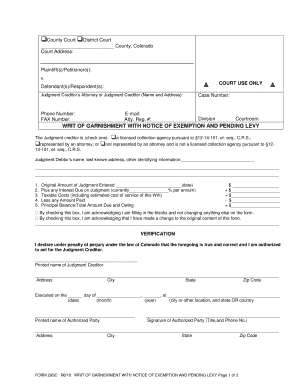

FORM 29 SC R8/18 WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY Page 1 of 3

❑ County Court ❑ District Court

___________________________ County, Colorado

Court Address:

Plaintiff(s)/Petitioner(s):

v.

Defendant(s)/Respondent(s):

COURT USE ONLY

Judgment Creditor’s Attorney or Judgment Creditor (Name and Address):

Phone Number: E -mail:

FAX Number: Atty. Reg. #:

Case Number:

Division Courtroom

WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY

The Judgment credi tor is (check one): ❑ a licensed collection agency pursuant to §12 -14 -101, et. seq., C.R.S. ;

❑ represented by an a ttorney ; or ❑ not represented by an attorney and is not a licensed collection agency pursuant to §12-

14 -101, et. seq., C.R. S.

Judgment Debtor’s name, last known add ress, other identifying information:_______ _______________________

____________________________ _________________________ _______________________________________________

____________________________ _____________________________________________________________ ___________

1. Original Amount of Judgment Entered ___ ________________________(date) $ _____________ ______

2. Plus any Interest Due on Judgment ( currently ________ ________% per annum) + $____________________

3. Taxa ble Costs (including estimated cost of service of this Writ) + $____________________

4. Less any Amount Paid - $____________________

5. Principal Balance/Total Amount Due and Owing = $____________________ By checking this box, I am acknowledging I am filling in the blanks and not changing anything else on the form.

By checking this box, I am acknowledging that I have made a change to the original content of this form .

__________________________________ __________________________________________________________________

VERIFICATION

I declare under penalty of perjury under the law of Colorado that the foregoing is true and correct and I am authorized

to act for the Judgment Creditor .

___________________ _______________________

Printed name of Judgment Creditor

______________________________________________________________________________ __________ ____________

Address City State Zip Code

Executed on the ______ day of ______________ __ __, _______, at __________________________________ ________ ____

(date) (month) (year) (city or other location, and state OR country

_________________________________________ ___________________________________________ ___________ _

Printed name of Authorized Party Signat ure of Authorized Party (Title,and Phone No.)

________________________________________________________________________________________ __________ __

Address City State Zip Code

FORM 29 SC R8/18 WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY Page 2 of 3

WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY

THE PEOPLE OF THE STATE OF COLORADO to the Sheriff of any Colorado County, or to any person 18 years or older and

who is not a pa rty to this action:

You are directed to serve a copy of this Writ of Garnishment upon __________________ ____________________ , Garnishee,

with proper return of service to be made to the Court.

TO THE GARNISHEE:

YOU ARE HEREBY SUMMONED AS GARNISHEE IN THIS ACTION AND ORDERED:

a. To answer the following questions under oath and file your answers with the Clerk of the Court (AND to mail a completed

copy with your answers to the Judgment Creditor or attorney when a stamped envelope is attached) within 14 days foll owing

service of this Writ upon you. YOUR FAILURE TO ANSWER THIS WRIT WITH NOTICE MAY RESULT IN THE ENTRY

OF A DEFAULT AGAINST YOU .

b. To hold pending court order the personal property of any kind (other than earnings of a natural person) in your possession

or control, including the debts, credits, choses in action or money owed to the Judgment Debtor whether they are due at

the time of the service of the writ or are to become due thereafter. YOU ARE NOTIFIED :

a. This Writ with Notice applies to all personal pr operty (other than earnings) owed to or owned by the Judgment Debtor and

in your possession or control as of the date and time this Writ was served upon you.

b. In no case may you withhold any personal property greater than the amount on Line 5 on the front o f this Writ unless the

personal property is incapable of being divided.

c. After you file your answers to the following questions , and after receiving a separate notice or order from the court ,

MAKE CHECKS PAYABLE AND MAIL TO: ❑ the J udgment Creditor named above ( May select only if the Judgment

Creditor is a licensed collection agency pursuant to 12 -14-101, et. seq., C.R.S.); ❑ the J udgment Creditor’s Attorney (if

applicable); or to the ❑ Clerk of the County Court or District Cou rt in _______________ _______ (city), Colorado

(Must select if the Judgment Creditor is not represented by an attorney AND is not a licensed collection agency pursuant

to 12 -14-101, et. seq., C.R.S.) at the address below: Name: __________________________ ________________________________________________________________

Address: ________________________________________________________________________________________

PLEASE PUT THE CASE NUMBER (above) ON THE FRONT OF THE CHECK.

CLERK OF THE COURT By Deput y Clerk: _____________________________ ___ ___

Date: _______ ______________________________________

QUESTIONS TO BE ANSWERED BY GARNISHEE Judgment Debtor’s Name : ___________________________________ Case Number: ___________________ The following questions MUST be answered by you under oath:

a. On the date and time this Writ was served upon you, did you possess or control any personal property of the Judgment

Debtor or did you owe any rents, payments, obligations, debts or moneys other than earnings to the Judgment Debtor?

❑ YES ❑ NO

b. If YES , list all items of personal property and their location(s) and/or describe the nature and amount of the debt or

obligation: (Attach additional pages if necessary): _______________________________________________ __________

_______________________________________________________________________________________________

c. Do you claim any setoff against any property, debt or obligation listed above? ❑ YES ❑ NO

d. If you answered YES to question c, describe the nature and amount of the setoff claimed:

(Attach additional pages if necessary): _______________________________________________________________

______________________________________________________________________________________________

VERIFIC ATION

I declare under penalty of perjury under the law of Colorado that I am authorized to act for the Garnishee and the

foregoing is true and correct.

Name of Garnishee (Print) ____________________ _______ _____________

Executed on the ______ day of ________________, _______, at ___________________________________ __________ ___

(date) (month) (year) (city or other location, and state OR country

_____________________________________ _____ ________________________________ __________ ______

(Printed name of Person Answering) Signature of Person Answering

FORM 29 SC R8/18 WRIT OF GARNISHMENT WITH NOTICE OF EXEMPTION AND PENDING LEVY Page 3 of 3

NOTICE TO JUDGMENT DEBTOR OF EXEMPTION AND PENDING LEVY This Writ with Notice is a Court order which may cause your property or money to be held and taken to pay a judgment entered

against you. You have legal rights which may prevent all or part of your money or property from being taken. That part of t he

money o r property which may not be taken is called “exempt property”. A partial list of “exempt property” is shown below, along

with the law which may make all or part of your money or property exempt. The purpose of this notice is to tell you about th ese

right s. PARTIAL LIST OF EXEMPT PROPERTY

1. All or part of your property listed in Sections 13-54 -101 and 102, C.R.S., including clothing, jewelry, books, burial sites,

household goods, food and fuel, farm animals, seed, tools, equipment and implements, military a llowances, stock -in-trade

and certain items used in your occupation, bicycles, motor vehicles (greater for disabled persons), life insurance, income

tax refunds, attributed to an earned income tax credit or child tax credit, money received because of loss of property or for

personal injury, equipment that you need because of your health, or money received because you were a victim of a crime.

2. All or part of your earnings under Section 13 -54 -104, C.R.S.

3. Worker’s compensation benefits under Section 8 -42 -124, C.R.S.

4. Unemployment compensation benefits under Section 8 -80-103, C.R.S.

5. Group life insurance benefits under Section 10 -7-205, C.R.S.

6. Health insurance benefits under Section 10 -16-212, C.R.S.

7. Fraternal society benefits under Section 10 -14-403, C.R.S.

8. Famil y allowances under Section 15 -11 -404, C.R.S.

9. Teachers’ retirement fund benefits under Section 22 -64 -120, C.R.S.

10. Public employees’ retirement benefits (PERA) under Sections 24 -51 -212 and 24 -54 -111, C.R.S.

11. Social security benefits (OASDI, SSI) under 42 U.S.C . §407.

12. Railroad employee retirement benefits under 45 U.S.C. §231m.

13. Public assistance benefits (OAP, AFDC, TANF, AND, AB, LEAP) under Section 26 -2-131, C.R.S.

14. Police Officer’s and Firefighter’s pension fund payments under Sections 31 -30 -1117 & 31 -30.5 -208 and 31 -31-203, C.R.S.

15. Utility and security deposits under Section 13 -54 -102(1)(r), C.R.S.

16. Proceeds of the sale of homestead property under Section 38 -41 -207, C.R.S.

17. Veteran’s Administration benefits under 38 U.S.C. §5301.

18. Civil service retirement benefits under 5 U.S.C. §8346.

19. Mobile homes and trailers under Section 38 -41-201.6, C.R.S.

20. Certain retirement and pension funds and benefits under Section 13 -54 -102(1)(s), C.R.S.

21. A Court -ordered child support or maintenance obligation or payment under Section 13 -54-102(1)(u), C.R.S.

22. Public or private disability benefits under Section 13 -54 -102(1)(v), C.R.S. If the money or property which is being withheld from you includes any “exempt property ,” you must file within 14 days of receiving

this notice a written Clai m of Exemption with the Clerk of the Court describing what money or property you think is “exempt

property” and the reason that it is exempt. YOU MUST USE THE APPROVED FORM attached to this Writ or a copy of it. Whe n

you file the claim, you must immediately deliver, by certified mail, return receipt requested, a copy of your claim to the Ga rnishee

(person/place that was garnished) and to the Judgment Creditor’s attorney, or if none, to the Judgment Creditor at the ad dress

shown on this Writ with Notice. Notwithstanding your right to claim the property as “exempt,” no exemption other than the

exemptions set forth in Section 13 -54 -104(3), C.R.S., may be claimed for a Writ which is the result of a judgment taken for

arr earages for child support or for child support debt. Once you have properly filed you r claim, the court will schedule a hearing within 14 days. The Clerk of the Court will notify you

and the Judgment Creditor or attorney of the date and time of the heari ng, by telephone, by mail or in person. When you come to your hearing, you should be ready to explain why you believe your money or property is “exempt property”.

If you do not appear at the scheduled time, your money or property may be taken by the Cour t to pay the judgment entered

against you. REMEMBER THAT THIS IS ONLY A PARTIAL LIST OF “EXEMPT PROPERTY”; you may wish to consult with a lawyer who

can advise you of your rights. If you cannot afford one, there are listings of legal assistance and legal aid offices in the yellow

pages of the telephone book. You must act quickly to protect your rights. Remember, you only have 14 days after receiving this notice to file your claim of

exemption with the Clerk of the Court.

Valuable advice on setting up your ‘Colorado Garnishment’ online

Are you fed up with the trouble of managing paperwork? Look no further than airSlate SignNow, the top electronic signature solution for individuals and businesses. Bid farewell to the lengthy process of printing and scanning documents. With airSlate SignNow, you can seamlessly finalize and authorize paperwork online. Utilize the powerful tools bundled into this intuitive and cost-effective platform and transform your method of document management. Whether you need to approve forms or gather electronic signatures, airSlate SignNow makes it all straightforward, with just a few clicks.

Refer to this comprehensive guide:

- Sign in to your account or sign up for a complimentary trial with our service.

- Click +Create to upload a document from your device, cloud storage, or our template collection.

- Edit your ‘Colorado Garnishment’ in the editor.

- Select Me (Fill Out Now) to set up the form on your end.

- Include and designate fillable fields for other parties (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to fret if you need to collaborate with others on your Colorado Garnishment or send it for notarization—our solution offers everything you require to accomplish these tasks. Create an account with airSlate SignNow today and elevate your document management to a new standard!