Fill and Sign the Authorization Letter to Conduct Ci Form

Useful tips for preparing your ‘Authorization Letter To Conduct Ci’ online

Are you fed up with the complications of managing paperwork? Search no further than airSlate SignNow, the top eSignature platform for individuals and small to medium-sized businesses. Bid farewell to the lengthy procedure of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign paperwork online. Utilize the powerful features embedded in this user-friendly and cost-effective platform to transform your document handling approach. Whether you need to authorize forms or collect electronic signatures, airSlate SignNow simplifies it all with just a few clicks.

Adhere to this detailed guide:

- Access your account or register for a complimentary trial with our service.

- Select +Create to upload a document from your device, cloud storage, or our template library.

- Edit your ‘Authorization Letter To Conduct Ci’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Insert and designate fillable fields for others (if necessary).

- Proceed with the Send Invite options to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

No need to worry if you need to collaborate with your team on your Authorization Letter To Conduct Ci or send it for notarization—our platform provides everything you need to achieve such objectives. Register for an account with airSlate SignNow today and take your document management to the next level!

FAQs

-

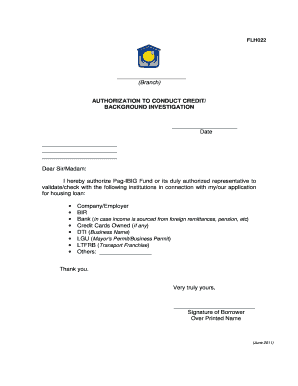

What is an Authorization Letter To Conduct Ci?

An Authorization Letter To Conduct Ci is a formal document that grants permission for a specific individual or organization to carry out certain actions, typically related to business transactions or legal processes. Using airSlate SignNow, you can easily create, send, and eSign your Authorization Letter To Conduct Ci, streamlining your document management.

-

How can I create an Authorization Letter To Conduct Ci using airSlate SignNow?

Creating an Authorization Letter To Conduct Ci with airSlate SignNow is straightforward. Simply choose a template or start from scratch, fill in the required details, and use our intuitive editor to customize your document before sending it for eSignature.

-

Is there a cost associated with using airSlate SignNow for an Authorization Letter To Conduct Ci?

Yes, airSlate SignNow offers several pricing plans to suit different business needs. Our plans provide various features, including unlimited document signing and templates, ensuring you can efficiently manage your Authorization Letter To Conduct Ci without breaking your budget.

-

What features does airSlate SignNow offer for managing Authorization Letters To Conduct Ci?

airSlate SignNow includes features like customizable templates, team collaboration tools, and real-time tracking for your Authorization Letter To Conduct Ci. These tools help ensure a smooth signing process and enhance productivity within your organization.

-

Can I integrate airSlate SignNow with other applications for my Authorization Letter To Conduct Ci?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more. This allows you to manage your Authorization Letter To Conduct Ci alongside other tools you already use, improving overall efficiency.

-

What are the benefits of using airSlate SignNow for Authorization Letters To Conduct Ci?

Using airSlate SignNow for your Authorization Letters To Conduct Ci provides numerous benefits, including faster turnaround times, enhanced security for sensitive documents, and a user-friendly interface. These advantages empower businesses to streamline their document workflows effectively.

-

Is it secure to send an Authorization Letter To Conduct Ci through airSlate SignNow?

Yes, sending an Authorization Letter To Conduct Ci through airSlate SignNow is secure. We utilize advanced encryption and security measures to protect your documents and personal information, ensuring that your sensitive data remains confidential.

Find out other authorization letter to conduct ci form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles