Fill and Sign the Ach Credit Authorization Form

Practical suggestions for finalizing your ‘Ach Credit Authorization Form’ online

Are you fed up with the complications of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature platform for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the powerful features integrated into this user-friendly and budget-friendly platform and transform your approach to paperwork administration. Whether you need to authorize forms or collect eSignatures, airSlate SignNow manages it all effortlessly, with just a few clicks.

Adhere to this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template library.

- Access your ‘Ach Credit Authorization Form’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and assign fillable fields for others (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t be concerned if you need to work with others on your Ach Credit Authorization Form or send it for notarization—our platform provides everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new height!

FAQs

-

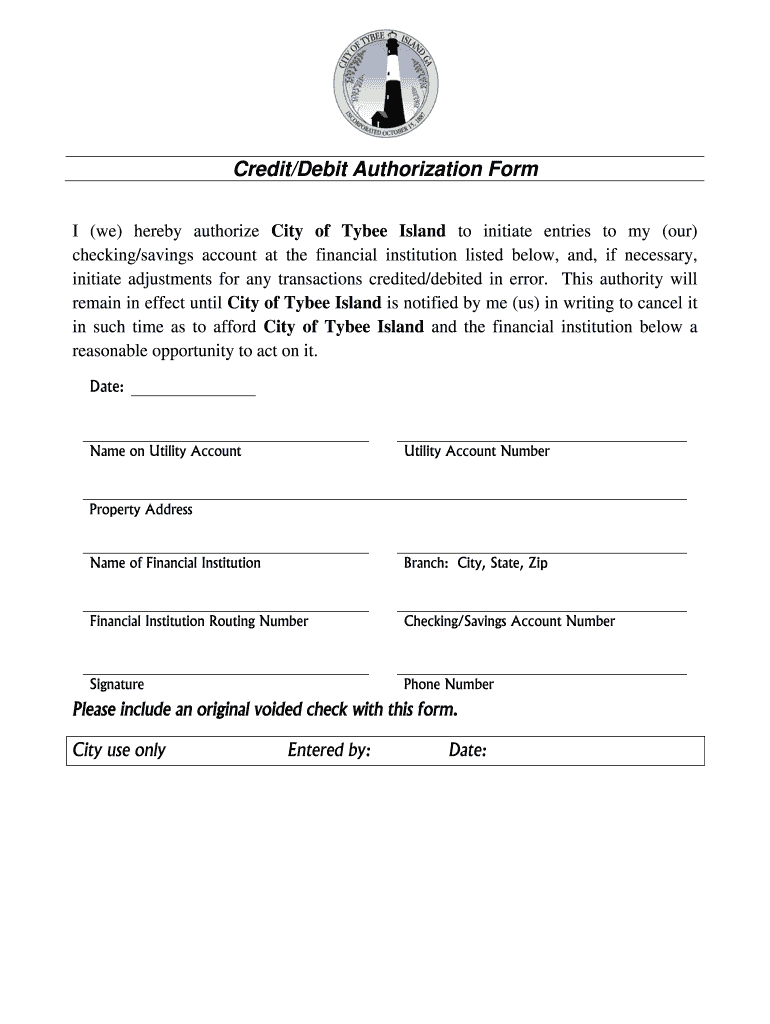

What is an ACH Authorization Form and how is it used?

An ACH Authorization Form is a document that allows businesses to obtain permission from customers to electronically withdraw funds from their bank accounts. This form is essential for automating payment processes and ensuring compliance with banking regulations. Using airSlate SignNow, you can easily create, send, and eSign ACH Authorization Forms securely.

-

How does airSlate SignNow simplify the process of creating ACH Authorization Forms?

airSlate SignNow offers a user-friendly interface that simplifies the creation of ACH Authorization Forms. You can customize templates, add fields for signatures and dates, and automate the workflow, making it easy to collect necessary authorizations quickly and efficiently. This streamlines your payment processes and enhances customer experience.

-

What are the benefits of using airSlate SignNow for ACH Authorization Forms?

Using airSlate SignNow for ACH Authorization Forms provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and tracking of documents, ensuring that you have all the necessary approvals in one place. Additionally, it helps maintain compliance with financial regulations.

-

Are there any pricing plans for using airSlate SignNow for ACH Authorization Forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, allowing you to choose the best option for your needs when managing ACH Authorization Forms. The plans include various features such as unlimited sending and signing, integrations, and advanced security options. You can select a plan that fits your budget while maximizing functionality.

-

Can I integrate airSlate SignNow with other software to manage ACH Authorization Forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRMs, accounting software, and payment processors. This integration allows you to streamline your workflow for ACH Authorization Forms, ensuring that all your systems work together efficiently to manage customer payments.

-

Is it secure to send ACH Authorization Forms through airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. The platform employs advanced encryption and security protocols to protect your ACH Authorization Forms and sensitive information. This ensures that all documents are sent securely, maintaining compliance with industry standards and safeguarding your data.

-

How can I track the status of sent ACH Authorization Forms in airSlate SignNow?

airSlate SignNow provides a comprehensive tracking feature that allows you to monitor the status of your sent ACH Authorization Forms in real time. You will receive notifications when documents are viewed, signed, or completed, giving you complete visibility over your transactions and helping manage follow-ups effectively.

Find out other ach credit authorization form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles