SURVEY

From Generation to Generation: Grandparents Imparting Lessons, Legacy, and Love

From Generation to Generation:

Grandparents Imparting Lessons,

Legacy, and Love

A MetLife Survey of African-American, Asian Indian,

and Chinese Grandparents

June 2010

Mature Market

I N S T I T U T E

�The MetLife Mature Market Institute®

Established in 1997, the Mature Market Institute (MMI) is MetLife’s research organization and

a recognized thought leader on the multi-dimensional and multi-generational issues of aging

and longevity. MMI’s groundbreaking research, gerontology expertise, national partnerships,

and educational materials work to expand the knowledge and choices for those in, approaching,

or caring for those in the mature market.

MMI supports MetLife’s long-standing commitment to identifying emerging issues and

innovative solutions for the challenges of life. MetLife, Inc. (NYSE: MET), through its

subsidiaries and affiliates, is a leading provider of insurance, employee benefits, and financial

services with operations throughout the United States and the Latin American, Europe and

Asia Pacific regions.

200 Park Avenue

40th Floor

New York, NY 10166

MatureMarketInstitute@MetLife.com

www.MatureMarketInstitute.com

Variable And Long-Term Care Products Are: • Not A Deposit Or Other Obligation

Of Bank • Not FDIC-Insured • Not Insured By Any Federal Government Agency

Only Variable Annuity Products: • Not Guaranteed By Any Bank Or Credit Union

• May Go Down In Value

Only Long-Term Care Products: • Not Issued, Guaranteed Or Underwritten

By Bank Or FDIC • Not A Condition To The Provision Or Term Of Any Banking Service Or Activity

• Policy Is An Obligation Of The Issuing Insurance Company

© 2013 MetLife

�Table of Contents

2

Overview

3

Key Findings

6

Major Findings

6

Financial Assistance Sometimes Involves Real Sacrifice

8

Building a Relationship — Money Isn’t Everything

10

Grandparents Agree About the Importance of Cultural and

Family Values

10

Smaller but Steady Financial Support Is Preferred, Perhaps in Response

to Their Concerns for Their Grandchildren

12

Grandma and Grandpa: Still a Great Source of Financial Wisdom

(and Very Often the Kids Actually Listen!)

15

Experience Allows Grandparents to Speak with Confidence About

Basic Financial Protection

16

Conclusion and Implications

18

Methodology

19

Demographics

�Overview

Whether they are called “Grandma” and “Granddad,” “Grandma” and “Dada,”

or “Pau Pau” and “Yeh Yeh,” grandparents embody a critical cultural and

financial link uniting their heritages, their familes, and the future. In From

Generation to Generation: Grandparents Imparting Lessons, Legacy, and Love, a

nationwide survey of African-American, Asian Indian, and Chinese grandparents,

the MetLife Mature Market Institute (MMI) uncovered both distinctive cultural

hallmarks as well as underlying universal values that grandparents share

with both their adult children as well as their grandchildren. They also share

generously of their time, caring, wisdom, and often their financial resources.

Generally, however, in comparison to cultural and family issues, they feel more

comfortable in an indirect role in advising their adult children and grandchildren

on financial matters.

2

Many of the results of this survey parallel findings from the 2009 MMI survey

Grandparents — Generous with Money, Not with Advice. Grandparents are

active and generous with both their grandchildren and their own adult children.

This survey also discovered that grandparents serve as a rich trove of resources

and guidance in reinforcing basic cultural, religious, and personal/family values

such as honesty, good behavior, and education, which are the foundation of

both personal development within their family, as well as within their broader

cultural community.

�Key Findings

Wide Agreement About Passing Down Important Values

Cultural

• There is consistency among the grandparents on what cultural values they

seek to pass down to their children and grandchildren. The most frequently

cited were heritage/ancestry (80%), cultural beliefs (79%), holiday traditions

(78%), and customs (77%).

Personal/Family

• Grandparents in all three groups identified similar personal and family values

that were highly important, with honesty (97%), education (96%), and good

behavior (96%) leading the way.

Popular Names for Grandparents

• “Grandma” (28%) and “Granddad” (17%) are the most popular names among

African-American grandparents, while “Grandma” (13%) and “Dada” (18%)

top the list for Asian Indian families, and “Pau Pau” (16%) and “Yeh Yeh”

(18%) for grandparents among Chinese households.

Time and Caregiving Define the Generations

• About one-third (32%) are providing direct caregiving for their grandchildren,

typically to one or two grandchildren. Primarily, care is given daily (54%) or

several times per week (30%).

• More than half (53%) spend 10 hours or more a week with their grandchildren,

with many (11%) who are living in the same household with grandchildren.

• The median number of hours spent with adult children each week is 10 hours

for all three groups.

3

> From Generation to Generation

�Overview

Financial Concerns for Grandchildren

Education Costs Are a Leading Concern

• Across all three groups, education costs (49%) and health costs (21%) are the

two main financial concerns for the future of their grandchildren.

Support Now Trumps Legacy Later

• Grandparents among the three groups studied exhibited a preference for

distributing smaller gifts throughout their lifetimes (46%) in comparison

to leaving a larger sum as a legacy at death (28%). However just over

one-quarter (26%) indicated that they were unsure about their choice in

this matter.

• Of those who responded, 62% prefer to provide smaller financial gifts as

needed compared to 38% who prefer to leave a larger sum as a legacy. This

is somewhat lower than the results from the 2009 poll of all grandparents

where 78% prefer to gift as needed and 22% would rather leave a lump sum.

Some Grandparents Push for Basic Economic Protection for Grandchildren

• Overall, more than a third (37%) have encouraged or spoken to their adult

children about how life insurance can protect the future of their grandchildren.

• Significantly more African-Americans have spoken about the benefits of life

insurance (69%). Fewer Chinese (18%) and Asian Indians (23%) have had

these conversations.

• Few Chinese and Asian Indians would consider buying life insurance for their

adult children to protect their grandchildren’s financial security (7%–8%).

Over a third (39%) of the African-Americans would consider it.

Providing Financial Assistance

“Cash Is King” As Financial Support and Gifts

• Just over a third (36%) have provided financial assistance to their grandchildren

in the past five years.

• There are cultural differences related to providing this financial support —

the majority (65%) of African-Americans have provided assistance, compared

to 12% of Chinese, and 31% of Asian Indians.

4

�• Of those who have provided assistance, almost half (49%) have given less

than $5,000.

• The primary form of assistance has been cash or in-kind gifts, results which are

similar to what was found in the 2009 survey.

Reasons for Assistance

• Education (36%) and general support (43%) are the main reasons for the

support from grandparents, which is similar to the 2009 survey. Other top

reasons include car purchase/lease (12%) and life event (10%).

Many Grandparents Sacrifice

• About three in 10 (29%) of those providing assistance have increased the

amount as a result of the current economic conditions, consistent with 2009

survey results (26%).

• A similar percentage (28%) report the assistance is having a negative impact

on their own finances.

• Twenty-seven percent report they used to provide support, but can’t anymore

due to tight finances.

Grandparents Promote Sound Basic Financial Advice for Both Adult Children

and Grandkids

• About one-third are providing financial advice to their grandchildren, very

similar to the 2009 survey where 32% were providing advice.

• Seventy percent of African-American grandparents are offering advice or

guidance to their grandchildren, compared to 25% of Asian Indians, and very

few Chinese grandparents (7%).

• Slightly more of the grandparents surveyed are providing financial advice to

their adult children (45%). African-Americans (72%), especially, are more

likely to give advice to their children, compared to Chinese (28%) and Asian

Indians (34%).

• Saving for the future is a key message to grandchildren: the main reasons for

the advice that grandparents are giving to their grandchildren across all three

groups is to make sure they save and have guarantees against uncertainties.

Saving is also a key message to the adult children across all groups; most

advise about saving and investing early and not getting into too much debt.

5

> From Generation to Generation

�Major Findings

Financial Assistance Sometimes Involves

Real Sacrifice

Grandparents in the three groups surveyed are all providing their adult children

and grandchildren ample amounts of their time, financial resources, and a living

legacy of cultural and family values, albeit with some distinctive differences

between the groups in terms of relative importance among these issues. For

example, while overall 36% of grandparents provided financial assistance or

monetary gifts to grandchildren directly or through their parents in the past five

years, there was considerable difference between the groups. Almost two-thirds

of African-American grandparents (65%) contributed in this way, while 31% of

the Asian Indian grandparents did, and 12% of Chinese grandparents.

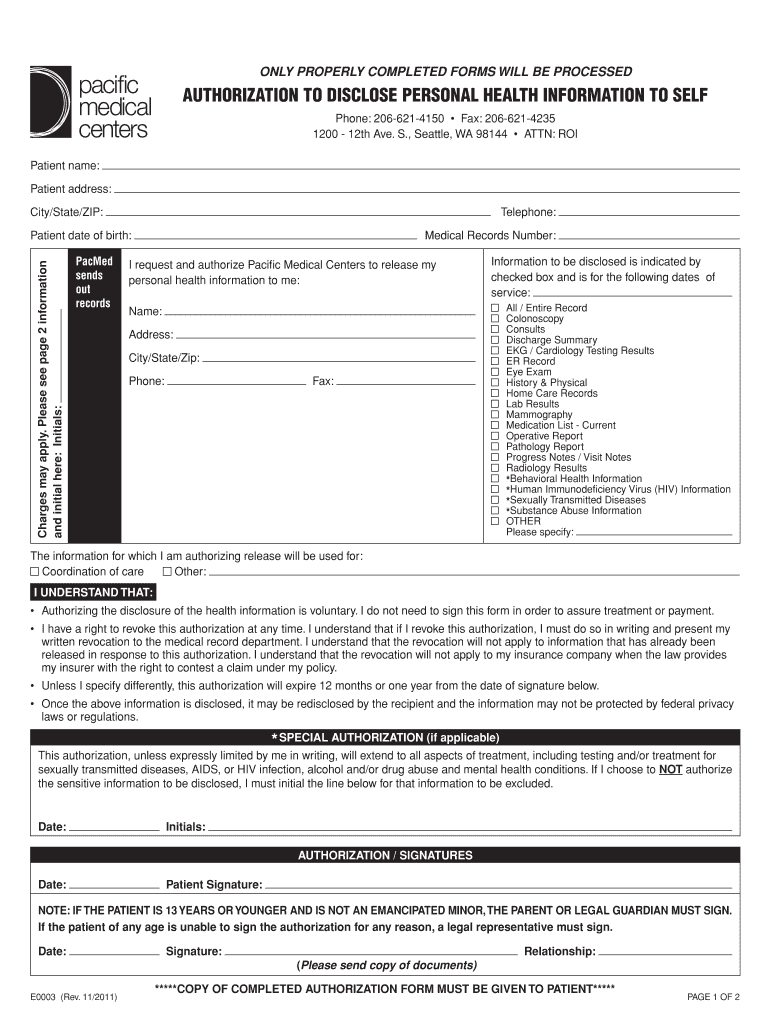

Figure 1: Provided Financial Assistance in the Past Five Years

Chinese

Asian Indian

12%

31%

African-American

Total

6

65%

36%

Among those who are providing assistance, almost half (49%) have given less

than $5,000 in the last five years, about one-quarter gave between $5,000 to

$25,000, while 10% have contributed over $25,000. Fourteen percent were

unsure or declined to answer. In the 2009 survey of grandparents in the general

population, 70% had given $5,000 or less to their grandchildren, and only 4%

had given $25,000 or more. Although a much smaller percentage of Chinese

grandparents have provided assistance, those who do tend to provide larger

amounts of support, with 22% providing $25,000 or more in the past five years.

�Cash gifts are the primary type of support grandparents in all three groups

provide, especially among Chinese (71%), and African-American (65%) grandparents. More African-American grandparents also make use of other means of

support in comparison to Chinese and Asian Indians — 44% provide in-kind gifts

(i.e., a car, furniture, computer), 20% use U.S. Savings Bonds, and 15% use life

insurance proceeds. In-kind gifting is also frequently used by Asian Indian (24%)

and Chinese (17%) grandparents as a form of support.

Overall, for those providing financial assistance, general financial support is the

most frequent reason (43%), followed by support for education costs (36%).

Other top reasons include a car purchase or lease (12%) and life events (10%).

African-American grandparents (59%) are more likely to identify general

support as the purpose for their assistance, in comparison to Asian Indian (21%)

and Chinese (14%) grandparents. Education is a very consistent focus for

Chinese (36%), Asian Indian (35%), and African-American (36%) grandparents.

Sometimes financial assistance goes beyond generosity to the point of a large

proportion of grandparents making sacrifices on behalf of the financial needs

and well-being of adult children and grandchildren. The economic turmoil of the

past few years has certainly had such an impact on grandparents in these three

groups who are assisting their own children and grandchildren. About three in

10 (29%) stated that they are providing more financial assistance now than in the

past due to these economic conditions, consistent with what was found in the

2009 survey where 26% of grandparents agreed that this was the case.

A similar result is evident, primarily among Asian Indian and African-American

grandparents, regarding those who are experiencing a negative impact on their

own finances, with 28% identifying this as a consequence of their support for

their family. More than one-fifth (22%) of all grandparents had identified this

result in the 2009 survey. Similar evidence of financial duress for some is that

in general 27% stated that they used to provide financial assistance, but can

no longer do so due to restrictions on their own finances, especially among

African-American grandparents.

7

> From Generation to Generation

�Major Findings

Figure 2: Personal Impact of Financial Assistance

I am providing more financial assistance to my adult

children/grandchildren now than in the past

due to current economic conditions

The financial assistance I am providing to my adult

children/grandchildren is having a negative

impact on my own finances

I used to provide support but cannot anymore

due to tight finances

29%

28%

27%

Building a Relationship —

Money Isn’t Everything

Caregiving goes along with caring, and grandparents extend themselves to their

families with their time and caregiving as well as their money. Almost one-third

(32%) provide direct caregiving, typically to one or two grandchildren, with 15%

of grandparents providing care for four or more grandchildren. Over half who

provide direct caregiving (54%) do so on a daily basis, while another 30% are

caregiving several times a week. Asian Indian (64%) and African-American (62%)

grandparents are especially likely to be providing care on a daily basis. Nationwide,

2.5 million grandparents are responsible for their grandchildren’s most basic

needs (food, shelter, and clothing).1 This number represents about 40% of all

grandparents who live with their grandchildren.

The grandparents surveyed are spending a median (i.e., 50% spend more time,

50% spend less time) of 12 hours per week with their grandchildren, with over

half (53%) who are spending 10 hours or more per week with their grandchildren. A sizable minority (11%) spend 60 hours or more a week with their

grandchildren, indicating that they may in fact be living in the same household

as their adult children and grandchildren. The monetary value of this level of

caregiving assistance is significant in addition to their direct financial contributions.

8

1

Facts for Features: “Grandparents Day 2008,” U.S. Census Bureau, July 7, 2008.

�Figure 3: Median Hours Spent with Adult Children and Grandchildren Per Week

15

12

10

10

Chinese

10

Asian Indian

Hours spent with adult children

10

African-American

Hours spent with grandchildren

Similar patterns emerge in time spent with adult children, with 38% of grandparents overall spending less than 10 hours, and another 21% spending between

10–20 hours. The median number of hours spent with adult children is 10 hours

per week.

Another family relationship builder within a multicultural perspective is that

each culture has its favorite endearing name for grandparents. While there were

myriad alternatives in this survey, a few front-runners emerged with the three

groups. The main names for African-Americans were “Grandma” and “Granddad,” while Asian Indians were most likely to use “Grandma” and “Dada,” and

Chinese grandparents use “Pau Pau” and “Mama” for grandmothers and “Yeh

Yeh” and “Gong Gong” for grandfathers.

Figure 4: Popular Names for Grandparents

African-American

Grand ma/

Grandma

28%

Granddaddy/

Granddad

17%

Asian Indian

Grand ma/

Grandma

Dada

Chinese

Yeh Yeh

18%

13%

Pau Pau

16%

18%

Ma ma/Mama

13%

Gong Gong

9

11%

> From Generation to Generation

�Major Findings

Grandparents Agree About the Importance

of Cultural and Family Values

Whatever their distinctive cultural perspective, there are some things grandparents

seem to be on the same page about — the importance of cultural values and

expression, and personal/family values. The most frequently identified personal

and family values grandparents seek to instill in their children and grandchildren

are honesty (97%), good behavior (96%), appreciation for education (96%),

good health (95%), and self-sufficiency (94%). These are followed very closely

by preserving family relationships (92%), diligence (91%), and creating financial

security (89%). The relative importance of these core personal and family values

are commonly and dramatically shared among grandparents in all three groups

surveyed, with a difference in only the area of financial security, which was

endorsed very highly by all three groups, but more so among Asian Indian (92%)

and African-American (91%) than Chinese (84%) grandparents.

Similar patterns emerged among the cultural values grandparents strive to

instill in their children and grandchildren. Overall, cultural values about heritage

and ancestry (80%), cultural beliefs (79%), holiday traditions/observances (78%),

and customs (77%) were the most frequently cited. Somewhat fewer put

emphasis on religion (70%), generally as a result of many fewer Chinese (38%)

grandparents emphasizing this cultural value. In fact, Asian Indians and AfricanAmericans generally placed more emphasis on these cultural issues than their

Chinese counterparts although again all were overwhelmingly supported by all

the grandparents.

Smaller but Steady Financial Support Is

Preferred, Perhaps in Response to Their

Concerns for Their Grandchildren

10

Grandparents among the three groups studied exhibited a preference for distributing smaller gifts throughout their lifetimes (46%) in comparison to leaving

a larger sum as a legacy at death (28%). However more than one-quarter (26%)

indicated that they were unsure about their choice in this matter, possibly

indicating that they are taking a wait-and-see attitude about distributing their

support. Of the grandparents who responded, 62% prefer to provide smaller

financial gifts as needed compared to 38% who prefer to leave a larger sum as a

legacy. These results are somewhat lower than the results from grandparents in

the general population in 2009, where 22% preferred a lump sum, while a much

larger majority (78%) intended to provide smaller gifts over their lifetimes.

�There may be some explanation for these consistent results in grandparent

financial concerns for their grandchildren’s future. Education costs were cited by

almost half of all the grandparents (49%) as their major concern, followed by

health costs for their grandchildren (21%), buying a home (17%), and the cost of

raising a family (15%). Many more African-American grandparents (82%) placed

a particular emphasis on education in comparison to the other groups. Since

educational costs may take place at different times for their grandchildren while

the grandparents are still living, along with the fact that the grandparents are

relatively young (the average age is 62.3), smaller, more targeted support strategies

may allow grandparents to exert more selective control over their own resources

and financial assistance provided.

Figure 5: Top Five Financial Concerns for Grandchildren

Education costs

49%

Health costs

21%

Buying a home

17%

Cost of raising a family

Wedding costs

15%

8%

11

> From Generation to Generation

�Major Findings

Grandma and Grandpa: Still a Great Source

of Financial Wisdom (and Very Often the Kids

Actually Listen!)

Overall, about one-third (34%) of the grandparents surveyed are providing

financial advice to their grandchildren. African-American grandparents take the

lead in comparison to the other groups surveyed when it comes to dispensing

financial advice to grandchildren, with 70% doing so, making them more than

twice as likely as either Asian Indian (25%) or Chinese (7%) grandparents to do

so. Chinese grandparents were also much more likely to be providing advice

directly to their adult children rather than to grandchildren, while Asian Indians

were somewhat more likely to include grandchildren. The results for these two

groups are closer to the findings from the 2009 study, where approximately 68%

of grandparents did not share advice on financial matters. African-American

grandparents typically feel that their entire immediate family can benefit from

their advice, and so a large majority of them spread it generously.

The major reason among the three groups for not providing advice is concern

that their grandchildren may be too young to understand the advice they might

provide. In the case of not talking with their adult children, a significant percentage (38%) of them are concerned that they don’t know enough about financial

issues while over one-quarter (28%) feel that their children are not interested.

Figure 6: Provide Financial Advice to Adult Children and Grandchildren

Chinese

Asian Indian

28%

7%

34%

25%

72%

African-American

70%

45%

Total

34%

12

Advice to adult children

Advice to grandchildren

�When they do provide advice, their emphasis on basic and sound financial

principles emerges very prominently, as it did in the 2009 study. Starting early

in the practice of saving and investing is their key message, with almost as many

recommending maintaining control over the amount of debt incurred. Having

basic financial security through essential financial products such as savings

accounts, life insurance, employer pensions, and IRAs is another, followed closely

by spreading out risk through a diverse financial product mix.

Figure 7: Types of Financial Advice to Adult Children and Grandchildren

70%

Start saving and investing early in life

64%

54%

Make sure you have basic financial security

41%

62%

Don’t get into too much debt

53%

50%

Don’t put all your financial eggs in one basket

38%

Get a good job/work hard

1%

2%

Advice to adult children

Get an education/stay in school

Other

0%

4%

Advice to grandchildren

3%

4%

The reasons for grandparents delivering this message are also instructive in

helping prepare their families for a sound financial future. The top reasons cited

by grandparents in all three groups were to ensure that their grandchildren

begin saving (60%), and to help them establish guarantees against future

uncertainties (36%). A smaller percentage (17%) identified more immediate

decisions such as a home purchase.

13

> From Generation to Generation

�Major Findings

Grandparents seem to be helping their children and grandchildren think longterm with sound fundamental financial principles, perhaps grounded in dealing

with the financial uncertainties of the past few years still fresh in their minds.

Figure 8: Top Three Reasons for Financial Advice to Grandchildren

To make sure they save

60%

Guarantees against uncertainties

They bought a house

36%

17%

These basic tenets of sound financial planning, and essential financial literacy

issues delivered by a respected and beloved family member, and the reasons for

grandparents delivering it, combine to have a real potential impact — a large

majority of these grandparents actually find that their children and grandchildren

follow their advice. Over half find that their adult children (52%) and grandchildren (54%) follow their advice frequently or most of the time. An additional

32% report that their grandchildren follow their advice at least sometimes, and

40% report the same for their adult children.

14

�Experience Allows Grandparents to

Speak with Confidence About Basic

Financial Protection

Despite the self-perceived lack of knowledge about finances, the survey results

also demonstrate that when grandparents have direct experience with financial

products and strategies, they are potentially more willing to be direct and vocal

with their advice. For example, 69% of African-American grandparents have spoken

to their adult children about protecting the future needs and opportunities for

their grandchildren through basic financial protection products such as life

insurance. In contrast, 23% of Asian Indian and 18% of Chinese grandparents

have done the same. Overall, 37% of the grandparents have had this discussion.

Of those who have not spoken to their adult children about this issue, 33% of

African-American grandparents would do so, while 13% of Asian Indian and 4%

of Chinese grandparents would.

A possible explanation for some of this disparity may be in the higher rates of

African-American grandparent life insurance ownership (61%), and potential

ownership (11%) when compared to Asian Indian (35% and 3% respectively),

and Chinese grandparents (44% and From Generation to Generation

�Conclusion and Implications

The multicultural perspectives from three distinctive groups in this survey help

reinforce fundamental realities of grandparenthood—they are willing contributors

to the financial well-being, cultural foundation, and deep interpersonal relationships that define intergenerational family connections. As was discovered in

2009 in Grandparents — Generous with Money, Not with Advice for the general

U.S. grandparent population, African-American, Asian Indian, and Chinese

grandparents share many basic values about their legacy for their adult children

and grandchildren, the major one being the transfer of important cultural roots

and family/personal values which will ensure the future of many generations.

But the values go beyond simply ideas and traditions. It is also apparent in the

practices of many of them such as providing financial support directly to their

immediate family, even to the point of sacrificing their own financial security.

It is there as well in the amount of time and direct caregiving they provide. The

contributions of time, attention, and caring form the real basis of the bond and

relationship within the family.

It became evident through both of these surveys

that generally grandparents clearly understand

the importance of basic financial security. They

demonstrate it through their reliance on fundamental

financial protection through life insurance, savings,

and pension/IRA products for themselves, and in their

motivation for passing along advice about these

products to their own children and grandchildren.

The soundness of the financial advice they give,

and their recognition of the importance of core

socioeconomic realities such as education, savings,

financial diversification, control of debt, etc.,

demonstrate that they can be a significant positive resource and influence on

their families and broader communities.

THE ESSENCE OF

GRANDPARENT

SUPPORT:

CASH, CONTACT,

AND CULTURE

16

Despite the wisdom of their advice, there is a very observable reluctance on the

part of most grandparents to insert themselves directly between adult child and

grandchild. However, family members and others who share a common cultural

tradition may all benefit even more through expanded ways of handing down

their knowledge and wise counsel to other generations. This may partly come in

the form of increased financial literacy for grandparents, and better strategies for

opening this conversation directly with their children and grandchildren.

�Cultural distinctions do exist among the grandparent groups surveyed. Some of

these may be from deeply ingrained traditions about the place of grandparents

within the larger family context. There are some cultural differences in how

directly grandparents demonstrate their influence and direct involvement with

their adult children and grandchildren. Nevertheless, they are almost universally

consistent in the basic values of respect and appreciation of traditions, customs,

and beliefs they pass along to succeeding generations, and the important

aspects of personal character such as honesty, good behavior, education, health,

and self-sufficiency which they seek to instill in them as well. Since many grandparents feel that they are not well-informed about financial issues, better

financial information and literacy could make them ambassadors of important

financial information. The entire community could benefit from enhancing

and expanding the opportunities for grandparents to extend their caring and

generosity to their own families and beyond.

17

> From Generation to Generation

�Methodology

The survey was conducted via telephone between February and March 2010,

by Frank N. Magid Associates, Inc. The survey included grandparents age 45+

with grandchildren age 25 or younger. The sample was comprised of 200

African-American grandparents, 200 Asian Indian grandparents, and 201

Chinese grandparents. Interviews were conducted in English, as well as

Mandarin and Cantonese for the Chinese respondents. Data were weighted

to be representative of African-American, Asian Indian, and Chinese adults

age 45+ within the U.S. population.

18

�Demographics

Gender

Male

Female

Total

Chinese

Asian Indians

AfricanAmericans

49%

51%

48%

52%

53%

47%

47%

53%

7%

34%

59%

62.3

4%

32%

64%

63.1

3%

34%

63%

63.0

14%

37%

49%

60.9

71%

14%

5%

4%

1%

81%

13%