Fill and Sign the Act of Donation Form

Practical advice on readying your ‘Act Of Donation Form’ online

Are you weary of the complications of handling paperwork? Search no further than airSlate SignNow, the leading electronic signature solution for individuals and small businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can easily complete and sign documents online. Make use of the robust features incorporated into this intuitive and cost-effective platform and transform your method of document handling. Whether you need to sign documents or gather signatures, airSlate SignNow manages everything smoothly, requiring only a few clicks.

Follow this detailed guide:

- Sign in to your account or initiate a free trial with our service.

- Click +Create to upload a document from your device, cloud, or our template repository.

- Open your ‘Act Of Donation Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to work with your coworkers on your Act Of Donation Form or send it for notarization—our platform offers everything you require to accomplish such tasks. Create an account with airSlate SignNow today and enhance your document management to a new standard!

FAQs

-

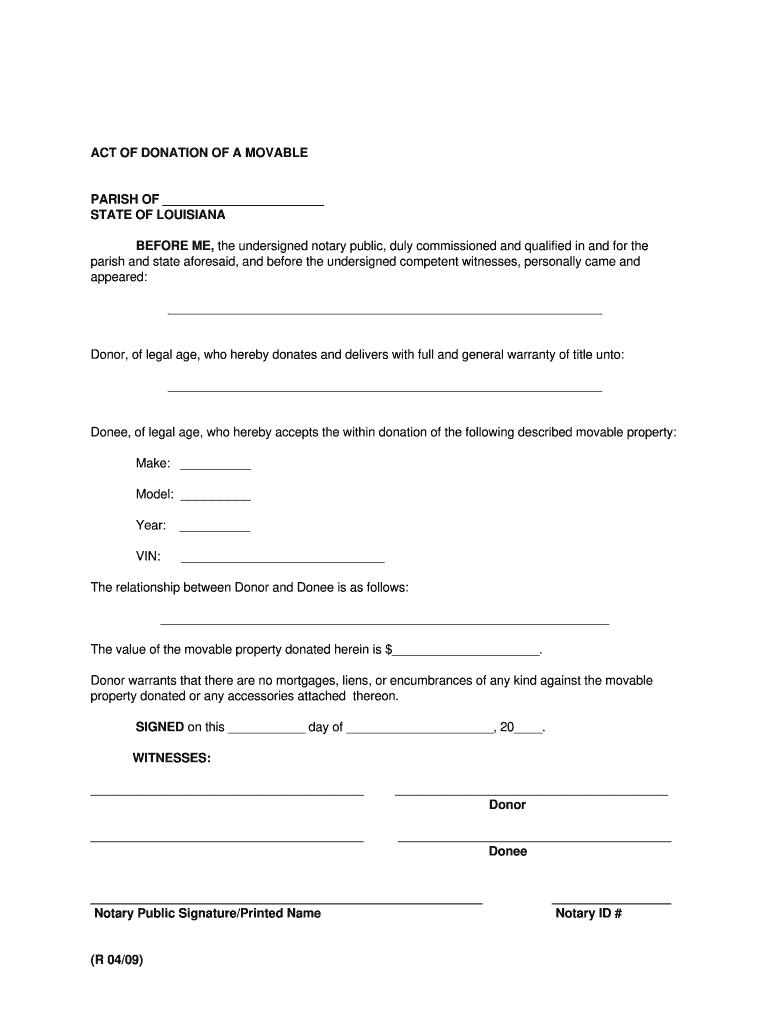

What is an Act Of Donation Louisiana?

An Act Of Donation Louisiana is a legal document that transfers ownership of property or assets from one person to another without any payment in return. This document is essential in formalizing acts of gift and ensuring clarity in the transfer of ownership. With airSlate SignNow, you can easily create, sign, and manage your Act Of Donation Louisiana online.

-

How can airSlate SignNow help with my Act Of Donation Louisiana?

airSlate SignNow provides a user-friendly platform to create and eSign your Act Of Donation Louisiana quickly and securely. The service allows you to customize templates, streamline the signing process, and store documents safely in the cloud. This ensures that your gift documentation is legally binding and easily accessible.

-

What features does airSlate SignNow offer for managing an Act Of Donation Louisiana?

With airSlate SignNow, you can leverage features such as document templates, customizable fields, and real-time tracking for your Act Of Donation Louisiana. The platform also supports multiple signers, allowing you to invite others to review and sign the document seamlessly. Additionally, you can integrate with various applications to enhance your workflow.

-

Is there a cost associated with using airSlate SignNow for my Act Of Donation Louisiana?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different needs and budgets. You can choose a plan that suits your requirements for managing documents like the Act Of Donation Louisiana. The cost-effective nature of airSlate SignNow makes it an ideal choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other tools for my Act Of Donation Louisiana?

Absolutely! airSlate SignNow integrates with various popular applications such as Google Drive, Dropbox, and Microsoft Office. This means you can easily manage your Act Of Donation Louisiana alongside your other documents, creating a streamlined workflow for your administrative tasks.

-

What are the benefits of using airSlate SignNow for an Act Of Donation Louisiana?

Using airSlate SignNow for your Act Of Donation Louisiana simplifies the document signing process, saving you time and effort. The platform ensures that your documents are secure, legally compliant, and easily accessible from anywhere. Furthermore, its intuitive interface makes it easy for anyone to use without extensive technical knowledge.

-

Is my data safe when using airSlate SignNow for my Act Of Donation Louisiana?

Yes, your data is safe with airSlate SignNow. The platform employs strong encryption and complies with industry standards to ensure the security of your Act Of Donation Louisiana and other documents. You can trust that your sensitive information is protected while you manage your electronic signatures.

Find out other act of donation form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles