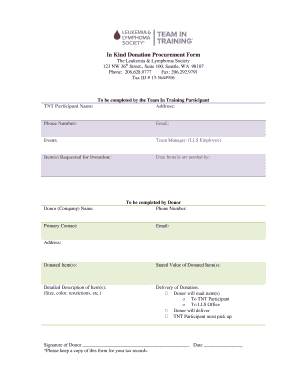

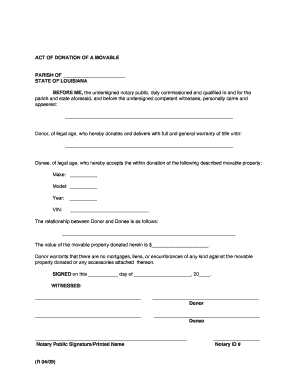

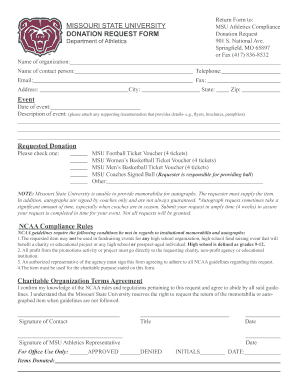

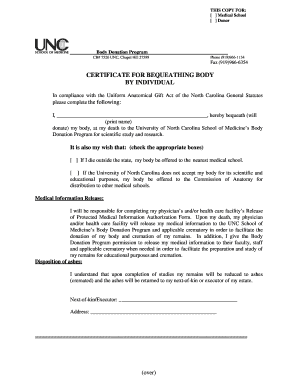

Charity forms

Browse over 85,000 state-specific fillable forms for all your business and personal needs. Customize legal forms using advanced airSlate SignNow tools.

Showing results for:

Oh dear! We couldn’tfind anything :(

Please try and refine your search for something like “sign”,“create”, or “request” or check the menu items on the left.