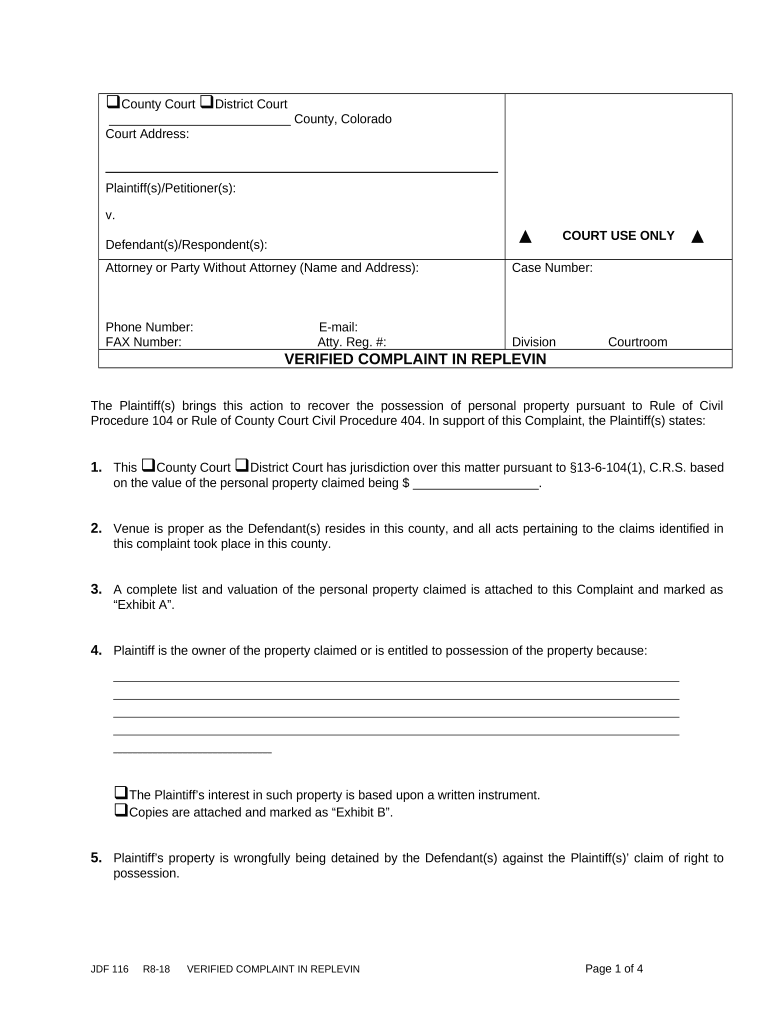

Fill and Sign the Colorado Replevin Form

Useful advice on preparing your 'Colorado Replevin' online

Are you fed up with the inconvenience of managing paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and businesses. Bid farewell to the dull routine of printing and scanning documents. With airSlate SignNow, you can seamlessly complete and sign documents online. Utilize the extensive features bundled into this straightforward and cost-effective platform and transform your approach to document handling. Whether you need to sign forms or collect electronic signatures, airSlate SignNow manages everything effortlessly, with just a few clicks.

Follow this step-by-step instructions:

- Access your account or sign up for a free trial with our service.

- Click +Create to upload a file from your device, cloud, or our template repository.

- Open your 'Colorado Replevin' in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and assign fillable fields for other participants (if necessary).

- Continue with the Send Invite settings to request eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don't fret if you need to collaborate with your colleagues on your Colorado Replevin or send it for notarization—our solution has all you need to complete such tasks. Register with airSlate SignNow today and take your document management to the next level!

FAQs

-

What is Form 104 Colorado and who needs to file it?

Form 104 Colorado is the state income tax return for residents of Colorado. Individuals who earn income in Colorado, including wages, self-employment income, and investment income, are required to file this form. This ensures compliance with Colorado tax regulations and helps determine your tax liability.

-

How do I fill out Form 104 Colorado accurately?

To fill out Form 104 Colorado accurately, you need to gather all relevant financial documents, such as W-2s and 1099s. The form requires information about your income, deductions, and credits. Ensure you follow the instructions provided with the form or consult a tax professional for guidance.

-

When is the deadline for submitting Form 104 Colorado?

The deadline for submitting Form 104 Colorado is typically April 15th of each year, unless it falls on a weekend or holiday. In such cases, the deadline is extended to the next business day. It's crucial to file on time to avoid penalties and interest on any taxes owed.

-

What are the benefits of using airSlate SignNow for submitting Form 104 Colorado?

Using airSlate SignNow for submitting Form 104 Colorado streamlines the eSignature process, making it easy to sign and send your tax documents securely. The platform is user-friendly and cost-effective, enabling you to manage your tax paperwork efficiently. This saves you time and ensures that your forms are submitted on time.

-

Can I integrate airSlate SignNow with my tax software for Form 104 Colorado?

Yes, airSlate SignNow offers integration with various tax software, which can enhance your workflow when preparing Form 104 Colorado. By integrating, you can easily access, sign, and submit your tax forms directly from your software, ensuring a seamless experience.

-

What features does airSlate SignNow provide for handling Form 104 Colorado?

airSlate SignNow provides several features for handling Form 104 Colorado, including electronic signatures, document templates, and secure sharing options. These features help you manage your tax documents efficiently and ensure compliance with Colorado tax laws.

-

Is airSlate SignNow cost-effective for individual users filing Form 104 Colorado?

Yes, airSlate SignNow is a cost-effective solution for individual users filing Form 104 Colorado. The platform offers flexible pricing plans that cater to various needs, making it accessible for everyone, from freelancers to small business owners.

The best way to complete and sign your colorado replevin form

Find out other colorado replevin form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles