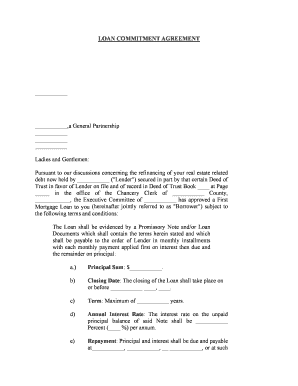

LOAN COMMITMENT AGREEMENT ______________________,a General Partnership _________________________________Ladies and Gentlemen: Pursuant to our discussions concerning the refinancing of your real estate related

debt now held by ___________ ("Lender") secured in part by that certain Deed of

Trust in favor of Lender on file and of record in Deed of Trust Book ____ at Page

_____ in the office of the Chancery Clerk of ___________ County,

____________, the Executive Committee of ___________ has approved a First

Mortgage Loan to you (hereinafter jointly referred to as "Borrower") subject to

the following terms and conditions: The Loan shall be evidenced by a Promissory Note and/or Loan

Documents which shall contain the terms herein stated and which

shall be payable to the order of Lender in monthly installments

with each monthly payment applied first on interest then due and

the remainder on principal: a.) Principal Sum: $___________ .b)Closing Date: The closing of the Loan shall take place on

or before ___________ ____, ____.c)Term: Maximum of ___________ years.d)Annual Interest Rate: The interest rate on the unpaid

principal balance of said Note shall be ___________

Percent (____ %) per annum.e) Repayment : Principal and interest shall be due and payable

at___________, ___________ , __ ___________, or at such

other place as the Lender may designate, in ___________

consecutive monthly installments of ___________ Dollars

($___________) on the first day of each month beginning

on ___________ ____, ____, and one final balloon

payment of ___________ Dollars ($___________), which

balloon payment shall be due and payable on ___________

____, ____ . The monthly principal and interest payments

shall be based on a ____ year amortization. Each monthly

installment shall be applied first to interest then due, and

the remainder to principal. f)Prepayment : Prepayments on the principal in addition to

the regular monthly installments on any installment date

may be made by Borrower paying a ____ Percent (____ %)

prepayment penalty on such excess payments during the

first year of this Loan, which prepayment penalty shall be

reduced thereafter at the rate of One Percent (1%) per year.

The Lender may require that any partial prepayments (i) be

made on the date monthly installments are due, and (ii) be

in the amount of that part of one or more monthly

installments which would be applicable to principal Any

partial prepayment shall be applied against the principal

amount outstanding in the inverse order of due dates and

shall not postpone the due date of any subsequent monthly

installments or change the amount of such installments,

unless the Lender shall otherwise agree in writing. g)Escrow : Upon receipt of written notice from Lender,

Borrower shall also make monthly deposits with Lender in

a non-interest bearing account, together with, and in

addition to, interest and principal, of a sum equal to one-

twelfth of the yearly taxes and assessments which may be

levied against the premises, and one-twelfth of the yearly

premiums for hazard insurance thereon. The amount of

such taxes, assessments and premiums, when unknown,

shall be estimated by Lender. Such deposits shall be used

by Lender to pay such taxes, assessments and premiums

when due. Any insufficiency of such account to pay such

charges when due shall be paid by Borrower to Lender on

demand. Until receipt by Borrower of such notice,

Borrower shall pay all such taxes, assessments and

insurance premiums, and shall promptly furnish to Lender

receipts evidencing such payments. h)Late Charge: The Note will provide that if any payment of

principal and interest, or principal and interest combined,

shall remain overdue for a period of fifteen (15) days after

the same becomes due and payable hereunder, Borrower

shall pay to Lender a late charge of ____ (____%) of the

overdue amount.i) Lender's Right to Accelerate: The Loan Documents shall

provide that Lender shall have the right, at its option, to

declare the entire Loan, regardless of the maturity date

specified in any note or agreement evidencing the same,

immediately due and payable if Borrower sells, enters into

a contract of sale, conveys, further encumbers or alienates

said property or any part thereof, or suffers his title or any

interest therein to be divested or encumbered, whether

voluntarily or involuntarily, or leases with an option to

purchase, or changes or permits to be changed the character

or use of said property, or drills or extracts or enters into a

lease for the drilling for, or extracting of, oil, gas or other

hydrocarbon substances or any mineral of any kind or

character on said property. If the maturity date is

accelerated due to the sale of the Real Property securing the

Loan, Borrower agrees to use as much of the proceeds of

any such sale as necessary to pay the remaining principal

and interest due on the Note, as well as any other sums due

pursuant to the Loan Documents, and Borrower shall grant

a security interest in such proceeds to Lender in the

appropriate Loan Document(s). j) Security: The Note shall be secured by a First Deed of

Trust of even date therewith on real property, including

without limitation all buildings, improvements and fixtures,

now or hereafter located thereon (hereafter "Security

Property") situated on all of Lots ____, ____ and ____ of

Block ____, ____, _____________, as shown on the ____

Official Map of the City of ____, ______________ , ____

Edition. The Note shall also be secured by assignments to

Lender of life insurance on each of the undersigned

Borrower(s) in the face amount of at least

$_________________. The Note shall be further secured

by an assignment of Borrower's interest in all leases

("Assignment of Leases") and rents affecting the Security

Property and by a Security Agreement covering all of

Borrower's right, title and interest in property personal in

nature located on the Security Property as Lender deems to

be necessary in connection with this Loan transaction. k) Title Insurance: Lender is to be furnished an A.L.T.A.

policy of title insurance, containing such endorsements or

affirmative coverage as Lender may require, written by a

title insurance company acceptable to Lender, with liability

equal to the amount of the Loan, and insuring Lender's

mortgage to be a first lien subject only to such exceptions

and conditions of title as Lender approves in writing prior

to the funding of this Loan and recordation of Lender's

Deed of Trust. The condition of title must be "marketable"

and satisfactory in all respects to the standards normally

required by Lender and by § 83-19-51(1) (c) of the

Mississippi Code of 1972, as amended. l) Survey: No survey will be required. m) Hazard Insurance: The Deed of Trust shall contain a

provision obligating Borrower to maintain hazard insurance

(with extended coverage endorsement including malicious

mischief and vandalism), flood insurance (in the event

flood insurance shall be required for the Security Property

under the United States Flood Disaster Protection Act of

1973 or any subsequent law then in effect), comprehensive

public liability insurance, and such other insurance

coverage as Lender may from time to time reasonably

deem necessary. Hazard insurance shall cover the

improvements and personal property, if any, on the

Security Property in an amount not less than the full

insurable replacement value thereof, and all insurance

required hereunder shall be issued by an insurance

company or companies satisfactory to Lender. All

insurance policies are to be deposited with Lender, and

each policy is to contain a Mortgagee Clause acceptable to

Lender in Lender's favor as first mortgagee. Blanket

insurance shall be acceptable provided Lender is furnished

certified copies of such policies together with satisfactory

evidence that the insurance is in force. Should coinsurance

or average clause be included, Lender may require a

stipulated value endorsement. n) Leases: Borrower will deposit with Lender Borrower's

copies of all leases affecting the Security Property, together

with any amendments thereto. Such leases must be

acceptable to Lender or be made acceptable to Lender, both

as to form and content. Lender will be provided with

satisfactory evidence that the leases are in full force and

effect at the time of closing. o) Form of Loan Documents: All Loan Documents used in

this transaction shall be on forms prescribed or approved by

Lender, and the Loan shall in every particular conform to

the standard practices of Lender's Investment Department

and be acceptable to Lender's counsel. The term "Loan

Documents" shall be defined as any and all documents

evidencing, securing, or related to the Loan. p) Appraisal: Lender has received any necessary appraisals

of the Security Property. q)Closing Costs: Borrower shall pay all costs, fees and

charges of every kind in connection with this Loan

transaction including, without limitation, Lender's attorneys

fees, the cost of obtaining, preparing and furnishing to

Lender all documents herein mentioned, surveys and title

reports, the premium for title insurance, the fees for

recording and filing documents, escrow fees, and any tax or

fees required to be paid at the time of recording the Loan

Documents (but only to the extent permitted by law). r)Hazardous Substances: In said Loan Documents

Borrower shall agree to protect and preserve the Security

Property, and with respect to said property not to (1) use or

permit the use of the property as a land fill or dump, (ii)

store or bury or permit the storage or burying of any

hazardous substances which require the issuance of a

permit by the Environmental Protection Agency or any

state or local agency governing the issuance of hazardous

substances permits for disposal sites, or (iii) request or

permit a change in zoning or land use classification except

to the extent such zoning or land use change is for

commercial use. Borrower shall further agree, at his sole

cost and expense, to comply with all federal, state and local

laws, rules, regulations and orders with respect to the

discharge and removal of hazardous substances, pay

immediately when due the cost of removal of any such

substances, and keep the Security Property free of any lien

imposed pursuant to such laws, rules, regulations and

orders. Borrower shall agree to indemnify Lender and hold

Lender harmless from and against all loss, cost, damage

and expense (including, without limitation, attorney's fees

and costs incurred in the investigation, defense and

settlement of claims) that Lender may incur as a result of or

in connection with the assertion against Lender or any

claim relating to the presence or removal of any hazardous

substances, referred to in this paragraph, or compliance

with any federal, state or local laws, rules, regulations or

orders relating thereto. As used in this paragraph, the term

"hazardous substances" shall mean all hazardous and toxic

substances, wastes or materials, any pollutants or

contaminants (including asbestos and raw materials which

include hazardous constituents), or any other similar

substances, or materials which are included under or

regulated by any local, state or federal law, rule or

regulation pertaining to environmental regulation,

contamination or clean-up, including the Comprehensive

Environmental Response, Compensation, and Liability Act

as amended, and the Resource Conservation and Recovery

Act as amended, and/or any state lien or state superlien or

environmental clean-up statutes. s) Preservation and Maintenance of Security: During the

term of the Loan and any extensions thereof, Borrower will

keep the Security Property in good condition and repair at

his expense and will not damage or demolish any part or do

any act by which the value of said Property will be

impaired. It is further agreed that Borrower will commit no

waste on the Property, and that, in the event the Borrower

fails to keep the Security Property in as good state of repair

as it now is, the Lender shall have the right at its option to

make any needed repairs, betterments, or improvements,

and that any expenditure for such purpose will be a

legitimate indebtedness against the Borrower and against

the Security Property, and the cost of any such repairs,

betterments, or improvements will become a part of the

debt secured by the Deed of Trust. Borrower agrees not to

abandon said Security Property, and that a breach of this

condition shall cause the entire indebtedness secured by

Security Property to become due and payable at the option

of the said Lender or its assigns. t)Loan the Personal Obligation of Borrower: Borrower

understands and agrees that the Loan shall be a personal

obligation of Borrower, which obligation shall include the

due and punctual payment of the principal of the Note

evidencing the Loan, the interest thereon, and any moneys

due or which may become due under the said Note or any

other Loan Document including, but not limited to, said

Deed of Trust. Notwithstanding the foregoing, the liability

of each of the undersigned Borrower(s) shall be limited to

$____________ each as long as the aforesaid Assignment

of Leases remains in full force and effect. u)Other Provisions: This Commitment is not assignable. It is

understood and agreed that no funds shall be disbursed on

this Loan until all conditions of this Loan have been

complied with. Should Borrower fail to comply with the

conditions of this Loan prior the expiration of this

Commitment, Borrower shall not be relieved from his

obligation to reimburse Lender's expenses as set forth in

subpart (q) above.This Commitment, as herein set out, is contingent upon Borrower's written

acceptance hereof and the return to Lender of Lender's original letter on or before ten (10) days from the date hereof.This Commitment will extend to ___________ ____, ____. Should

Borrower fail to borrow the funds from Lender in accordance with the

provisions hereof, Lender will have no further obligation to Borrower. We are glad to be of assistance in this financing. If the conditions of this

letter meet with your approval, please indicate your acceptance of same by

signing this letter and returning it to our attorney, ___________,

___________, ___________, ______________ ___________. ___________ of the law firm of ___________ ___________,

___________, __ (___________ ) will be our counsel and will provide

your attorney with instructions for closing this Loan. Please have your

attorney contact ___________ in plenty of time to complete the

requirements for closing this Loan prior to the expiration of this

Commitment. This Commitment completely supersedes and replaces that certain

Commitment from Lender to Borrower dated ___________ ____, ____,

and which has expired. The enclosed copy of this Commitment is for your files. Sincerely yours,______________________________By:______________________________Assistant Vice PresidentThe above terms and conditions are accepted and agreed to this ___ day of ___________, ____

.

Our attorney shall be ___________

of ___________

, ____________.

________________________________________________________________________________________________________________________________________________________________________________________________________________________