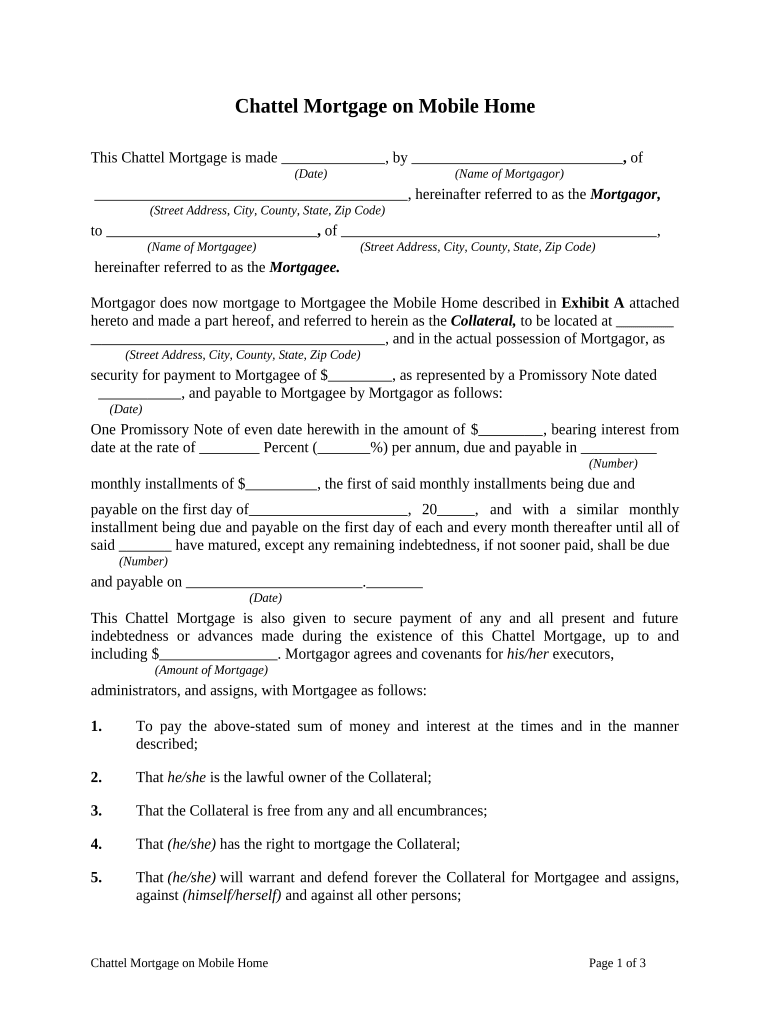

Fill and Sign the Chattel Mortgage on Mobile Home Virginia Form

Valuable advice on finalizing your ‘Chattel Mortgage On Mobile Home Virginia’ online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the leading electronic signature solution for individuals and organizations. Bid farewell to the tedious routine of printing and scanning documents. With airSlate SignNow, you can effortlessly fill out and sign documents online. Leverage the powerful features embedded in this user-friendly and affordable platform and transform your approach to document management. Whether you need to authorize forms or obtain electronic signatures, airSlate SignNow takes care of everything seamlessly, needing just a few clicks.

Adhere to this comprehensive guide:

- Access your account or sign up for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template collection.

- Open your ‘Chattel Mortgage On Mobile Home Virginia’ in the editor.

- Click Me (Fill Out Now) to complete the form on your end.

- Include and assign fillable fields for others (if required).

- Continue with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don't fret if you need to collaborate with others on your Chattel Mortgage On Mobile Home Virginia or submit it for notarization—our platform provides you with all the tools needed to accomplish such endeavors. Register with airSlate SignNow today and elevate your document management to new levels!

FAQs

-

What is a chattel mortgage and how does it work?

A chattel mortgage is a type of loan specifically secured by movable personal property, like vehicles or equipment. This financing option allows businesses to acquire assets while maintaining ownership. With airSlate SignNow, you can easily eSign chattel mortgage documents, streamlining the process for quick approval.

-

How can airSlate SignNow help with chattel mortgage applications?

AirSlate SignNow simplifies the chattel mortgage application process by enabling businesses to electronically sign and send documents securely. This reduces the turnaround time for approvals and enhances the overall efficiency of managing your chattel mortgage. Our platform ensures that all necessary documents are easily accessible and securely stored.

-

What are the benefits of using airSlate SignNow for chattel mortgages?

Using airSlate SignNow for chattel mortgages offers numerous benefits, including faster document processing, enhanced security, and user-friendly features. Our eSigning solution ensures that your chattel mortgage agreements are completed quickly, reducing delays and improving cash flow. Plus, our platform is cost-effective, making it accessible for businesses of all sizes.

-

Is airSlate SignNow compliant with chattel mortgage regulations?

Yes, airSlate SignNow is compliant with all relevant regulations governing chattel mortgages. Our platform adheres to the legal standards required for electronic signatures, ensuring that your chattel mortgage documents are legally binding. You can trust that your transactions are secure and meet all regulatory requirements.

-

What features does airSlate SignNow offer for managing chattel mortgage documents?

AirSlate SignNow provides a range of features for managing chattel mortgage documents, including customizable templates, in-app notifications, and tracking capabilities. These tools help you streamline your workflow, ensuring that all parties are updated on the status of the chattel mortgage process. Additionally, our cloud storage keeps your documents organized and accessible.

-

How much does it cost to use airSlate SignNow for chattel mortgage transactions?

The cost of using airSlate SignNow for chattel mortgage transactions varies depending on the features you choose. We offer flexible pricing plans suitable for businesses of all sizes, making our eSigning solution cost-effective. This means you can manage your chattel mortgage needs without breaking the bank.

-

Can I integrate airSlate SignNow with other software for chattel mortgage management?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications that can enhance your chattel mortgage management. Whether you're using CRM systems or financial software, our platform enables smooth data transfer and improves your overall efficiency in handling chattel mortgages.

The best way to complete and sign your chattel mortgage on mobile home virginia form

Find out other chattel mortgage on mobile home virginia form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles