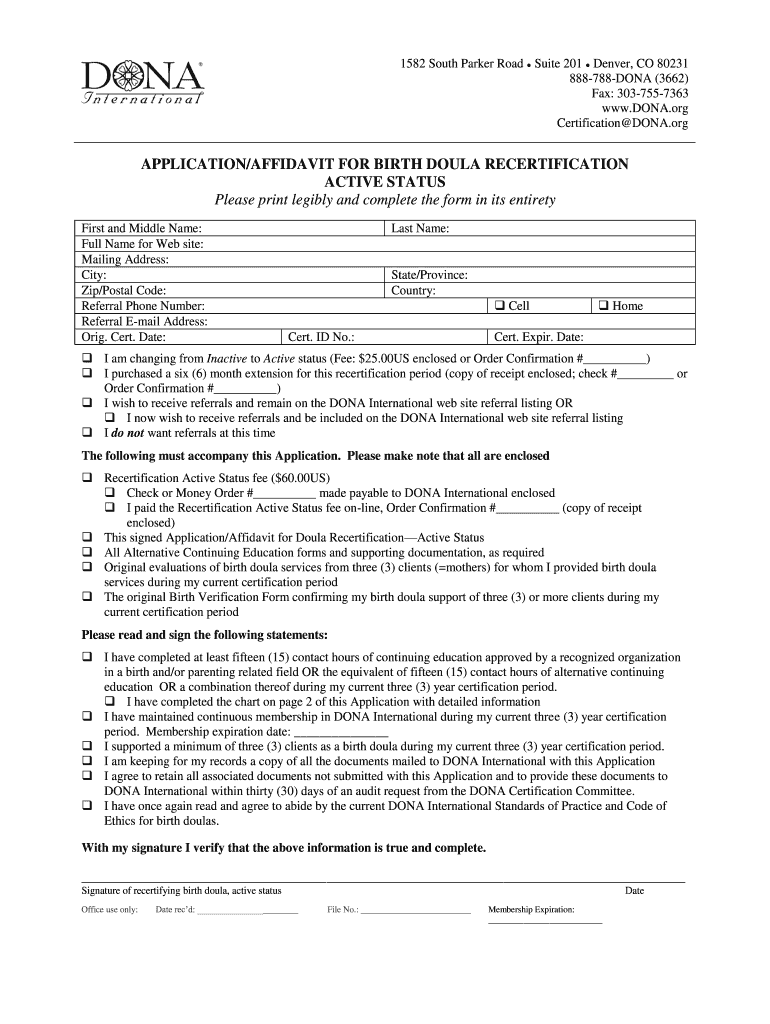

Issue 6 | 1st Quarter 2010

™

Wells Fargo Merchant Connect

Best practices in payment

processing

Maximize revenues by successfully

resolving chargebacks

PCI compliance and data

security updates

Is your third-party service provider

putting you at risk of a data

compromise?

Countdown to PA-DSS validation by

July 1, 2010

Card networks news

New MasterCard® POS requirements

improve prepaid card experience

Payment solutions

Managing your merchant processing

account has never been easier

Resources for your business

Start navigating through every

business stage today!

The clock is ticking away fast…

Merchants who fail to use a payment application

validated to comply with the Payment Application

Data Security Standard (PA-DSS) by July 1, 2010

will no longer be able to process card payments

with any merchant processor. Read more

Looking for New Year’s resolutions

to help grow your business in 2010?

We’ve got a great suggestion: Sign up for

online reporting with ClientLine® today and

find out how easy it is to manage your

merchant processing transactions online,

24/7…at no extra cost. Read more

�Dear Customer,

Welcome to a fresh slate for the New Year! Although we can look

forward to a year of new opportunities, we continue to face some

old challenges that haven’t quite subsided yet. Wells Fargo

Merchant Services is here to help you succeed every stage of

the way.

In this first 2010 issue of the Wells Fargo Merchant Connect

information bulletin, you’ll find a wealth of information and tips

to help you save time and money, better serve your customers,

and reduce fraud and data security risk.

• Save time and money

– Control losses by learning the immediate steps to take to remedy

card disputes in your favor.

– Manage your merchant processing account online 24/7 with

ClientLine® online reporting. It’s easy to use, fast, and available

at no extra cost.

• Reduce fraud and data security risk

– Learn 8 important questions to ask your vendors to ensure that

they are not putting you at risk of a data compromise.

– The deadline to comply with the Payment Application Data

Security Standard (PA-DSS) is July 1, 2010. Are you ready?

• Better serve your customers

– To help improve the prepaid card experience at the point of sale,

MasterCard® is rolling out new compliance requirements,

beginning May 1, 2010. Get a list of impacted industries and

effective implementation dates.

• Successfully plan for business growth

– Ask your banker for the Special Edition of the Wells Fargo

Strategies & Solutions For Your Business® Guide to help you

better manage through each business stage.

Don’t forget these important

dates

Take note of these important dates

affecting merchants.

Stay informed

We wish you much success this coming year. We remain dedicated

to providing you with the tools and resources to help you succeed.

Sincerely,

Learn more on important matters that

may impact your payment processing

activities with our two regular newsletters:

Merchant Intelligence™ and Wells Fargo

Merchant Connect™.

www.wellsfargo.com/biz/merchantnews

Charmaine Clay

Senior Vice President

Wells Fargo Merchant Services

1

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Wells Fargo Merchant Connect

—Topics

TM

Best practices in payment processing

Payment solutions

Maximize revenues by successfully resolving chargebacks

On the heels of the increased sales volume many merchants

enjoyed during the holiday season often comes the increased

incidence of chargebacks, or card disputes. Learn about

important steps you can take to improve your chances of

resolving a chargeback and minimize losses. Read more

Managing your merchant processing account has never

been easier

Did you know that as a Wells Fargo Merchant Services

customer you had access to ClientLine® online reporting at

no extra cost? With ClientLine, you can easily manage your

merchant processing transactions 24/7. Learn more on how it

can help you grow your business in 2010. And get a sneak peak

of great things you can do, such as viewing your statements,

analyzing sales trends, lowering payment processing expenses

and much more. Read more

PCI compliance and data security updates

Is your third-party service provider putting you at risk of

a data compromise?

Did you know that in 81% of data security breaches that were

investigated by Trustwave, a global provider of data security and

payment card industry compliance management solutions, a third

party provider was responsible for the compromised system’s

administration? 1 Today many businesses outsource some of their

data transmission or security processes and are unknowingly

putting themselves at risk of a data compromise and a heavy

liability burden. Do not assume your vendors are compliant with

the Payment Card Industry Data Security Standard (PCI DSS).

Learn about 8 questions you can ask your vendors so that you can

better protect your business from undue risk. Read more

Countdown to PA-DSS validation by July 1, 2010

The clock is ticking away fast. Merchants who fail to use a

payment application validated to comply with the Payment

Application Data Security Standard (PA-DSS) by July 1, 2010

will no longer be able to process card payments with any

merchant processor. Read more

Resources for your business

Start navigating through every business stage today!

Wells Fargo has helped millions of business owners flourish in

every stage of their growth, through good times and bad. To

help you achieve your own vision, we’ve produced the Special

Edition of the Strategies & Solutions For Your Business® Guide

that helps you manage and successfully navigate through the

business lifecycle. Ask for your complimentary issue today.

Read more

New!

Don’t forget these important dates

A lot is happening in the payment card industry that affects

merchants. This new section helps you remember important

dates and deadlines that may impact your business. Read more

Card networks news

New MasterCard® POS requirements improve prepaid

card experience

In parallel with the increased number of consumers who are

using prepaid cards to better control their expenses, the

payment card industry has seen a spike in decline rates at the

point of sale (POS) and a subsequent influx of cardholder

complaints. To address these issues and help improve the

“prepaid card experience” for both merchants and consumers,

MasterCard is rolling out new requirements. They will affect a

large number of merchants and be introduced in three phases,

beginning in May 2010 and in full effect by May 2011. Find out

if your business is impacted and when the mandates may apply

to you. Read more

(1) Trustwave, Global Security Report 2010

2

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Best practices in payment

processing

Maximize revenues by successfully

resolving chargebacks

On the heels of the increased sales volume many merchants

enjoyed during the holiday season often comes the increased

incidence of chargebacks, or card disputes. A chargeback

occurs when, at the request of your customer or your customer’s

card issuing bank, a payment card transaction is disputed.

A cardholder can initiate a chargeback within 120 days of the

delivery date of the products and/or services. A customer’s

card issuing bank can also initiate a chargeback but only within

7 to 75 days.

When a chargeback happens, the amount of the original sales

transaction is deducted from your checking or savings account

along with any chargeback fee. Chargeback related losses can

therefore weigh heavily on any business.

There are key steps you can take to improve your chances of

resolving a chargeback and minimize losses. Let’s look at some

of the most common causes of chargebacks and the immediate

steps you can take to help Wells Fargo Merchant Services

remedy any disputes in your favor.

Minimize losses. Save time.

Cause: The card issuer requests a copy of the sales receipt

and receives a substitute that does not contain all required

information, or the receipt is not legible.

Possible remedy: Immediately resubmit a legible copy of the

sales receipt and ensure it includes all required information. If

you microfilm receipts, make copies from the microfilm to the

same size as the original receipt.

Cause: Your merchant store name or location on the billing

statement is not recognized by the cardholder.

Possible remedy: Provide any documentation that will help the

cardholder recognize the transaction, such as a sales receipt,

shipping invoice or delivery receipt, or a description of the

merchandise or service purchased. Remember that the

merchant name is the single most important factor in

cardholder recognition. If using a “Doing Business As” (DBA)

name, be sure that the merchant name your customer knows

you by is also identified.

Cause: The cardholder claims they did not receive the

merchandise, or the merchandise did not arrive by the agreedupon delivery date.

Possible remedy: If the merchandise was delivered by the

expected delivery date, send us evidence of delivery, such as

3

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

There are key steps you can take to

improve your chances of resolving

a chargeback and minimize losses.

a delivery receipt signed by the cardholder or the carrier’s

confirmation. If the merchandise was shipped after the specified

delivery date, provide us with the shipment date and expected

arrival date, or proof of delivery and acceptance by the

cardholder.

Cause: The card issuer receives a written complaint from a

cardholder in regard to a card-not-present transaction, claiming

that they did not authorize or participate in the transaction.

Possible remedy: If authorization was obtained and Address

Verification Service (AVS) or Card Verification Value (CVV – 3

digit code on the back of the card) used, and you have proof that

the merchandise was delivered to the AVS address, send a copy

of the transaction invoice, proof of delivery and any other

information to us. Keep in mind that AVS and CVV are

primarily fraud prevention tools. Although they can, in some

cases, provide you with the ability to resolve a chargeback, they

do not directly prevent chargebacks.

Cause: The customer claims that the same transaction was

submitted for processing more than once.

Possible remedy: If both transactions are valid transactions,

send legible copies of both transaction receipts. Include any

related documentation such as signed receipts and invoices and

clearly indicate that the transactions are not for the same

merchandise and/or services.

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Best practices in payment

processing

Cause: The customer claims that a credit was not processed.

Possible remedy: Check to see if you have already issued a

credit and if you have, please provide the proof to us. If the

credit hasn’t been issued, check and see whether or not the

cardholder contacted you to request a credit and if the product

has been returned or attempted to be returned by the

cardholder.

Cause: The retrieval request was not fulfilled within the given

time frame. A “retrieval” is a request to receive details or

documentation associated with a credit card transaction, such

as the copy of a receipt or invoice.

Possible remedy: If the requested copy has already been sent,

provide documentation supporting this submission. Include a

copy of the receipt as well as fax confirmation or certified

mail receipt.

24/7 chargeback resources

ClientLine® online reporting

View chargebacks

www.myclientline.net

Electronic Integrated Dispute System (eIDS)

Resolve chargebacks online

No more faxing or mailing

Process and manage chargebacks and retrieval requests

in an automated online environment, eliminating the

delays and costs associated with faxed and mailed paper

transactions.

Logon or enroll: www.myclientline.net

Enrolling is easy—Get step by step instructions

To learn more, call us at 1-800-451-5817, 24/7 or contact

your Wells Fargo Relationship Manager directly.

Online “Resolve chargeback tool”

www.wellsfargo.com/biz/chargeback

Tips to prevent e-commerce card disputes

www.wellsfargo.com/biz/merchantconnect3 (page 10)

More chargeback prevention resources

www.wellsfargo.com/biz/merchant/service/manage/

prevent

4

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�PCI compliance and data security

updates

Is your third-party service provider putting

you at risk of a data compromise?

It is unsettling to learn that in 81% of data security breaches

that were investigated by Trustwave, a global provider of data

security and payment card industry compliance management

solutions, a third party provider was responsible for the

compromised system’s administration.1

Since many businesses today outsource at least part of their data

transmission or security processes, such as Internet connectivity,

firewall management, and systems support, the concern continues

to mount. In fact, many point of sale (POS) system developers,

integrators and IT firms are not following the Payment Card

Industry Data Security Standard (PCI DSS). Bottom line: a

surprising number of merchants are unknowingly at risk.

The big 8: know these important questions to ask

your third-party providers

It’s critical to understand that, if your system experiences a

security breach, you hold responsibility—not your vendor, even

if they failed to comply with the PCI DSS. So, in your own

interest, it is not only a best practice but a necessity to properly

oversee and manage their services.

Here’s a guide to help you ask your vendors the right questions

to successfully protect your business:

If your system experiences a

security breach, you hold

responsibility—not your vendor,

even if they failed to comply with

the Payment Card Industry Data

Security Standard.

Question #1: Are my POS application and version validated with

the Payment Application Data Security Standard (PA-DSS)?

A good foundation question, but the answer does not

necessarily guarantee compliance.

Do not assume that your payment application or version are

PCI compliant. Investigate and do your research.

As of July 1, 2010, complying with the PA-DSS is no longer just

good business, it’s a requirement. Merchants who fail to use a

PA-DSS validated application will no longer be able to process

card payments with any merchant processor.

For more information on the PA-DSS or to view an updated list

of validated applications and versions, please visit the PCI

Security Standards Council’s website at:

www.pcisecuritystandards.org/security_standards/pa_dss.shtml *

Question #2: Is my POS system protected by a hardwarebased firewall?

The majority of breaches, especially those involving smaller

merchants’ systems, are caused by a reliance on routers or cable

modems for firewall protection. Neither of these blocks traffic

into your processing system nor allows only necessary

outbound traffic. Be aware: hardware-based firewall protection

is rarely supplied by POS integrators.

Your business may be at risk of a data

compromise.

Assess your data security risk today and ensure your

system and the cardholder data you handle are protected.

Use Trustwave’s Risk Profiler Tool:

www.wellsfargo.riskprofiler.net *

Available at no additional cost.

* By clicking this link, you will enter a site which is developed and managed by a

third party. Wells Fargo does not provide the products and services on the site nor

is responsible for its content and accuracy. Please review the applicable privacy

and security policies and terms and conditions for the site you are visiting.

(1) Trustwave, Global Security Report 2010

5

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�PCI compliance and data security

updates

Question #3: How is remote access granted to my system?

Remote access allows your third-party vendors to tap into your

processing environment for systems support. It’s important to

ensure that the credentials (user name/password) of each

person remotely accessing your system are unique.

Question #4: Is anti-virus software installed on my POS system?

Your last line of defense, anti-virus software must be installed

on all POS systems, including registers. Be sure to ask the

question early on: you may need to purchase the software.

Question #5: Who is responsible for updating my POS system?

Although POS integrators may update your POS application,

they may not update your operating system, remote access

applications or anti-virus programs. All of these must be

consistently updated to remain secure.

Not all versions of payment

applications are PA-DSS validated.

Make sure to check that not only is

your payment application PA-DSS

validated but also the version you

are using.

Question #6: Are operating system account user names and

passwords unique to my location and rotated accordingly?

POS systems are often configured by integrators from backups

or clones, so user names and passwords are identical. Make sure

your system is configured to force password rotation.

Question #7: Are my audit logs reviewed on a consistent basis

for malicious activity?

PA-DSS validated systems must generate detailed audit logs,

which must be routinely reviewed and maintained for one year.

Question #8: Now that I’ve updated to a PA-DSS compliant

system, how can I ensure that restricted credit card data has

been removed?

Non-compliant POS systems often store restricted credit card

data that simply updating your system does not always purge.

Make sure that your vendor has a process in place to locate and

purge old data. Physically destroying your system’s hard drive is

the most secure way to ensure restricted data has been removed.

The PCI Security Standards Council recommends deleting files

by using a military wipe program or via degaussing or

otherwise physically destroying the media.

6

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

More PCI compliance resources

PCI Quick Reference Guide

www.pcisecuritystandards.org/pdfs/pci_ssc_quick_guide.

pdf *

Get a list of PA-DSS validated applications

www.pcisecuritystandards.org/security_standards/vpa/

vpa_approval_list.html *

Questions?

We’re here to help. Just email Wells Fargo Merchant

Services at WFMSPCICompliance@wellsfargo.com

Countdown to PA-DSS validation by

July 1, 2010

On the merchant “clock,” time is ticking away quickly to

July 1, 2010. This is the date set by the Payment Card

Industry Security Standards Council (PCI SSC), on which

all businesses using a payment application to process,

store or transmit card data will need to ensure that their

application is validated to comply with the Payment

Application Data Security Standard (PA-DSS).

Merchants who fail to use a PA-DSS

validated application by July 1, 2010

will no longer be able to process card

payments with any merchant processor.

For more information on the PA-DSS or to view an

updated list of validated applications, please visit the PCI

Security Standards Council’s website at:

www.pcisecuritystandards.org/security_standards/pa_dss

.shtml *

* By clicking this link, you will enter a site which is developed and managed by a

third party. Wells Fargo does not provide the products and services on the site nor

is responsible for its content and accuracy. Please review the applicable privacy

and security policies and terms and conditions for the site you are visiting.

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Card networks news

Let’s take an example: A customer makes a $100 purchase.

They can use a $75 prepaid debit card (such as a prepaid

MasterCard debit card they received as a gift during the

holidays) and pay the rest with their regular credit card.

• Balance response: Providing cardholders with the account

balance will alert them to their open-to-buy balance at the time

of purchase. According to MasterCard research, lack of

awareness of available balances in debit and prepaid accounts

is the chief cause of declined transactions at POS.

• Authorization reversal: When the sale is not completed,

merchants can reverse the authorization and free up the opento-buy amount that otherwise would be blocked from

authorization approval.

Changes will impact a large number of merchants

New MasterCard POS requirements

improve prepaid card experience

Driven by consumers’ concern over accumulating debt and better

managing their budget in recessionary times, there has been a

rapid rise in the volume of debit and prepaid card transactions

over the past several years. Prepaid cards allow consumers to

control their expenses by only spending up to the amount

deposited on their account. With increased usage, the payment

card industry has also seen a spike in decline rates at the point

of sale (POS) and a subsequent influx of cardholder complaints.

To address these issues and help improve the “prepaid card

experience” for both merchants and consumers, MasterCard is

rolling out new compliance requirements, known as “partial

authorization” requirements. These mandates will allow new

processing features designed to increase the number of successful

transactions and reverse problems faster at the point of sale.

All e-commerce and integrated POS merchants must be able

to support the new MasterCard requirements to remain in

compliance by the three phased dates per impacted MCC:

• Phase I: May 1, 2010

• Phase II: November 1, 2010

• Phase III: May 1, 2011

Exception for select merchants

Merchants who batch-authorize the following transaction types:

– E-commerce

– Mail and phone order

– Recurring payments

These merchants will be exempt from complying with

MasterCard’s requirement to support Partial Approval and

Balance Response. However, they will need to support

Authorization Reversals.

Terminal-based merchants do not need to upgrade their

existing terminals as of these dates.

Merchants in MCC 5542 (Fuel Dispenser, Automated) will be

exempt from the Balance Response requirement.

The roll-out is structured by Merchant Category Code (MCC)

in three phases, beginning May 2010 and in full effect by May

2011. Support will be required for all Debit MasterCard and

Maestro card programs and will affect merchants in 47 MCCs.

See full list of MCCs below, sorted by the date the requirements

go into effect.

Look to future issues of the Wells Fargo Merchant Connect

information bulletin for further updates, as additional

information, such as non-compliance penalties, becomes

available from MasterCard.

Solutions to high decline rates at the point of sale

For any questions on the new requirements or to upgrade your

terminal functionality, please contact us at 1-800-451-5817, 24/7

or contact your Wells Fargo Relationship Manager directly.

Here’s a closer look at how the new processing features and

requirements will help improve the prepaid experience:

• Partial approvals: Merchants can allow debit and prepaid

cardholders to get partial approvals when their account open-tobuy amount is not sufficient to complete the transaction. This

will allow customers to use multiple cards to make a purchase.

7

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

If you are using an integrated POS software application such as

Aloha, Counterpoint, or Squirrel or an E-payment/Gateway

application such as Authorize.Net, Cybersource, and First Data

Global Gateway, please contact your application software

vendor directly to find out what updates are available. Your

vendor is responsible for updating your application software.

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Card networks news

Impacted merchants and effective

implementation dates

Effective date: May 1, 2010

MCC Merchant category name

MCC Merchant category name

5999

Miscellaneous and Specialty Retail Stores

7829

Motion Picture-Video Tape ProductionDistribution

Stationery, Office Supplies

7832

Motion Picture Theaters

5200

Home Supply Warehouse Stores

7841

Video Entertainment Rental Stores

5300

Wholesale Clubs

8011

Doctors—not elsewhere classified

5310

Discount Stores

8021

Dentists, Orthodontists

5311

Department Stores

8041

Chiropractors

5331

Variety Stores

8042

Optometrists, Ophthalmologists

5399

Miscellaneous General Merchandise Stores

8043

Opticians, Optical Goods, and Eyeglasses

5411

Grocery Stores, Supermarkets

8062

Hospitals

5499

Miscellaneous Food Stores—Convenience Stores,

Markets, Specialty Stores and Vending Machines

8099

Health Practitioners, Medical Services—not

elsewhere classified

5541

Service Stations (with or without Ancillary Services)

5542

Fuel Dispenser, Automated

5732

Electronic Sales

5734

Computer Software Stores

5735

Record Shops

5812

Eating Places, Restaurants

5814

Fast Food Restaurants

5912

4812

Telecommunication Equipment including

Telephone Sales

4814

Telecommunication Services

5111

Effective date: November 1, 2010

MCC Merchant category name

4111

Transportation—Suburban and Local Commuter

Passenger, including Ferries

Drug Stores, Pharmacies

4816

Computer Network/Information Services

5921

Package Stores, Beer, Wine, and Liquor

4899

5941

Sporting Goods Stores

Cable, Satellite, and Other Pay Television and

Radio Services

5942

Book Stores

7996

Amusement Parks, Carnivals, Circuses, Fortune

Tellers

5943

Office, School Supply and Stationery Stores

7997

Clubs—Country Membership

5964

Direct Marketing—Catalog Merchants

7999

Recreation services—not elsewhere classified

5965

Direct Marketing—Combination Catalog—Retail

Merchants

5966

Direct Marketing—Outbound Telemarketing

Merchants

5967

Direct Marketing—Inbound Telemarketing

Merchants

5969

Direct Marketing—Other Direct Marketers—not

elsewhere classified

8

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

Effective date: May 1, 2011

MCC Merchant category name

8999

Professional Services—not elsewhere classified

9399

Government Services—not elsewhere classified

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Payment solutions

Managing your merchant processing

account has never been easier

Bangkok to Boston, desk to deck chair, get the information you

need—whenever you need it—by getting set up on ClientLine®.

Our Internet-based reporting tool is easy to use, fast, and

available to our Merchant Services customers at no extra cost.

Yes, no monthly fee, no set up fee!

ClientLine can help you manage

your merchant processing account

around the clock, around the world.

Save time

• Monitor account activity 24/7.

• Easily review and retrieve transactions and data.

Track cash flow

• Review and reconcile recently processed transactions, bank

deposits, settlements and disputes.

Reduce costs

• No set-up fee, no monthly fee.

• View, print and download your statements at no extra cost,

before paper statements are mailed.

• Use reports to clearly understand processing expenses

and identify opportunities at the point of sale to potentially

reduce them.

Manage fraud & card disputes

• Investigate, track and even resolve card disputes online.

• Identify both internal and external fraud.

Gain greater insight into your merchant processing account

& business

• Schedule delivery of reports directly to your email or fax, per the

schedule and format (Excel, PDF, Word and CSV) you prefer.

• Understand how your business is performing overall by

identifying sales trends over time.

Access data through a secure Internet connection

• Access detailed history for up to 6 months and summary

information for up to 13 months.

Not yet enrolled in ClientLine?

Getting started is easy

No set up fee—no monthly fee

1. Logon to www.myclientline.net

2. Click Enroll

3. Click Begin Enrollment

4. Completely fill out the form, including:

a. Your Merchant ID (for which you are requesting

online reporting access)

b. Business Checking Account (checking account in

which we deposit your payment transactions’ funds)*

c. Tax ID (as recorded with Wells Fargo Merchant

Services)*

5. Click Next

6. Select the applications for which you’d like to enroll.

Choose:

a. ClientLine. No set-up fee, no monthly fee

b. eIDS (electronic Integrated Dispute System). Gives

you the ability to manage card disputes quickly and

efficiently online.

7. Click Next

What happens after I sign up?

Congratulations! You are only a few clicks away from

enjoying the ease, convenience and benefits of

ClientLine.

Within 1-5 business days and once your information has

been validated, you will receive an email confirming next

steps to complete your enrollment. Simply follow the

instructions provided.

* The business checking account and tax ID numbers used to enroll for ClientLine

must match the numbers on record with Wells Fargo Merchant Services. If they

have changed, please contact us at 1-800-451-5817, 24/7, to update your

information before you enroll.

9

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Payment solutions

Look at some of the great things you

can do on ClientLine!

Just logon to www.myclientline.net for all

functions—and off you go!

View a snapshot of your account activity, such as sales

transactions, refunds, bank deposits and card disputes.

• Click Dashboard and select Reporting

View your monthly statement

• Click Funding and select Monthly Statement

• Enter your Merchant ID

• To review a recap of your statement for multiple merchant

locations, select Recap. Otherwise, select Location.

Then click Submit

• Select the month you want to view and click Get Statement

ClientLine® online reporting

Review the funding of transactions

• Click Funding and select Bank Deposits

Learn more

www.wellsfargo.com/biz/clientline

Analyze your payment processing rates

• Click Rate Analysis

• Select Qualification Analysis to view transactions’ information

for each main interchange category

• Select Billbacks to view information on transactions that failed

to qualify for the best possible interchange rates

Access the online demo

www.myclientline.net

Research card information

• Click Research and select Card Search

For technical assistance during enrollment in

ClientLine, please call 1-800-285-3978, option 2,

Monday through Friday, 8am to 10pm Eastern Time.

Enroll or logon today

www.myclientline.net

How can we help?

For general questions regarding ClientLine online

reporting, please call us at 1-800-451-5817, 24/7.

View card disputes

• Click Disputes and select Chargebacks

Schedule reports

• Click Reports and select Scheduled Report

• Select the report category you want and click Submit

• Then select the specific report you want and click Submit

• The report schedule will appear. Simply fill it in based on your

preferences and click Submit

• A report confirmation will then appear

View reports

• Click Reports and select View Reports

• Select the report you want to view and click Open. Or click Save

to save the report to your desktop or file

10

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Resources for your business

Start navigating through every business

stage today!

Each stage of life ushers in new

opportunities and challenges. The

same can be said for the lifecycle of

your business, as it evolves from an

idea into a mature company.

In the seed stage, your greatest challenge is turning your idea

into a product or service. In the startup phase, you’ll face

challenges you never anticipated, along with rewarding

moments you’ve only dreamed of. Then, just when it seems you

have it all worked out, the growth stage brings in a whole new

set of cash flow and marketing challenges. Finally, as your

business enters maturity, your questions turn from “How do I

grow my business?” to “How do I protect it?” and “How do I

plan for a secure retirement and change of ownership?”

Wells Fargo has helped millions of business owners flourish in

every stage of their growth, through good times and bad. To

help you achieve your own vision and identify the opportunities

and challenges to successfully navigate through the business

lifecycle, we’ve produced the Special Edition of the Strategies &

Solutions For Your Business® Guide.

Smart tax planning for your business

Watch Wells Fargo’s latest free webcast and learn how

proactive tax planning can help improve cash flow and

provide a solid financial foundation for your business.

https://wellsfargobusinesssolutions.com/mediaplayer/?

episode=E08

To view other webcasts, please visit:

www.wellsfargo.com/biz/webcast

Topics include:

• Cost-saving real estate strategies for your business

• Retirement and transition strategies for your business

• Health care options for your business

Ask your Wells Fargo

banker for your

complimentary Special

Edition of the Wells Fargo

Strategies & Solutions

For Your Business Guide

today to help you start

managing through the

business lifecycle.

• And more.

And be sure to visit:

www.wellsfargo.com/biz/education to explore

our rich library of tools and resources.

11

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�Don’t forget these important dates

Effective date

What’s happening?

Notes and resources

Merchants in select Merchant Category Codes must comply with

MasterCard’s Partial Authorization Mandate (Phase I)

May 1, 2010

Impacted merchants include restaurants, grocery stores and

supermarkets, specialty retailers, health care providers, automated fuel

dispensers, book stores and many more.

• Learn more

Your payment application must be PA-DSS validated

July 1, 2010

The Payment Card Industry Security Standards Council (PCI SSC)

mandates that all businesses who use a payment application to

process card payments ensure that it has been validated to comply

with the Payment Application Data Security Standard (PA-DSS).

Merchants who are not compliant will no longer be able to process

card payments.

Your PIN Entry Devices must use Triple Data Encryption standard

July 1, 2010

The PCI SSC mandates that all transactions originating at point of

sale PIN Entry Devices (POS PEDs) encrypt PINs using the Triple

Data Encryption Standard (TDES) from the point of transactions.

Order your gift cards in time for the holiday season

Mid-September

2010

Call 1-800-430-3292, Monday – Friday, 9am – 6pm Eastern Time or

contact your Wells Fargo Relationship Manager directly.

• Learn more about this mandate.

• To view the list of PA-DSS validated

applications, please visit:

www.pcisecuritystandards.org/security_

standards/vpa/vpa_approval_list.html *

• To verify if your equipment is compliant,

call us at 1-800-622-0842, 24/7 or contact

your Wells Fargo Merchant Services

Relationship Manager directly.

• Learn more:

www.wellsfargo.com/biz/merchantconnect4

(page 6)

• Learn more on how gift cards can help you

grow your revenues:

www.wellsfargo.com/biz/merchantconnect4

(page 4)

Merchants in select Merchant Category Codes must comply with

MasterCard’s Partial Authorization Mandate (Phase II)

November 1, 2010

• Learn more

Impacted merchants include transportation businesses, computer

network/information services merchants, amusement parks, and more.

You must truncate the merchant copy of card receipts

December 31,

2010

• This requirement is already in effect for

merchants located in AK, CA, CO, NV, TN

and WA.

• Also note that all merchants are already

required to truncate the receipts that they

provide to their customers today.

All merchants must truncate the card receipts that they keep for

their records.

Receipts can only show the following:

Number: ************1234 Expiration date: **/**

Merchants in select Merchant Category Codes must comply with

MasterCard’s Partial Authorization Mandate (Phase III)

May 1, 2011

• Learn more

Impacted merchants include professional services and government

services merchants.

* By clicking this link, you will enter a site which is developed and managed by a third party. Wells Fargo does not provide the products and services on the site nor is responsible

for its content and accuracy. Please review the applicable privacy and security policies and terms and conditions for the site you are visiting.

12

Issue 6 | 1st Quarter 2010 | Wells Fargo Merchant Connect

© 2010 Wells Fargo Bank, N.A. All rights reserved. (1-10 126746)

�