Fill and Sign the Accounting Agreement Self Employed Independent Contractor Form

Helpful tips on preparing your ‘Accounting Agreement Self Employed Independent Contractor’ online

Are you frustrated with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature platform for individuals and organizations. Say farewell to the time-consuming process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign paperwork online. Utilize the extensive features embedded in this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to approve forms or gather signatures, airSlate SignNow efficiently takes care of it all, with merely a few clicks.

Follow this step-by-step guide:

- Sign in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Edit your ‘Accounting Agreement Self Employed Independent Contractor’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Add and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or turn it into a reusable template.

No need to worry if you need to work with others on your Accounting Agreement Self Employed Independent Contractor or send it for notarization—our solution provides everything you require to accomplish such tasks. Sign up with airSlate SignNow today and enhance your document management to a new level!

FAQs

-

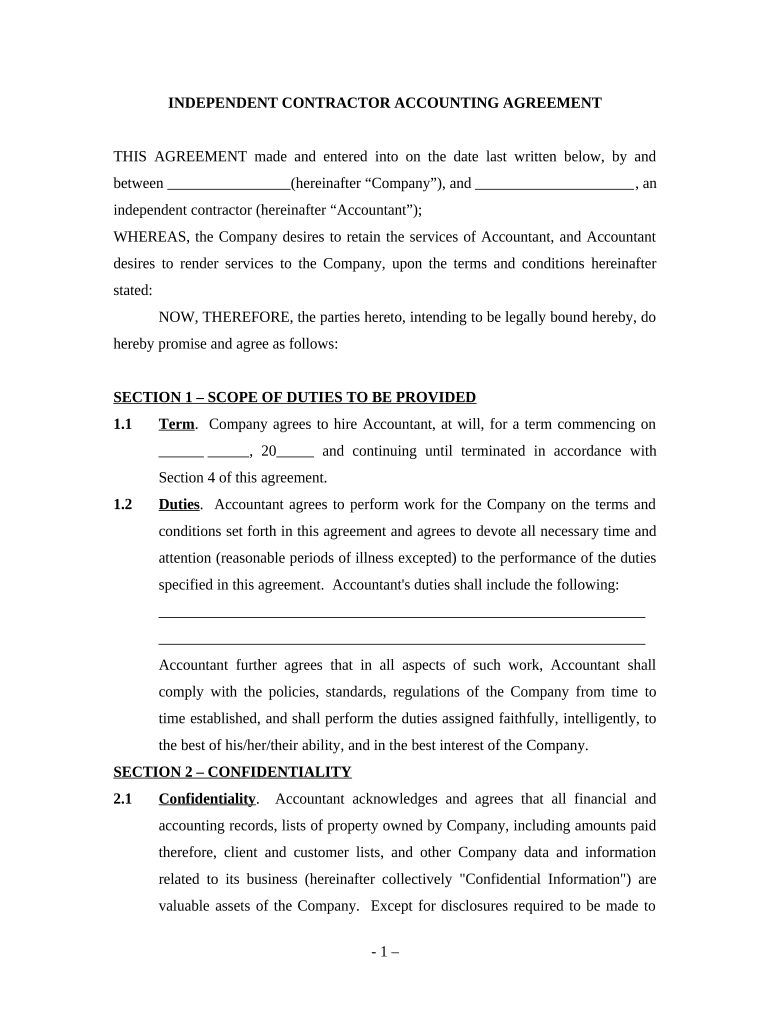

What is an Accounting Agreement for Self Employed Independent Contractors?

An Accounting Agreement for Self Employed Independent Contractors is a formal document that outlines the terms and conditions of the financial relationship between the contractor and their clients. This agreement typically includes payment details, services rendered, and any tax implications, ensuring clarity for both parties involved in the business arrangement.

-

How can airSlate SignNow help with Accounting Agreements for Self Employed Independent Contractors?

airSlate SignNow streamlines the process of creating, sending, and eSigning Accounting Agreements for Self Employed Independent Contractors. With its user-friendly interface and robust features, you can quickly customize templates, gather signatures, and manage documents all in one place, saving time and reducing administrative burdens.

-

What are the pricing options for using airSlate SignNow for Accounting Agreements?

airSlate SignNow offers several pricing plans to suit different needs, making it a cost-effective solution for managing Accounting Agreements for Self Employed Independent Contractors. You can choose from monthly or annual subscriptions, and each plan comes with a variety of features designed to enhance your document management experience.

-

Are there templates available for Accounting Agreements for Self Employed Independent Contractors?

Yes, airSlate SignNow provides a range of customizable templates specifically designed for Accounting Agreements for Self Employed Independent Contractors. These templates can be easily edited to include your unique terms and conditions, ensuring that your agreements are tailored to your specific business needs.

-

Can I integrate airSlate SignNow with other tools for managing Accounting Agreements?

Absolutely! airSlate SignNow offers seamless integrations with a variety of business tools, allowing you to manage your Accounting Agreements for Self Employed Independent Contractors efficiently. You can connect with popular applications like Google Drive, Dropbox, and more, enhancing your workflow and productivity.

-

What security measures does airSlate SignNow implement for Accounting Agreements?

Security is a top priority at airSlate SignNow. When handling Accounting Agreements for Self Employed Independent Contractors, your documents are protected with advanced encryption and secure cloud storage. This ensures that your sensitive information stays safe and compliant with industry standards.

-

How does eSigning work for Accounting Agreements using airSlate SignNow?

eSigning with airSlate SignNow is quick and straightforward. Simply upload your Accounting Agreement for Self Employed Independent Contractors, add the necessary fields for signatures, and send it out for signing. Recipients can sign from any device, making the process efficient and hassle-free.

The best way to complete and sign your accounting agreement self employed independent contractor form

Find out other accounting agreement self employed independent contractor form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles