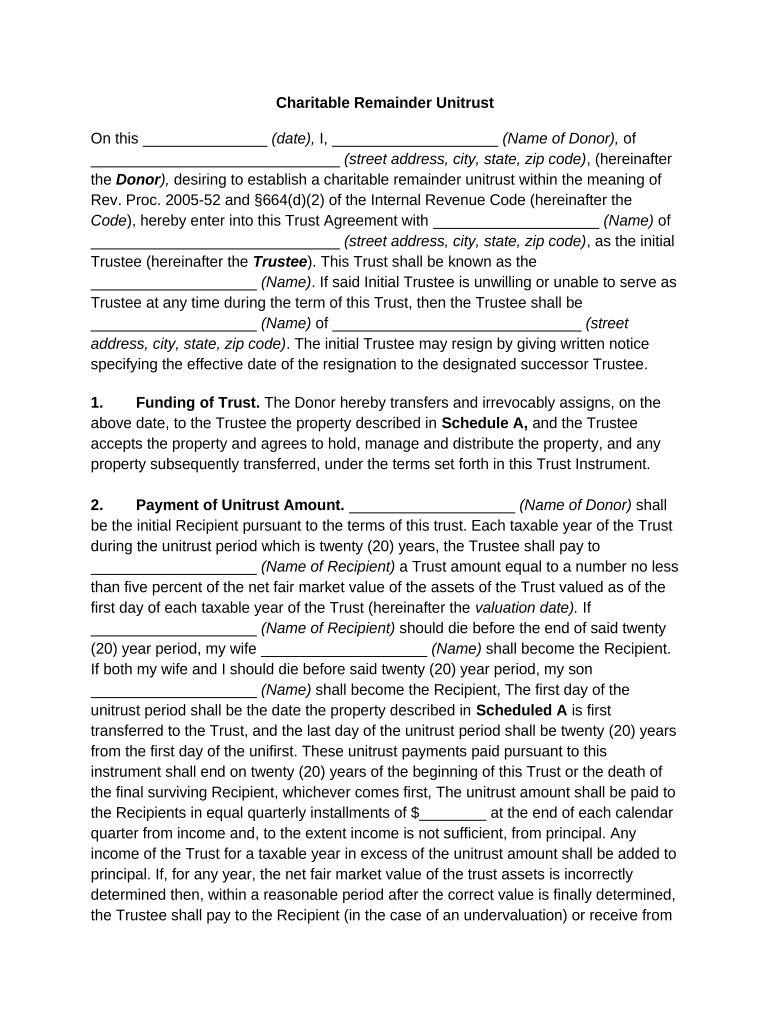

Charitable Remainder Unitrust

On this __________________ (date), I, ________________________ (Name of Donor), of

____________________________________ (street address, city, state, zip code) , (hereinafter

the Donor ), desiring to establish a charitable remainder unitrust within the meaning of

Rev. Proc. 2005-52 and §664(d)(2) of the Internal Revenue Code (hereinafter the

Code ), hereby enter into this Trust Agreement with ________________________ (Name) of

____________________________________ (street address, city, state, zip code) , as the initial

Trustee (hereinafter the Trustee ). This Trust shall be known as the

________________________ (Name) . If said Initial Trustee is unwilling or unable to serve as

Trustee at any time during the term of this Trust, then the Trustee shall be

________________________ (Name) of ____________________________________ ( street

address, city, state, zip code) . The initial Trustee may resign by giving written notice

specifying the effective date of the resignation to the designated successor Trustee.

1. Funding of Trust. The Donor hereby transfers and irrevocably assigns, on the

above date, to the Trustee the property described in Schedule A, and the Trustee

accepts the property and agrees to hold, manage and distribute the property, and any

property subsequently transferred, under the terms set forth in this Trust Instrument.

2. Payment of Unitrust Amount. ________________________ (Name of Donor) shall

be the initia l Recipient pursuant to the terms of this trust. Each taxable year of the Trust

during the unitrust period which is twenty (20) years, the Trustee shall pay to

________________________ (Name of Recipient) a Trust amount equal to a number no less

than five percent of the net fair market value of the assets of the Trust valued as of the

first day of each taxable year of the Trust (hereinafter the valuation date). If

________________________ (Name of Recipient) should die before the end of said twenty

(20) year period, my wife ________________________ (Name) shall become the Recipient.

If both my wife and I should die before said twenty (20) year period, my son

________________________ (Name) shall become the Recipient, The first day of the

unitrust period shall be the date the property described in Scheduled A is first

transferred to the Trust, and the last day of the unitrust period shall be twenty (20) years

from the first day of the unifirst. These unitrust payments paid pursuant to this

instrument shall end on twenty (20) years of the beginning of this Trust or the death of

the final surviving Recipient, whichever comes first, The unitrust amount shall be paid to

the Recipients in equal quarterly installments of $________ at the end of each calendar

quarter from income and, to the extent income is not sufficient, from principal. Any

income of the Trust for a taxable year in excess of the unitrust amount shall be added to

principal. If, for any year, the net fair market value of the trust assets is incorrectly

determined then, within a reasonable period after the correct value is finally determined,

the Trustee shall pay to the Recipient (in the case of an undervaluation) or receive from

the Recipient (in the case of an overvaluation) an amount equal to the difference

between the unitrust amount(s) properly payable and the unitrust amount(s) actually

paid.

3. Proration of Unitrust Amount. For a short taxable year and for the taxable year

during which the unitrust period ends, the Trustee shall prorate on a daily basis the

unitrust amount described pursuant to Paragraph 2 above or, if an additional

contribution is made to the Trust, the unitrust amount described in Paragraph 5.

4. Distribution to Charity.

A. At the termination of the unitrust period, the Trustee shall distribute all of

the then principal and income of the Trust (other than any amount due the

Recipient under the terms of this Trust) to the ________________________ (Name of

Scholarship Fund) , which shall be a nonprofit organization formed under the

laws of ________________________ (Name of State). The Scholarship Fund shall

be a permanently endowed fund, the income of which will provide annual

scholarship awards based on financial needs to one or more deserving

undergraduate students at ________________________ (Name) University. If the

remaining assets of this Trust are less than the minimum required to establish an

endowed fund at the time the gift is received, the University shall use these

assets as a current use fund with the same preferences as stated above. The

Scholarship Fund , which shall hereinafter be referred to as the Charitable

Organization.

B. If the Charitable Organization is not, or shall not be, an organization

described in §§170(b)(1)(A), 170(c), 2055(a) and 2522(a) of the Code at the time

when any principal or income of the Trust is to be distributed to it, then the

Trustee shall distribute the then principal and income to one or more

organizations described in §§170(b)(1)(A), 170(c), 2055(a) and 2522(a) of the

Code as the Trustee shall select, and in the proportions as the Trustee shall

decide, in the Trustee’s sole discretion.

5. Additional Contributions. If any additional contributions are made to the Trust

after the initial contribution, the unitrust amount for the year in which any additional

contribution is made shall be ______ percent of the sum of (a) the net fair market value

of the trust assets as of the valuation date (excluding the assets so added and any post-

contribution income from, and appreciation on, such assets during that year) and (b) for

each additional contribution during the year, the fair market value of the assets so

added as of the valuation date (including any post-contribution income from, and

appreciation on, such assets through the valuation date) multiplied by a fraction the

numerator of which is the number of days in the period that begins with the date of

contribution and ends with the earlier of the last day of the taxable year or the last day

of the unitrust period and the denominator of which is the number of days in the period

that begins with the first day of such taxable year and ends with the earlier of the last

day in such taxable year or the last day of the unitrust period. In a taxable year in which

an additional contribution is made on or after the valuation date, the assets so added

shall be valued as of the date of contribution, without regard to any post-contribution

income or appreciation, rather than as of the valuation date.

6. Deferral of the Unitrust Payment Allocable to Testamentary Transfer. All

property passing to the Trust by reason of the death of the last Recipient (hereinafter

called the testamentary transfer) shall be considered to be a single contribution that is

made on the date of the Recipient’s death. Notwithstanding the provisions of

Paragraphs 2 and 5 above, the obligation to pay the unitrust amount with respect to the

testamentary transfer shall commence with the date of death of the last Recipient.

Nevertheless, payment of the unitrust amount with respect to the testamentary transfer

may be deferred from the date of the Recipient’s death until the end of the taxable year

in which the funding of the testamentary transfer is completed. Within a reasonable time

after the end of the taxable year in which the testamentary transfer is completed, the

Trustee must pay to the Recipient (in the case of an underpayment) or receive from the

Recipient (in the case of an overpayment) the difference between any unitrust amounts

allocable to the testamentary transfer that were actually paid, plus interest, and the

unitrust amounts allocable to the testamentary transfer that were payable, plus interest.

The interest shall be computed for any period at the rate of interest, compounded

annually, that the federal income tax regulations under §664 of the Code prescribe for

this computation.

7. Unmarketable Assets. Whenever the value of a Trust asset must be

determined, the Trustee shall determine the value of any assets that are not cash, cash

equivalents or other assets that can be readily sold or exchanged for cash or cash

equivalents (hereinafter unmarketable assets ), by either (a) obtaining a current qualified

appraisal, as defined in §1.170A-13(c)(3) and §1.170A-13(c)(5) of the Income Tax

Regulations, respectively, or (b) ensuring the valuation of these unmarketable assets is

performed exclusively by an independent trustee, within the meaning of §1.664-1(a)(7)

(iii) of the Income Tax Regulations.

8. Prohibited Transactions. The Trustee shall not engage in any act of self-

dealing within the meaning of §4941(d) of the Code, as modified by §4947(a)(2)(A) of

the Code, and shall not make any taxable expenditures within the meaning of §4945(d)

of the Code, as modified by §4947(a)(2)(A) of the Code.

9. Taxable Year. The taxable year of the Trust shall be the calendar year.

10. Governing Law. The operation of the trust shall be governed by the laws of the

State of ________________________ (name of state). However, the Trustee is prohibited

from exercising any power or discretion granted under said laws that would be

inconsistent with the qualification of the Trust as a charitable remainder unitrust under

§664(d)(2) of the Code and the corresponding regulations.

11. Compensation . Each person who serves as a Trustee shall be entitled to

receive reasonable compensation for services rendered. In the case of a corporate

trustee, reasonable compensation is based upon its published fee schedule in effect at

the time its services are rendered, or as otherwise agreed, and its compensation may

vary from time to time based on that schedule.

12. Management powers. I grant the Trustee the powers described below, to be

exercised in a fiduciary capacity:

A. The Trustee may hold and retain as part of the Trust any assets received

from any source, and invest and reinvest them (or leave them temporarily

uninvested) in any type of property and every kind of investment in the same

manner as a prudent investor would invest its own assets.

B. The Trustee may sell or exchange any real or personal property contained

in the Trust , for cash or credit, at public or private sale, and with such warranties

or indemnifications as the Trustee may deem advisable.

C. The Trustee may grant security interests and execute all instruments

creating such interests on such terms as the Trustee may deem advisable.

D. The Trustee may compromise and adjust claims against or on behalf of

the T rust on such terms as the Trustee may deem advisable.

E. The Trustee may determine whether receipts are to be allocated to

income or principal and whether disbursements are to be charged against

income or principal to the extent not clearly established by state law. All

determinations made by the Trustee in good faith shall not require equitable

adjustments.

F. The Trustee may make all tax elections and allocations the Trustee may

consider appropriate; however, this authority is exercisable only in a fiduciary

capacity and may not be used to enlarge or shift any beneficial interest except as

an incidental consequence of the discharge of fiduciary duties. All tax elections

and allocations made by the Trustee in good faith shall not require equitable

adjustments.

G. The Trustee may employ such lawyers, accountants, and other advisers

as the Trustee may deem useful and appropriate for the administration of the

trust . The Trustee may employ a professional investment adviser and delegate to

this adviser any discretionary investment authorities to manage the investments

of the Trust (including any investment in mutual funds, investment trusts , or

managed accounts), and may rely on the adviser's investment

recommendations without liability to any Recipient.

H. The Trustee may divide and distribute the assets of the Trust in kind or in

cash, or partly in each, without regard to the income tax basis of any asset and

without the consent of any Recipient. The decision of the Trustee in dividing any

portion of the Trust between or among two or more Recipient shall be binding on

all persons.

13. Limited Power of Amendment. This Trust is irrevocable. However, the Trustee

shall have the power, acting alone, to amend the Trust from time to time in any manner

required for the sole purpose of ensuring that the Trust qualifies and continues to qualify

as a charitable remainder unitrust within the meaning of §664(d)(2) of the Code.

14. Investment of Trust Assets. Nothing in this trust instrument shall be construed

to restrict the Trustee from investing the Trust assets in a manner that could result in the

annual realization of a reasonable amount of income or gain from the sale or disposition

of trust assets.

15. Definition of Recipient. References to the Recipient in this trust instrument shall

be deemed to include the Executor of the Estate of the Recipient with regard to all

provisions in this trust instrument that describe amounts payable to and/or due from the

Recipient. The prior sentence shall not apply to the determination of the last day of the

unitrust period.

WITNESS our signature as of the day and date first above stated.

___________________________________ __________________________

(Signature of Grantor) (Signature of Initial Trustee)

(Printed Name of Grantor) (Printed Name of Initial

Trustee)

Acknowledgments (form of acknowledgment may vary by state)

Attach Schedule A

Practical advice on finishing your ‘Charitable Remainder Unitrust’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading eSignature solution for individuals and organizations. Bid farewell to the monotonous task of printing and scanning documents. With airSlate SignNow, you can effortlessly finalize and sign documents online. Utilize the robust features packed into this user-friendly and budget-friendly platform and transform your strategy for paperwork management. Whether you need to authorize forms or gather electronic signatures, airSlate SignNow manages it all with ease, requiring only a few clicks.

Follow this comprehensive guide:

- Sign in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our template collection.

- Open your ‘Charitable Remainder Unitrust’ in the editor.

- Click Me (Fill Out Now) to finalize the document on your side.

- Add and designate fillable fields for others (if needed).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Save, print your copy, or convert it into a reusable template.

No need to worry if you need to collaborate with your colleagues on your Charitable Remainder Unitrust or send it for notarization—our platform offers everything you need to achieve these tasks. Create an account with airSlate SignNow today and elevate your document management to new levels!