Fill and Sign the 880 Lease Form

Valuable tips on preparing your ‘880 Lease Form’ online

Are you exhausted by the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small businesses. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the robust features available in this user-friendly and cost-effective platform and transform your document management process. Whether you need to sign forms or gather eSignatures, airSlate SignNow makes it all simple, with just a few clicks required.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘880 Lease Form’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Include and assign fillable fields for additional users (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or transform it into a multi-use template.

Don’t fret if you need to collaborate with others on your 880 Lease Form or send it for notarization—our platform has everything necessary to help you complete these tasks. Register with airSlate SignNow today and elevate your document management to new heights!

FAQs

-

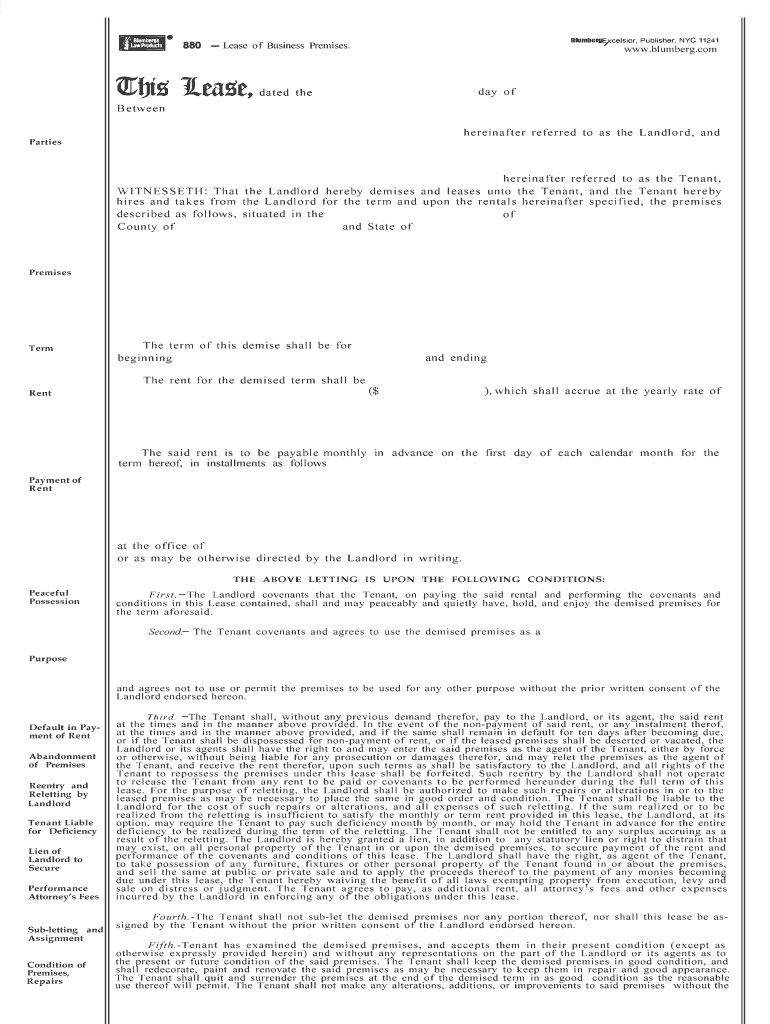

What is a Fillable Blumberg Commercial Lease Agreement?

A Fillable Blumberg Commercial Lease Agreement is a customizable legal document specifically designed for commercial rental transactions. This agreement can be easily filled out online, allowing landlords and tenants to include their specific terms and conditions efficiently. Utilizing airSlate SignNow, users can effortlessly create, edit, and manage this essential lease document.

-

How can airSlate SignNow help me with my Fillable Blumberg Commercial Lease Agreement?

airSlate SignNow provides a user-friendly platform to create and eSign your Fillable Blumberg Commercial Lease Agreement. With intuitive tools, you can quickly input information, customize clauses, and ensure that all parties can review and sign the document electronically. This streamlines the leasing process, saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow to create a Fillable Blumberg Commercial Lease Agreement?

airSlate SignNow offers several pricing plans that cater to different business needs, making it affordable to create a Fillable Blumberg Commercial Lease Agreement. You can choose from monthly or annual subscriptions, with various features included at each level. This flexibility allows businesses of all sizes to access professional document management without breaking the bank.

-

Is the Fillable Blumberg Commercial Lease Agreement legally binding?

Yes, the Fillable Blumberg Commercial Lease Agreement created and signed through airSlate SignNow is legally binding, provided all parties involved have properly signed the document. The platform adheres to electronic signature laws, ensuring that your lease agreement holds up in court. It's important to ensure that all necessary parties review and agree to the terms before signing.

-

Can I customize my Fillable Blumberg Commercial Lease Agreement?

Absolutely! airSlate SignNow allows you to fully customize your Fillable Blumberg Commercial Lease Agreement to meet your specific needs. You can add clauses, modify existing terms, and adjust the layout to ensure the document aligns with your rental requirements. This level of customization helps you create a lease that is tailored for your unique situation.

-

What features does airSlate SignNow offer for managing my Fillable Blumberg Commercial Lease Agreement?

airSlate SignNow offers a variety of features to enhance the management of your Fillable Blumberg Commercial Lease Agreement. Key features include easy document sharing, automated reminders for signers, and a secure cloud storage system for all your important agreements. These tools help streamline the leasing process and improve overall efficiency.

-

Are there any integrations available for the Fillable Blumberg Commercial Lease Agreement?

Yes, airSlate SignNow provides numerous integrations with popular business applications to enhance your Fillable Blumberg Commercial Lease Agreement workflow. You can easily integrate with tools like Google Drive, Dropbox, and CRM systems, allowing for seamless document management and access across your organization. This connectivity improves collaboration and simplifies your leasing processes.

Find out other 880 lease form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles