Fill and Sign the After Death Form

Valuable advice on completing your ‘After Death Form’ digitally

Are you fed up with the inconvenience of dealing with documentation? Look no further than airSlate SignNow, the top electronic signature option for individuals and businesses. Bid farewell to the tedious undertaking of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign forms online. Take advantage of the powerful features integrated into this user-friendly and cost-effective platform and transform your method of document management. Whether you need to approve forms or gather signatures, airSlate SignNow manages it all seamlessly, requiring only a few clicks.

Follow these comprehensive steps:

- Log into your account or initiate a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

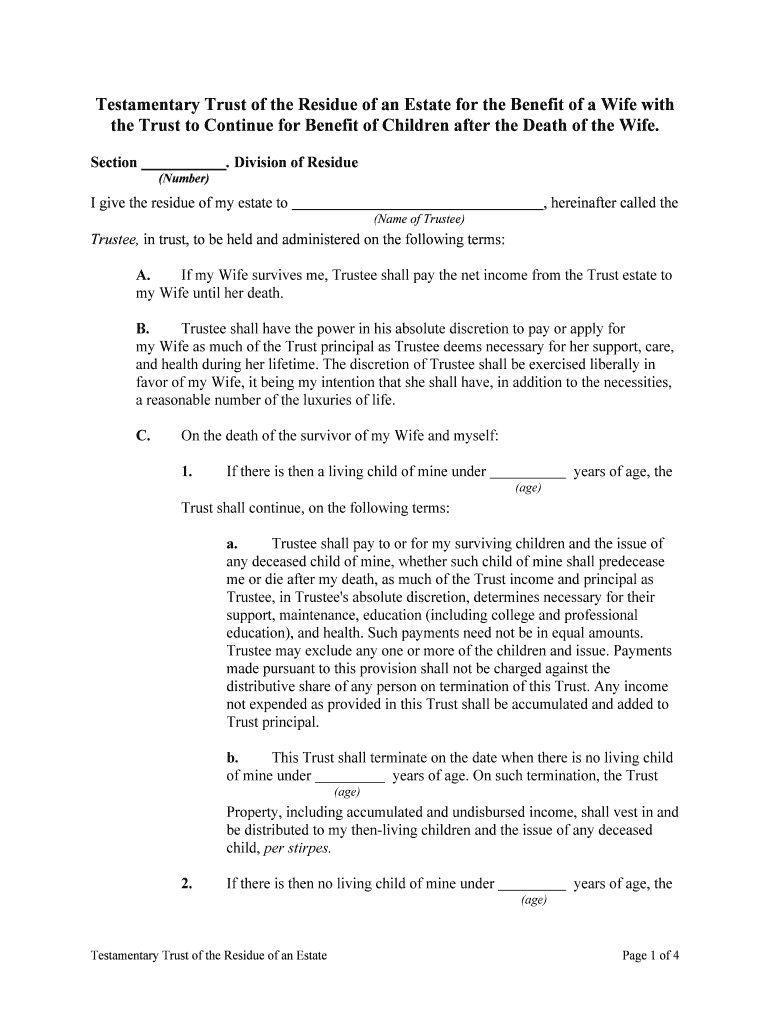

- Open your ‘After Death Form’ in the editor.

- Click Me (Fill Out Now) to get the form ready on your end.

- Add and designate fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you require collaboration with others on your After Death Form or need to send it for notarization—our solution provides everything you might need to accomplish such tasks. Register with airSlate SignNow today and enhance your document management to a new standard!

FAQs

-

What is an After Death Form and how is it used?

An After Death Form is a legal document used to manage the affairs of a deceased person. This form is essential for settling estates, transferring assets, and addressing outstanding debts. With airSlate SignNow, you can easily create, sign, and send your After Death Form securely, ensuring a smooth process during a difficult time.

-

How can airSlate SignNow help with signing an After Death Form?

airSlate SignNow simplifies the process of signing an After Death Form by allowing multiple parties to eSign securely and efficiently. Our platform ensures that all signatures are legally binding and that the document is properly stored for future reference. You can complete the After Death Form process from anywhere, making it convenient for all involved parties.

-

Is airSlate SignNow affordable for managing After Death Forms?

Yes, airSlate SignNow offers a cost-effective solution for managing After Death Forms. Our pricing plans are designed to cater to a variety of needs, ensuring that you can access powerful eSignature features without breaking the bank. Sign up today and experience the affordability of our services!

-

What features does airSlate SignNow offer for After Death Forms?

airSlate SignNow provides a range of features for After Death Forms, including customizable templates, secure cloud storage, and tracking for document statuses. You can also integrate with other applications to enhance your workflow. These features help streamline the process, making it easier to handle legal documentation.

-

Can I integrate airSlate SignNow with other tools for After Death Forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your After Death Forms alongside your existing workflows. Whether you’re using CRM software or document management systems, our integrations enhance efficiency and ensure you can access all your documents in one place.

-

What are the benefits of using airSlate SignNow for After Death Forms?

Using airSlate SignNow for your After Death Forms offers numerous benefits, including enhanced security, time savings, and ease of use. You can reduce the stress of managing legal documents by utilizing our intuitive platform. Plus, eSigning eliminates the need for physical paperwork, making the process faster and more efficient.

-

Is my data safe when using airSlate SignNow for After Death Forms?

Yes, your data is secure with airSlate SignNow. We utilize advanced encryption and security protocols to protect all documents, including After Death Forms. Our commitment to data privacy ensures that your sensitive information remains confidential and is handled with the utmost care.

The best way to complete and sign your after death form

Find out other after death form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles