FORM

DP-146

171

STATE OF NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

NON-RESIDENT PERSONAL PROPERTY TRANSFER TAX RETURN

FOR DRA USE ONLY

PLEASE PRINT OR TYPE

STEP 1

NAME

ADDRESS

SSN

FEIN

ESTATE OF:

LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEDENT'S SSN

DATE OF DEATH

DOMICILE AT DATE OF DEATH:

STREET

CITY/TOWN

STATE

COUNTY

PROBATE NO.

FIRST NAME

MIDDLE INITIAL

EXECUTOR/ADMINISTRATOR SSN OR FEIN

STREET

CITY/TOWN

STATE

NAME OF EXECUTOR/ADMINISTRATOR:

LAST NAME

EXECUTOR/ADMINISTRATOR ADDRESS:

STEP 2

POWER

OF

ATTORNEY

ZIP CODE

Authorization is granted to the representative listed below to receive confidential tax information under RSA 21-J:14 and to act as the estate's

representative before the NH Department of Revenue Administration.

NAME OF REPRESENTATIVE:

STREET

CITY/TOWN

STATE

ZIP CODE

(AREA CODE) TELEPHONE NO.

SIGNATURE OF EXECUTOR/ADMINISTRATOR: (THIS LINE MUST BE SIGNED TO GRANT A POWER OF ATTORNEY)

STEP 3

ANSWER

QUESTIONS

Did the decedent own any real estate in New Hampshire?

Does the decedent's gross estate total $650,000 or

more for 1999 or $675,000 or more for 2000?

(See instructions for other years gross amounts).

Is this an

Initial Return or

Amended Return?

STEP 4

PERSONAL

PROPERTY

LOCATION

A

Yes

No

If yes, list location

No

If yes, a NH 706 Estate Tax Return must be filed.

TOWN/CITY

Yes

PERSONAL PROPERTY LOCATED IN NEW HAMPSHIRE

B

C

DESCRIPTION OF PERSONAL

PROPERTY

LOCATION OF

PROPERTY

OWNERSHIP

JOINT

INDIVIDUAL

D

FAIR MARKET VALUE

OF PROPERTY

1

2

3

4

5

6

7 Total amount from supplemental (attached)

8 Total Value of Personal Property (sum of lines 1-7)

STEP 5

TOTAL

TAXABLE

ESTATE,

CREDITS

AND

PAYMENTS

9 TOTAL TAXABLE ESTATE (Total of Line 8, Column D). . . . . . . . . . . . . . 9

10 NH Non-Resident Personal Property Transfer Tax (Line 9 x 2%). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Credits and

(a) Estimated tax paid . . . . . . . . . . . . . . . . . . . . .11(a)

Payments:

(b) Tax paid with application for extension. . . . 11(b)

(c) Tax paid with original return . . . . . . . . . . . . 11(c)

(d) Other credits or payments (Attach explanation) . . 11(d)

11 TOTAL CREDITS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Balance of tax due (Line 10 less Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Additions to tax:(a) Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13(a)

(b) Failure to pay . . . . . . . . . . . . . . . . . . . . . . . . 13(b)

(c) Failure to file. . . . . . . . . . . . . . . . . . . . . . . . . 13(c)

13 TOTAL ADDITIONS TO TAX . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

STEP 6

14 Balance Due (Line 12 plus Line 13) Make check payable to: State of New Hampshire. . . . . . . . . . . . . . . .14

BALANCE DUE

15 Refund Due (Line 11 less Line 10 adjusted by Line 13) . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

OR REFUND

STEP 7

Under penalties of perjury, I declare that I have examined this return and to the best of my belief it is true, correct and complete. If

SIGNATURE

prepared by a person other than the taxpayer, this declaration is based on all information of which the preparer has knowledge.

FOR DRA USE ONLY

SIGNATURE OF EXECUTOR/ADMINISTRATOR

DATE

SIGNATURE OF PREPARER IF OTHER THAN EXECUTOR/ADMINISTRATOR

DATE

PREPARER'S TAX IDENTIFICATION NUMBER

MAIL

TO:

NH DEPT OF REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

PO BOX 637

CONCORD NH 03302-0637

PREPARER'S ADDRESS

CITY/TOWN, STATE & ZIP CODE

DP-146

Rev. 11/00

�FORM

DP-146

Instructions

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

NON-RESIDENT PERSONAL PROPERTY TRANSFER TAX RETURN

GENERAL INSTRUCTIONS

WHO MUST FILE

The executor or administrator of any non-resident decedent owning tangible personal property in New Hampshire must file a

New Hampshire Non-Resident Personal Property Transfer Tax Return. A non-resident decedent is someone who did not claim

New Hampshire as their legal residence. Tangible personal property is personal property which has physical substance such

as furniture, boat, car, etc. Stocks or bank accounts are not tangible personal property.

WHAT TO FILE

You must file the DP-146 New Hampshire Non-Resident Personal Property Transfer Tax Return along with full payment of tax

within 9 months from the decedent's date of death. If the return cannot be filed on time, then an extension, Form DP-147, must

be filed with full payment if a tax is due. If more than a 6 month extension is needed, you must attach a letter of explanation.

WHEN TO FILE

The New Hampshire Non-Resident Personal Property Transfer Tax Return and payment are due 9 months from the decedent's

date of death.

WHERE TO FILE

NH DEPARTMENT OF REVENUE ADMINISTRATION

DOCUMENT PROCESSING DIVISION

PO BOX 637

CONCORD, NEW HAMPSHIRE 03302-0637

CONFIDENTIAL

INFORMATION

FACSIMILE DOCUMENTS ARE NOT ACCEPTED

Disclosure of Social Security Numbers is mandatory under Department of Revenue Administration rules 203.01, 221.02,

221.03 and 1308.04(a). This information is required for the purpose of administering the tax laws of this state and authorized

by 42 U.S.C.S. § 405 (c)(2)(C)(i).

Tax information which is disclosed to the New Hampshire Department of Revenue Administration is held in strict confidence

by law. The information may be disclosed to the United States Internal Revenue Service, agencies responsible for the

administration of taxes in other states in accordance with compacts for the exchange of information, and as otherwise

authorized by New Hampshire Revised Statutes Annotated 21-J:14.

The failure to provide Social Security Numbers may result in a rejection of a return or application. The failure to timely file a

return or application complete with Social Security Account Numbers may result in the imposition of civil or criminal penalties,

the disallowance of claimed exemptions, exclusions, credits, deductions, or adjustments that may result in increased tax

liability.

EXTENSION

TO FILE

The New Hampshire Department of Revenue Administration requires Form DP-147, a request for a 6 month Extension of Time

to File, for all New Hampshire Non-Resident Personal Property Transfer Tax Returns filed by taxpayers unable to meet the 9

month filing requirement. The Form DP-147 must be filed with the department prior to the due date of the return in order to be

considered timely. Extension requests for a period in excess of 6 months must be accompanied by a letter of explanation. A

Probate Court approved extension (Form 77A) will not be accepted as an extension to file the Form DP-146

New Hampshire Non-Resident Personal Property Transfer Tax Return.

PAYMENT OF

ESTIMATED TAX

An executor or administrator may make an estimated payment of the tax liability using Form DP-146-ES, Estimated NonResident Personal Property Transfer Tax Payment form.

ROUNDING OFF

TO WHOLE

DOLLARS

Money items on all New Hampshire Non-Resident Personal Property Transfer Tax forms may be rounded off to the nearest

whole dollar.

NEED FORMS

OR HELP

Forms are available at each county Probate Court, from our website at www.state.nh.us/revenue or by calling the Department's

forms line (603) 271-2192, 24 hours a day, 7 days a week. For taxpayer assistance, call the New Hampshire Department

of Revenue Administration, Audit Division at (603) 271-2580, Monday through Friday, 8:00 am to 4:30 pm. Hearing or speech

impaired individuals may call TDD Access: Relay NH 1-800-735-2964.

PROBATE

COURT

Questions regarding Probate

property is located.

Belknap County

Carroll County

CheshireCounty

Coos County

Grafton County

Court documents of filing should be directed to the Probate Court in the County where the

(603)

(603)

(603)

(603)

(603)

524-0903

539-4123

357-7786

788-2001

787-6931

Hillsborough County

Merrimack County

Rockingham County

Stratford County

Sullivan County

(603)

(603)

(603)

(603)

(603)

882-1231

224-9589

642-7117

742-2550

863-3150

DP-146

Instructions

Rev. 11/00

�NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

FORM

DP-146

Instructions

NON-RESIDENT PERSONAL PROPERTY TRANSFER TAX RETURN

LINE-BY-LINE INSTRUCTIONS

STEP 1

Type or print the name of the decedent, the domicile of the decedent at date of death, the decedent's social security number, the date

of death, and the probate number, if applicable. Type or print the executor or administrator name, address and social security number

or federal employer identification number.

STEP 2

Complete this section if someone other than the executor or administrator will represent the estate on matters dealing with this tax

return. THE EXECUTOR OR ADMINISTRATOR MUST SIGN ON THIS LINE IN ADDITION TO SIGNING THE RETURN FOR THE POWER

OF ATTORNEY TO BE EFFECTIVE.

STEP 3

Check the Initial Return box only if this is the first Form DP-146 Return that has ever been filed. Check the Amended Return box if this

is the second (or additional) return that has been filed for this estate. Attach a copy of approved Federal Extension request.

Calendar Year

1998

1999

2000

2001

STEP 4

Column

Column

Column

Column

STEP 5

Line 9

Line 10

Line 11 (a)

(A)

(B)

(C)

(D)

(b)

(c)

(d)

Line 11

Line 12

Line 13 (a)

Calendar Year

2002 & 2003

2004

2005

2006

Credit Amount

$ 625,000

$ 650,000

$ 675,000

$ 675,000

Credit Amount

$ 700,000

$ 850,000

$ 950,000

$1,000,000

Enter a description of the personal property held on behalf of the non-resident decedent.

Enter the city or town where the property is located.

Indicate whether the property was jointly or individually held by placing an X in the appropriate column.

Enter the fair market value of the property as of the decedent's date of death. If jointly held, enter the fair market value

of the decedent's share of the property as of the date of death. If there are insufficient lines to list all property held,

attach a supplemental schedule using the same format. Enter, on Line 7, the total amount from the supplemental

schedule. Enter on Line 8, the total sum of Lines 1-7.

Enter the total from Column D, Line 8.

Multiply Line 9 by the 2% tax rate and enter the amount on Line 10.

Enter the amount of estimated tax paid with Form DP-146-ES.

Enter the amount paid with Form DP-147 application for extension.

Enter the amount paid with the original return.

Enter any other credits or payments and attach an explanation.

Enter the sum of Lines 11(a) through 11(d).

Enter the amount of Line 10 less Line 11.

INTEREST: Interest is calculated on the balance of tax due (line 12) from the original due date to the date paid at the

applicable rate listed below. Tax due x number of days from due date to date tax was paid x daily rate decimal

equivalent.

x

Tax Due (line 12)

.

x

Number of days

(see decimal rate below)

Enter on line 13(a).

Interest due

NOTE: The interest rate is recomputed each year under the provisions of RSA 21-J:28, II. Applicable rates are as

follows: (contact the department for applicable rates in any other year)

PERIOD

1/1/2001 - 12/31/2001

1/1/1999 - 12/31/2000

1/1/1998 - 12/31/1998

Prior to 1/1/98

STEP 6

RATE

11%

10%

11%

15%

DAILY RATE DECIMAL EQUIVALENT

.000301

.000274

.000301

.000411

(b)

FAILURE TO PAY: A penalty equal to 10% of any nonpayment or underpayment of taxes shall be imposed if the

executor/administrator fails to pay the tax when due and the failure to pay is due to willful neglect or intentional

disregard of the law but without intent to defraud. If the failure to pay is due to fraud, the penalty shall be 50% of the

amount of the nonpayment or underpayment.

(c)

FAILURE TO FILE: An executor/administrator failing to timely file a complete return will be subject to a penalty equal to

5% of the tax due or $10, whichever is greater, for each month or part thereof that the return remains unfiled or

incomplete. The total amount of this penalty shall not exceed 25% of the balance of tax due or $50, whichever is

greater. Calculate this penalty starting from the original due date of the return until the date a complete return is filed.

Line 13

Enter the total of Lines 13(a), 13(b) and 13(c).

Line 14

If the total tax (Line 10) plus interest and penalties (Line 13) is greater than the amount previously paid, (Line 11), then

enter the balance due. If less than $1.00, do not pay, but still file the return. Make check or money order payable to the

State of New Hampshire. To ensure that the check is credited to the proper account, please put the decedent's name

and social security number on the check.

Line 15

If the total tax (Line 10) plus interest and penalties (Line 13) is less than the amount previously paid, (Line 11), then you

have overpaid the tax and a refund is due. Enter the amount on Line 15. Please allow 12 weeks for processing your

refund.

STEP 7

The return must be dated and signed in ink by the executor or administrator. If the return was completed by a paid preparer, then the

preparer must also sign and date the return. The preparer must also enter their Federal Employer Identification Number or Preparer's

Tax Identification Number and complete address.

DP-146

Instructions

Rev. 11/00

�

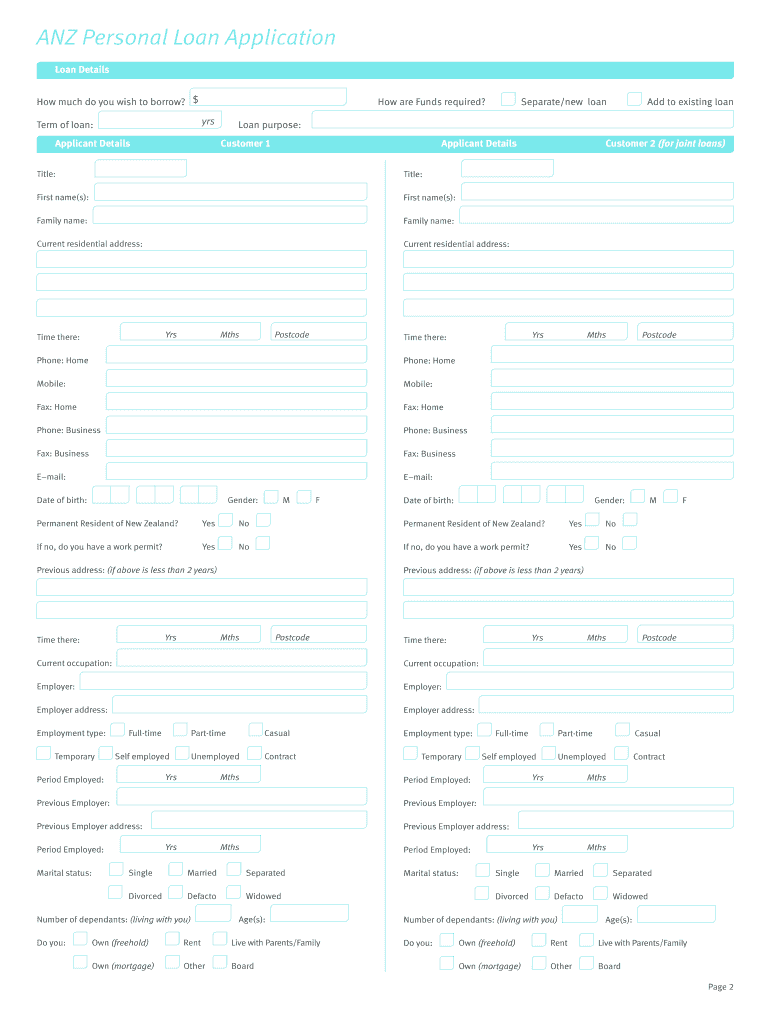

Valuable advice on preparing your ‘Anz Loan Application Form’ digitally

Are you fed up with the inconvenience of managing documentation? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and small to medium-sized businesses. Farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the extensive features included in this user-friendly and cost-effective platform and transform your document management strategies. Whether you need to authorize forms or collect signatures, airSlate SignNow manages it all effortlessly, with merely a few clicks.

Adhere to this step-by-step procedure:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form repository.

- Open your ‘Anz Loan Application Form’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your end.

- Insert and designate fillable fields for others (if needed).

- Continue with the Send Invite settings to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don't stress if you need to collaborate with your teammates on your Anz Loan Application Form or send it for notarization—our platform provides everything necessary to accomplish such tasks. Sign up with airSlate SignNow today and take your document management to new levels!