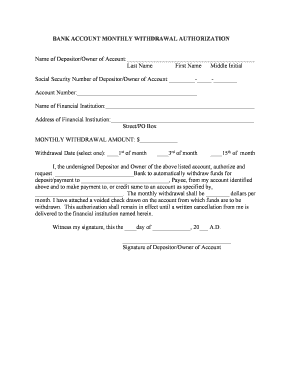

Fill and Sign the Bank Form Document

Convenient tips for finalizing your ‘Bank Form Document’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier electronic signature tool for individuals and businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the extensive features available in this user-friendly and cost-effective platform to transform your document management process. Whether you need to approve forms or gather signatures, airSlate SignNow takes care of everything effortlessly, requiring just a few clicks.

Adhere to these comprehensive steps:

- Access your account or register for a free trial of our service.

- Select +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Bank Form Document’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or turn it into a reusable template.

No need to be concerned if you must collaborate with others on your Bank Form Document or send it for notarization—our solution provides everything required to complete such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is a bankform and how does it work with airSlate SignNow?

A bankform is a digital document used for banking transactions that can be easily signed and sent electronically. With airSlate SignNow, you can create, customize, and eSign bankforms securely, streamlining your banking processes and eliminating the need for paper forms.

-

How does airSlate SignNow improve the efficiency of bankform transactions?

airSlate SignNow enhances the efficiency of bankform transactions by allowing users to send and receive documents instantly. This eliminates delays associated with traditional paper methods, enabling faster approvals and smoother workflows for banking operations.

-

What pricing plans are available for using airSlate SignNow with bankforms?

airSlate SignNow offers several pricing plans tailored to different business sizes and needs, including options for individual users and teams. Each plan provides access to features that streamline the creation and management of bankforms, ensuring cost-effectiveness for your organization.

-

Can I integrate airSlate SignNow with other software for managing bankforms?

Yes, airSlate SignNow offers seamless integrations with various software platforms, including CRM and document management systems. This allows you to manage your bankforms efficiently within your existing workflow, enhancing productivity and collaboration.

-

What security measures does airSlate SignNow implement for bankform transactions?

Security is a top priority for airSlate SignNow, which employs industry-standard encryption and compliance with regulations like GDPR and HIPAA. This ensures that your bankform transactions are secure and confidential, protecting sensitive information throughout the signing process.

-

Is it easy to create a bankform using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that allows you to create bankforms quickly and easily. With customizable templates and drag-and-drop features, you can design bankforms that meet your specific needs without any technical expertise.

-

What are the benefits of eSigning bankforms with airSlate SignNow?

eSigning bankforms with airSlate SignNow offers numerous benefits, including reduced turnaround times, enhanced accuracy, and improved document tracking. These advantages lead to a more streamlined banking process, enabling businesses to operate more efficiently.

The best way to complete and sign your bank form document

Find out other bank form document

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles