Fill and Sign the Business Credit Application All Tex Supply Form

Practical advice on finishing your ‘Business Credit Application All Tex Supply’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature option for individuals and organizations. Bid farewell to the tedious process of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your approach to document management. Whether you need to sign forms or collect signatures, airSlate SignNow simplifies the entire process, requiring only a few clicks.

Adhere to this comprehensive guideline:

- Log into your account or initiate a free trial with our service.

- Select +Create to upload a file from your device, cloud, or our template library.

- Access your ‘Business Credit Application All Tex Supply’ in the editor.

- Click Me (Fill Out Now) to set up the form on your end.

- Add and assign fillable fields for other participants (if needed).

- Continue with the Send Invite options to request eSignatures from others.

- Download, print your version, or convert it into a reusable template.

Don't worry if you need to collaborate with your colleagues on your Business Credit Application All Tex Supply or send it for notarization—our solution has everything you require to accomplish such tasks. Register with airSlate SignNow today and elevate your document management to a new standard!

FAQs

-

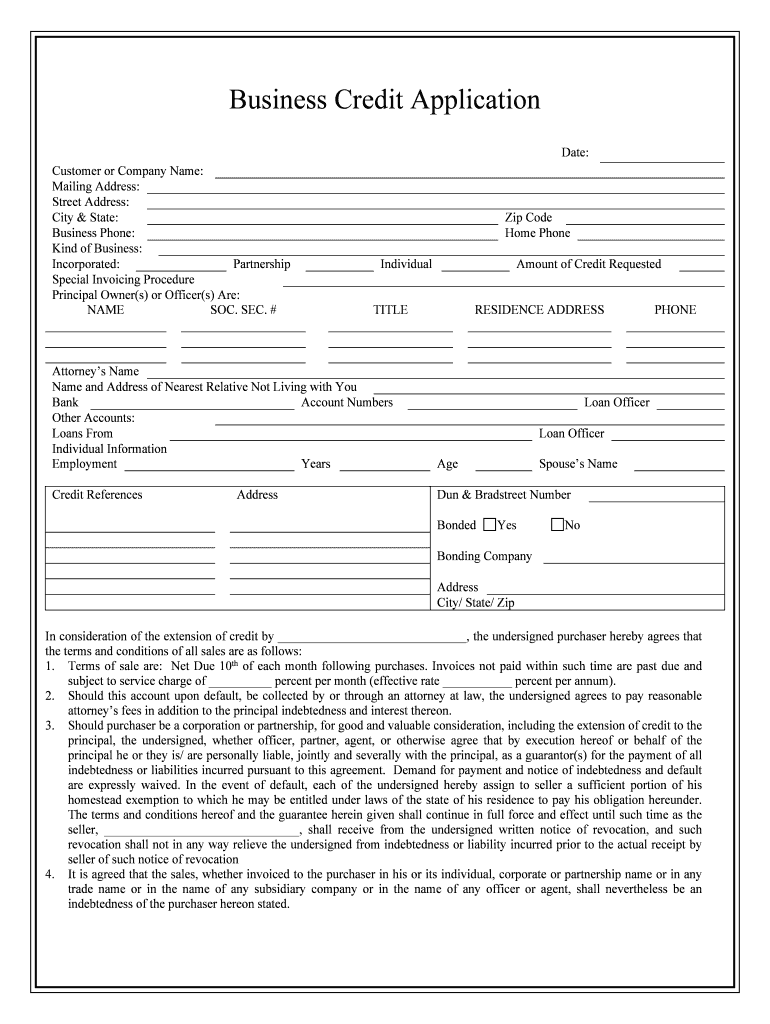

What is the Business Credit Application All Tex Supply?

The Business Credit Application All Tex Supply is a streamlined digital form that allows businesses to apply for credit efficiently. This application simplifies the process of gathering necessary information and ensures that all required details are captured accurately.

-

How does the Business Credit Application All Tex Supply benefit my business?

Using the Business Credit Application All Tex Supply can signNowly speed up the credit approval process. It reduces paperwork, minimizes errors, and enhances communication between your business and the credit provider, ultimately leading to quicker decisions.

-

What features are included in the Business Credit Application All Tex Supply?

The Business Credit Application All Tex Supply includes customizable templates, eSignature capabilities, and secure document storage. These features ensure that your application process is not only efficient but also compliant with industry standards.

-

Is the Business Credit Application All Tex Supply easy to integrate with existing systems?

Yes, the Business Credit Application All Tex Supply is designed to integrate seamlessly with various business management systems. This allows for a smooth transition and ensures that your existing workflows are not disrupted.

-

What is the pricing structure for the Business Credit Application All Tex Supply?

The pricing for the Business Credit Application All Tex Supply is competitive and varies based on the features you choose. We offer flexible plans to accommodate businesses of all sizes, ensuring you only pay for what you need.

-

Can I customize the Business Credit Application All Tex Supply for my specific needs?

Absolutely! The Business Credit Application All Tex Supply is fully customizable, allowing you to tailor the application to meet your specific requirements. You can add or remove fields, adjust branding, and modify the layout as needed.

-

How secure is the Business Credit Application All Tex Supply?

Security is a top priority for the Business Credit Application All Tex Supply. We utilize advanced encryption and secure storage solutions to protect your sensitive information, ensuring that your data remains confidential and safe.

The best way to complete and sign your business credit application all tex supply form

Find out other business credit application all tex supply form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles