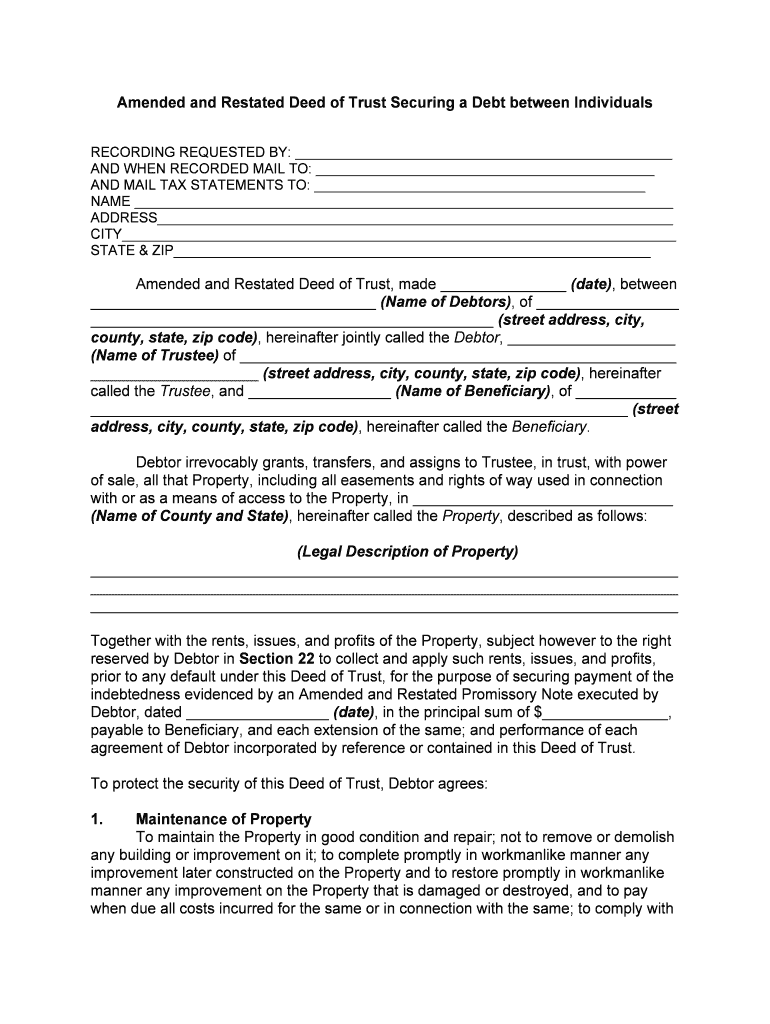

Amended and Restated Deed of Trust Securing a Debt between Individuals RECORDING REQUESTED BY: _________________________________________________AND WHEN RECORDED MAIL TO: ____________________________________________AND MAIL TAX STATEMENTS TO: ___________________________________________NAME ______________________________________________________________________ADDRESS___________________________________________________________________ CITY________________________________________________________________________ STATE & ZIP______________________________________________________________Amended and Restated Deed of Trust, made _______________ (date) , between

__________________________________ (Name of Debtors), of _________________

________________________________________________ (street address, city,

county, state, zip code), hereinafter jointly called the Debtor, ____________________

(Name of Trustee) of ____________________________________________________

____________________ (street address, city, county, state, zip code), hereinafter

called the Trustee , and _________________ (Name of Beneficiary) , of ____________

________________________________________________________________ (street

address, city, county, state, zip code) , hereinafter called the Beneficiary .Debtor irrevocably grants, transfers, and assigns to Trustee, in trust, with power

of sale, all that Property, including all easements and rights of way used in connection

with or as a means of access to the Property, in _______________________________

(Name of County and State), hereinafter called the Property , described as follows: (Legal Description of Property) ______________________________________________________________________ ______________________________________________________________________ ______________________________________________________________________Together with the rents, issues, and profits of the Property, subject however to the right

reserved by Debtor in Section 22 to collect and apply such rents, issues, and profits,

prior to any default under this Deed of Trust, for the purpose of securing payment of the

indebtedness evidenced by an Amended and Restated Promissory Note executed by

Debtor, dated _________________ (date), in the principal sum of $_______________,

payable to Beneficiary, and each extension of the same; and performance of each

agreement of Debtor incorporated by reference or contained in this Deed of Trust.To protect the security of this Deed of Trust, Debtor agrees:1. Maintenance of PropertyTo maintain the Property in good condition and repair; not to remove or demolish

any building or improvement on it; to complete promptly in workmanlike manner any

improvement later constructed on the Property and to restore promptly in workmanlike

manner any improvement on the Property that is damaged or destroyed, and to pay

when due all costs incurred for the same or in connection with the same; to comply with

all laws, ordinances, regulations, covenants, conditions, and restrictions affecting the

Property; not to commit, suffer, or permit any waste of the Property or any act on the

Property in violation of law or of covenants, conditions, or restrictions affecting the

Property; and to do all other acts that from the character or use of the Property are

reasonably necessary to protect and preserve the security, the specific enumerations in

this Paragraph not excluding the general.2. Hazard InsuranceTo provide, maintain, and deliver to Beneficiary fire insurance, and if required by

Beneficiary, other insurance satisfactory to and with loss payable to Beneficiary. The

amount collected under any fire or other insurance policy and all return premiums may

be applied by Beneficiary on any indebtedness secured by this Deed of Trust in such

order as Beneficiary determines, or at the option of Beneficiary the entire amount so

collected or any part of it may be released to Debtor. Such application or release shall

not cure or waive any default or notice of default under this Deed of Trust or invalidate

any act done pursuant to such notice. Any unexpired insurance shall inure to the benefit

of, and pass to, the purchaser of the Property covered by the insurance at any Trustee's

sale held under this Deed of Trust, or at any foreclosure sale of such Property.3. Proceeding Affecting Deed of TrustTo appear in and defend any action or proceeding purporting to affect the

security of this Deed of Trust or the rights or powers of Beneficiary or Trustee; and also,

if at any time Beneficiary or Trustee is a party to or appears in any such action or

proceeding, or in any action or proceeding to enforce any obligation secured by this

Deed of Trust, to pay all costs and expenses paid or incurred by them or either of them

in connection with the same, including, but not limited to, the cost of evidence of title

and attorney's fees in a reasonable sum.4.Taxes and AssessmentsTo pay: (a) at least _________ days before delinquency, all taxes and

assessments affecting the Property, all assessments on water company stock, and all

rents, assessments, and charges for water appurtenant to or used in connection with

the Property; (b) when due, all encumbrances, charges, and liens, with interest, on the

Property or any part of it, that appear to be prior or superior to this Deed of Trust; and

(c) all costs, fees, and expenses of this trust.5. Power of Beneficiary or Trustee to ActIf Debtor fails to make any payment or to do any act as provided in this Deed of

Trust, then Beneficiary or Trustee (but without obligation so to do, and with or without

notice to or demand on Debtor, and without releasing Debtor from any obligation) may:

(a) make or do the same in such manner and to such extent as either deems necessary

to protect the security of this Deed of Trust, Beneficiary or Trustee being authorized to

enter on the Property for such purpose; (b) appear in or commence any action or

proceeding purporting to affect the security of this Deed of Trust or the rights or powers

of Beneficiary or Trustee; (c) pay, purchase, contest, or compromise any encumbrance,

charge, or lien that, in the judgment of either, appears to be superior to this Deed of

Trust; and in exercising any such power, Beneficiary or Trustee may incur necessary

expenses, including reasonable attorney's fees.6. Reimbursement of Beneficiary or TrusteeTo pay immediately and without demand all sums expended under this Deed of

Trust by Beneficiary or Trustee, with interest from the date of expenditure at _______%

per annum.7. CondemnationAny award of damages made in connection with the condemnation for public use

of or injury to the Property or any part of it is now assigned and shall be paid to

Beneficiary, who may apply or release such moneys received in the same manner and

with the same effect as provided above for the disposition of proceeds of fire or other

insurance, and Debtor will execute such further assignment of any such award as

Beneficiary or Trustee requires.8.Forbearance Not a WaiverThe acceptance by Beneficiary of any payment less than the amount then due

shall be deemed an acceptance on account only and shall not constitute a waiver of the

obligation of Debtor to pay the entire sum then due or of Beneficiary's right either to

require prompt payment of all sums then due or to declare a default. The acceptance of

payment of any sum owed pursuant to the Promissory Note secured by this Deed of

Trust after its due date will not waive the right of Beneficiary either to require prompt

payment when due of all other sums so secured or to declare a default for the failure so

to pay, and no waiver of any default shall be a waiver of any preceding or succeeding

default of any kind.9. Powers of TrusteeAt any time or from time to time, without liability for the same and with or without

notice, on written request of Beneficiary and the presentation of this Deed of Trust

and/or the Promissory Note for endorsement and without affecting the personal liability

of any person for payment of the indebtedness secured by this Deed of Trust or the

effect of this Deed of Trust on the remainder of the Property, Trustee may reconvey

any part of the Property, consent to the making of any map or plat of the Property, join

in granting any easement, or join in any extension agreement or any agreement

subordinating the lien or charge of the same.10. ReconveyanceOn the written request of Beneficiary stating that all sums secured by this Deed

of Trust have been paid, the surrender of this Deed of Trust and the Promissory Note to

Trustee for cancellation and retention, and the payment of its fees, Trustee shall

reconvey, without warranty, the Property then held under this Deed of Trust. The

recitals in the reconveyance shall be conclusive proof of their truthfulness. The grantee

may be designated in the reconveyances as "the person or persons legally entitled to

the Property."

11.Payment of Rent after DefaultIf Debtor or any subsequent owner of the Property covered by this Deed of Trust

shall occupy the Property, or any part of it, after any default in the payment of any

amount secured by this Deed of Trust, Debtor or such owner shall pay to the

Beneficiary in advance on the (e.g., first) ___________ day of each month a

reasonable rental for the Property so occupied, and on failure to pay such reasonable

rental, Debtor or such owner may be removed from the Property by summary

dispossession proceedings or by any other appropriate action or proceeding.12. AccelerationIf a default is made in the payment of any indebtedness or in the performance of

any agreement secured by this Deed of Trust, then Beneficiary, with or without notice to

Debtor, may declare all sums secured by this Deed of Trust immediately due and

payable by instituting suit for the recovery of the same or for the foreclosure of this

deed, or by delivering to Trustee a written declaration of default and demand for sale, as

well as a written notice of default and of election to cause the Property to be sold, which

notice Trustee shall cause to be filed for record. If the declaration is delivered to

Trustee, Beneficiary also shall deposit with the Trustee this Deed of Trust, the

Promissory Note, and all documents evidencing expenditures secured by this Deed of

Trust.13. Transfer of PropertyExcept as prohibited by law, should Debtor, without the consent in writing of

Beneficiary, voluntarily sell, transfer, or convey Debtor's interest in the Property or any

part of the Property, or if by operation of law, it be sold, transferred, or conveyed, then

Beneficiary may, at its option, declare all sums secured by this Deed of Trust

immediately due and payable. Consent to one such transaction shall not be deemed to

be a waiver of the right to require consent to future or successive transactions.14.Sale of Property after DefaultAfter the time then required by law has elapsed after recordation of the notice of

default, and notice of sale having been given as then required by law, Trustee, with or

without demand on Debtor, shall sell the Property at the time and place fixed in the

notice of sale, either as a whole or in separate parcels and in such order as Trustee

determines, at public auction, to the highest bidder, for cash in lawful money of the

United States, payable at the time of sale. Trustee may postpone from time to time the

sale of all or any part of the Property by public announcement at the time and place of

sale originally fixed or at the last preceding postponed time. Trustee shall deliver to the

purchaser its deed conveying the Property sold, but without any covenant or warranty,

express or implied. The recitals in the deed of any matters or facts shall be conclusive

proof of their truthfulness. Debtor, Trustee, Beneficiary, or any other person may

purchase at any such sale.15. Application of Proceeds from SaleAfter deducting all costs, fees, and expenses of Trustee and of this trust,

including the cost of evidence of title and reasonable counsel fees in connection with

the sale, Trustee shall apply the proceeds of the sale to the payment of: (a) all sums

expended under the terms of this Deed of Trust and not previously repaid, with accrued

interest at ______% per annum; and (b) all other sums then secured by this Deed of

Trust in such order as Beneficiary, in the exercise of its sole discretion, directs; and the

remainder, if any, shall be paid to the person or persons legally entitled to it.16.Rescinding Notice of DefaultBefore Trustee's sale, Beneficiary may rescind such notices of default and of

election to cause the Property to be sold by delivering to Trustee a written notice of

rescission, which notice, when recorded, shall cancel any prior declaration of default,

demand for sale, and acceleration of maturity. The exercise of the right of rescission

shall not constitute a waiver of any default then existing or subsequently occurring, or

impair the right of Beneficiary to deliver to Trustee other declarations of default and

demands for sale or notices of default and of election to cause the Property to be sold,

or otherwise affect any provision of the Promissory Note or of this Deed of Trust or any

of the rights, obligations, or remedies of Beneficiary or Trustee under this Deed of Trust.17. Successor of TrusteeBeneficiary may from time to time, as provided by statute, or by a writing signed

and acknowledged by Beneficiary and recorded in the office of the county recorder of

the county in which the above-described land or such part of it as is then affected by

this Deed of Trust is situated, appoint another Trustee in place and stead of Trustee

named in this Deed of Trust; and in that event, the Trustee named in this Deed of Trust

shall be discharged, and Trustee so appointed shall be substituted as Trustee with the

same effect as if originally named Trustee in this Deed of Trust.18. Multiple TrusteesIf two or more persons are designated as Trustee, any, or all, powers granted in

this Deed of Trust to Trustee may be exercised by any of such persons if the other

person or persons is unable, for any reason, to act. Any recital of such inability in any

instrument executed by any of such persons shall be conclusive against Debtor, and the

heirs and assigns of Debtor.19. Leases Affecting PropertyAll leases now or later affecting the Property are now assigned and transferred to

Beneficiary by Debtor, and Debtor agrees that none of the leases will be modified or

terminated without the written consent of Beneficiary.20. Additional SecurityWhen requested so to do, Debtor shall give such further written assignments of

rents, royalties, issues, and profits, of all security for the performance of leases, and of

all money payable under any option to purchase, and shall give executed originals of all

leases, now or later on or affecting the Property.21. Debtor’s Rights Prior to DefaultDebtor reserves the right, prior to any default in the payment of any indebtedness

or the performance of any obligation secured by this Deed of Trust, to collect all such

rents, royalties, issues, and profits, as but not before they become due. On any such

default, Debtor's right to collect such moneys shall cease, not only as to amounts

accruing subsequently but also as to amounts then accrued and unpaid. In the event of

default, Beneficiary, with or without notice and without regard to the adequacy of

security for the indebtedness secured by this Deed of Trust, either in person or by

agent, or by a receiver to be appointed by the court: (a) may enter on and take

possession of the Property at any time and manage and control it in Beneficiary's

discretion; and (b) with or without taking possession, may sue for or otherwise collect

the rents, issues, and profits of the same, whether past due or coming due

subsequently, and apply the same, less expenses of operation and collection, including

reasonable attorney's fees, on any obligation secured by this Deed of Trust and in such

order as Beneficiary determines. None of the foregoing acts shall cure or waive any

default under this Deed of Trust or invalidate any act done pursuant to such notice.22.ReleaseWithout affecting the liability of Debtor or of any other party now or later bound by

the terms of this Deed of Trust for any obligation secured by this Deed of Trust,

Beneficiary, from time to time and with or without notice, may release any person now

or later liable for the performance of such obligation, and may extend the time for

payment or performance, accept additional security, and alter, substitute, or release any

security.23.Attorney’s FeesIn any action brought to foreclose this deed or to enforce any right of Beneficiary

or of Trustee under this Deed of Trust, Debtor shall pay to Beneficiary and to Trustee

attorney's fees in a reasonable sum, to be fixed by the court.24. Remedies Not ExclusiveNo remedy given by this Deed of Trust to Beneficiary or Trustee is exclusive of

any other remedy under this Deed of Trust or under any present or future law. In the

event of a default in the payment of any indebtedness secured by this Deed of Trust,

and if such indebtedness is secured at any time by any other instrument, Beneficiary

shall not be obligated to resort to any security in any particular order, and the exercise

by Beneficiary of any right or remedy with respect to any security shall not be a waiver

of or limitation on the right of Beneficiary to exercise, at any time or from time to time

afterward, any right or remedy with respect to this deed.25. Annual StatementsDebtor shall, on request made by Beneficiary, furnish the Beneficiary with annual

statements covering the operations of the Property.26. Late ChargesBeneficiary may collect a late charge not to exceed an amount equal to ______%

of any installment that is not paid within ______ days from its due date, to cover the

extra expense involved in handling delinquent payments.

27.Binding EffectThis Deed of Trust applies to, inures to the benefit of, and binds, all parties to it,

their heirs, legatees, devisees, administrators, executors, successors, successors in

interest, and assigns. The term Beneficiary means the owner and holder, including

pledges, of the Promissory Note secured by this Deed of Trust, whether or not named

as Beneficiary. In this Deed of Trust, whenever the context so requires, the masculine

gender includes the feminine and neuter, and the singular number includes the plural,

and all obligations of each Debtor under this Deed of Trust are joint and several.28. Acceptance of TrustTrustee accepts this trust when this Deed of Trust, duly executed and

acknowledged, is made a public record as provided by law. Trustee is not obligated to

notify any party of a pending sale under any other Deed of Trust or of any action or

proceeding in which Debtor, Beneficiary, or Trustee is a party unless brought by

Trustee. Debtor requests that a copy of any notice of default and of any notice of sale

under this Deed of Trust shall be mailed to Debtor at his address set out above.29.This Amended and Restated Deed of Trust is an amendment to that certain Deed

of Trust from the undersigned dated _______________ (date) , a copy of which Deed of

Trust is attached hereto as Exhibit A. This Amendment is being made at the request of

the undersigned and is in no manner to be considered or construed as a novation of the

indebtedness or security evidenced by said Deed of Trust shown in Exhibit A, and all

terms and conditions of said Deed of Trust, except as specifically modified herein, shall

remain in full force and effect.This Deed of Trust was executed on the day and year first above written. ________________________________ (Printed Name & Signature of Debtor)________________________________(Printed Name & Signature of Debtor)Debtors’ mailing address for notice is ________________________________________

_______________________________ (street address, city, county, state, zip code).

State of ___________________County of _____________________On ________________ (date), before me, __________________________________

(name and title of Notary Public), personally appeared ______________________

(Name of Debtor), personally known to me/proved to me on the basis of satisfactory

evidence to be the person whose name is subscribed to the within instrument and

acknowledged to me that the executed the same in his authorized capacity, and that by

his signature on the instrument, the person executed the instrument.Witness my hand and official seal.

_____________________________

Notary PublicMy Commission Expires: ____________________SealState of ___________________County of _____________________On __________________ (date), before me, ________________________________

(name and title of Notary Public), personally appeared ________________________

(Name of Debtor), personally known to me/proved to me on the basis of satisfactory

evidence to be the person whose name is subscribed to the within instrument and

acknowledged to me that the executed the same in her authorized capacity, and that by

her signature on the instrument, the person executed the instrument.Witness my hand and official seal.

_____________________________

Notary PublicMy Commission Expires: ____________________Seal