

accessibility of coverage.

[ ] The other parent shall contribute their proportionate share of the premium paid.

(check one)

[ ] The health insurance premium is included in the Worksheet. No

separate payment is needed.

[ ] The health insurance premium is not included in the worksheets.

Separate payment is needed. A parent or nonparent custodian may ask

DCS or the court to enforce payment of the proportional share.

[ ] The other parent is excused from contributing to health insurance premium for

state purposes because:

Neither parent must pay an amount for health insurance premiums that is more than

twenty-five percent of their basic support obligation, unless otherwise ordered by the

court.

[ ] Other:

All parties’ obligation:

If the child(ren) are receiving state financed medical coverage, the Division of Child

Support may enforce the responsible parent’s monthly premium.

The parent(s) shall maintain health insurance coverage, if available for the child(ren)

listed in paragraph 3.1, until further order of the court or until health insurance is no

Ord of Child Support (TMORS, ORS) - Page 10 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

longer available through the parents’ employer or union and no conversion privileges

exist to continue coverage following termination of employment.

A parent who is required under this order to provide health insurance coverage is liable

for any covered health care costs for which that parent receives direct payment from an

insurer.

A parent who is required under this order to provide health insurance coverage shall

provide proof that such coverage is available or not available within 20 days of the entry

of this order to the custodian and the other parent, or the Washington State Support

Registry if the parent has been notified or ordered to make payments to the Washington

State Support Registry.

If proof that health insurance coverage is available or not available is not provided within

20 days, the custodian or parent seeking enforcement or the Department of Social and

Health Services may seek direct enforcement of the coverage through the employer or

union of either parent or both parents without further notice to the parent as provided

under Chapter 26.18 RCW.

3.18.2 Change of Circumstances and Enforcement

A parent required to provide health insurance coverage must notify the Division of Child

Support, the custodian, and the other parent when coverage terminates.

If the parents’ circumstances change, or if the court has not specified how medical support shall

be provided, the parents’ medical support obligations will be enforced as provided in

RCW 26.18.170. If a parent does not provide proof of accessible coverage for the child(ren)

through private insurance, a parent may be required to satisfy his or her medical support

obligation by doing one of the following, listed in order of priority:

1) Providing or maintaining health insurance coverage through the parent’s employment or

union at a cost not to exceed 25% of that parent’s basic support obligation;

2) Contributing the parent’s proportionate share of a monthly premium being paid by the

other parent for health insurance coverage for the child(ren) listed in paragraph 3.1 of this

order, not to exceed 25% of the obligated parent’s basic support obligation; or

3) Contributing the parent’s proportionate share of a monthly premium paid by the state if

the child(ren) receive(s) state-financed medical coverage through DSHS or HCA (Health

Care Authority) under RCW 74.09 for which there is an assignment.

A custodian or parent seeking to enforce the obligation to provide health insurance coverage may

apply for support enforcement services from the Division of Child Support; file a motion for

contempt (use form WPF DRPSCU 05.0100, Motion/Declaration for an Order to Show Cause re

Contempt); or file a petition.

3.19 Uninsured Medical Expenses

Both parents have an obligation to pay their share of uninsured medical expenses.

Respondent (name) ____________________________ shall pay _________% of uninsured

medical expenses (unless stated otherwise, that parent’s proportional share of income from the

Worksheet, line 6) and respondent (name) ______________________ shall pay __________% of

uninsured medical expenses (unless stated otherwise, that parent’s proportional share of income

from the Worksheet, line 6).

3.20 Back Child Support

Ord of Child Support (TMORS, ORS) - Page 11 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

[ ] Back child support that may be owed is not affected by this order.

[ ] Back interest that may be owed is not affected by this order.

[ ] (Name) ___________________________________ is awarded a judgment against

(name) __________________________ in the amount of $_______________ for back

child support for the period from (date) _____________ through (date) _____________ .

[ ] (Name) _______________________________ is awarded a judgment against

(name) ____________________________ in the amount of $ _______________for back

interest for the period from (date) ______________ through (date) ________________.

[ ] No back child support is owed at this time.

[ ] No back interest is owed at this time.

[ ] Other:

3.21 Past Due Unpaid Medical Support

[ ] Unpaid medical support that may be owed is not affected by this order.

[ ] Back interest that may be owed is not affected by this order.

[ ] (Name) ____________________________ is awarded a judgment against

(name) _________________________ in the amount of $ _______________for past due

unpaid medical support for the period from (date) ________ through (date) ________.

[ ] (Name) __________________________ is awarded a judgment against

(name) ________________________ in the amount of $ _______________for back

interest for the period from (date) ______________ through (date) _______________.

[ ] No past due unpaid medical support is owed at this time.

[ ] No back interest is owed at this time.

[ ] Other:

3.22 Other Unpaid Obligations

[ ] Other obligations that may be owed are not affected by this order.

[ ] Back interest that may be owed is not affected by this order.

[ ] (Name) ________________________________ is awarded a judgment against

(name) _________________________ in the amount of $ _______________for [ ] child

care [ ] ordered contributions to extracurricular activities [ ] long distance transportation

costs [ ] educational expenses [ ] post secondary [ ] other _________________________

for the period from (date) ______________ through (date) ___________________.

[ ] (Name) ________________________ is awarded a judgment against

(name) _______________________ in the amount of $ _______________for back

interest for the period from (date) ______________ through (date) ________________.

[ ] No other obligations are owed at this time.

[ ] No back interest is owed at this time.

[ ] Other:

3.23 Other

Ord of Child Support (TMORS, ORS) - Page 12 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

Dated:

Judge/Commissioner

Presented by: Approved for entry:

Notice of presentation waived:

Signature of Party or Lawyer/WSBA No. Signature of Party or Lawyer/WSBA No.

Print Name Print Name

Approved for entry: Approved for entry:

Notice of presentation waived Notice of presentation waived:

Signature of Party or Lawyer/WSBA No. Signature of Party or Lawyer/WSBA No.

Print Name Print Name

[ ] I apply for full support enforcement services from the DSHS Division of Child Support (DCS).

(Note: If you never received TANF, tribal TANF, or AFCD, an annual $25 fee applies if over

$500 is disbursed on a case, unless the fee is waived by DCS.)

Signature of Party

[ ] Approval required in Public Assistance cases. The DSHS’ Division of Child Support received

notice required by RCW 26.23.130. This order has been reviewed and approved as to:

[ ] Current Child Support

[ ] Back Child Support

[ ] Medical Support

[ ] Other:

_________________________________________

Deputy Prosecuting Attorney/WSBA No.

Ord of Child Support (TMORS, ORS) - Page 13 of 13

WPF CU 01.0500 Mandatory (07/2015) – RCW 26.10.040; 26.10.050

Valuable advice on setting up your ‘497429425’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for both individuals and businesses. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the robust features embedded in this intuitive and cost-effective platform and transform your document handling methods. Whether you require to sign forms or collect eSignatures, airSlate SignNow makes it all simple, needing just a handful of clicks.

Follow this detailed guide:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Open your ‘497429425’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your behalf.

- Add and designate fillable fields for other parties (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a multi-use template.

No need to worry if you need to work with your colleagues on your 497429425 or send it for notarization—our platform provides all the necessary tools to achieve these tasks. Sign up with airSlate SignNow today and enhance your document management to a new standard!