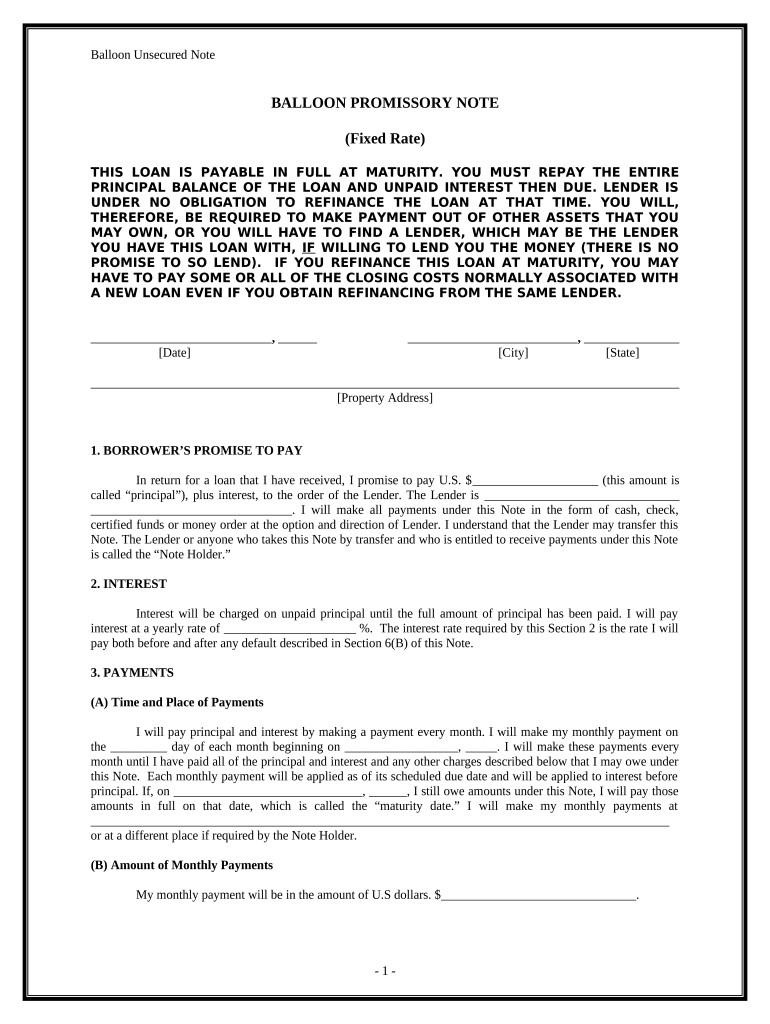

Balloon Unsecured Note

BALLOON PROMISSORY NOTE

(Fixed Rate)

THIS LOAN IS PAYABLE IN FULL AT MATURITY. YOU MUST REPAY THE ENTIRE

PRINCIPAL BALANCE OF THE LOAN AND UNPAID INTEREST THEN DUE. LENDER IS

UNDER NO OBLIGATION TO REFINANCE THE LOAN AT THAT TIME. YOU WILL,

THEREFORE, BE REQUIRED TO MAKE PAYMENT OUT OF OTHER ASSETS THAT YOU

MAY OWN, OR YOU WILL HAVE TO FIND A LENDER, WHICH MAY BE THE LENDER

YOU HAVE THIS LOAN WITH, IF WILLING TO LEND YOU THE MONEY (THERE IS NO

PROMISE TO SO LEND). IF YOU REFINANCE THIS LOAN AT MATURITY, YOU MAY

HAVE TO PAY SOME OR ALL OF THE CLOSING COSTS NORMALLY ASSOCIATED WITH

A NEW LOAN EVEN IF YOU OBTAIN REFINANCING FROM THE SAME LENDER.

, ,

[Date] [City] [State]

[Property Address]

1. BORROWER’S PROMISE TO PAY

In return for a loan that I have received, I promise to pay U.S. $ ____________________ (this amount is

called “principal”), plus interest, to the order of the Lender. The Lender is _______________________________

________________________________ . I will make all payments under this Note in the form of cash, check,

certified funds or money order at the option and direction of Lender. I understand that the Lender may transfer this

Note. The Lender or anyone who takes this Note by transfer and who is entitled to receive payments under this Note

is called the “Note Holder.”

2. INTEREST

Interest will be charged on unpaid principal until the full amount of principal has been paid. I will pay

interest at a yearly rate of _____________________ %. The interest rate required by this Section 2 is the rate I will

pay both before and after any default described in Section 6(B) of this Note.

3. PAYMENTS

(A) Time and Place of Payments

I will pay principal and interest by making a payment every month. I will make my monthly payment on

the _________ day of each month beginning on __________________ , _____ . I will make these payments every

month until I have paid all of the principal and interest and any other charges described below that I may owe under

this Note. Each monthly payment will be applied as of its scheduled due date and will be applied to interest before

principal. If, on ______________________________ , ______ , I still owe amounts under this Note, I will pay those

amounts in full on that date, which is called the “maturity date.” I will make my monthly payments at

____________________________________________________________________________________________

or at a different place if required by the Note Holder.

(B) Amount of Monthly Payments

My monthly payment will be in the amount of U.S dollars. $ _______________________________ .

- 1 -

Balloon Unsecured Note

4. BORROWER’S RIGHT TO PREPAY

I have the right to make payments of principal at any time before they are due. A payment of principal only

is known as a “prepayment.” When I make a prepayment, I will tell the Note Holder in writing that I am doing so. I

may not designate a payment as a prepayment if I have not made all the monthly payments due under the Note. I

may make a full prepayment or partial prepayments without paying a prepayment charge. The Note Holder will use

my prepayments to reduce the amount of principal that I owe under this Note. However, the Note Holder may apply

my prepayment to the accrued and unpaid interest on the prepayment amount, before applying my prepayment to

reduce the principal amount of the Note. If I make a partial prepayment, there will be no changes in the due date or

in the amount of my monthly payment unless the Note Holder agrees in writing to those changes.

5. LOAN CHARGES

If a law, which applies to this loan and which sets maximum loan charges, is finally interpreted so that the

interest or other loan charges collected or to be collected in connection with this loan exceed the permitted limits,

then: (i) any such loan charge shall be reduced by the amount necessary to reduce the charge to the permitted limit;

and (ii) any sums already collected from me which exceeded permitted limits will be refunded to me. The Note

Holder may choose to make this refund by reducing the principal I owe under this Note or by making a direct

payment to me. If a refund reduces principal, the reduction will be treated as a partial prepayment.

6. BORROWER’S FAILURE TO PAY AS REQUIRED

(A) Late Charge for Overdue Payments and Receipt of Payments

If the Note Holder has not received the full amount of any monthly payment by the end of ___________

{ enter days before late charges are due under your State’s laws } calendar days after the date it is due, I will pay a

late charge to the Note Holder. The amount of the charge will be _____ % of my overdue payment of principal and

interest {[ or] ________ dollars for each late payment }. I will pay this late charge promptly but only once on each

late payment. In no event will the late charge exceed the maximum amount allowed by the applicable state law.

Payments to the note holder shall not be considered made until received by the Note Holder at the address

specified. Mailing is insufficient to constitute delivery to the Note Holder.

The number of days required for payment of a late charge shall not be considered as a grace period for the

payment date required under this Note and the Borrower shall be default if the payment is not paid on the due date.

(B) Default

If I do not pay the full amount of each monthly payment on the date it is due, I will be in default.

(C) Notice of Default

If I am in default, the Note Holder may send me a written notice telling me that if I do not pay the overdue

amount by a certain date, the Note Holder may require me to pay immediately the full amount of principal which has

not been paid and all the interest that I owe on that amount. That date must be at least 30 days after the date on

which the notice is mailed to me or delivered by other means.

(D) No Waiver By Note Holder

Even if, at a time when I am in default, the Note Holder does not require me to pay immediately in full as

described above, the Note Holder will still have the right to do so if I am in default at a later time.

(E) Payment of Note Holder’s Costs and Expenses

- 2 -

Balloon Unsecured Note

If the Note Holder has required me to pay immediately in full as described above, the Note Holder will

have the right to be paid back by me for all of its costs and expenses in enforcing this Note to the extent not

prohibited by applicable law. Those expenses include, for example, reasonable attorneys’ fees.

7. GIVING OF NOTICES

Unless applicable law requires a different method, any notice that must be given to me under this Note will

be given by delivering it or by mailing it by first class mail to me at the Property Address above or at a different

address if I give the Note Holder a notice of my different address. Any notice that must be given to the Note Holder

under this Note will be given by delivering it or by mailing it by first class mail to the Note Holder at the address

stated in Section 3(A) above or at a different address if I am given a notice of that different address.

8. OBLIGATIONS OF PERSONS UNDER THIS NOTE

If more than one person signs this Note, each person is fully and personally obligated to keep all of the

promises made in this Note, including the promise to pay the full amount owed. Any person who is a guarantor,

surety or endorser of this Note is also obligated to do these things. Any person who takes over these obligations,

including the obligations of a guarantor, surety or endorser of this Note, is also obligated to keep all of the promises

made in this Note. The Note Holder may enforce its rights under this Note against each person individually or

against all of us together. This means that any one of us may be required to pay all of the amounts owed under this

Note.

9. WAIVERS

I and any other person who has obligations under this Note waive the rights of presentment and notice of

dishonor. “Presentment” means the right to require the Note Holder to demand payment of amounts due. “Notice of

dishonor” means the right to require the Note Holder to give notice to other persons that amounts due have not been

paid.

WITNESS THE HAND(S) AND SEAL(S) OF THE UNDERSIGNED

(Seal) ________________________________________

Borrower ________________________________

(Seal) ________________________________________

Borrower ________________________________

(Seal) ________________________________________

Borrower ________________________________

(Seal) ________________________________________

Borrower

________________________________

- 3 -

Changes based upon state of use.

The following changes MAY be made to this document at the

lender’s option or MUST be made under certain circumstances only:

1. Lenders MAY include at the bottom of each page “initial lines”

on which borrowers may insert their initials to acknowledge

that all pages of the document are present. If these lines are

added, lenders MUST require the borrowers to initial the lines

on each page of the document.

2. Lenders MAY add the borrowers’ social security numbers, if

the borrowers do not want to provide this information on the

security instrument.

3. Lenders MAY adjust cross-references to section, paragraph,

or page numbers, if needed to reflect changes in section,

paragraph, or page numbers that result from adding,

modifying, or deleting certain language in accordance with

another authorized change.

4. Lenders MAY add the following language (with all letters

being capitalized) above the Borrower signature lines, if the

security property is located in Alabama :

Caution -- It is important that you thoroughly read the contract

before you sign it.

5. Lenders MUST insert the following language above the

Borrower signature lines, if the security property is located in

Alaska :

NOTICE OF OTHER REMEDIES

To the extent set forth in this Note and any Rider(s) attached

hereto (i) the mortgagor or trustor (“Borrower”) is personally

obligated and fully liable for all amounts due under this Note, and

(ii) the holder hereof has the right to sue on this Note and obtain a

personal judgment against the Borrower for satisfaction of all

amounts due under this Note either before or after a judicial

foreclosure, under Alaska statutes 09.45.170 through 09.45.220,

of the deed of trust which secured this Note.

6. Lenders MUST insert the following language at the end of the

document before the sentence reading “Witness the Hand(s)

and Seal(s) of the Undersigned,” if the security property is

located in Florida :

The state documentary tax due on this Note has been paid on the

Mortgage securing this indebtedness.

4

7 . Lenders MAY add the following language immediately after

the Borrower signature lines, if the security property is

located in Louisiana :

‘Ne varietur’ for identification with a mortgage given before me on

__________, ____.

___________________________________________________________

___________

Notary qualified in ____________________________ Parish,

Louisiana

8. Lenders MAY add the following language to the second

sentence in Section 6(A). Late Charges for Overdue

Payments immediately before the period(.), if the security

property is located in Louisiana :

...,but not more than U.S. $25.00...

9. Lenders MAY add the following language immediately after

the Borrower signature lines, if the security property is

located in Maryland :

This loan transaction is governed by Title 12, Subtitle 10 of the

Commercial Law Article of the Annotated Code of Maryland.

10. Lenders MUST add the following language as a new Section

immediately preceding the paragraph that reads: “Witness

the hand(s) and Seal(s) of the Undersigned”, if the s ecurity

property is located in New Hampshire:

11. Attorneys’ Fees

Pursuant to New Hampshire Revised Statutes Annotated

§361-C:2, in the event that Borrower shall prevail in (a) any action,

suit or proceeding, brought by Lender, or (b) an action brought by

Borrower, reasonable attorneys’ fees shall be awarded to

Borrower. Further, if Borrower shall successfully assert a partial

defense or set-off, recoupment or counterclaim to an action

brought by Lender, a court may withhold from Lender the entire

amount of such portion of its attorneys’ fees as the court shall

consider equitable.

12. Lenders MAY add the following language (with all letters

being capitalized and bold-faced) immediately after the

Borrower signature lines, if the security property is located in

Texas :

5

This written loan agreement represents the final agreement

between the parties and may not be contradicted by evidence of

prior, contemporaneous, or subsequent oral agreements of the

parties.

There are no unwritten oral agreements between the parties.

_______________________________

Signature of Lender

_______________________________

Signature of Borrower

13. Lenders MUST insert the following language (in at least 10-

point bold-faced type) at the end of the document before the

sentence reading “Witness the Hand(s) and Seal(s) of the

Undersigned,” if the security property is located in Vermont :

Notice to Co-signer

Your signature on this Note means that you are equally liable for

repayment of this loan. If the Borrower does not pay, the Lender

has the legal right to collect from you.

14. Lenders MAY add the following text after the Borrower

signature lines, if the security property is located in Virginia :

This is to certify that this is the Note described in and secured by a

Deed of Trust dated _____________, ____ on the Property

located in ___________________, Virginia.

My Commission Expires:

___________________________________

Notary Public

15. Lenders MUST change the first sentence in Section 9.

Waivers to read as follows, if the security property is located

in Virginia :

I and any other person who has obligations under this Note waive

the rights of Presentment and Notice of Dishonor and waive the

benefit of the homestead exemption as to the Property described

in the Security Instrument (as defined below).

16. Lenders MUST add the following language as the third

paragraph under Section 2. Interest, if the security property is

located in Wisconsin :

6

Solely for the purpose of computing interest, a monthly payment

received by the Note Holder within 30 days prior to or after the

date it is due will be deemed to be paid on such due date.

17. Lenders MUST delete the following language from the fourth

sentence of Section 3(A). Time and Place of Payments, if the

security property is located in Wisconsin :

...will be applied as of its scheduled due date and...

18. Lenders MUST change the second sentence in Section 6(A).

Late Charges for Overdue Payments to read as follows, if

the security property is located in West Virginia :

The amount of the charge will be ____% of my overdue payment

of principal and interest but not more than U.S.

$____________________ and not less than U.S. $1.00.

19. Lenders MUST delete the sentence in Section 6(E). Payment

of Note Holder’s Costs and Expenses that reads as follows, if

the security property is located in West Virginia :

Those expenses include, for example, reasonable attorneys’ fees.

7

Useful Suggestions for Finishing Your ‘Balloon Promissory’ Digitally

Are you exhausted from the burden of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and organizations. Wave farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can conveniently fill out and sign papers online. Utilize the robust features integrated into this user-friendly and economical platform and transform your method of document management. Whether you need to authorize forms or gather eSignatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this comprehensive guide:

- Log into your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our template library.

- Open your ‘Balloon Promissory’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your behalf.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No concerns if you need to collaborate with your teammates on your Balloon Promissory or send it for notarization—our platform provides everything required to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to new levels!