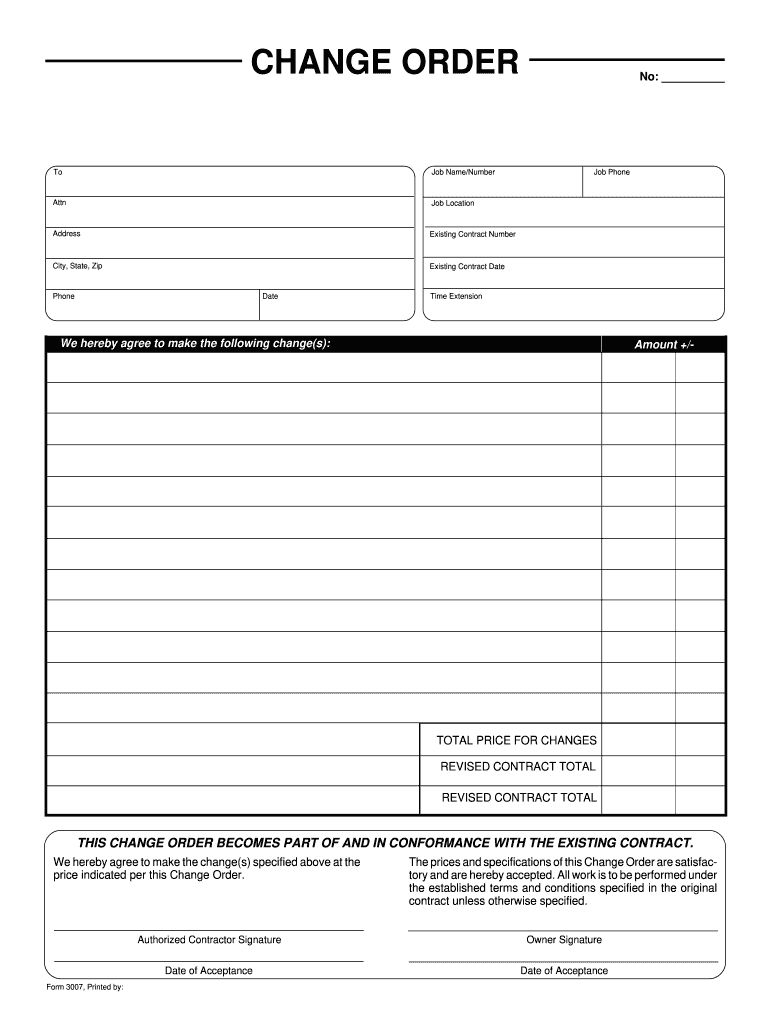

Fill and Sign the Bank Change Order Form

Valuable assistance on finalizing your ‘Bank Change Order Form’ online

Are you weary of the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier electronic signature solution for individuals and organizations. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and endorse documents online. Utilize the extensive tools embedded within this user-friendly and cost-effective platform and transform your method of document management. Whether you require approval for forms or the collection of signatures, airSlate SignNow manages everything with simplicity, requiring just a few clicks.

Follow this detailed guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Access your ‘Bank Change Order Form’ in the editor.

- Click Me (Fill Out Now) to set up the form on your side.

- Add and assign fillable fields for other participants (if necessary).

- Advance with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or transform it into a multi-use template.

Don’t fret if you need to collaborate with others on your Bank Change Order Form or send it for notarization—our platform provides you with everything necessary to accomplish such tasks. Create an account with airSlate SignNow today and enhance your document management to a new standard!

FAQs

-

What is a Bank Change Order Form and why do I need it?

A Bank Change Order Form is a document used to authorize changes to your banking account, such as updating contact information or altering account signatories. Utilizing a digital solution like airSlate SignNow to manage your Bank Change Order Form ensures quick processing and compliance with banking regulations.

-

How does airSlate SignNow simplify the process of creating a Bank Change Order Form?

airSlate SignNow simplifies the creation of a Bank Change Order Form by providing customizable templates and an intuitive interface. This allows users to fill out and sign their forms electronically, reducing the time and effort needed compared to traditional paper forms.

-

Is there a cost associated with using airSlate SignNow for my Bank Change Order Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. You can choose a plan that suits your volume of transactions and required features for managing your Bank Change Order Form effectively.

-

Can I track the status of my Bank Change Order Form with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your Bank Change Order Form, allowing you to monitor its status and know when it has been reviewed or completed. This feature ensures transparency and keeps you informed throughout the process.

-

What security measures does airSlate SignNow implement for my Bank Change Order Form?

airSlate SignNow prioritizes your security by using advanced encryption protocols and secure servers to protect your Bank Change Order Form and sensitive information. This ensures that your data remains safe and confidential while being processed.

-

Can I integrate airSlate SignNow with other software for my Bank Change Order Form?

Yes, airSlate SignNow seamlessly integrates with various third-party applications such as CRM systems and cloud storage services. This allows you to streamline your workflow and manage your Bank Change Order Form alongside other business processes.

-

How can I ensure compliance when using airSlate SignNow for my Bank Change Order Form?

Using airSlate SignNow for your Bank Change Order Form helps ensure compliance with legal standards, as the platform adheres to eSignature laws and regulations. Additionally, it provides audit trails and certificates of completion for each signed document.

Find out other bank change order form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles