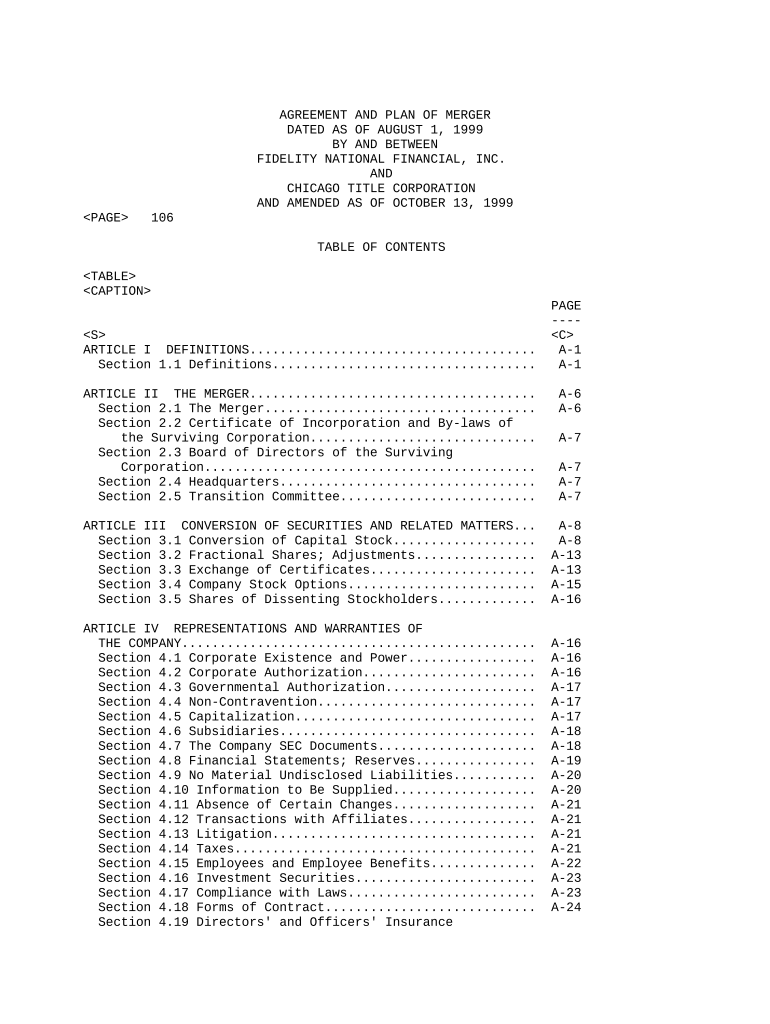

AGREEMENT AND PLAN OF MERGER

DATED AS OF AUGUST 1, 1999

BY AND BETWEEN

FIDELITY NATIONAL FINANCIAL, INC.

AND

CHICAGO TITLE CORPORATION

AND AMENDED AS OF OCTOBER 13, 1999

106

TABLE OF CONTENTS

PAGE

----

ARTICLE I DEFINITIONS...................................... A-1

Section 1.1 Definitions................................... A-1

ARTICLE II THE MERGER...................................... A-6

Section 2.1 The Merger.................................... A-6

Section 2.2 Certificate of Incorporation and By-laws of

the Surviving Corporation.............................. A-7

Section 2.3 Board of Directors of the Surviving

Corporation............................................ A-7

Section 2.4 Headquarters.................................. A-7

Section 2.5 Transition Committee.......................... A-7

ARTICLE III CONVERSION OF SECURITIES AND RELATED MATTERS... A-8

Section 3.1 Conversion of Capital Stock................... A-8

Section 3.2 Fractional Shares; Adjustments................ A-13

Section 3.3 Exchange of Certificates...................... A-13

Section 3.4 Company Stock Options......................... A-15

Section 3.5 Shares of Dissenting Stockholders............. A-16

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF

THE COMPANY............................................... A-16

Section 4.1 Corporate Existence and Power................. A-16

Section 4.2 Corporate Authorization....................... A-16

Section 4.3 Governmental Authorization.................... A-17

Section 4.4 Non-Contravention............................. A-17

Section 4.5 Capitalization................................ A-17

Section 4.6 Subsidiaries.................................. A-18

Section 4.7 The Company SEC Documents..................... A-18

Section 4.8 Financial Statements; Reserves................ A-19

Section 4.9 No Material Undisclosed Liabilities........... A-20

Section 4.10 Information to Be Supplied................... A-20

Section 4.11 Absence of Certain Changes................... A-21

Section 4.12 Transactions with Affiliates................. A-21

Section 4.13 Litigation................................... A-21

Section 4.14 Taxes........................................ A-21

Section 4.15 Employees and Employee Benefits.............. A-22

Section 4.16 Investment Securities........................ A-23

Section 4.17 Compliance with Laws......................... A-23

Section 4.18 Forms of Contract............................ A-24

Section 4.19 Directors' and Officers' Insurance

Policies............................................... A-24

Section 4.20 Environmental Matters........................ A-24

Section 4.21 Finders' Fees; Opinion of Financial

Advisor................................................ A-24

Section 4.22 Required Vote; Board Approval................ A-25

Section 4.23 State Takeover Statutes...................... A-25

Section 4.24 Year 2000 Compliance......................... A-25

i

107

TABLE OF CONTENTS (CONTINUED)

PAGE

----

ARTICLE V REPRESENTATIONS AND WARRANTIES OF FIDELITY....... A-25

Section 5.1 Corporate Existence and Power................. A-25

Section 5.2 Corporate Authorization....................... A-26

Section 5.3 Governmental Authorization.................... A-26

Section 5.4 Non-Contravention............................. A-26

Section 5.5 Capitalization of Fidelity.................... A-26

Section 5.6 Subsidiaries.................................. A-27

Section 5.7 Fidelity SEC Documents........................ A-28

Section 5.8 Financial Statements; Reserves................ A-28

Section 5.9 No Material Undisclosed Liabilities........... A-29

Section 5.10 Information to Be Supplied................... A-29

Section 5.11 Absence of Certain Changes................... A-30

Section 5.12 Transactions with Affiliates................. A-30

Section 5.13 Litigation................................... A-30

Section 5.14 Taxes........................................ A-31

Section 5.15 Employees and Employee Benefits.............. A-31

Section 5.16 Investment Securities........................ A-32

Section 5.17 Compliance with Laws......................... A-32

Section 5.18 Forms of Contract............................ A-33

Section 5.19 Directors' and Officers' Insurance

Policies............................................... A-33

Section 5.20 Environmental Matters........................ A-33

Section 5.21 Finders' Fees; Opinion of Financial

Advisor................................................ A-33

Section 5.22 Required Vote; Board Approval................ A-33

Section 5.23 Ownership of Company Common Shares........... A-34

Section 5.24 Year 2000 Compliance......................... A-34

Section 5.25 Financing.................................... A-34

ARTICLE VI COVENANTS OF THE COMPANY........................ A-34

Section 6.1 The Company Interim Operations................ A-34

Section 6.2 Stockholder Meeting........................... A-36

Section 6.3 Acquisition Proposals; Board Recommendation... A-37

Section 6.4 Purchases of Company Common Shares............ A-38

ARTICLE VII COVENANTS OF FIDELITY.......................... A-38

Section 7.1 Fidelity Interim Operations................... A-38

Section 7.2 Executive Management.......................... A-40

Section 7.3 Stockholder Meeting........................... A-40

Section 7.4 Indemnification, Exculpation and Insurance.... A-41

Section 7.5 Employee Benefits............................. A-41

Section 7.6 Stock Exchange Listing........................ A-42

ii

108

TABLE OF CONTENTS (CONTINUED)

PAGE

----

ARTICLE VIII COVENANTS OF FIDELITY AND THE COMPANY......... A-42

Section 8.1 Reasonable Best Efforts....................... A-42

Section 8.2 Certain Filings; Cooperation in Receipt of

Consents............................................... A-42

Section 8.3 Public Announcements.......................... A-44

Section 8.4 Access to Information; Notification of Certain

Matters................................................ A-44

Section 8.5 Payment of Special Dividend................... A-44

Section 8.6 Further Assurances............................ A-44

Section 8.7 Tax Matters................................... A-45

Section 8.8 Control of Other Party's Business............. A-45

Section 8.9 Affiliate Letters............................. A-45

Section 8.10 Financing.................................... A-45

ARTICLE IX CONDITIONS TO THE MERGER........................ A-45

Section 9.1 Conditions to the Obligations of Each Party... A-45

Section 9.2 Conditions to the Obligations of the

Company................................................ A-46

Section 9.3 Conditions to the Obligations of Fidelity..... A-47

ARTICLE X TERMINATION...................................... A-48

Section 10.1 Termination.................................. A-48

Section 10.2 Effect of Termination........................ A-49

Section 10.3 Termination Fee and Expenses................. A-49

ARTICLE XI MISCELLANEOUS................................... A-50

Section 11.1 Notices...................................... A-50

Section 11.2 Survival of Representations, Warranties and

Covenants after the Effective Time........... A-51

Section 11.3 Amendments; No Waivers....................... A-51

Section 11.4 Successors and Assigns....................... A-51

Section 11.5 Governing Law................................ A-51

Section 11.6 Counterparts; Effectiveness; Third Party

Beneficiaries.......................................... A-52

Section 11.7 Jurisdiction................................. A-52

Section 11.8 Waiver of Jury Trial......................... A-52

Section 11.9 Enforcement.................................. A-52

Section 11.10 Entire Agreement............................ A-52

iii

109

AGREEMENT AND PLAN OF MERGER

AGREEMENT AND PLAN OF MERGER dated as of August 1, 1999, and amended as of

October 13, 1999, by and between Chicago Title Corporation, a Delaware

corporation (the "Company"), and Fidelity National Financial, Inc., a Delaware

corporation ("Fidelity") (the "Agreement").

RECITALS

WHEREAS, the Boards of Directors of the Company and Fidelity each have

determined that a business combination between the Company and Fidelity is

advisable and in the best interests of their respective companies and

stockholders and presents an opportunity for their respective companies to

achieve long-term strategic and financial benefits, and accordingly have agreed

to effect the merger provided for herein upon the terms and subject to the

conditions set forth herein; and

WHEREAS, the parties hereto intend that the merger provided for herein

shall qualify for U.S. federal income tax purposes as a reorganization within

the meaning of Section 368 of the U.S. Internal Revenue Code of 1986, as amended

(together with the rules and regulations promulgated thereunder, the "Code") (a

"368 Reorganization"); and

WHEREAS, by resolutions duly adopted, the respective Boards of Directors of

the Company and Fidelity have approved and adopted this Agreement and the

transactions contemplated hereby.

NOW, THEREFORE, in consideration of the foregoing, and of the

representations, warranties, covenants and agreements contained herein, and

intending to be legally bound hereby, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

Section 1.1 Definitions.

(a) As used herein, the following terms have the following meanings:

"AAM" means Alleghany Asset Management, a Delaware corporation.

"AAM Distribution" means the distribution of Alleghany Asset Management to

Alleghany by Chicago Title & Trust Company, a wholly-owned subsidiary of the

Company, in June 1998.

"Acquisition Proposal" means any offer or proposal for, or indication of

interest in, a merger, consolidation, share exchange, business combination,

reorganization, recapitalization, liquidation, dissolution or other similar

transaction involving, or any purchase or acquisition of, 25% or more of (i) any

class of equity securities of the Company or (ii) the consolidated assets of the

Company and its Subsidiaries, other than the transactions contemplated by this

Agreement.

"Affiliate" means, with respect to any Person, any other Person, directly

or indirectly, controlling, controlled by, or under common control with, such

Person. For purposes of this definition, the term "Control" (including the

correlative terms "Controlling", "Controlled By" and "Under Common Control

With") means the possession, direct or indirect, of the power to direct or cause

the direction of the management and policies of a Person, whether through the

ownership of voting securities, by contract, or otherwise.

A-1

110

"Alleghany" means Alleghany Corporation, a Delaware corporation of which

the Company was a wholly-owned subsidiary prior to the distribution of the

Company to stockholders of Alleghany in June 1998.

"Business Combination" means, with respect to the Company, (i) a merger,

reorganization, consolidation, share exchange, business combination,

recapitalization, liquidation, dissolution or similar transaction involving the

Company as a result of which either (A) the Company's stockholders prior to such

transaction (by virtue of their ownership of Company Common Shares) in the

aggregate cease to own at least 50.1% of the voting securities of the entity

surviving or resulting from such transaction (or the ultimate parent entity

thereof), or (B) the individuals comprising the board of directors of the

Company prior to such transaction do not constitute a majority of the board of

directors of the ultimate parent entity after such transaction, or (ii) a sale,

lease, exchange, transfer or other disposition of at least 49.9% of the assets

of the Company and its Subsidiaries, taken as a whole, in a single transaction

or a series of related transactions.

"Business Day" means any day other than a Saturday, Sunday or one on which

banks are authorized by law to close in New York, New York.

"Company Balance Sheet" means the Company's consolidated balance sheet

included in the Company 10-K relating to its fiscal year ended on December 31,

1998.

"Company Common Share" means one share of common stock of the Company,

$1.00 par value per share.

"Company Proceedings" means the litigation and other proceedings identified

as such on Section 4.13 of the Company Disclosure Schedule.

"Company SEC Documents" means (i) the annual report on Form 10-K of the

Company (the "Company 10-K") for the fiscal year ended December 31, 1998, (ii)

the quarterly report on Form 10-Q of the Company (the "Company 10-Q") for the

fiscal quarter ended March 31, 1999, (iii) the Company's proxy statement dated

March 29, 1999 relating to the 1999 Annual Meeting of Stockholders (the "Company

Proxy Statement"), and (iv) all other reports, filings, registration statements

and other documents filed by the Company with the SEC since June 17, 1998.

"Exchange Act" means the Securities Exchange Act of 1934, as amended, and

the rules and regulations promulgated thereunder.

"Exchange Ratio" means a fraction the numerator of which is the product of

1.004 and the number of outstanding Fidelity Common Shares immediately prior to

the Effective Time, and the denominator of which is the number of Merger Shares

(calculated to the nearest 0.0001).

"Fidelity Balance Sheet" means Fidelity's consolidated balance sheet

included in the Fidelity 10-K relating to its fiscal year ended on December 31,

1998.

"Fidelity Common Share" means one share of common stock of Fidelity, $.0001

par value per share.

"Fidelity Proceedings" means the litigation and other proceedings

identified as such on Section 5.13 of the Fidelity Disclosure Schedule.

"Fidelity SEC Documents" means (i) Fidelity's annual reports on Form 10-K

for its fiscal years ended December 31, 1997 and December 31, 1998 (the

"Fidelity 10-Ks"), (ii) Fidelity's quarterly report on Form 10-Q (the "Fidelity

10-Q") for its fiscal quarter ended March 31, 1999, (iii) Fidelity's proxy

statement dated May 10, 1999 relating to the 1999 Annual Meeting

A-2

111

of Stockholders (the "Fidelity Proxy Statement"), and (iv) all other reports,

filings, registration statements and other documents filed by Fidelity with the

SEC since December 31, 1997.

"Governmental Entity" means any federal, state, municipal or local

governmental authority, any foreign or international governmental authority, or

any court, administrative or regulatory agency or commission or other

governmental agency.

"Joint Proxy Statement/Prospectus" means the joint proxy

statement/prospectus including the Registration Statement and the proxy

statement for the Company Stockholders Meeting and the Fidelity Stockholders

Meeting, together with any amendments or supplements thereto.

"knowledge" (and all correlative terms) as to any party means to the

knowledge of such party's executive officers or senior management identified on

Section 1.1 of that party's Disclosure Schedule.

"Law" means all laws, statutes and ordinances and all regulations, rules

and other pronouncements of Governmental Entities having the effect of law of

the United States, any foreign country or any foreign or domestic state,

province, commonwealth, city, country, municipality, territory, protectorate,

possession or similar instrumentality or any Governmental Entity thereof.

"Lien" means, with respect to any asset, any mortgage, lien, pledge,

charge, security interest or encumbrance of any kind in respect of such asset;

provided, however, that the term "Lien" shall not include (i) liens for water

and sewer charges and taxes not yet due and payable or being contested in good

faith (and for which adequate accruals or reserves have been established by the

Company or Fidelity, as the case may be) and (ii) mechanics', carriers',

workers', repairers', materialmen's, warehousemen's and other similar liens

arising or incurred in the ordinary course of business.

"Material Adverse Effect" means a material adverse effect on the financial

condition, business or results of operations of a Person and its Subsidiaries,

taken as a whole, other than (x) effects caused by (i) changes in general

economic or securities markets conditions, (ii) changes in interest rate levels,

(iii) changes that affect the title insurance industry, (iv) (A) in the case of

the Company, the identity of Fidelity as acquiror of the Company or the conduct

of Fidelity with respect to the transactions contemplated by this Agreement

prior to the Effective Time, or (B) in the case of Fidelity, the identity of the

Company as the acquired party or the conduct of the Company with respect to the

transactions contemplated by this Agreement prior to the Effective Time, or (v)

the public announcement of the transactions contemplated by this Agreement, or

(y) developments in, effects of, or circumstances arising from, in the case of

the Company, the Company Proceedings or, in the case of Fidelity, the Fidelity

Proceedings. "Fidelity Material Adverse Effect" means a Material Adverse Effect

in respect of Fidelity and its Subsidiaries, taken as a whole, and "Company

Material Adverse Effect" means a Material Adverse Effect in respect of the

Company and its Subsidiaries, taken as a whole.

"Merger Shares" means each Company Common Share outstanding immediately

prior to the Effective Time (other than Dissenting Shares (as hereinafter

defined) and other than shares to be cancelled in accordance with Section 3.1(a)

hereof).

"Micro General" means Micro General Corporation, a Delaware corporation of

which Fidelity is a controlling stockholder.

"NYSE" means the New York Stock Exchange.

"Person" means an individual, a corporation, a limited liability company, a

partnership, an association, a trust or any other entity or organization,

including any Governmental Entity.

A-3

112

"Registration Statement" means the Registration Statement on Form S-4

registering under the Securities Act the Fidelity Common Shares issuable in

connection with the Merger.

"Revolving Credit Facility" means the Credit Agreement, dated as of August

1, 1998, by and among Fidelity, Sanwa Bank California and the Lenders from time

to time party thereto, or any similar replacement facility.

"SEC" means the Securities and Exchange Commission.

"Securities Act" means the Securities Act of 1933, as amended, and the

rules and regulations promulgated thereunder.

"Subsidiary" when used with respect to any Person, means any other Person,

whether incorporated or unincorporated, of which (i) more than fifty percent of

the securities or other ownership interests or (ii) securities or other

interests having by their terms ordinary voting power to elect more than fifty

percent of the board of directors or others performing similar functions with

respect to such corporation or other organization, is directly owned or

controlled by such Person or by any one or more of its Subsidiaries.

"Superior Proposal" means a written proposal made by a Person other than

Fidelity which is (A) for a merger, consolidation, share exchange, business

combination, reorganization, recapitalization, liquidation, dissolution or other

similar transaction involving, or any purchase or acquisition of, that

percentage equal to 100% less the Minimum Percentage (as hereinafter defined) or

more of (i) any class of equity securities of the Company or (ii) the

consolidated assets of the Company and its Subsidiaries, and which is (B)

otherwise on terms which the Company's Board of Directors by a majority vote

determines in good faith (after consultation with its investment advisors and

outside legal counsel) would result in a transaction, if consummated, that is

more favorable to the Company's stockholders, from a financial point of view

(taking into account, among other things, all legal, financial, regulatory and

other aspects of the proposal, including conditions to consummation (which shall

not include a financing condition)) than the transactions contemplated hereby.

"Tax Sharing Agreement" means the Tax Sharing Agreement between the Company

and Alleghany dated as of June 17, 1998.

(b) Each of the following terms is defined in the Section set forth

opposite such term:

TERMS SECTION

----- -------

368 Reorganization Recitals

Aggregate Cash Share Fraction Section 3.1(e)

Allocation of Merger Consideration Section 3.1(c)

Average Fidelity Common Share Price Section 3.1(b)(iv)

Burdensome Condition Section 8.1

By-law Amendment Section 2.2

Cash Election Section 3.1(d)

Cash Election Shares Section 3.1(d)

Cash Fraction Section 3.1(f)(iii)

Cash Portion Section 3.1(b)(ii)

Certificate Section 3.1(d)

Certificate Amendment Section 2.2

Certificate of Merger Section 2.1(b)

Closing Section 2.1(d)

Code Recitals

A-4

113

TERMS SECTION

----- -------

Company Preamble

Company 10-K Section 1.1

Company 10-Q Section 1.1

Company Employee Plans Section 4.15(a)

Company GAAP Financial Statements Section 4.8(a)

Company Insurance Subsidiaries Section 4.6(b)

Company Option Section 3.4(a)

Company Proxy Statement Section 1.1

Company Recommendation Section 6.2

Company Returns Section 4.14

Company Securities Section 4.5(b)

Company Statutory Financial Statements Section 4.8(b)

Company Stockholder Approval Section 4.22(a)

Company Stockholders Meeting Section 6.2

Company Systems Section 4.24

Confidentiality Agreement Section 6.3(a)

Determination Date Section 3.1(b)

DGCL Section 2.1(a)

Differential Section 3.1(b)(iii)

Dissenting Shares Section 3.5(a)

Effective Time Section 2.1(b)

Election Section 3.1(d)

Election Deadline Section 3.1(i)

End Date Section 10.1(b)(i)

Environmental Laws Section 4.20(b)

ERISA Section 4.15(a)

Exchange Agent Section 3.3(a)

Exchange Fund Section 3.3(a)

Extended End Date Section 10.1(b)(i)

Fidelity Preamble

Fidelity 10-Ks Section 1.1

Fidelity 10-Q Section 1.1

Fidelity Employee Plans Section 5.15(a)

Fidelity GAAP Financial Statements Section 5.8(a)

Fidelity Insurance Subsidiaries Section 5.6(b)

Fidelity Option Section 3.4(a)

Fidelity Proxy Statement Section 1.1

Fidelity Returns Section 5.14

Fidelity Securities Section 5.5(b)

Fidelity Statutory Financial Statements Section 5.8(b)

Fidelity Stockholder Approval Section 5.22(a)

Fidelity Stockholders Meeting Section 7.3

Fidelity Systems Section 5.24

Form of Election Section 3.1(d)

A-5

114

TERMS SECTION

----- -------

GAAP Section 4.8(a)

Guarantee of Delivery Section 3.1(i)

HSR Act Section 4.3

Maximum Cash Section 3.1(c)

Maximum Shares Section 3.1(c)

Merger Section 2.1(a)

Merger Consideration Section 3.1(c)

Minimum Percentage Section 3.1(c)(i)

Non-Election Section 3.1(d)

Non-Election Shares Section 3.1(d)

Non-Election Fraction Section 3.1(h)(iii)

Per Share Cash Amount Section 3.1(e)

Per Share Stock Amount Section 3.1(e)

Reduced Supplemental Consideration Section 3.1(b)(iii)

Reduced Differential Section 3.1(b)(iv)

Restated By-laws Section 2.2

Restated Certificate Section 2.2

Stock Election Section 3.1(d)

Stock Election Shares Section 3.1(d)

Stock Fraction Section 3.1(g)(iii)

Stock Portion Section 3.1(b)(i)

Supplemental Consideration Section 3.1(b)(iii)

Supplemental Cash Portion Section 3.1(b)(iii)

Supplemental Exchange Ratio Section 3.1(b)(iv)

Supplemental Stock Portion Section 3.1(b)(iii)

Surviving Corporation Section 2.1(a)

Termination Fee Section 10.3(c)

Transition Committee Section 2.5

Year 2000 Compliant Section 4.24

ARTICLE II

THE MERGER

Section 2.1 The Merger.

(a) At the Effective Time, the Company shall be merged (the "Merger") with

and into Fidelity in accordance with the terms and conditions of this Agreement

and of the General Corporation Law of the State of Delaware (the "DGCL").

Following the Effective Time, Fidelity shall be the surviving corporation (the

"Surviving Corporation"), and shall succeed to and assume all the rights and

obligations of the Company in accordance with the DGCL.

(b) Not later than the second Business Day after satisfaction or, to the

extent permitted hereby, waiver of the conditions set forth in Article IX (other

than conditions that by their nature are to be satisfied at the Closing, but

subject to those conditions), the Company and Fidelity will file a certificate

of merger (the "Certificate of Merger") with the Secretary of State of the State

of Delaware and make all other filings or recordings required by the DGCL in

connection with the Merger. The Merger shall become effective upon the filing of

the

A-6

115

Certificate of Merger with the Secretary of State of the State of Delaware in

accordance with the DGCL or at such later time which the parties hereto shall

have agreed upon and designated in such Certificate of Merger as the effective

time of the Merger (the "Effective Time").

(c) From and after the Effective Time, the Merger shall have the effects

set forth in the DGCL.

(d) The closing of the Merger (the "Closing") shall be held at the offices

of Dewey Ballantine LLP, 1301 Avenue of the Americas, New York, NY (or such

other place as agreed by the parties) at 10:00 a.m. New York City time on a date

to be specified by the parties, which shall be no later than the second Business

Day after satisfaction or, to the extent permitted hereby, waiver of the

conditions set forth in Article IX (other than conditions that by their nature

are to be satisfied at the Closing, but subject to those conditions), unless the

parties hereto agree to another date or time.

Section 2.2 Certificate of Incorporation and By-laws of the Surviving

Corporation. The restated certificate of incorporation of Fidelity, as in effect

immediately prior to the Effective Time, shall be amended as of the Effective

Time as described in Exhibit A-1 hereto and, as so amended, such restated

certificate of incorporation shall be the restated certificate of incorporation

of the Surviving Corporation until thereafter changed or amended as provided

therein or by applicable law (as so amended, the "Restated Certificate"). The

by-laws of Fidelity, as in effect immediately prior to the Effective Time, shall

be amended as of the Effective Time as described in Exhibit A-2 hereto and, as

so amended, such by-laws shall be the by-laws of the Surviving Corporation until

thereafter changed or amended as provided therein or by applicable law (as so

amended, the "Restated By-laws"). Such amendment and restatement of Fidelity's

certificate of incorporation and by-laws are referred to herein as the

"Certificate Amendment" and the "By-law Amendment," respectively.

Section 2.3 Board of Directors of the Surviving Corporation. Prior to the

Effective Time, Fidelity shall adopt resolutions to constitute the Board of

Directors of Fidelity and committees thereof from and after the Effective Time

in the manner described in Exhibit B hereto. From and after the Effective Time,

the members of the Board of Directors, the committees of the Board of Directors

and the composition of such committees shall be as set forth on or designated in

accordance with the Restated Certificate, the Restated By-laws and Exhibit B

hereto until the earlier of the resignation or removal of any individual set

forth on or designated in accordance with the Restated Certificate, the Restated

By-laws and Exhibit B or until their respective successors are duly elected and

qualified, as the case may be, or until as otherwise provided in the Restated

Certificate, the Restated By-laws and Exhibit B.

Section 2.4 Headquarters. Fidelity and the Company agree that the

headquarters of the Surviving Corporation shall be located in Irvine,

California; provided, however, that the Chicago Title and Trust Company

Foundation and the headquarters of certain business segments of the Surviving

Corporation to be mutually agreed by the parties prior to the Effective Time

will be located in Chicago, Illinois.

Section 2.5 Transition Committee. The parties agree to establish a

Transition Committee (the "Transition Committee") which will have a consultative

role and which will be in effect from the date hereof until the earlier of the

termination hereof or the Effective Time. The Transition Committee shall be

comprised of eleven persons, six of whom shall be designated by Fidelity

(including Patrick F. Stone, who shall serve as Chairman of the Transition

Committee), and five of whom shall be designated by the Company. The Transition

Committee will coordinate contacts between officers and employees of Fidelity

and the Company and will plan matters relating to the integration after the

Effective Time of Fidelity

A-7

116

and the Company, including organization and staffing. The Transition Committee

will draw upon the resources of Fidelity and the Company as necessary or

appropriate.

ARTICLE III

CONVERSION OF SECURITIES AND RELATED MATTERS

Section 3.1 Conversion of Capital Stock. At the Effective Time, by virtue

of the Merger:

(a) Each Company Common Share held by the Company as treasury stock or

owned by Fidelity or any of its Subsidiaries immediately prior to the Effective

Time shall be cancelled, and no payment shall be made in respect thereof.

(b) Subject to Section 3.5 hereof, each Merger Share shall be cancelled

and, at the Effective Time, shall be converted into the right to receive

consideration having a value of $52.00 (unless Fidelity elects to pay the

Reduced Supplemental Consideration (as defined below), in which case the Company

shall have the right to terminate this Agreement as provided in Section

10.1(c)(iii) below), consisting of:

(i) a number of Fidelity Common Shares (the "Stock Portion") equal to

the Exchange Ratio;

(ii) an amount in cash equal to the lesser of (x) $26.00 or (y)(1)

$52.00 less (2) the Stock Portion multiplied by the Average Fidelity Common

Share Price (the "Cash Portion"); and

(iii) to the extent that the sum of (1) the product of the Stock

Portion multiplied by the Average Fidelity Common Share Price plus (2) the

Cash Portion is less than $52.00 (the "Differential"), then Fidelity shall

add an additional amount (the "Supplemental Consideration") to make up the

Differential; provided, however, that if the Average Fidelity Common Share

Price is less than $15.00, then Fidelity shall elect either (i) to pay the

Supplemental Consideration or (ii) to pay a reduced amount of Supplemental

Consideration (the "Reduced Supplemental Consideration") equal to the

product of the Average Fidelity Common Share Price multiplied by the lesser

of (x) a fraction (1) the numerator of which is the sum of (A) the product

of 0.50 multiplied by the Reduced Differential plus (B) the product of the

Average Fidelity Common Share Price multiplied by a fraction, the numerator

of which is the product of 0.50 multiplied by the Reduced Differential and

the denominator of which is $15.00 and (2) the denominator of which is the

Average Fidelity Common Share Price, or (y) a fraction, the numerator of

which is the Reduced Differential and the denominator of which is $13.00.

Any payment of the Supplemental Consideration or the Reduced

Supplemental Consideration, as the case may be, shall be made, at the

election of Fidelity, in the form of cash, Fidelity Common Shares or a

combination thereof. If Fidelity elects to pay all or any portion of the

Supplemental Consideration or the Reduced Supplemental Consideration, as

the case may be, in Fidelity Common Shares, the number of Fidelity Common

Shares to be issued as Supplemental Consideration or Reduced Supplemental

Consideration (the "Supplemental Stock Portion") shall be equal to the

Supplemental Exchange Ratio. If Fidelity elects to pay all or any portion

of the Supplemental Consideration or the Reduced Supplemental

Consideration, as the case may be, in cash, the amount of cash to be paid

as Supplemental Consideration or Reduced Supplemental Consideration shall

be the "Supplemental Cash Portion."

A-8

117

(iv) For purposes of this Agreement, (1) the "Average Fidelity Common

Share Price" shall be determined on the second trading day immediately

prior to the date of the Effective Time (the "Determination Date") and

shall mean the average of the daily averages of the high and low sales

prices of a Fidelity Common Share (calculated to the nearest 0.0001) on the

NYSE Composite Transactions Tape for the 30 consecutive trading days

immediately preceding and including the Determination Date (or, in the

event that there is no trading of Fidelity Common Share on any day during

the 30-trading-day period, for such lesser number of days within such

30-trading-day period when Fidelity Common Shares are traded); (2) the

"Reduced Differential" shall be determined if the Average Fidelity Common

Share Price on the Determination Date is less than $15.00 and Fidelity

elects to pay the Reduced Supplemental Consideration, and shall be an

amount equal to the difference between (A) $52.00 and (B) the sum of (x)

$26.00 and (y) the product of the Stock Portion and $15.00; and (3) the

"Supplemental Exchange Ratio" shall be a fraction (calculated to the

nearest 0.0001), the numerator of which is the portion of the Supplemental

Consideration or the Reduced Supplemental Consideration, as the case may

be, to be paid in Fidelity Common Shares and the denominator of which is

the Average Fidelity Common Share Price.

(v) Schedule I hereto illustrates the application of this Section

3.1(b) at various assumed Average Fidelity Common Share Prices.

(c) The amount of merger consideration payable pursuant to Section 3.1(b)

(which shall consist of the Stock Portion, the Cash Portion, the Supplemental

Stock Portion (if any), and the Supplemental Cash Portion (if any), and which

shall have an aggregate value equal to $52.00 or, if Fidelity has elected to pay

the Reduced Supplemental Consideration, an aggregate value equal to $52.00 less

the difference between the Supplemental Consideration and the Reduced

Supplemental Consideration) shall be referred to herein as the "Merger

Consideration." After determining the aggregate amount of Merger Consideration

in accordance with the provisions of Section 3.1(b) (and giving effect to any

determination by Fidelity to pay any Supplemental Consideration (or Reduced

Supplemental Consideration) in the form of cash, Fidelity Common Shares or a

combination thereof), a determination shall be made (the "Allocation of Merger

Consideration") as to the total number of Fidelity Common Shares to be paid as

Merger Consideration (the "Maximum Shares") and the total amount of cash to be

paid as Merger Consideration (the "Maximum Cash"), taking into account the

following adjustments:

(i) in the event that the Allocation of Merger Consideration would

result in holders of Merger Shares owning less than that percentage (the

"Minimum Percentage") of whole outstanding Fidelity Common Shares

immediately after the Effective Time as is equal to the sum of (A) 50.1%,

plus (B) that percentage as is equal to (x) the Company Common Shares

issued by the Company (regardless of the consideration, if any, received by

the Company) to any person other than Alleghany, and not repurchased by the

Company directly from such person prior to the Effective Time, divided by

(y) the number of shares of Company Common Shares outstanding immediately

prior to the Effective Time, then if necessary to satisfy the conditions in

Section 9.2(c) or Section 9.3(c) hereof, the foregoing allocation shall be

adjusted (i.e., the Maximum Cash shall be reduced, and the Maximum Shares

shall be increased) such that the holders of the Merger Shares immediately

prior to the Effective Time will acquire at the Effective Time whole

Fidelity Common Shares equal to the Minimum Percentage of the Fidelity

Common Shares outstanding immediately after the Effective Time;

(ii) after giving effect to any adjustment required pursuant to the

immediately preceding clause (i), if the product of (A) the number of

Fidelity Common Shares to be issued in the Merger and (B) the mean of the

highest and lowest quoted trading price of

A-9

118

Fidelity Common Shares on the date of the Effective Time (such product

referred to as "Value of Stock Consideration") is less than 40% of the sum

of the Value of Stock Consideration and the amount of cash consideration to

be issued in the Merger (such sum referred to as "Value of Merger

Consideration"), then the amount of cash to be issued in the Merger shall

be reduced and the amount of Fidelity Common Shares to be issued in the

Merger shall be increased such that the Value of Stock Consideration is at

least equal to 40% of the Value of Merger Consideration. For purposes of

the preceding sentence, Dissenting Shares, Company Common Shares exchanged

for cash in lieu of fractional shares of Fidelity Common Shares, Company

Common Shares owned by Fidelity or any of its Subsidiaries that will be

cancelled in accordance with Section 3.1(a), and Company Common Shares

repurchased by the Company since January 1, 1999, shall be treated as

Company Common Shares exchanged in the Merger for an amount of cash equal

to the purchase price therefor. The adjustments referred to in this

subparagraph (ii) shall be made in a manner so as to ensure that the Merger

qualifies as a reorganization under Section 368(a) of the Code and that the

conditions in Section 9.2(b) and Section 9.3(b) are satisfied.

(iii) The foregoing adjustments in subparagraphs (i) and (ii) shall be

applied in a manner such that the sum of (x) the total cash payable in

exchange for each Company Common Share and (y) the product of the number of

Fidelity Common Shares to be issued in exchange for each Company Common

Share multiplied by the Average Fidelity Common Share Price, shall be equal

to the amount of such sum in the absence of any adjustments under

subparagraphs (i) and (ii). For this purpose, the Average Fidelity Common

Share Price shall be equal to $15 if under Section 3.1(b)(iii) Fidelity has

elected to pay the Reduced Supplemental Consideration.

(d) Subject to the allocation and election procedures set forth in this

Section 3.1, each record holder (or beneficial owner through appropriate and

customary documentation and instructions) of Company Common Shares immediately

prior to the Effective Time shall be entitled to designate the number of such

holder's Company Common Shares with respect to which the holder elects to

receive the Merger Consideration entirely in cash ("Cash Election Shares"), and

to designate the number of such holder's Company Common Shares with respect to

which the holder elects to receive the Merger Consideration entirely in Fidelity

Common Shares ("Stock Election Shares"). Any Company Common Shares (other than

Dissenting Shares) with respect to which the holder (or the beneficial owner, as

the case may be) shall not have submitted to the Exchange Agent (as hereinafter

defined) an effective, properly completed Form of Election at or prior to the

Election Deadline (as hereinafter defined) shall be deemed to be "Non-Election

Shares." Any election to receive the Merger Consideration in cash (a "Cash

Election"), any election to receive the Merger Consideration in Fidelity Common

Shares (a "Stock Election") and any failure to indicate a preference as to the

receipt of cash, Fidelity Common Shares or a combination thereof (a

"Non-Election") shall be herein referred to as an "Election;" provided, however,

that no holder of Dissenting Shares shall be entitled to make an Election. All

such Elections shall be made on a form furnished by Fidelity for that purpose (a

"Form of Election") and reasonably satisfactory to the Company. If more than one

certificate which immediately prior to the Effective Time represented

outstanding Company Common Shares (a "Certificate") shall be surrendered for the

account of the same holder, the number of Fidelity Common Shares, if any, to be

issued to such holder in exchange for the Certificates which have been

surrendered shall be computed on the basis of the aggregate number of Company

Common Shares represented by all of the Certificates surrendered for the account

of such holder. Holders of record of Company Common Shares who hold such Company

Common Shares as nominees, trustees or in other representative capacities may

submit multiple Forms of Election, provided that such nominee, trustee or

A-10

119

representative certifies that each such Form of Election covers all Company

Common Shares held for a particular beneficial owner.

(e) For purposes of this Agreement (including without limitation the

election procedures set forth in this Section 3.1), the following terms shall

have the following meanings (after giving effect to Section 3.1(b) and Section

3.1(c)): (i) the "Aggregate Cash Shares" shall mean the aggregate number of

Company Common Shares which may be converted into the right to receive the

Merger Consideration in the form of cash, and shall be equal to the product of

(A) a fraction (the "Aggregate Cash Share Fraction"), the numerator of which

shall be equal to the amount of cash to be issued in the Merger and the

denominator of which shall be equal to the sum of (x) the amount of cash to be

issued in the Merger and (y) the product of (1) the number of Fidelity Common

Shares to be issued in the Merger and (2) the Average Fidelity Common Share

Price, and (B) the number of Merger Shares; (ii) the "Aggregate Stock Shares"

shall mean the aggregate number of Company Common Shares which may be converted

into the right to receive the Merger Consideration in the form of Fidelity

Common Shares, and shall be equal to the product of (A) one minus the Aggregate

Cash Share Fraction and (B) the number of Merger Shares; (iii) the "Per Share

Stock Amount" shall mean a number of Fidelity Common Shares equal to (A) the

Merger Consideration divided by (B) the Average Fidelity Common Share Price; and

(iv) the "Per Share Cash Amount" shall mean an amount of cash equal to the

Merger Consideration.

(f) If the aggregate number of Cash Election Shares exceeds the Aggregate

Cash Shares, then:

(i) each Stock Election Share shall be converted into the right to

receive the Per Share Stock Amount;

(ii) each Non-Election Share shall be converted into the right to

receive the Per Share Stock Amount; and

(iii) each Cash Election Share shall be converted into the right to

receive: (x) the amount in cash, without interest, equal to the product of

(A) the Per Share Cash Amount and (B) a fraction (the "Cash Fraction"), the

numerator of which shall be the Aggregate Cash Shares, and the denominator

of which shall be the aggregate number of Cash Election Shares, and (y) the

number of Fidelity Common Shares equal to the product of (A) the Per Share

Stock Amount and (B) a fraction equal to one minus the Cash Fraction.

(g) If the aggregate number of Stock Election Shares exceeds the Aggregate

Stock Shares, then:

(i) each Cash Election Share shall be converted into the right to

receive the Per Share Cash Amount;

(ii) each Non-Election Share shall be converted into the right to

receive the Per Share Cash Amount; and

(iii) each Stock Election Share shall be converted into the right to

receive: (x) the number of Fidelity Common Shares equal to the product of

(A) the Per Share Stock Amount and (B) a fraction (the "Stock Fraction"),

the numerator of which shall be the Aggregate Stock Shares, and the

denominator of which shall be the aggregate number of Stock Election

Shares, and (y) the amount in cash, without interest, equal to the product

of (A) the Per Share Cash Amount and (B) a fraction equal to one minus the

Stock Fraction.

A-11

120

(h) In the event that neither Section 3.1(f) nor Section 3.1(g) is

applicable, then:

(i) Each Cash Election Share shall be converted into the right to

receive the Per Share Cash Amount;

(ii) Each Stock Election Share shall be converted into the right to

receive the Per Share Stock Amount; and

(iii) Each Non-Election Share, if any, shall be converted into the

right to receive: (x) an amount in cash, without interest, equal to the

product of (A) the Merger Consideration and (B) a fraction (the

"Non-Election Fraction"), the numerator of which shall be the excess of (1)

the Aggregate Cash Shares over (2) the aggregate number of Cash Election

Shares, and the denominator of which shall be the number of Non-Election

Shares, and (y) the number of Fidelity Common Shares equal to the product

of (a) the Per Share Stock Amount and (B) a fraction equal to one minus the

Non-Election Fraction.

(i) Elections shall be made by holders of Company Common Shares by

delivering the Form of Election to the Exchange Agent (as hereinafter defined).

To be effective, a Form of Election must be properly completed, signed and

submitted to the Exchange Agent by no later than 5:00 p.m. (New York City time)

on the date of the Effective Time (the "Election Deadline"), and accompanied by

(1)(x) the Certificates representing the Company Common Shares as to which the

election is being made or (y) an appropriate guarantee of delivery of such

Certificates as set forth in such Form of Election from a firm which is a member

of a registered national securities exchange or of the National Association of

Securities Dealers, Inc. or a commercial bank or trust company having an office

or correspondent in the United States, provided such Certificates are in fact

delivered to the Exchange Agent within three NYSE trading days after the date of

execution of such guarantee of delivery (a "Guarantee of Delivery"), and (2) a

properly completed and signed letter of transmittal. Failure to deliver

Certificates covered by any Guarantee of Delivery within three NYSE trading days

after the date of execution of such Guarantee of Delivery shall be deemed to

invalidate any otherwise properly made Cash Election or Stock Election. Fidelity

will have the discretion, which it may delegate in whole or in part to the

Exchange Agent, to determine whether Forms of Election have been properly

completed, signed and submitted or revoked and to disregard immaterial defects

in Forms of Election. The good faith decision of Fidelity (or the Exchange

Agent) in such matters shall be conclusive and binding. Neither Fidelity nor the

Exchange Agent will be under any obligation to notify any person of any defect

in a Form of Election submitted to the Exchange Agent. A Form of Election with

respect to Dissenting Shares shall not be valid. The Exchange Agent shall also

make all computations contemplated by Sections 3.1(f), 3.1(g) and 3.1(h) above

and all such computations shall be conclusive and binding on the holders of

Company Common Shares in the absence of manifest error. Any Form of Election may

be changed or revoked prior to the Election Deadline. In the event a Form of

Election is revoked prior to the Election Deadline, Fidelity shall, or shall

cause the Exchange Agent to, cause the Certificates representing the Company

Common Shares covered by such Form of Election to be promptly returned without

charge to the Person submitting the Form of Election upon written request to

that effect from such Person.

(j) For the purposes hereof, a holder of Company Common Shares who does not

submit a Form of Election which is received by the Exchange Agent prior to the

Election Deadline (including a holder who submits and then revokes his or her

Form of Election and does not resubmit a Form of Election which is timely

received by the Exchange Agent), or who submits a Form of Election without the

corresponding Certificates or a Guarantee of Delivery, shall be deemed to have

made a Non-Election. Holders of Dissenting Shares shall not be entitled to make

an Election and shall not be deemed to have made a Non-Election; the rights of

such

A-12

121

holders of Dissenting Shares shall be determined in accordance with Section 262

of the DGCL and as provided in Section 3.5 hereof. If any Form of Election is

defective in any manner such that the Exchange Agent cannot reasonably determine

the election preference of the stockholder submitting such Form of Election, the

purported Cash Election or Stock Election set forth therein shall be deemed to

be of no force and effect and the stockholder making such purported Cash

Election or Stock Election shall, for purposes hereof, be deemed to have made a

Non-Election.

(k) A Form of Election and a letter of transmittal shall be included with

or mailed contemporaneously with each copy of the Joint Proxy

Statement/Prospectus mailed to stockholders of the Company in connection with

the Company Stockholders Meeting (as hereinafter defined). Fidelity and the

Company shall each use its reasonable best efforts to mail or otherwise make

available the Form of Election and a letter of transmittal to all persons who

become holders of Company Common Shares during the period between the record

date for the Company Stockholders Meeting and the Election Deadline.

Section 3.2 Fractional Shares; Adjustments.

(a) No certificate or scrip representing fractional Fidelity Common Shares

shall be issued upon the surrender for exchange of Certificates, and such

fractional share interests will not entitle the owner thereof to vote or to any

other rights of a stockholder of Fidelity. Notwithstanding any other provision

of this Agreement, each holder of Company Common Shares exchanged pursuant to

the Merger who would otherwise have been entitled to receive a fraction of a

Fidelity Common Share (after taking into account all Certificates delivered by

such holder) shall receive, in lieu thereof, cash (without interest) in an

amount equal to such fractional part of a Fidelity Common Share multiplied by

the Average Fidelity Common Share Price.

(b) If at any time during the period between the Determination Date and the

Effective Time, any change in the outstanding shares of capital stock of

Fidelity or securities convertible or exchangeable into capital stock of

Fidelity shall occur, including by reason of any reclassification,

recapitalization, stock split or combination, exchange or readjustment of

shares, or any dividend or distribution thereon (other than regular quarterly

cash dividends, not in excess of $0.084 per Fidelity Common Share) or a record

date with respect to any of the foregoing shall occur during such period, the

number of Fidelity Common Shares constituting part of the Merger Consideration

shall be appropriately adjusted to provide to the holders of the Fidelity Common

Shares and the Company Common Shares the same economic effect as contemplated by

this Agreement prior to the consummation of such event.

Section 3.3 Exchange of Certificates.

(a) Exchange Agent. Promptly after the date hereof, Fidelity shall appoint

a commercial bank or trust company reasonably acceptable to the Company, having

net capital of not less than $100,000,000, or a subsidiary thereof, as an

exchange agent (the "Exchange Agent") for the benefit of holders of Company

Common Shares. At or immediately prior to the Effective Time, Fidelity shall

deposit with the Exchange Agent, for exchange or payment in accordance with this

Section 3.3, through the Exchange Agent, (i) certificates evidencing the total

number of Fidelity Common Shares to be issued in the Merger, and (ii) (1) cash

in an amount equal to (x) the Per Share Cash Amount multiplied by (y) the

Aggregate Cash Shares, and (2) any cash necessary to pay amounts due pursuant to

Section 3.2(a) and Section 3.5 (such certificates for Fidelity Common Shares and

such cash being hereinafter referred to as the "Exchange Fund"). The Exchange

Agent shall, pursuant to irrevocable instructions in accordance with this

Article III, deliver the Fidelity Common Shares and cash contemplated to be

issued pursuant to this Article III out of the Exchange Fund. Except as

contemplated by

A-13

122

Section 3.3(e), Section 3.3(f) or Section 3.3(g) hereof, the Exchange Fund shall

not be used for any other purpose.

(b) Exchange Procedures. As promptly as practicable after the Effective

Time, Fidelity shall send, or will cause the Exchange Agent to send, to each

holder of record of a Certificate or Certificates that were converted into the

right to receive Fidelity Common Shares and/or cash pursuant Section 3.1, a

letter of transmittal and instructions (which shall be in customary form and

specify that delivery shall be effected, and risk of loss and title shall pass,

only upon delivery of the Certificates to the Exchange Agent), for use in the

exchange contemplated by this Section 3.3. Upon surrender of a Certificate to

the Exchange Agent, together with a duly executed letter of transmittal, the

holder of such Certificate shall be entitled to receive in exchange therefor a

certificate representing that number of whole Fidelity Common Shares and/or cash

which such holder has the right to receive pursuant to the provisions of this

Article III (after giving effect to any required withholding tax). Until

surrendered as contemplated by this Section 3.3, each Certificate shall be

deemed at any time after the Effective Time to represent only the right to

receive the Merger Consideration and unpaid dividends and distributions thereon,

if any, as provided in this Article III. If any portion of the Merger

Consideration is to be paid to a Person other than the Person in whose name the

Certificate is registered, it shall be a condition to such payment that the

Certificate so surrendered shall be properly endorsed or otherwise be in proper

form for transfer and that the Person requesting such payment shall pay to the

Exchange Agent any transfer or other taxes required as a result of such payment

to a Person other than the registered holder of such Certificate or establish to

the satisfaction of the Exchange Agent that such tax has been paid or is not

payable. If any Certificate shall have been lost, stolen or destroyed, upon the

making of an affidavit of that fact by the Person claiming such Certificate to

be lost, stolen or destroyed and, if required by Fidelity, the posting by such

Person of a bond, in such reasonable amount as Fidelity may direct, as indemnity

against any claim that may be made against it with respect to such Certificate,

the Exchange Agent will deliver, in exchange for such lost, stolen or destroyed

Certificate, the proper amount of the Merger Consideration, together with any

unpaid dividends and distributions on any such Fidelity Common Shares, as

contemplated by this Article III.

(c) Distributions with Respect to Unexchanged Shares. Whenever a dividend

or other distribution is declared by Fidelity in respect of the Fidelity Common

Shares, the record date for which is at or after the Effective Time, that

declaration shall include dividends or other distributions in respect of all

Fidelity Common Shares issuable pursuant to this Agreement. No dividends or

other distributions declared or made after the Effective Time with respect to

Fidelity Common Shares constituting part of the Merger Consideration shall be

paid to the holder of any unsurrendered Certificate, and no cash payment in lieu

of fractional shares shall be paid to any such holder, until such Certificate is

surrendered as provided in this Section 3.3. Following such surrender, there

shall be paid, without interest, to the Person in whose name the Fidelity Common

Shares have been registered (i) at the time of such surrender, the amount of

dividends or other distributions with a record date at or after the Effective

Time previously paid or payable on the date of such surrender with respect to

such whole Fidelity Common Shares, less the amount of any withholding taxes that

may be required thereon, and (ii) at the appropriate payment date subsequent to

surrender, the amount of dividends or other distributions with a record date at

or after the Effective Time but prior to surrender and a payment date subsequent

to surrender payable with respect to such whole Fidelity Common Shares, less the

amount of any withholding taxes which may be required thereon.

(d) No Further Ownership Rights in the Company Common Shares. As of the

Effective Time, all Company Common Shares shall automatically be cancelled and

retired and shall cease to exist, and each holder of a Certificate representing

any such Company Common Shares shall cease to have any rights with respect

thereto, except the right to receive, upon

A-14

123

surrender of such Certificate, the Merger Consideration. As of the Effective

Time, the stock transfer books of the Company shall be closed and there shall be

no further registration of transfers on the Company's stock transfer books of

Company Common Shares outstanding immediately prior to the Effective Time. If,

after the Effective Time, Certificates are presented to the Surviving

Corporation for any reason, they shall be cancelled and exchanged as provided in

this Section 3.3.

(e) Return of Merger Consideration. Upon demand by Fidelity, the Exchange

Agent shall deliver to Fidelity any portion of the Merger Consideration

deposited with the Exchange Agent pursuant to this Section 3.3 that remains

undistributed to holders of Company Common Shares one year after the Effective

Time. Holders of Certificates who have not complied with this Section 3.3 prior

to such demand shall thereafter look only to Fidelity for payment of any claim

to the Merger Consideration and dividends or distributions, if any, in respect

thereof.

(f) No Liability. Neither Fidelity nor the Exchange Agent shall be liable

to any Person in respect of any Company Common Shares (or dividends or

distributions with respect thereto) for any amounts paid to a public official

pursuant to any applicable abandoned property, escheat or similar law.

(g) Withholding Rights. Fidelity shall be entitled to deduct and withhold

from the Merger Consideration (and any dividends or distributions thereon)

otherwise payable hereunder to any Person such amounts as it is required to

deduct and withhold with respect to the making of such payment under any

provision of federal, state, local or foreign income tax law. To the extent that

Fidelity so withholds those amounts, such withheld amounts shall be treated for

all purposes of this Agreement as having been paid to the holder of Company

Common Shares in respect of which such deduction and withholding was made by

Fidelity.

Section 3.4 Company Stock Options.

(a) At the Effective Time, each option to purchase Company Common Shares

(each, a "Company Option") outstanding under any stock option or compensation

plan or arrangement of the Company, whether or not vested or exercisable, shall

cease to represent a right to acquire Company Common Shares and shall be

converted into an option (each, a "Fidelity Option") to acquire, on the same

terms and conditions