APPROVAL OF AUTHORIZATION OF PREFERRED STOCK

The Board of Directors has recommended that the Articles of Incorporation of the Company

be further amended to authorize the Company's issuance of up to 1,000,000 shares of preferred stock, par

value $1.00 per share (the "Preferred Stock"). To accomplish this, the Board of Directors has recommended

that ARTICLE VI of the Company's Articles of incorporation be further amended through the addition and

inclusion of the following provision, which describes and defines the terms and conditions of the Preferred

Stock. The authorized shares of preferred stock of this Corporation shall consist of 1,000,000 shares of

preferred stock, par value $1.00 per share. Ownership of the preferred stock shall entitle the holders thereof

to the following rights:

SECTION 1. Dividend Preference. The holders of the preferred stock shall be entitled to

receive a cumulative dividend equal to eight percent (8%) per annum of the per share par value of the

preferred stock. Such dividends shall be payable to the extent that the Corporation has sufficient

profits and earnings to make the dividend payments. In the event that dividends are not paid on the

preferred stock, then the dividends shall accumulate, and such accumulated dividends must all be paid

prior to the payment of any dividend declared by the Corporation on any shares of its common stock

or preferred stock authorized and issued by the Corporation.

SECTION 2. Liquidation Preference. If any voluntary or involuntary sale of all or

substantial]), all of the Corporation's capital stock or all or substantially all of the Corporation's

assets, or any merger or consolidation of the Corporation with another entity, or any liquidation or

dissolution of the Corporation, shall be effected (such events to be hereinafter collectively referred to

as the "Corporate Events"), then the holders of the preferred stock shall be entitled to receive, prior to

the receipt of any assets by holders of all other equity securities of the Corporation, a cash amount

equal to an initial value of $1.00 for each share of preferred stock held, plus any and all accumulated

dividends thereon together with any dividends payable in the then current year calculated on a pro

rata basis from the beginning of such year to the effective date of the relevant Corporate Event. Such

payment with respect to the preferred stock shall constitute the extent of the participation of the

preferred stockholders in any and all present or future corporate distributions, or the stock, securities,

or assets to be received by holders of equity securities of the Corporation, and the shares of the

preferred stock shall thereafter be redeemed and canceled and shall be so reflected on the books of the

Corporation.

SECTION 3. Voting Rights . Except as provided herein, the holders of the preferred stock shall

not be entitled to any voting rights as stockholders of the Corporation prior to conversion pursuant to

Section 4 hereof. Notwithstanding the foregoing, the following actions by the Corporation will

require prior approval by the holders of a majority of the issued and outstanding shares of preferred

stock: (a) a material change in the business of the Corporation; (b) the sale of all or substantially all of

the assets of the Corporation; (c) a change in the rights, preferences, privileges or restrictions related

to the preferred stock; (d) the authorization or issuance of any shares of an), class of stock of the

Corporation not currently authorized, (e) the retirement of any class of outstanding securities of the

Corporation; (f) the reclassification of any class or series of securities of the Corporation; and (g) the

issuance of additional shares, or an increase in the number of authorized shares, of the preferred stock.

SECTION 4. Conversion of Preferred Stock to Common Stock. The shares of preferred stock

shall be convertible at the holder's option into common stock, at any time after issuance of the shares

of preferred stock, at the initial rate of ten (10) shares of common stock for each share of preferred

stock. Except upon the occurrence of a Corporate Event, a preferred stockholder will be required to

provide the Corporation with not less than ninety (90) days' advance notice of its intent to convert all

or a portion of its shares of preferred stock to common stock. (The conversion price of the shares of

preferred stock into shares of common stock, which initially is $.10 per share, shall hereinafter be

referred to as the "Conversion Price.") Upon the occurrence of a Corporate Event, the preferred

stockholder shall give reasonable prior notice of such conversion to the Corporation taking into

consideration when the preferred stockholder is advised of the pendency of a Corporate Event. After

notice of conversion from the preferred stockholder to the Corporation, and prior to the expiration of

the ninety (90) day notice period, the preferred stockholder will surrender all shares of the preferred

stock to the Corporation, and the Corporation will simultaneously issue the appropriate number of

shares of common stock to the preferred stockholder.

SECTION 5. Anti-Dilution Provisions .

(a) If the Corporation shall at any time after the issuance of the shares of preferred stock

subdivide or combine the outstanding shares of common stock or declare a dividend payable in

common stock, the Conversion Price in effect immediately prior to the subdivision, combination or

record date for such dividend payable in common stock shall forthwith be proportionately increased,

in the case of combination, or proportionately decreased, in the case of a subdivision or dividend

payable in common stock, by multiplying the Conversion Price in effect immediately prior to the

combination, subdivision, or dividend payable in common stock, by a fraction the numerator of which

is the number of shares of common stock outstanding immediately prior to such combination,

subdivision or record date for the dividend payable in common stock and the denominator of which is

the number of shares of common stock outstanding immediately after such combination, subdivision

or record date for the dividend payable in common stock. Correspondingly, in the event of any such

combination, subdivision or dividend payable in common stock, each share of common stock into

which the preferred stock is convertible shall be changed to the number determined by dividing the

Conversion Price in effect immediately prior to the subdivision, combination, or dividend payable in

common stock by the Conversion price as adjusted immediately after the subdivision, combination, or

dividend payable in common stock.

(b) No fractional shares of common stock are to be issued upon a conversion of preferred

stock into shares of common stock, but the Corporation shall pay a cash adjustment in respect of any

fraction of a share which would otherwise be issuable in an amount equal to the same fraction of the

per share market price of the common stock on the date of exercise as determined in good faith by the

corporation.

(c) The Conversion Price of the shares of preferred stock into shares of the common stock

shall additionally be subject to adjustment as follows:

(i) If the Company shall issue shares of common stock other than "Excluded Stock" (as

the term "Excluded Stock" is hereinafter defined) without consideration or for a consideration

per share less than the Conversion Price in effect immediately prior to the issuance of such

common stock, the Conversion Price in effect immediately prior to such issuance shall

forthwith be adjusted to a price equal to the lesser of $.10 per share or the quotient obtained by

dividing the total aggregate consideration paid for all common stock issued subsequent to June

15, 1988, by the total number of shares of common stock issued subsequent to June 15, 1988

(including, without limitation, any shares of common stock deemed to have been issued

pursuant to Section 5 (c) 00 hereof);(ii) For the purpose of any adjustment of the Conversion Price pursuant to Section 5

(c), the following provisions shall be applicable: (i) in the case of the issuance of common

stock for cash, the consideration shall be deemed to be the amount of cash paid therefor; (ii) in

the case of the issuance of common stock for a consideration in whole or in part other than

cash, the consideration other than cash shall be deemed to be the fair market value thereof as

determined by the Corporation's Board of Directors in its sole discretion, irrespective of any

accounting treatment; and (iii) in the case of the issuance of options or warrants to purchase or

rights to subscribe for common stock. or securities or debt which by their terms are

convertible into or exchangeable for common stock:

1. the aggregate maximum number of shares of common stock deliverable

upon exercise of such options or warrants to purchase or rights to subscribe for

common stock shall be deemed to have been issued at the time such options or rights

were issued and for a consideration equal to the consideration (determined in the

manner provided in Sections 5(c) (ii) (1) and 5 (c) (ii) (11) above), if any, received by

the Corporation upon the issuance of such options, warrants, or rights, plus the

purchase price provided in such options, warrants, or rights for the common stock

covered thereby;

2. the aggregate maximum number of shares of common stock deliverable

upon conversion of or in exchange for any such convertible or exchangeable securities

or debt shall be deemed to have been issued at the time such securities were issued and

for a consideration equal to the consideration received by the Corporation for any such

securities (excluding any cash received on account of accrued interest or accrued

dividends), plus the additional consideration, if any, to be received by the Corporation

upon the conversion or exchange of such securities or the exercise of any related

options, warrants or rights;

3. on the expiration of any such options, warrants, rights or debt, the

termination of any such rights to convert or exchange or the expiration of any options,

warrants, or rights related to such convertible or exchangeable securities or debt, the

Conversion Price shall forthwith be readjusted to such conversion price as would have

obtained had the adjustment made upon the issuance of such options, warrants, rights

or securities (or options, warrants, or rights related to such securities) been made upon

the basis of the issuance of only the number of shares of common stock, if any,

actually issued upon the conversion or exchange of such securities or upon the exercise

of the options or rights related to such securities; and (iii) the term "Excluded Stock"

shall mean shares of common stock issued (a) as a stock dividend payable in shares of

common stock or upon any subdivision or split-up of the outstanding shares of

common stock or otherwise as described in Section 5(a) or 5(b) hereof, and (b) upon

the exercise of any options, warrants, or convertible debt outstanding as of June 15, 1988.

SECTION 6. Corporation's Call Option . At any time after issuance of shares of preferred

stock, and upon ninety (90) days' prior notice to the holder hereof, the Corporation shall have the

option to call the shares of preferred stock, and the holders thereof shall be obligated to sell the shares

of the preferred stock to the Corporation upon the exercise of such call option, at the greater of the

following prices: (a) One and 00/ 100 Dollars ($1.00) per share plus any unpaid dividends, including

any pro rata dividend due in the then current year calculated on a pro rata basis to the date the option

is exercised; or (b) at a price equal to the average of the closing bid prices of the common stock as

reported in the Minneapolis Tribune for the ten (10) successive business days immediately preceding

the Corporation's notice to the preferred stockholder of the Corporation's exercise of the call,

provided that any and all material information regarding the Corporation had been publicly disclosed

on a timely basis prior to the date of such notice.SECTION 7. Holder's Put Option . At any time after issuance of shares of preferred stock, and

upon ninety (90) days' prior notice to the Corporation, the holders thereof may sell to the Corporation,

and the Corporation shall be obligated to buy from the holders thereof upon exercise of such put

option, up to twenty percent (20%) per year of the shares of preferred stock originally issued to the

stockholder at the lesser of the following prices: (a) One and 00/100 Dollars ($1.00) per share plus

any unpaid dividends, including any pro rata dividends due in the then current year calculated on a

pro rata basis to the date the option is exercised; or (b) at a price equal to the average of the closing

bid prices of the common stock as reported in the Minneapolis Tribune for the ten (10) successive

business days immediately preceding the holder's notice to the Corporation of the holder's exercise of

the put, provided that any and all material information regarding the Corporation has been publicly

disclosed on a timely basis prior to the date of such notice.

The Company has entered into the Investment Agreement with CDC pursuant to which CDC has

agreed to convert up to $750,000 of debt owed by the Company to CDC into shares of Preferred Stock. See

"Election of Directors-Certain Transactions." Under the terms and subject to the conditions of the Investment

Agreement, one share of the par value $1.00 per share Preferred Stock will be issued for each dollar of debt

converted. The CDC debt consists of trade accounts payable, real estate taxes payable, lease payments due

and other outstanding obligations of the Company to CDC, totalling $1,296,811 plus interest, which were

consolidated pursuant to the terms of the Restructuring Agreement. See "Election of Directors- Certain

Transactions" for more information regarding the terms of the CDC debt and the Restructuring Agreement.

Shareholder approval of the amendment described above is necessary to enable the Company to obtain the

benefits and advantages available to it under the Investment Agreement. The CDC debt converted to

Preferred Stock under the Investment Agreement presently accrues interest at 3% in excess of the prime rate

of interest quoted by the Chase Manhattan Bank, New York, New York. As of June 15, 1988, this would

yield an annual rate of 12%. In contrast, the Preferred Stock provides a dividend rate of 8% per annum.

Further, although dividends accumulate if not paid, they must be paid only to the extent that the Company

has sufficient profits and earnings to make the payments, thus reducing the Company's financial burden in

the event of a cash flow deficiency. However, this assumes that the Preferred Stock holders do not exercise

those put option rights described in Section 7 of the proposed amendment pursuant to which they may

obligate the Company to purchase up to 20% per year of their Preferred Stock at a specified price regardless

of the Company's cash flow position. Finally, the amount of CDC debt so converted pursuant to the

Investment Agreement will not be included as a liability on the Company's financial statements, thus

improving the financial statements of the Company and perhaps increasing its ability to raise additional funds

at a lower cost as needed. Consequently, the Board of Directors and management for the Company believe

that it is essential for the shareholders to approve this amendment authorizing the Preferred Stock and that the

failure to do so would substantially hinder the Company's future growth and financial improvement.

The following pro forma consolidated financial statements reflect, for accounting purposes, the effect

which operation of the Investment Agreement would have upon the Company's financial statements. Each of

the pro forma financial statements has been prepared on the basis of various assumptions, including that the

maximum conversion of debt into Preferred Stock allowed for under the Investment Agreement will occur,

which is dependent upon the success of the Regulation A Offering and of which there can be no assurance,

and includes certain pro forma adjustments described in the footnotes thereto.

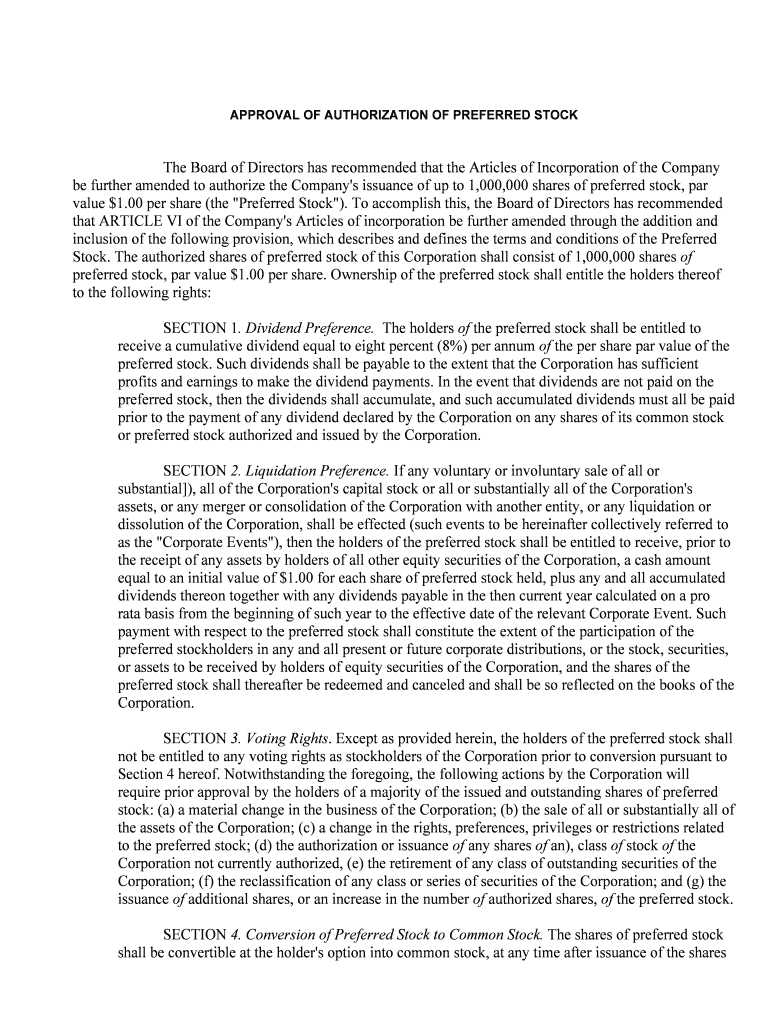

UNAUDITED PRO FORMA CONSOLIDATED CONDENSED INCOME (LOSS) STATEMENTSFor the Year Ended 12/31/87 For the Three Months Ended 3/31/98

CONSOLIDATED STATEMENTS of

INCOME (LOSS) Pro

FormaForma

Income Income Income Income

(Loss) Pro Forma(Loss) (Loss) Pro Forma(LAM)

Statement Adjustment Statement Statement Adjustment Statement

Sales $ 4,803,003 $ 4,803,003 $1,581,617 $1,581,617Cost and expenses:

Cost of sales $4,713,522 $4,713,522 $1,433,824 $1,433,824

Selling, general and

admin $ 816,241 $ 816,241 $ 149,605 $ 149,605

Interest expense, net $ 379,940 $ (79,000) (A) $ 300,940 $ 81,716 $ (22,000) (A) $ 59,716

Total $5,909,703 $ (79,000) $5,830,703 $1,665,145 $(22,000) $1,643,145

Loss before

extraordinary gain ($1,106,700) $79,000 ($1,027,700) ($83,528) $22,000 ($61,528)

Extraordinary gain $337,147 ________ $ 337,147 _________ _________ _________

Net income (loss) $ (769,553) $ 79,000 $ (690,533) $ (83,528) $ 22,000 $ (61,528)

Income (loss) per share

of common stock: *

Before extraordinary

gain $ (.18) $ .01 (B) $ (.17) $ (.01) $ - (B) $ (.01)

Extraordinary gain _.05__ _______ __.05__ _______ _________ __________

Net income (loss) $ (.13) $ .01 $ (.12 ) $ (.01) $ $ (.01)

For purposes of the pro forma consolidated condensed income (loss) statement for the year ended 12/31/87,

and for the three months ended 3/31/88, it is assumed that the maximum conversion of debt to preferred stock

occurred at the beginning of the year ended 12/31/87 and three months ended 3/31/88, respectively.__________

(A) Adjustment is for a reduction in interest expense due to the conversion of $750,000 of outstanding

debt to the 8% cumulative redeemable Preferred Stock.

(B) Consolidated net income (loss) per share is based on the weighted average number of shares of Common Stock outstanding during each period and has been adjusted for the 8% cumulative

redeemable Preferred Stock dividend requirement. The dividend payable for the period ended

December 31, 1987 and March 31, 1988 would be $60,000 and $15,000, respectively.

UNAUDITED PRO FORMA CONSOLIDATED CONDENSED BALANCE SHEETDecember 31, 1987 and March 31, 1988

ASSETS Pro Forma Pro Forma

Balance Balance Balance Balance

Sheet Pro Forma Sheet Sheet Pro Forma Sheet

12/31/87 Adjustment 12/31/87 05/31/88 Adjustment 05/31/88

Current assets:

Cash and cash equivalents $ 6,531 $ 6,531 $ 9,488 $ 9,488

Accounts receivable, net $267,053 $267,053 $ 457,285 $457,285

Inventories $480,619 $480,619 $ 696,051 $686,051

Prepaid expenses and other $10,640. $10,640 $ 31,582 $31,582

Total current assets .. $764,843 $ 764,843 $1,184.406 $1,184,406

Property, equipment and leasehold

improvements, at cost $1,331,135 $1,331,135 $1,330,128 $1,330,128

Less accumulated depreciation

and amortization (947,508) (947,508) (992,970) (992,970) $383,627 $383,627 $337,158 $337,158

Other assets $39,821 $39,821 $ 9.484 $9,484

Total Assets $1,188,291 $ 1,188,291 $ 1,531,048 $ 1,531,048

LIABILITIES AND SHAREHOLDERS' DEFICIENCY

Current liabilities:

Notes payable $ 489,038 $ 489,038 $ 439,914 $ 439,914

Current maturities of long-term

debt * * * * * * $13,894 $13,894 $ 33,581 $33,581

Current maturities of note

payable, shareholder $231,472 $ (231,472) $593,984 (A) $ (593,984)

Accounts payable $568,505 $568,505 $1,090,898 $1,090,898

Accrued expenses $377,213 $377,213 $334,692 $334,692

Total current liabilities $1,680,122 (231,472) $1,448,650 $2,493,069 (593,984) $1,899,085

Long-term debt, less current

maturities $275,361 $275,361 $251,211 $251,211

Notes payable and long-term debt,

shareholder 1,060,762 (A) (518,528) 542,234 698,250 (A) (156,016) $542,234

Total liabilities 3,016,245 (750,000) 2,266,245 3,442,530 (750,000) 2,692,530

Redeemable preferred stock (B) 750,000 750,000 (B) 750.000 750,000

Shareholders' deficiency:

Common stock $306,119 $306,119 $306,119 $306,119

Additional paid-in capital $10,851,948 $10,851,948 $10,851,948 $10,851,948

Accumulated deficit (12,986,021) (12,986,021) (13,069,549) (13,069,549)

Total shareholders' deficiency (1,827,954) (1,827,954) (1,911,482) (1,911,482)

Total liabilities and

shareholders'

deficiency $ 1.188,291 $_______ - $ 1,188,291 $ 1,531,048 $ ____________ $ 1,531,048

For purposes of the 12/31/87 and 3/31/88 pro forma consolidated condensed balance sheets, it is assumed

that the conversion of debt to preferred stock occurred on 12/31/87 and 3/31/88, respectively._______

(A) Adjustment for a reduction of long-term debt to shareholder by conversion into 8% cumulative

redeemable Preferred Stock.

( B) Adjustment for issuance of redeemable Preferred Stock on a dollar for dollar basis up to the

maximum agreed amount of $750,000 in debt.

The affirmative vote of a majority of the outstanding shares of the Common Stock of the Company

represented at the meeting at which a quorum is present in person or by proxy is required to approve the

proposed amendment to the Company's Articles of Incorporation. If approved, the shares of Preferred Stock

so authorized may be issued at the direction of the Board of Directors and upon the terms and conditions

upon which they in their sole discretion deem appropriate. Thereafter, other than receipt of approval for any

such issuance by the holders of a majority of the issued and outstanding shares of preferred stock as provided

for in Section 3(g) of ARTICLE VI as described above, or as otherwise required by law, no additional

approval of the shareholders of the Company will be required prior to issuance of the Preferred Stock.

Digigraphic Systems Corporation8/11/88