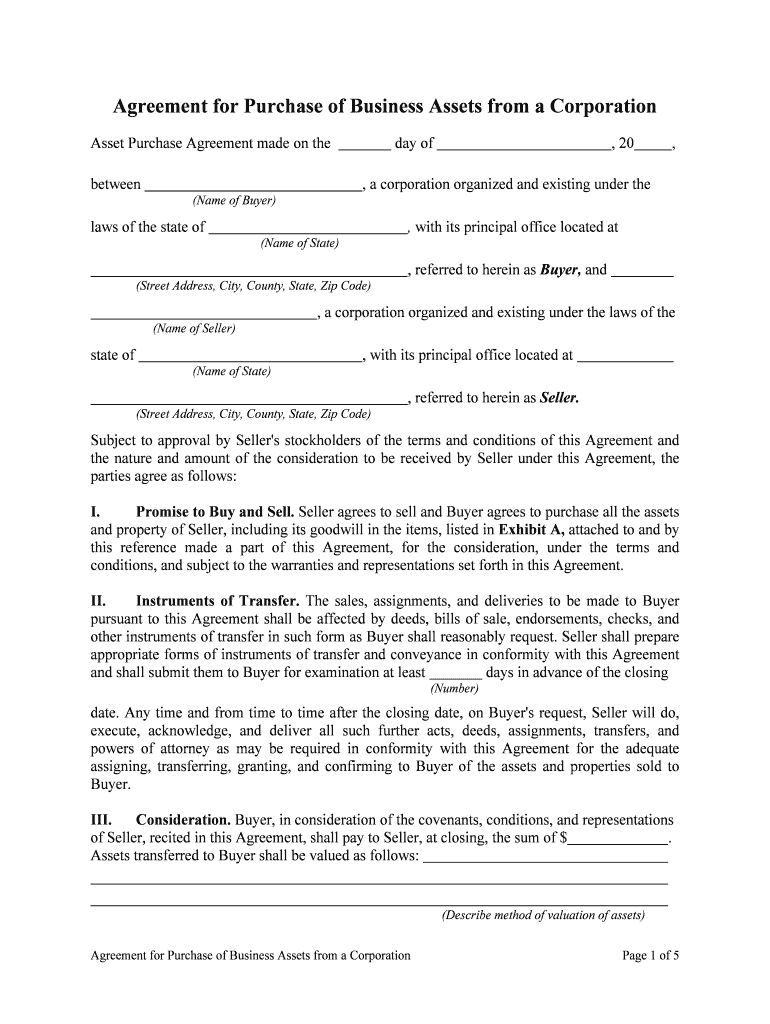

Agreement for Purchase of Business Assets from a Corporation Page 1 of 5 Agreement for Purchase of Business Assets from a Corporation Asset Purchase Agreement made on the day of , 20 , between , a corporation organized and existing under the (Name of Buyer) laws of the state of , with its principal office located at (Name of State) , referred to herein as Buyer, and (Street Address, City, County, State, Zip Code) , a corporation organized and existing under the laws of the (Name of Seller) state of , with its principal office located at (Name of State) , referred to herein as Seller. (Street Address, City, County, State, Zip Code) Subject to approval by Seller's stockholders of the terms and conditions of this Agreement and

the nature and amount of the consideration to be received by Seller under this Agreement, the

parties agree as follows:

I.Promise to Buy and Sell. Seller agrees to sell and Buyer agrees to purchase all the assets

and property of Seller, including its goodwill in the items, listed in Exhibit A, attached to and by

this reference made a part of this Agreement, for the consideration, under the terms and

conditions, and subject to the warranties and representations set forth in this Agreement.

II. Instruments of Transfer. The sales, assignments, and deliveries to be made to Buyer

pursuant to this Agreement shall be affected by deeds, bills of sale, endorsements, checks, and

other instruments of transfer in such form as Buyer shall reasonably request. Seller shall prepare

appropriate forms of instruments of transfer and conveyance in conformity with this Agreement

and shall submit them to Buyer for examination at least days in advance of the closing (Number) date. Any time and from time to time after the closing date, on Buyer's request, Seller will do,

execute, acknowledge, and deliver all such further acts, deeds, assignments, transfers, and

powers of attorney as may be required in conformity with this Agreement for the adequate

assigning, transferring, granting, and confirming to Buyer of the assets and properties sold to

Buyer.III. Consideration. Buyer, in consideration of the covenants, conditions, and representations

of Seller, recited in this Agreement, shall pay to Seller, at closing, the sum of $ .

Assets transferred to Buyer shall be valued as follows:

(Describe method of valuation of assets)

Agreement for Purchase of Business Assets from a Corporation Page 2 of 5The purchase price shall be allocated as follows: . (Allocation of purchase price to assets being sold) IV.Warranties and Covenants of Seller. Seller agrees, represents, and warrants as follows:A. Seller is duly incorporated and authorized to do Business under the laws of . (Name of State) B. The execution of this Agreement has been duly authorized by the Board of Directors of Seller.C. Seller shall use its best efforts to obtain, on or before , the (Date) approval of its shareholders of the terms and conditions of this Agreement and of the

nature and amount of the consideration to be received by Seller under this Agreement.D. The balance sheets and profit and loss statements of Seller, attached to this

Agreement as Exhibit B and by this reference made part of this Agreement, fully and

correctly reflect the financial condition, assets and liabilities, and operation of Seller as of

the dates stated in such documents.E. The list of accounts and notes receivable, attached as Exhibit C and by this

reference made a part of this Agreement, is complete as of the date of this Agreement. If

any accounts or notes receivable so listed or acquired by Seller before the closing date are

not fully paid when due, Seller agrees to pay them in full on written notice by Buyer of

any default, provided that Seller's liability shall be limited to the amount exceeding the

reserve for bad debts shown in Seller's balance sheet.F. Seller has good and marketable title to all assets and property sold under this

Agreement, except as otherwise stated in the Exhibits attached to this Agreement and

except for property disposed of or encumbered in the ordinary course of Business. All

tangible property sold under this Agreement is in good condition and repair and conforms

to all applicable zoning, building, safety, and other regulations.G. Attached as Exhibit D, and by this reference made a part of this Agreement, is a

list of insurance policies in effect with respect to Seller's property and Business as of the

date of this Agreement. Seller agrees to continue this insurance, or insurance with similar

coverage, until the closing date.H. Seller agrees to use its best efforts to obtain the necessary consents for the

assignment or transfer of any contract, lease, license, or permit to be assigned or

transferred under this Agreement and to perform its duties under such contracts, leases,

licenses, and permits without default until the closing date.I. Seller agrees to disclose to Buyer not later than days after the closing (Number) date, all trade secrets, customer lists, and technical information held or controlled by

Seller and relating to the Business sold under this Agreement.

Agreement for Purchase of Business Assets from a Corporation Page 3 of 5K. Until the closing date of this Agreement, Seller shall not, without the written

consent of Buyer, dispose of or encumber any of the assets or property to be sold under

this Agreement, with the exception of any transactions occurring in the ordinary course of

Seller's Business. Seller shall use its best efforts to preserve its Business and goodwill.

Seller further agrees to permit Buyer and its representatives full access to its property and

records any time prior to the closing date during normal Business hours and to supply all

information concerning its property and affairs as Buyer may reasonably demand.V.Closing Date. The closing date shall be , and the closing shall take (Date) place on that date at : , in the offices of (e.g., Seller or Buyer) at (Date) , or at such other time and place as (Street Address, City, County, State, Zip Code)the parties shall agree.VI.Indemnification and Resolution of Claims. A.In case of claim of breach of contract by either party, the party so claiming shall notify the other party in writing, indicating the alleged breach and the amount of

damages claimed. In case of dispute as to the existence of a breach, or the amount of

damages, the parties shall submit the dispute to Arbitration as set forth in Section XVII

below. B.Except as otherwise expressly provided in this Agreement, Seller shall indemnify

Buyer against any liability connected with the assets or Business sold under this

Agreement accruing as a result of acts or omissions occurring before the closing date, and

Buyer shall indemnify Seller against any such liability accruing as a result of acts or

omissions occurring after the closing date. Each party to this Agreement shall cooperate

with the other party in defending claims for which the other party is or may be liable

under this provision by giving notice to the other party of the assertion or existence of

any such claim and by furnishing such documents and information as may be useful in

defense of such claims.VII. Transfer of Title and Risk of Loss. Title to the assets and property sold under this

Agreement shall pass to Buyer on the closing date on delivery to it of the proper instruments of

transfer. If at any time any of the tangible property sold under this Agreement shall have been

lost or damaged, except for damage or loss through use and wear in the ordinary course of

Business, by any cause or event beyond the reasonable power and control of Seller, Buyer shall

be entitled to collect all insurance proceeds collectible by reason of such loss or damage or, if the

amount of the loss or damage exceeds % of the value of that property, Buyer shall have

the right to elect to complete the sale and collect all insurance proceeds or to terminate this

Agreement in lieu of any other right or remedy. If Buyer becomes entitled to collect insurance

under this provision, the purchase price of lost or damaged assets covered by insurance shall not

be reduced.

VIII. Impossibility of Performance. If, except as otherwise provided in this Agreement, either

party shall be prevented from completing the sale for any cause beyond its reasonable power and

Agreement for Purchase of Business Assets from a Corporation Page 4 of 5control, the other party may elect to accept partial performance or, in lieu of any other remedy,

elect to terminate this Agreement.VIII.Sales and Use Taxes. Any sales or use tax payable by reason of the sale of any of the

assets under this Agreement shall be paid by Buyer, and such payment shall not be construed as

part of the purchase price. Seller agrees to furnish to Buyer resale certificates for any items sold

to Buyer for resale. Seller shall also obtain and deliver to Buyer a clearance receipt of the for sales and use taxes due from Seller. (Name of Government Agency)IX.Inventory of Goods to be Sold. An inventory of all stock in trade, supplies, fixtures,

furnishings, and equipment shall be taken by Seller and Buyer on . The (Date) inventory of Seller's stock in trade shall set forth the aggregate value for which the items are to

be sold under this Agreement based on Seller's actual cost for each item.X.Books and Records. Sellers shall have the right to retain minute books, stock books, and

other corporate records of

Corporation having exclusively to do with a corporate organization or

capitalization. All other records and books of account of every kind and nature shall be delivered

to, and become the property of, Buyer. Each party shall have reasonable access to and the right to

make extract copies of all books, records, and documents referred to in this agreement that are in

the possession of the other party.

XI.Costs. Buyer shall bear the cost of title insurance premiums and record costs. All other

costs incidental to the sale under this Agreement shall be borne by the parties equally.XII.Severability. The invalidity of any portion of this Agreement will not and shall not be

deemed to affect the validity of any other provision. If any provision of this Agreement is held to

be invalid, the parties agree that the remaining provisions shall be deemed to be in full force and

effect as if they had been executed by both parties subsequent to the expungement of the invalid

provision. XIII.No Waiver. The failure of either party to this Agreement to insist upon the performance

of any of the terms and conditions of this Agreement, or the waiver of any breach of any of the

terms and conditions of this Agreement, shall not be construed as subsequently waiving any such

terms and conditions, but the same shall continue and remain in full force and effect as if no such

forbearance or waiver had occurred.XIV.Governing Law. This Agreement shall be governed by, construed, and enforced in

accordance with the laws of the State of . (Name of State) XV.Notices. Unless provided herein to the contrary, any notice provided for or concerning

this Agreement shall be in writing and shall be deemed sufficiently given when sent by certified

or registered mail if sent to the respective address of each party as set forth at the beginning of

this Agreement.

Agreement for Purchase of Business Assets from a Corporation Page 5 of 5XVI. Attorney’s Fees. In the event that any lawsuit is filed in relation to this Agreement, the

unsuccessful party in the action shall pay to the successful party, in addition to all the sums that

either party may be called on to pay, a reasonable sum for the successful party's attorney fees.XVII. Mandatory Arbitration. Notwithstanding the foregoing, and anything herein to the

contrary, any dispute under this Agreement shall be required to be resolved by binding

arbitration of the parties hereto. If the parties cannot agree on an arbitrator, each party shall select

one arbitrator and both arbitrators shall then select a third. The third arbitrator so selected shall

arbitrate said dispute. The arbitration shall be governed by the rules of the American Arbitration

Association then in force and effect. XVIII.Entire Agreement. This Agreement shall constitute the entire agreement between the

parties and any prior understanding or representation of any kind preceding the date of this

Agreement shall not be binding upon either party except to the extent incorporated in this

Agreement.XIX. Modification of Agreement. Any modification of this Agreement or additional

obligation assumed by either party in connection with this Agreement shall be binding only if

placed in writing and signed by each party or an authorized representative of each party.XX.Assignment of Rights. The rights of each party under this Agreement are personal to that

party and may not be assigned or transferred to any other person, firm, corporation, or other

entity without the prior, express, and written consent of the other party.XXI.Counterparts. This Agreement may be executed in any number of counterparts, each of

which shall be deemed to be an original, but all of which together shall constitute but one and the

same instrument.XXII. Compliance with Laws. In performing under this Agreement, all applicable

governmental laws, regulations, orders, and other rules of duly-constituted authority will be

followed and complied with in all respects by both parties.WITNESS our signatures as of the day and date first above stated. (Name of Buyer) (Name of Seller) By: By: (Printed Name & Office in Corporation) (Printed Name & Office in Corporation) (Signature of Officer) (Signature of Officer)

Attach Exhibits