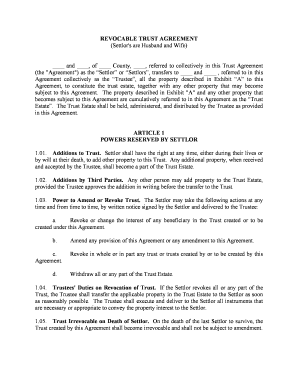

REVOCABLE TRUST AGREEMENT

(Settlor's are Husband and Wife)

____ and ____, of ____ County, ____, referred to collectively in this Trust Agreement

(the "Agreement") as the “Settlor” or “Settlors”, transfers to ____ and ____ , referred to in this

Agreement collectively as the “Trustee”, all the property described in Exhibit “A” to this

Agreement, to constitute the trust estate, together with any other property that may become

subject to this Agreement. The property described in Exhibit "A" and any other property that

becomes subject to this Agreement are cumulatively referred to in this Agreement as the “Trust

Estate”. The Trust Estate shall be held, administered, and distributed by the Trustee as provided

in this Agreement.

ARTICLE 1

POWERS RESERVED BY SETTLOR

1.01. Additions to Trust. Settlor shall have the right at any time, either during their lives or

by will at their death, to add other property to this Trust. Any additional property, when received

and accepted by the Trustee, shall become a part of the Trust Estate.

1.02. Additions by Third Parties. Any other person may add property to the Trust Estate,

provided the Trustee approves the addition in writing before the transfer to the Trust.

1.03. Power to Amend or Revoke Trust. The Settlor may take the following actions at any

time and from time to time, by written notice signed by the Settlor and delivered to the Trustee:

a.

Revoke or change the interest of any beneficiary in the Trust created or to be

created under this Agreement.

b.

c.

Agreement.

d.

Amend any provision of this Agreement or any amendment to this Agreement.

Revoke in whole or in part any trust or trusts created by or to be created by this

Withdraw all or any part of the Trust Estate.

1.04. Trustees' Duties on Revocation of Trust. If the Settlor revokes all or any part of the

Trust, the Trustee shall transfer the applicable property in the Trust Estate to the Settlor as soon

as reasonably possible. The Trustee shall execute and deliver to the Settlor all instruments that

are necessary or appropriate to convey the property interest to the Settlor.

1.05. Trust Irrevocable on Death of Settlor. On the death of the last Settlor to survive, the

Trust created by this Agreement shall become irrevocable and shall not be subject to amendment.

�ARTICLE 2

DISTRIBUTIONS BY TRUSTEE

2.01. Net Income to Settlor. During the life of the Settlor, the Trustee shall pay to the Settlor,

or apply for the benefit of the Settlor, all of the net income from the Trust Estate. These

distributions shall be made in monthly or other convenient installments unless otherwise directed

in writing by the Settlor.

2.02. Invasion of Principal for Trustor. Should one or both of the Settlors become

incapacitated or, in the judgment of the Trustee, unable for any reason to act in his and/or her

own behalf, the Trustee shall have the discretion to pay to, or apply for the benefit of, the Settlor

any amounts from the principal of the Trust Estate, in addition to the net income from the Trust

Estate. The Trustee may invade the Trust Estate, at any time, as the Trustee deems advisable for

the Settlor’s support and maintenance, to the extent of the entire Trust Estate.

2.03. Payment of Settlor’s Funeral Expenses and Death Taxes. On the death of the Settlors,

the Trustee shall pay the expenses of the Settlor’s last illness, funeral, and burial, either from the

income or principal of the Trust Estate, at Trustee’s discretion. The Trustee shall pay any federal

estate tax and any state inheritance taxes that may be due by reason of the Settlor’s death, unless

the Trustee determines that other adequate provisions have been made for payment of those

expenses and taxes.

2.04. Payments After Death of Both Settlors. After the deaths of the Settlors and payment of

the expenses of the last illness, funeral, and burial of the Settlors, this Trust shall terminate. At

that time, subject to the further terms of this Agreement, the Trustee shall distribute all the Trust

Estate in the possession of the Trustee to the children of the Settlors, free of trust. If any child of

the Settlor dies before the last to die of the Settlors, and the deceased child leaves a child or

children surviving, that child or children shall take their/his/her parent's share. If, after the

deaths of the Settlors, no issue of the Settlors is then living, the Trustees shall distribute all the

Trust Estate to the heirs at law of the Settlors in the manner provided for by the laws of intestate

succession of the State of ____ .

2.05. Payments to Minors or Incompetents. If any beneficiary entitled to receive income or

principal from the Trust Estate is a minor or an incompetent or a person whom the Trustee deems

unable to handle funds wisely if paid directly to the beneficiary, the Trustee has discretion to

make payments in any manner the Trustee deems advisable, including, but not limited to, the

following ways:

a.

b.

beneficiary.

Directly to the beneficiary.

To the natural guardian or legally appointed guardian of the person or estate of the

c.

By making expenditures directly for the care, support, maintenance, or education

of the beneficiary.

�d.

To any person or organization furnishing care, support, maintenance, or education

fore the beneficiary.

The receipt by any person for any payment to or for a beneficiary shall completely

discharge the Trustee as to the amounts paid. Decisions of the Trustee as to methods of making

payments shall be conclusive and binding on all parties concerned.

2.06. Support of Guardian. The Trustee has the discretion to provide payments for the care,

support, maintenance, and education of the guardian of the person of a beneficiary and also of

the guardian's spouse and children.

2.07. Spendthrift Provision. Except as may be expressly provided in this Agreement, no

beneficiary of the Trust shall have any right, power, or authority to alienate, encumber, assign, or

pledge his or her interest in the principal or income of the Trust in any manner. No interest of

any beneficiary shall be subject to any claims of his or her creditors (including the creditors of

the spouse of a married beneficiary) or liable to attachment, execution, or other process of law.

If any beneficiary should attempt to alienate, encumber, or dispose of all or any part of the

income or principal of this Trust before it has been delivered by the Trustee, or if by reason of

bankruptcy or insolvency or any attempted execution, levy, attachment, or seizure of any assets

remaining in the hands of the Trustee under claims of creditors or otherwise, all or any part of

the income or principal might fail to be enjoyed by any beneficiary or might vest in or be

enjoyed by some other person, then the interest of that beneficiary shall immediately terminate.

Thereafter, the Trustee shall pay to or for the benefit of that beneficiary only those amounts that

the Trustee, in their sole and absolute discretion, deems advisable for the education and support

of that beneficiary until the death of the beneficiary or the maximum period permissible under

the ____ rule against perpetuities, whichever first occurs. The Trustees shall then distribute the

Trust Estate or the affected part: (1) to the surviving issue of that beneficiary, by right of

representation; (2) to the surviving issue of the Settlor, if the beneficiary has no surviving issue

at the time of distribution, by right of representation; and (3) if neither the beneficiary nor the

Settlor leave surviving issue, to those persons who would be entitled to take the property under

the laws of intestate succession of the State of ____ .

2.08. Other Income of Beneficiary for Discretionary Payments. In exercising their

discretionary authority under this Agreement to make payments to or for the benefit of any

beneficiary from the net income or principal of the Trust Estate, the Trustee shall consider any

income or other means of care, maintenance, support, or education available to the beneficiary

from sources outside the Trust known to the Trustee. The determination of the Trustee with

respect to the necessity for and the amounts of any discretionary payments made to or for the

benefit of any beneficiary shall be conclusive on all persons in any manner interested in the

Trust.

2.09. Undistributed Income on Termination of Beneficial Interest. On the termination of

any interest in this Trust, the Trustee shall pay all undistributed principal and income to the

person or persons entitled to receive them under the terms of this Agreement.

�2.10. Distribution in Kind or in Cash. On any partial or final distribution of the assets of the

Trust Estate and on any division of the assets of the Trust Estate into shares or partial shares, the

Trustee may distribute or divide the assets in kind, distribute or divide undivided interests in the

assets, or sell all or any part of the assets and make distribution or division in cash, in kind, or

partly in cash and partly in kind. The decision of the Trustee, either before or on any division or

distribution of the assets, as to what constitutes a proper division of the assets of the Trust Estate

shall be binding on all persons in any manner interested in the Trust.

ARTICLE 3

POWERS AND DUTIES OF TRUSTEES

3.01. Retain Property Received in Trust Estate. The Trustee shall have the power to retain

any property in the Trust for as long as deemed advisable. The Trustee shall have this power

whether or not the property is of the character permitted by the ____ Trust Code for the

investment of trust funds.

3.02. Management of Trust Property. The Trustee may exercise the following powers with

respect to any and all property in the Trust Estate. These powers apply to principal or

accumulated income of the Trust. The Trustee shall have the discretion to take the following

actions at any time, on the terms and in the manner that the Trustee deems advisable:

a.

Sell, convey, exchange, convert, grant an option, assign, improve, build, manage,

operate, and control Trust property.

b.

Partition, divide, subdivide, assign, develop, and improve Trust property.

c.

Make or obtain plats, adjust boundaries, adjust differences in valuation on

exchange or participation, and dedicate easements for public use of Trust property, with or

without consideration.

d.

Lease property in the Trust Estate for terms within or beyond the term of the Trust

and for any purpose, and enter into any covenants and agreements relating to the leased property

or any improvements that may be erected on the property.

e.

Take the following actions regarding natural resources related to Trust property:

(1)

Enter into oil, gas, liquid or gaseous hydrocarbon, sulphur, metal, and any

and all other natural resource leases on terms the Trustees deem advisable.

(2)

Enter into any pooling, unitization, repressurization, community, and other

types of agreements relating to the exploration, development, operation, and conservation of

properties containing minerals or other natural resources.

(3)

Drill, mine, and otherwise develop oil, gas, and other minerals.

�(4)

Contract for the installation and operation of absorption and repressuring

(5)

Install and maintain pipelines.

plants.

f.

Encumber or hypothecate Trust property for any Trust purpose by mortgage, deed

of trust, pledge, or otherwise.

g.

Carry insurance of the kinds and in the amounts that the Trustee deems advisable

to protect the Trust Estate at the expense of the Trust.

h.

Invest and reinvest in property that the Trustee deems advisable, including the

option to acquire an asset, whether or not of the character permitted by the ____ Trust Code for

the investment of trust funds.

i.

Vote and give proxies to vote any securities in the Trust Estate.

j.

Pay any assessments or other charges levied on any stock or other security in the

Trust Estate.

k.

Exercise any subscription, conversion, or other rights or options that may attach to

the holders of any stocks, bonds, securities, or other instruments in the Trust Estate.

l.

Continue and operate, sell, or liquidate any business or partnership interests

received by the Trust Estate.

m.

Participate in any plans or proceedings for the foreclosure, reorganization,

consolidation, merger, or liquidation of any corporation or organization that has issued securities

in the Trust Estate and, incident to that participation, deposit securities with and transfer title of

securities to any protective or other committee established to further or defeat any such plan or

proceeding.

n.

Enforce any mortgage or deed of trust or pledge in the Trust Estate and, at any

sale under any mortgage, deed of trust, or pledge, and bid and purchase, at Trust expense, any

property subject to the security instrument.

o.

Employ any attorney, investment adviser, accountant, broker, tax specialist, or

any other agent, and pay reasonable compensation from the Trust Estate for all services

performed by any of them.

p.

Compromise, submit to arbitration, release with or without consideration, extend

time for payment, and otherwise adjust any claims in favor of or against the Trust.

q.

Commence or defend any litigation with respect to the Trust or any Trust property

at the expense of the Trust.

�r.

Abandon any Trust asset that the Trustee deems advisable.

s.

Terminate the Trust and, regardless of the age of the income beneficiary,

distribute the principal and any undistributed net income to the income beneficiary, or to his or

her guardian, conservator, or other fiduciary if the fair market value of the Trust Estate becomes

less than $____ .

t.

Do all acts, take part in any proceedings, and exercise all rights and privileges as

could an absolute owner of property in the Trust Estate, subject to any limitations expressly set

forth in this Agreement. The enumeration of powers in this Agreement shall not limit the

general or implied powers of the Trustee or any additional powers provided by law.

3.03. Power to Borrow Money. The Trustees has the power to borrow money from any

person, firm, or corporation, including the Trustee, for any Trust purpose on whatever terms and

conditions that the Trustee deems advisable and to obligate the Trust to repay the borrowed

money.

3.04. Power to Loan Money to Trust. The Trustee shall have the power to loan or advance

its own funds to the Trust for any Trust purpose, on the terms as the Trustee shall establish. Any

loan or advance, together with interest accruing on the loan or advance, shall be a first lien

against and shall be repaid from the Trust Estate.

3.05. Manner of Holding Trust Property. The Trustee may hold securities or other property

in the Trust Estate: (1) in the name of the Trustee under this Agreement; (2) in the Trustee’s

name without a designation showing he or she to be Trustee under this Agreement; or, (3) in the

name of its nominee. Further, the Trustee may hold securities in an unregistered condition such

that ownership passes by delivery.

3.06. Determination of Principal and Income. Except as otherwise specifically provided in

this Agreement, the Trustee shall have the power to determine, in the Trustee’s discretion, what

constitutes principal of the Trust Estate, gross income from the Trust Estate, and net income of

the Trust Estate distributable under the terms of this Agreement. The determination of the

Trustee as to what constitutes principal, gross income, or net income of the Trust Estate shall,

except as may be otherwise expressly provided in this Agreement, be conclusive and binding on

all persons in any manner interested in the Trust.

3.07. Payment of Trust Expenses. All property taxes, assessments, fees, charges, and other

expenses incurred by the Trustee in the administration or protection of the Trust, shall be a

charge on the Trust Estate and shall be paid by the Trustee before final distribution of the Trust

Estate:

a.

in full out of the principal;

b.

in full out of the income of the Trust Estate; or,

c.

partially out of the principal and partially out of the income of the Trust Estate.

�The payments shall be made in the manner and proportions that the Trustee deems

advisable. The Trustee’s determination regarding the payment of these expenses and charges

from the principal or income of the Trust Estate or partially from each is conclusive and binding

on all persons in any manner interested in the Trust.

3.08. Dealing With Settlor’s Estates. The Trustee shall have the power to make loans and

advancements from the Trust Estate to the executor or other representative of the Settlor’s

estates, with or without security. The Trustee shall also have the power to purchase securities or

other property from the executor or other representative of the Settlor’s estates.

3.09. Elections Under Tax Laws. The Trustees may make any elections under the federal and

state tax laws applicable to the Trust Estate that the Trustees determine should be made for the

benefit of the Trust beneficiaries. The Trustees shall have the discretion to make adjustments

between principal and income to compensate for elections made under the tax laws by the

executor or other representative of the Settlor’s estates or the Trustee that may affect,

beneficially or adversely, the interests of the beneficiaries. The actions of the Trustee shall be

binding on all beneficiaries.

3.10. Limitation of Trustee’s Liability. No Trustee appointed under this Agreement shall be

liable for the action or default of the Trustees or the Trustee’s agent, unless caused by gross

negligence or willful commission of an act in breach of trust by the Trustee or the Trustee’s

agent.

ARTICLE 4

ADMINISTRATIVE PROVISIONS

4.01. Bond. A Bond shall not be required of the original Trustee or of any successor trustee to

secure faithful performance of the Trustee’s duties.

4.02. Mingling of Trust Property. The Trustee is authorized to mingle the trust property of

separate trusts established by this Agreement, allotting to each separate trust an undivided

interest in the mingled funds. However, if the Trustee mingles trust property, the Trustee shall

maintain reliable records to assure that each beneficiary shall receive his or her proportionate

share, as adjusted for accumulation of income, payments of principal, and additions to principal.

4.03. Accounting. The Trustee shall make an annual accounting to each beneficiary under this

Agreement. If a beneficiary is a minor, the accounting shall be made to the beneficiary's natural

guardian or legally appointed guardian. The accounting shall include a report of the receipts,

disbursements, and distributions since the last accounting, and the status of the principal and any

undistributed income on hand on the date of the accounting. Each beneficiary shall have the

right to inspect the books and records of the Trustee, and the Trustee shall make the books and

records available for inspection by the beneficiaries, or by their representatives at any reasonable

time and place. The Trustee and each beneficiary may apply for judicial settlement of the

Trustee’s accounts.

�4.04.

Definitions. The following definitions are used in this Agreement:

a.

The terms "child" or "children" mean lawful blood descendents in the first degree

of the parent designated and include any children who may be born after the execution of this

Agreement.

b.

The term "issue" means lawful blood descendents in the first, second, or any other

degree of the ancestor designated.

c.

The term "education" includes college and post-graduate study at any accredited

institution of the beneficiary's choice for any period of time that, in the judgment of the Trustee,

is advantageous to the beneficiary concerned. The Trustee shall provide adequate amounts for

all related living and travel expenses of the beneficiary within reasonable limits.

d.

Whenever distribution is to be made to designated issue on a "per stirpes" basis,

the property shall be distributed to the persons and in the proportions that personal property of

the named ancestor would be distributed under the laws of the State of ____ in force at the time

provided for distribution if the named ancestor had died intestate at such time, domiciled in

____, not married, and survived only by such issue.

e.

A child in gestation, who is later born alive, shall be regarded as a child in being

during the period of gestation, in determining whether any person had died without leaving issue

surviving him or her, and in determining, on the termination of any trust described in this

Agreement, whether the child is entitled to share in the disposition of the then remaining

principal and undistributed income of the trust. For other purposes, the child's right shall accrue

from the date of birth.

ARTICLE 5

RESIGNATION, REMOVAL, DEATH, AND

COMPENSATION OF TRUSTEES

5.01. Appointment of Successor Trustee. The Trustee shall have the right to resign at any

time. At any time during the Settlor’s lifetime, the Settlor shall have the right to remove the

Trustee, with or without good cause. After Settlor’s death, any beneficiary of the Trust may

petition a court of competent jurisdiction to remove the Trustee for good cause. On the

resignation, removal, or death of a Trustee, the Settlor shall appoint a successor trustee. In the

event of the failure, refusal, or inability of the Settlor to appoint a successor trustee, the Trustee

or any beneficiary of the Trust may petition for the appointment of a successor trustee by a court

of competent jurisdiction. In that event, the court shall appoint (Name), of (Address) if (he

or she) is qualified and willing to serve as successor trustee.

5.02. Rights and Powers of Successor Trustee. Any successor trustee shall immediately

succeed to the title of the Trustee and to all powers, rights, discretions, obligations, and

immunities of the Trustee under this Agreement with the same effect as if the successor was

originally named as the Trustee in this Agreement.

�5.03. Compensation of Trustee. The Trustee shall not receive compensation for services

under this Agreement.

ARTICLE 6

CONSTRUCTION OF TRUST

6.01. Applicable Law. This Trust has been accepted by the Trustee in the State of ____, will

be administered by the Trustee in ____ , and the validity, construction, and all rights under this

Agreement shall be governed by the laws of ____ .

6.02. Severability. Should any provision of this Agreement be or become void, invalid, or

unenforceable, the remaining provisions of this Agreement shall continue to be fully effective.

6.03. Notices. Any notices or other communications required or permitted by this Agreement

to be delivered to or served on the Trustee shall be deemed properly delivered to, served on, and

received by the Trustee when personally delivered to the Trustee. However, in lieu of personal

service, notice shall be deemed to be delivered when deposited in the United States mail,

certified mail with postage prepaid, addressed to the Trustee at (Address) or to the then current

address of the initial Trustee or any successor trustee.

6.04. Interpretative Clause. As used in this Agreement, the masculine, feminine, or neuter

gender, and the singular or plural number shall be deemed to include the others whenever the

context so indicates.

6.05. Copies. Anyone may rely on a copy of this Agreement certified to be a true copy of this

Agreement by a notary public to the same extent as if it were the original. Anyone may rely on

any statement of fact certified by someone who appears to be the Trustee of this Trust from the

original Agreement or a certified copy of the Agreement.

This Agreement is executed by Settlors and deemed effective ____ .

Settlors

Trustee

[Exhibit "A": Description of Property]

�