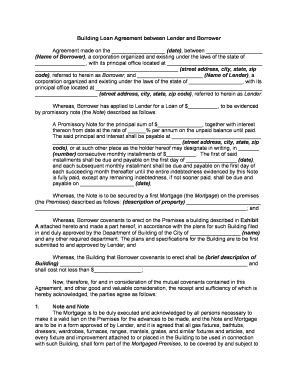

Building Loan Agreement between Lender and Borrower

Agreement made on the __________________ (date) , between ___________________

(Name of Borrower) , a corporation organized and existing under the laws of the state of

_________________, with its principal office located at ________________________________

________________________________________________

(street address, city, state, zip

code)

, referred to herein as Borrower , and ______________________ (Name of Lender) , a

corporation organized and existing under the laws of the state of __________________, with its

principal office located at ________________________________________________________

_____________________

(street address, city, state, zip code) , referred to herein as Lender .

Whereas, Borrower has applied to Lender for a Loan of $__________, to be evidenced

by promissory note (the

Note ) described as follows:

A Promissory Note for the principal sum of $_______________, together with interest

thereon from date at the rate of ______% per annum on the unpaid balance until paid.

The said principal and interest shall be payable at ______________________________

___________________________________________

(street address, city, state, zip

code)

, or at such other place as the holder hereof may designate in writing, in _______

(number) consecutive monthly installments of $__________. The first of said

installments shall be due and payable on the first day of _________________

(date) ,

and each subsequent monthly installment shall be due and payable on the first day of

each succeeding month thereafter until the entire indebtedness evidenced by this Note

is fully paid, except any remaining indebtedness, if not sooner paid, shall be due and

payable on __________________

(date) ;

Whereas, the Note is to be secured by a first Mortgage (the

Mortgage ) on the premises

(the

Premises ) described as follows: (description of property) _________________________

_______________________________________________________________________; and

Whereas, Borrower covenants to erect on the Premises a building described in

Exhibit

A

attached hereto and made a part hereof, in accordance with the plans for such Building filed

in and duly approved by the Department of Building of the City of _________________

(name)

and any other required department. The plans and specifications for the Building are to be first

submitted to and approved by Lender; and

Whereas, the Building that Borrower covenants to erect shall be

(brief description of

Building)

_______________________________________________________________ and

shall cost not less than $________________;

Now, therefore, for and in consideration of the mutual covenants contained in this

Agreement, and other good and valuable consideration, the receipt and sufficiency of which is

hereby acknowledged, the parties agree as follows:

1. Note and Note

The Mortgage is to be duly executed and acknowledged by all persons necessary to

make it a valid lien on the Premises for the advances to be made, and the Note and Mortgage

are to be in a form approved of by Lender, and it is agreed that all gas fixtures, bathtubs,

dressers, wardrobes, furnaces, ranges, mantels, grates, and similar fixtures and articles, and

every fixture and improvement attached to or placed in the Building to be used in connection

with such Building, shall form part of the

Mortgaged Premises, to be covered by and subject to

the lien of the Mortgage given to secure the advances provided for in this Agreement. The Note

and Mortgage are to be delivered at __________

(time) , on _____________________ (date of

closing)

, at the office of _________________________ (name of title company) , at ________

_____________________________________________________

(address of title company) .

2. Title Expenses

Lender may deduct from any payment to be made under this Agreement any amount

necessary for the payment of any expenses relating to the examination of the title to the

Premises or incurred in the procuring and making of the Loan, or in the payment of any

encumbrance, tax, assessment, or other charge or lien upon the Premises existing at any time,

whether before or after the making of the Loan, and apply such amounts in making these

payments, and all sums so applied shall be deemed advances under this Agreement and

secured by the Note and Mortgage.

3. Security for Advances

The advances to be made upon the Mortgage, and to be secured by the Premises and

the Building and improvements, including all fixtures, to be erected on the Premises, shall be as

Lender shall determine, but substantially in accordance with the following schedule:

(schedule

of advances)

________________________________________________________________

___________________________________________________________________________.

4. Charges and Fees

Borrower at the time fixed for the delivery of the Mortgage shall pay the charges for the

examination of the title to the Premises, surveys, and drawing of papers, and shall also pay the

recording fees.

5. Inspection Fees

The fees paid to Lender for any inspection fees and all fees regarding the making of this

Loan shall be made by Borrower.

6. Release of Portions of Premises

Lender may at any time release portions of the Mortgaged Premises upon receiving

what, in the opinion of Lender, is a proper payment on account of the Mortgage debt.

7. Written Notice for Advances

Lender may require ______ (number) days' notice in writing from Borrower before an

advance shall be called for.

8. Prerequisites to Making an Advance

A. No advance shall be due unless, in the judgment of Lender, all work usually done

at the stage of construction when the advance is made payable be done in a good and

quality manner, and all material and fixtures usually furnished and installed at that time

are furnished and installed, but Lender may advance parts or the whole of any

installments before they become due, if Lender believes it advisable to do so, and all

such advancements or payments shall be deemed to have been made in pursuance of

this Agreement.

B. A receipt for any advance may be made by any one of the parties constituting

Borrower, if more than one person, with the same effect as if signed by all such persons.

9. Loan to be Made by other Person or Corporation

A. Lender may cause this Loan to be made by some other person or corporation

and, in that event, the Note and Mortgage shall then run to this person or corporation.

The provisions of this Agreement shall apply to such Note and Mortgage, and, if the

Loan be so made, it shall be deemed in compliance by Lender with this Agreement.

B. Lender may assign the Note and Mortgage and cause the assignee to make any

advances not made at the time of the assignment, and all the provisions of this

Agreement shall continue to apply to the Loan and Note and Mortgage.

10. Extension of Payment of Principal

Lender or any holder of the Note and Mortgage may extend the payment of the principal

secured by the Note and Mortgage, and any extension so granted shall be deemed made in

pursuance of this Agreement and not to be a modification of this Agreement.

11. Discontinuance of Construction

If the construction of the Building is at any time discontinued or not carried on with

reasonable dispatch in the judgment of Lender, Lender or any holder of the Note and Mortgage

may purchase materials and employ workers to protect the Building so that they will not suffer

from depredation or the weather, or to complete the Building, so that they may be used for the

purposes for which they are designed under the plans and specifications.

12. Borrower’s Loss of Title

In the event of Borrower's parting with or being in any way deprived of its title to the

Premises described in this Agreement, Lender may, at its option, continue to make advances

under this Agreement and subject to all its terms and conditions, to such person or persons or

corporations as may succeed to Borrower's title; and all sums so advanced by Lender shall be

deemed advances under this Agreement, and shall be secured by the Note and Mortgage.

13. Termination of Lender’s Obligation for Future Advances

Borrower agrees not to do any act or thing prohibited by the terms of this Agreement,

and it is agreed that in any of the following events all obligations on the part of Lender to make

the Loan or to make any further advance shall, if Lender so elect, cease and terminate, and the

Note and Mortgage shall, at the option of the holder of such Note and Mortgage, become

immediately due and payable, but Lender may make advances without becoming liable to make

any other advances:

A. If the Mortgage offered by Borrower does not give Lender a lien for the

indebtedness to be secured by the Mortgage on the Premises above set forth that is

satisfactory to the attorney of Lender.

B. If the Loan is to be advanced in more than one payment, and any payment is

requested and the attorney of Lender does not approve of the payment requested

because of some act, encumbrance, or question arising after the making of the

preceding payment.

C. If Borrower assigns this Agreement or any advances or any interest in this

Agreement, or if the Premises are conveyed or encumbered in any way without the prior,

express, and written consent of Lender.

D. If the improvements on the Premises or any Building that may be erected upon

the Premises materially encroaches upon the street or upon any adjoining property.

E. If Borrower does not take the Loan or the advances within ______ (number)

days after they are made payable, or, in a case where the payment of advances is

dependent upon the erection of a Building, the Building is not fully enclosed within

________

(number) months from date, or fully completed and ready for occupancy

within _______

(number) months from date.

F. If the improvements on the Premises are, in the judgment of Lender, materially

injured or destroyed by fire or otherwise.

G. If the makers of the Note and Mortgage fail to comply with any of the covenants

contained in such Note and Mortgage.

H. If any materials, fixtures, or articles used in the construction of a Building or

appurtenant to such Building are not purchased in such a way that the ownership of

such Building or appurtenant will vest in the owner of the Premises free from

encumbrance upon delivery at the Premises.

I. If Borrower does not erect the Building in accordance with plans and

specifications satisfactory to Lender and plans that have been approved by the

Department of Building of the City of _________________

(name of city) , and any other

required department.

J. If the owners of the Premises do not permit Lender or a representative of Lender

to enter upon the Premises and inspect the Building erected or to be erected at all

reasonable times.

K. If the construction of the Building is at any time discontinued or not carried on

with reasonable dispatch in the judgment of Lender.

L. If, by reason of the death of any owner of the Premises, the heirs, devisees, or

legal representatives of such owner shall permit or allow the construction of the Building

to be discontinued for a period of _______

(number) days.

M. If Borrower makes any conditional purchases of, or executes any chattel

mortgage or security agreement on, any materials, fixtures, or articles used in the

construction of the Building or appurtenant to such Building.

N. If Borrower fails to comply with any requirement of any department of the City of

__________________

(name of city) , within _______ (number) days after notice in

writing of such requirement shall have been given to Borrower by Lender.

14. Future Notes and Mortgage Subject to Agreement

It is mutually agreed between the parties to this Agreement on behalf of themselves and

their respective legal representatives that the Note and Mortgage contemplated to be executed,

acknowledged, and delivered pursuant to this Agreement shall be made subject to all the

conditions, stipulations, agreements, and covenants contained in this Agreement, to the same

extent and effect as they would be if fully set forth and made part of such Note and Mortgage;

and it is further agreed that if Borrower fails to keep, observe, or perform any of the stipulations

or covenants contained in the Note or Mortgage, or in this Agreement, at the option of the holder

of the Note and Mortgage, the amount secured shall become at once due and payable, in spite

of anything to the contrary in this Agreement.

15.Severability

The invalidity of any portion of this Agreement will not and shall not be deemed to affect

the validity of any other provision. If any provision of this Agreement is held to be invalid, the

parties agree that the remaining provisions shall be deemed to be in full force and effect as if

they had been executed by both parties subsequent to the expungement of the invalid provision.

16. No Waiver

The failure of either party to this Agreement to insist upon the performance of any of the

terms and conditions of this Agreement, or the waiver of any breach of any of the terms and

conditions of this Agreement, shall not be construed as subsequently waiving any such terms

and conditions, but the same shall continue and remain in full force and effect as if no such

forbearance or waiver had occurred.

17. Governing Law

This Agreement shall be governed by, construed, and enforced in accordance with the

laws of the State of ________________.

18. Notices

Any notice provided for or concerning this Agreement shall be in writing and shall be

deemed sufficiently given when sent by certified or registered mail if sent to the respective

address of each party as set forth at the beginning of this Agreement.

19. Attorney’s Fees

In the event that any lawsuit is filed in relation to this Agreement, the unsuccessful party

in the action shall pay to the successful party, in addition to all the sums that either party may be

called on to pay, a reasonable sum for the successful party's attorney fees.

20. Entire Agreement

This Agreement shall constitute the entire agreement between the parties and any prior

understanding or representation of any kind preceding the date of this Agreement shall not be

binding upon either party except to the extent incorporated in this Agreement.

21. Modification of Agreement

Any modification of this Agreement or additional obligation assumed by either party in

connection with this Agreement shall be binding only if placed in writing and signed by each

party or an authorized representative of each party.

22. Assignment of Rights

The rights of each party under this Agreement are personal to that party and may not be

assigned or transferred to any other person, firm, corporation, or other entity without the prior,

express, and written consent of the other party.

23. In this Agreement, any reference to a party includes that party's heirs, executors,

administrators, successors and assigns, singular includes plural and masculine includes

feminine.

WITNESS our signatures as of the day and date first above stated.

___________________________________________________

(Name of Borrower)(Name of Lender)

By:______________________________By:_______________________________

_____________________________________________________

(Printed name & Office in Corporation)(Printed name & Office in Corporation

_____________________________________________________

(Signature of Officer) (Signature of Officer)