- Electronic Signature

- Templates

- Other

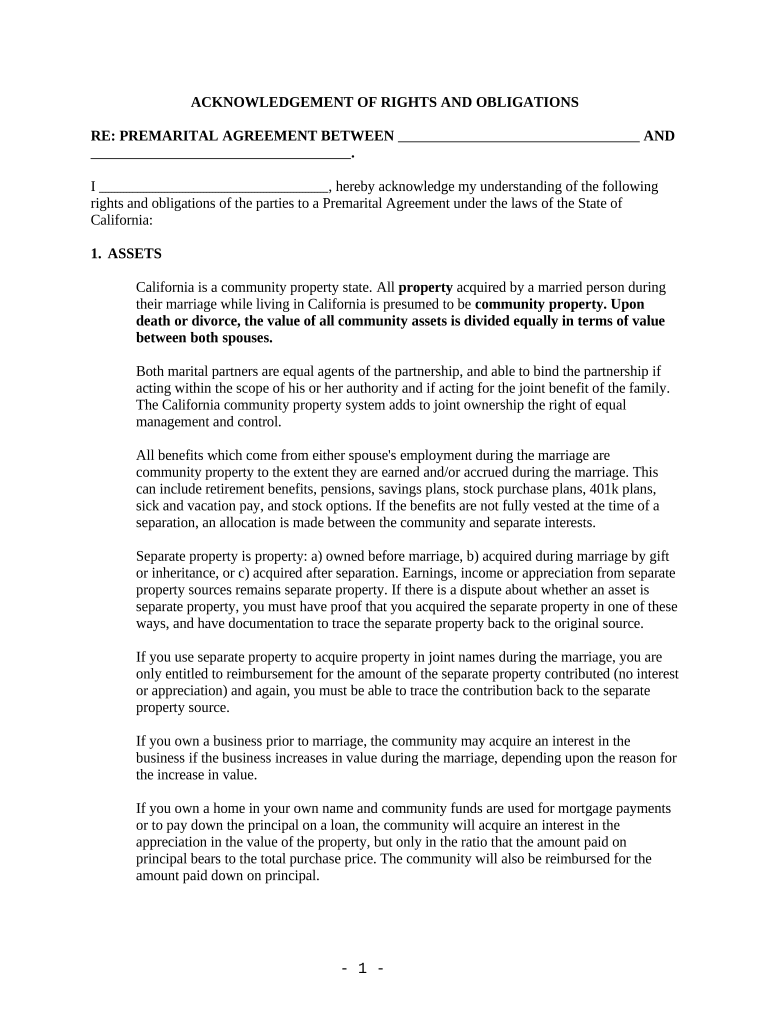

- California prenuptial premarital agreement with financial statements california form

Fill and Sign the California Prenuptial Premarital Agreement with Financial Statements California Form

How it works

Rate template

Satisfied

Useful suggestions for preparing your ‘California Prenuptial Premarital Agreement With Financial Statements California’ online

Are you fed up with the troubles of handling documents? Look no further than airSlate SignNow, the premier eSignature solution for individuals and businesses. Say farewell to the tedious process of printing and scanning papers. With airSlate SignNow, you can effortlessly complete and sign documents online. Utilize the extensive features bundled into this user-friendly and affordable platform and transform your method of document management. Whether you need to endorse papers or collect eSignatures, airSlate SignNow manages it all seamlessly, requiring only a few clicks.

Follow this detailed guide:

- Log in to your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form library.

- Open your ‘California Prenuptial Premarital Agreement With Financial Statements California’ in the editor.

- Click Me (Fill Out Now) to finish the document on your part.

- Add and assign fillable fields for others (if needed).

- Proceed with the Send Invite configurations to request eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

Don’t stress if you need to cooperate with your colleagues on your California Prenuptial Premarital Agreement With Financial Statements California or send it for notarization—our solution offers everything required to accomplish such tasks. Sign up with airSlate SignNow today and enhance your document management to a new level!

FAQs

Here is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

-

What is a prenuptial agreement in California?

A prenuptial agreement in California is a legal contract that couples create before marriage to outline the distribution of assets and financial responsibilities in the event of divorce. This agreement helps protect individual assets and can clarify financial obligations, making it an essential tool for many couples in California.

-

Why should I consider a prenuptial agreement in California?

Considering a prenuptial agreement in California is beneficial for protecting your assets and ensuring clarity in financial matters before tying the knot. It can prevent disputes in the event of a divorce and provide peace of mind regarding property rights, making it a smart choice for many couples.

-

How much does it cost to create a prenuptial agreement in California?

The cost of creating a prenuptial agreement in California can vary widely, depending on the complexity of the agreement and whether you hire an attorney. Basic agreements can start from a few hundred dollars when using online services, while attorney-drafted agreements may cost signNowly more. It's crucial to consider the value of protecting your assets.

-

What features does airSlate SignNow offer for signing prenuptial agreements in California?

airSlate SignNow provides a user-friendly platform for eSigning prenuptial agreements in California. Key features include customizable templates, secure document storage, and real-time tracking of signatures, making the process efficient and convenient for couples looking to finalize their agreements.

-

Can I integrate airSlate SignNow with other applications for my prenuptial agreement in California?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline the process of creating and signing your prenuptial agreement in California. This flexibility enables you to connect your existing workflow tools, enhancing productivity and ensuring all necessary documents are easily accessible.

-

What are the benefits of using airSlate SignNow for my prenuptial agreement in California?

Using airSlate SignNow for your prenuptial agreement in California comes with numerous benefits, including ease of use, cost-effectiveness, and enhanced security. The platform simplifies the signing process and ensures that your agreements are legally binding, all while providing a seamless digital experience.

-

Is a prenuptial agreement in California enforceable?

Yes, a prenuptial agreement in California is enforceable as long as it meets specific legal requirements, such as being in writing and signed by both parties. To ensure enforceability, it's advisable to consult with a legal professional who can help you draft and review the agreement properly.

The best way to complete and sign your california prenuptial premarital agreement with financial statements california form

Save time on document management with airSlate SignNow and get your california prenuptial premarital agreement with financial statements california form eSigned quickly from anywhere with our fully compliant eSignature tool.

How to fill out and sign documents online

In the past, coping with paperwork took lots of time and effort. But with airSlate SignNow, document management is quick and easy. Our powerful and easy-to-use eSignature solution enables you to effortlessly fill out and eSign your california prenuptial premarital agreement with financial statements california form online from any internet-connected device.

Follow the step-by-step guide to eSign your california prenuptial premarital agreement with financial statements california form template online:

- 1.Register for a free trial with airSlate SignNow or log in to your account with password credentials or SSO authentication.

- 2.Click Upload or Create and import a form for eSigning from your device, the cloud, or our form catalogue.

- 3.Click on the document name to open it in the editor and use the left-side menu to complete all the empty fields accordingly.

- 4.Put the My Signature field where you need to eSign your sample. Type your name, draw, or upload a photo of your regular signature.

- 5.Click Save and Close to accomplish editing your completed document.

After your california prenuptial premarital agreement with financial statements california form template is ready, download it to your device, export it to the cloud, or invite other parties to eSign it. With airSlate SignNow, the eSigning process only takes a couple of clicks. Use our robust eSignature tool wherever you are to deal with your paperwork efficiently!

How to complete and sign paperwork in Google Chrome

Completing and signing paperwork is simple with the airSlate SignNow extension for Google Chrome. Installing it to your browser is a fast and beneficial way to deal with your forms online. Sign your california prenuptial premarital agreement with financial statements california form template with a legally-binding electronic signature in just a couple of clicks without switching between tools and tabs.

Follow the step-by-step guide to eSign your california prenuptial premarital agreement with financial statements california form template in Google Chrome:

- 1.Go to the Chrome Web Store, locate the airSlate SignNow extension for Chrome, and install it to your browser.

- 2.Right-click on the link to a form you need to sign and select Open in airSlate SignNow.

- 3.Log in to your account with your password or Google/Facebook sign-in buttons. If you don’t have one, sign up for a free trial.

- 4.Use the Edit & Sign toolbar on the left to fill out your sample, then drag and drop the My Signature option.

- 5.Insert a photo of your handwritten signature, draw it, or simply type in your full name to eSign.

- 6.Make sure all the details are correct and click Save and Close to finish editing your form.

Now, you can save your california prenuptial premarital agreement with financial statements california form sample to your device or cloud storage, email the copy to other people, or invite them to electronically sign your form via an email request or a secure Signing Link. The airSlate SignNow extension for Google Chrome enhances your document workflows with minimum time and effort. Try airSlate SignNow today!

How to fill out and sign paperwork in Gmail

Every time you receive an email containing the california prenuptial premarital agreement with financial statements california form for approval, there’s no need to print and scan a file or download and re-upload it to another tool. There’s a much better solution if you use Gmail. Try the airSlate SignNow add-on to quickly eSign any paperwork right from your inbox.

Follow the step-by-step guide to eSign your california prenuptial premarital agreement with financial statements california form in Gmail:

- 1.Go to the Google Workplace Marketplace and locate a airSlate SignNow add-on for Gmail.

- 2.Install the program with a related button and grant the tool access to your Google account.

- 3.Open an email with an attachment that needs signing and use the S symbol on the right panel to launch the add-on.

- 4.Log in to your airSlate SignNow account. Choose Send to Sign to forward the document to other parties for approval or click Upload to open it in the editor.

- 5.Put the My Signature option where you need to eSign: type, draw, or upload your signature.

This eSigning process saves efforts and only takes a few clicks. Utilize the airSlate SignNow add-on for Gmail to update your california prenuptial premarital agreement with financial statements california form with fillable fields, sign documents legally, and invite other parties to eSign them al without leaving your mailbox. Boost your signature workflows now!

How to fill out and sign forms in a mobile browser

Need to quickly fill out and sign your california prenuptial premarital agreement with financial statements california form on a mobile phone while working on the go? airSlate SignNow can help without the need to set up extra software programs. Open our airSlate SignNow tool from any browser on your mobile device and create legally-binding eSignatures on the go, 24/7.

Follow the step-by-step guidelines to eSign your california prenuptial premarital agreement with financial statements california form in a browser:

- 1.Open any browser on your device and go to the www.signnow.com

- 2.Create an account with a free trial or log in with your password credentials or SSO authentication.

- 3.Click Upload or Create and import a file that needs to be completed from a cloud, your device, or our form library with ready-to go templates.

- 4.Open the form and fill out the empty fields with tools from Edit & Sign menu on the left.

- 5.Put the My Signature area to the sample, then enter your name, draw, or add your signature.

In a few simple clicks, your california prenuptial premarital agreement with financial statements california form is completed from wherever you are. As soon as you're done with editing, you can save the file on your device, generate a reusable template for it, email it to other people, or ask them to eSign it. Make your documents on the go fast and effective with airSlate SignNow!

How to fill out and sign forms on iOS

In today’s business world, tasks must be accomplished rapidly even when you’re away from your computer. Using the airSlate SignNow app, you can organize your paperwork and sign your california prenuptial premarital agreement with financial statements california form with a legally-binding eSignature right on your iPhone or iPad. Install it on your device to close deals and manage forms from anywhere 24/7.

Follow the step-by-step guidelines to eSign your california prenuptial premarital agreement with financial statements california form on iOS devices:

- 1.Go to the App Store, search for the airSlate SignNow app by airSlate, and install it on your device.

- 2.Launch the application, tap Create to upload a template, and choose Myself.

- 3.Opt for Signature at the bottom toolbar and simply draw your autograph with a finger or stylus to eSign the sample.

- 4.Tap Done -> Save right after signing the sample.

- 5.Tap Save or use the Make Template option to re-use this paperwork in the future.

This process is so straightforward your california prenuptial premarital agreement with financial statements california form is completed and signed in just a few taps. The airSlate SignNow application works in the cloud so all the forms on your mobile device remain in your account and are available whenever you need them. Use airSlate SignNow for iOS to boost your document management and eSignature workflows!

How to fill out and sign documents on Android

With airSlate SignNow, it’s simple to sign your california prenuptial premarital agreement with financial statements california form on the go. Install its mobile app for Android OS on your device and start improving eSignature workflows right on your smartphone or tablet.

Follow the step-by-step guidelines to eSign your california prenuptial premarital agreement with financial statements california form on Android:

- 1.Go to Google Play, search for the airSlate SignNow application from airSlate, and install it on your device.

- 2.Sign in to your account or create it with a free trial, then upload a file with a ➕ key on the bottom of you screen.

- 3.Tap on the uploaded document and choose Open in Editor from the dropdown menu.

- 4.Tap on Tools tab -> Signature, then draw or type your name to eSign the template. Fill out empty fields with other tools on the bottom if required.

- 5.Utilize the ✔ key, then tap on the Save option to finish editing.

With an easy-to-use interface and total compliance with primary eSignature requirements, the airSlate SignNow app is the best tool for signing your california prenuptial premarital agreement with financial statements california form. It even works offline and updates all form changes when your internet connection is restored and the tool is synced. Fill out and eSign forms, send them for approval, and make re-usable templates whenever you need and from anywhere with airSlate SignNow.

Related links california prenuptial premarital agreement with financial statements california form

- 2 0 2 1 FEDERAL & CALIFORNIA TAX UPDATE ... Annual Report ... agreement regarding any requirements for the release. FAMILY TAX CREDITS §24. Family Tax Credits. The child tax credit has been expanded ...

- The California Supreme Court Swings and Misses in Defining ... by JG Gherini · 2001 · Cited by 11 — A premarital agreement, also called a prenuptial agreement, is made before marriage to resolve property division issues if the marriage ends in divorce or ...

- Opinion No. 10-503 Aug 25, 2011 — When marriage partners have entered into a premarital agreement specifying that each spouse has no present or future financial interest ...

Find out other california prenuptial premarital agreement with financial statements california form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles

- Close deals in minutes instead of days

- Increase the productivity of your organization

- Sign documents anytime & anywhere