decedent's will and codicils, if any, be admitted to

probate. (name):

be appointed

$ bond be fixed. The bond will be furnished by an admitted surety insurer or

as

otherwise provided bylaw. (Specify reasons in Attachment 2 if the amount is different from the maximum

required by Prob. Code, § 8482.)

$ in deposits in a blocked account be allowed. Receipts will be filed.

(Specify institution and location):

$

This petition is not the first petition for appointment of a personal representative with general powers filed in

this proceeding. The first petition was filed on (date) CASE NUMBER

HEARING DATE–––––

–––––

–––––

–––––

––––– –––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

––

–––

––

––– –––––

––

–––

––

––– ––

––– –––––

––

–––

––

––– ––––– –––––

––

––

–––––

––

–– –––––

––

––

––

–– ––

–– ––

––

–– –––––

–– –––––

–––––

––

––

––

––

––

––

––

–– –––––

––

––

––––– DE-

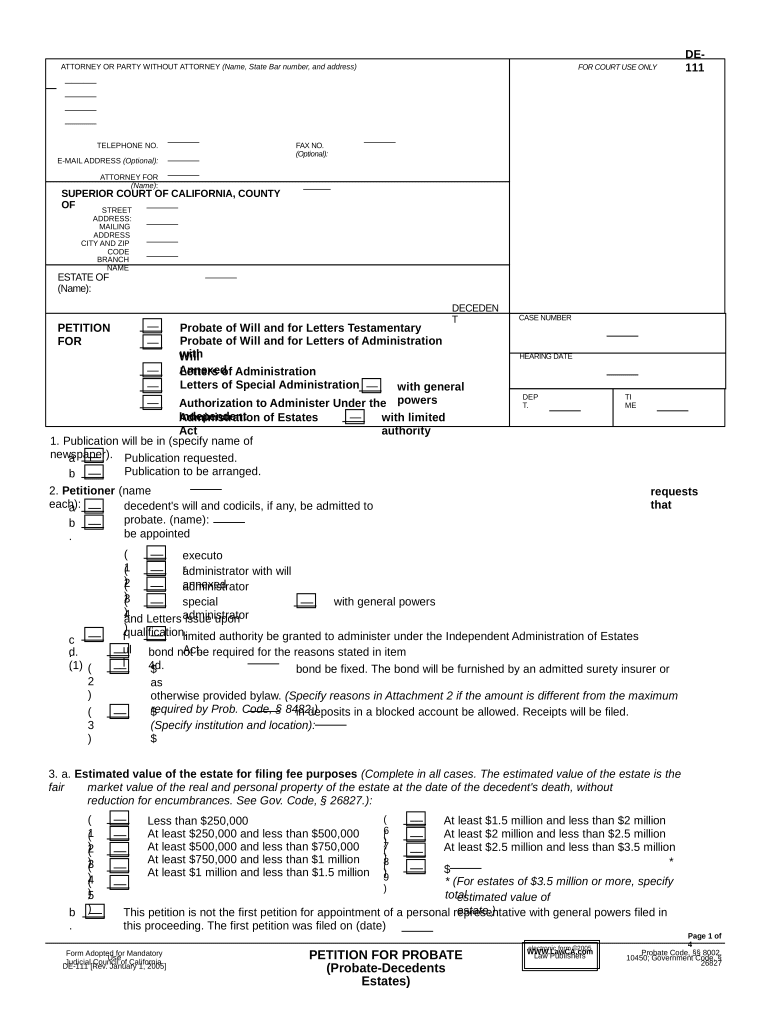

111ATTORNEY OR PARTY WITHOUT ATTORNEY (Name, State Bar number, and address)

FOR COURT USE ONLY

TELEPHONE NO. FAX NO.

(Optional):

E-MAIL ADDRESS (Optional):

ATTORNEY FOR

(Name) :

SUPERIOR COURT OF CALIFORNIA, COUNTY

OF

STREET

ADDRESS:

MAILING

ADDRESS

CITY AND ZIP

CODE

BRANCH

NAME

ESTATE OF

(Name):

DECEDEN

T

PETITION

FOR Probate of Will and for Letters Testamentary

Probate of Will and for Letters of Administration

with

Will

Annexed

Letters of Administration

Letters of Special Administration

with general

powers

Authorization to Administer Under the

Independent DEP

T. TI

ME

Administration of Estates

Act with limited

authority

1. Publication will be in (specify name of

newspaper).

a

.

b

. Publication requested.

Publication to be arranged.

2. Petitioner (name

each): requests

that

a

.

b

.

(

1

) executo

r

(

2

) administrator with will

annexed

(

3

) administrator

(

4

) special

administrator with general powers

and Letters issue upon

qualification.

c

.

. f

ul

l limited authority be granted to administer under the Independent Administration of Estates

Act.

d.

(1) bond not be required for the reasons stated in item

4d.

(

2

)

(

3

)

3. a. Estimated value of the estate for filing fee purposes (Complete in all cases. The estimated value of the estate is the

fair market value of the real and personal property of the estate at the date of the decedent's death, without

reduction for encumbrances. See Gov. Code, § 26827.):

(

1

) Less than $250,000

At least $250,000 and less than $500,000

At least $500,000 and less than $750,000

At least $750,000 and less than $1 million

At least $1 million and less than $1.5 million (

6

)(

2

) (

7

)(

3

) (

8

) At least $1.5 million and less than $2 million

At least $2 million and less than $2.5 million

At least $2.5 million and less than $3.5 million

(

4

) (

9

) $ *

(

5

) estimated value of

estate.)* (For estates of $3.5 million or more, specify

total

b

.

Page 1 of

4

Form Adopted for Mandatory

Use

Judicial Council of California

DE-111 [Rev. January 1, 2005] PETITION FOR PROBATE

(Probate-Decedents

Estates) Probate Code, §§ 8002,

10450; Government Code, §

26827electronic form ã 2005

WWW.LawCA.com

Law Publishers

Petitioner is a person entitled to Letters. (If necessary, explain priority in Attachment 4(2)

(a).) Petitioner is a nominee of a person entitled to Letters. (Affix nomination as Attachment

4(2)(b).) Petitioner is related to the decedent as (specify) :

–––––

–––––

––––– –––––

––

––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–––––

–– ––

––

––

––

––

–– –––––

–– –––––

–––––

––

––

––

––

–– –– ––

–– –––––

––

––

––

–– –––––

––ESTATE OF

(Name) CASE

NUMBER:

DECEDEN

T

4 a

Decedent died on

(date): at

(place):

(

1

) a resident of the county named

above.

(

2

) a nonresident of California and left an estate in the county named above located at (specify location

permitting publication in the newspaper named in item 1):

b. Street address, city, and county of decedent's residence at time of death (specify):

c. Character and estimated value of the property of the estate (complete in all cases):

(1 ) Personal

property: $

(2) Annual gross income

from

(a) real

property: $

(b) personal

property: $

(3) Subtotal (add (1) and (2)):

(4) Gross fair market value of real property:

(5) (Less) Encumbrances:

(6) Net value of real property:

(7) Total (add (3) and (6)): $

$

$

(

)

$

$

d.

(1) Will waives

bond. Special administrator is the named executor, and the will waives

bond.

(

2

) All beneficiaries are adults and have waived bond, and the will does not require a

bond. (Affix waiver as Attachment 4d(2).)

(

3

)(

4

)e.

(1) All heirs at law are adults and have waived bond. (Affix waiver as Attachment

4d(3).) Sole personal representative is a corporate fiduciary or an exempt

government agency.

(

2

) Decedent died intestate.

Copy of decedent's will

dated: codicil dated (specify for

each):

are affixed as Attachment 4e(2).

(Include typed copies of handwritten documents and English translations of foreign-language documents.)

The will and all codicils are self-proving (Prob. Code, § 8220).

f. Appointment of personal representative (check all applicable

boxes):

(1) Appointment of executor or administrator with will annexed:

(

a

) Proposed executor is named as executor in the will and consents to act.

(

b

) No executor is named in the will.

(

c

)

(

d

) deat

hProposed personal representative is a nominee of a person entitled to Letters.

(Affix nomination as Attachment 4f(1)(c).)

Other named executors will not act because of

declinatio

n

other reasons

(specify):

Continued in Attachment 4f(l)(d).

(2) Appointment of

administrator:

(

a

)(

b

)(

c

)(

3

) Appointment of special administrator requested (Specify grounds and requested powers in Attachment 4(3).)

DE-111 [Rev. January 1,

2005] PETITION FOR PROBATE

(Probate-Decedents

Estates) Page 2 of

4electronic form ã 2005

WWW.LawCA.com

Law Publishers

–––––

–––––

––

–– –––––

––

––

––

––

––

––

––

––

––

––

––

––

––

––

––

–– ––

––

––

––

––

––

––

––

––

––

––

––

––

––

––

––

––

––

––ESTATE OF

(Name) CASE

NUMBER:

DECEDEN

T

4. g. Proposed personal representative is

a

resident of California.

nonresident of California (specify permanent

address):

resident of the United States.

nonresident of the United States.

5

. Decedent's will does not preclude administration of this estate under the Independent Administration of Estates

Act.

6. a. Decedent is survived by (check items (1) or (2), and (3) or (4), and (5) or (6), and (7) or

(8))

(

1

) spous

e.

(

2

) no spouse as

follows:

(

a

)(

b

) divorced or never

married. spouse

deceased.

(

3

)(

4

) registered domestic partner.

no registered domestic

partner.

(See Fam. Code, § 297.5(c); Prob. Code, §§ 37(b), 6401(c), and 6402.)

(

5

) child as follows:

(

a

)(

b

) natural or adopted.

natural adopted by a third

party.

(

6

) no child.

(

7

) issue of a predeceased child.

(

8

) no issue of a predeceased

child.

b.

Decedent i

s is not survived by a stepchild or foster child or children who would have been adopted

by

decedent but for a legal barrier. (See Prob. Code, §

6454 )

7. (Complete if decedent is survived by (1) a spouse or registered domestic partner but no issue (only a or b apply),

or (2) no spouse, registered domestic partner, or issue. (Check the first box that applies):

a

.

b

.

c

.

d

.

e

.

f

. Decedent is survived by a parent or parents who are listed in item 9.

Decedent is survived by issue of deceased parents, all of whom are listed in item 9.

Decedent is survived by a grandparent or grandparents who are listed in item 9.

Decedent is survived by issue of grandparents, all of whom are listed in item 9.

Decedent is survived by issue of a predeceased spouse, all of whom are listed in item 9.

Decedent is survived by next of kin, all of whom are listed in item 9.

g

.

h

. Decedent is survived by parents of a predeceased spouse or issue of those parents, if both are predeceased, all of

whom are listed in item 9.

Decedent is survived by no known next of kin.

8. (Complete only if no spouse or issue survived decedent.)

a

.

b

.

(

1

) Decedent had no predeceased spouse.

Decedent had a predeceased spouse

who

died not more than 15 years before decedent and who owned an interest in real property that

passed to decedent,

(

2

) died not more than five years before decedent and who owned personal property valued at

$10,000or more that passed to decedent,

(If you checked (1) or (2), check only the first box that applies):

(

a

)(

b

)(

c

)(

d

)(

e

) Decedent is survived by issue of a predeceased spouse, all of whom are listed in item 9.

Decedent is survived by a parent or parents of the predeceased spouse who are listed in item 9.

Decedent is survived by issue of a parent of the predeceased spouse, all of whom are listed in item

9. Decedent is survived by next of kin of the decedent, all of whom are listed in item 9.

Decedent is survived by next of kin of the predeceased spouse, all of whom are listed in item 9.

(

3

) neither (1) nor (2)

apply.

DE-111 [Rev. January 1,

2005] Page 3 of

4

PETITION FOR PROBATE

(Probate-Decedents

Estates) electronic form ã 2005

WWW.LawCA.com

Law Publishers

–––––

–––––

–––––

–––––––––– –––––

–––––

–––––

–––––

––

10. Number of pages attached:

–––––

–––––

–––––

–––––

––ESTATE OF

(Name) CASE

NUMBER:

DECEDEN

T

9

. Listed below are the names, relationships to decedent, ages, and addresses, so far as known to or reasonably ascertainable

by petitioner, of (1) all persons mentioned in decedent's will or any codicil, whether living or deceased-, (2) all persons

named or checked in items 2, 6, 7, and 8; and (3) all beneficiaries of a trust named in decedent's will or any codicil in which

the trustee and personal representative are the same person.

Name and relationship to decedent Ag

e Addre

ss

Continued on Attachment

9.

Date

:

(TYPE OR PRINT NAME OF

ATTORNEY) (SIGNATURE OF

ATTORNEY)*

* (Signatures of all petitioners are also required. All petitioners must sign, but the petition may be verified by any one of them (Prob. Code, §§ 1020, 1021 , Cal. Rules of Court, rule

7.103).)

I declare under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Dat

e:

(TYPE OR PRINT NAME OF

PETITIONER) (SIGNATURE OF

PETITIONER)

(TYPE OR PRINT NAME OF

PETITIONER) (SIGNATURE OF

PETITIONER)

Signatures of additional petitioners follow last attachment.

DE-111 [Rev. January 1,

2005] PETITION FOR PROBATE

(Probate-Decedents

Estates) Page 4 of

4electronic form ã 2005

WWW.LawCA.com

Law Publishers

Valuable tips on finishing your ‘Ca Probate Form’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and companies. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the powerful features integrated into this user-friendly and affordable platform and transform your method of document management. Whether you need to approve forms or collect signatures, airSlate SignNow takes care of it all seamlessly, requiring merely a few clicks.

Adhere to this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our form library.

- Open your ‘Ca Probate Form’ in the editor.

- Select Me (Fill Out Now) to prepare the form on your end.

- Insert and allocate fillable fields for other participants (if needed).

- Proceed with the Send Invite settings to request eSignatures from others.

- Download, print your copy, or convert it into a reusable template.

No need to worry if you need to work with your colleagues on your Ca Probate Form or send it for notarization—our platform offers everything you need to accomplish these tasks. Register with airSlate SignNow today and elevate your document management to a new standard!