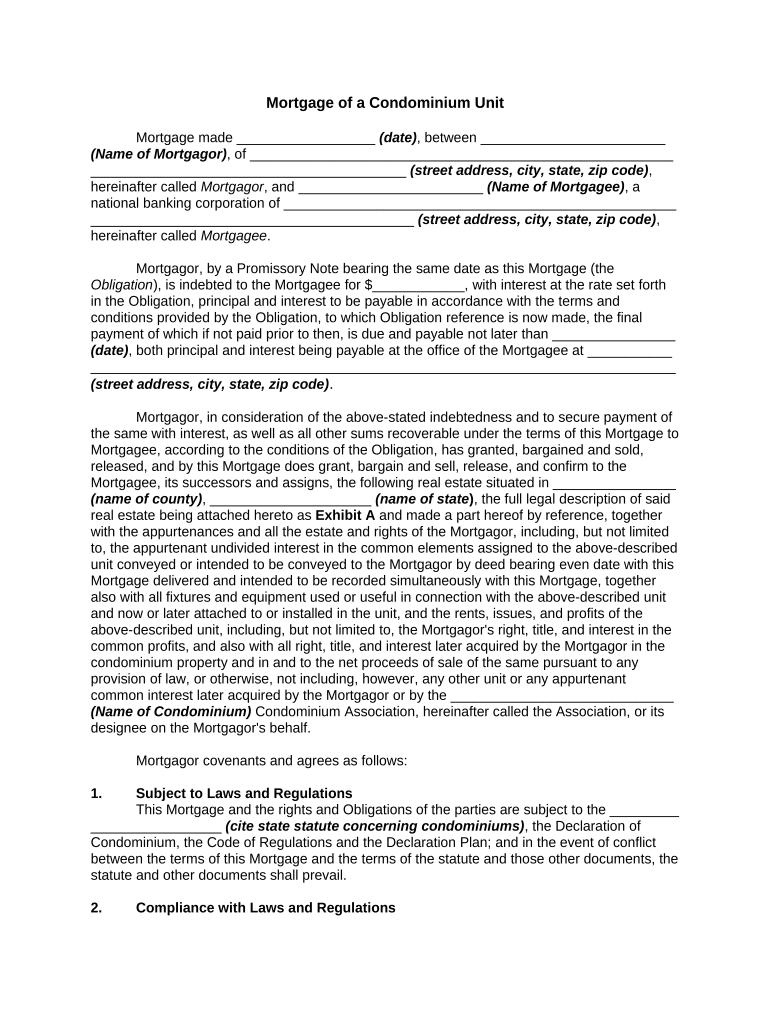

Mortgage of a Condominium Unit

Mortgage made __________________ (date) , between ________________________

(Name of Mortgagor) , of _______________________________________________________

_________________________________________ (street address, city, state, zip code) ,

hereinafter called Mortgagor , and ________________________ (Name of Mortgagee) , a

national banking corporation of ___________________________________________________

__________________________________________ (street address, city, state, zip code) ,

hereinafter called Mortgagee .

Mortgagor, by a Promissory Note bearing the same date as this Mortgage (the

Obligation ), is indebted to the Mortgagee for $____________, with interest at the rate set forth

in the Obligation, principal and interest to be payable in accordance with the terms and

conditions provided by the Obligation, to which Obligation reference is now made, the final

payment of which if not paid prior to then, is due and payable not later than ________________

(date) , both principal and interest being payable at the office of the Mortgagee at ___________

____________________________________________________________________________

(street address, city, state, zip code) .

Mortgagor, in consideration of the above-stated indebtedness and to secure payment of

the same with interest, as well as all other sums recoverable under the terms of this Mortgage to

Mortgagee, according to the conditions of the Obligation, has granted, bargained and sold,

released, and by this Mortgage does grant, bargain and sell, release, and confirm to the

Mortgagee, its successors and assigns, the following real estate situated in ________________

(name of county) , _____________________ (name of state ) , the full legal description of said

real estate being attached hereto as Exhibit A and made a part hereof by reference, together

with the appurtenances and all the estate and rights of the Mortgagor, including, but not limited

to, the appurtenant undivided interest in the common elements assigned to the above-described

unit conveyed or intended to be conveyed to the Mortgagor by deed bearing even date with this

Mortgage delivered and intended to be recorded simultaneously with this Mortgage, together

also with all fixtures and equipment used or useful in connection with the above-described unit

and now or later attached to or installed in the unit, and the rents, issues, and profits of the

above-described unit, including, but not limited to, the Mortgagor's right, title, and interest in the

common profits, and also with all right, title, and interest later acquired by the Mortgagor in the

condominium property and in and to the net proceeds of sale of the same pursuant to any

provision of law, or otherwise, not including, however, any other unit or any appurtenant

common interest later acquired by the Mortgagor or by the _____________________________

(Name of Condominium) Condominium Association, hereinafter called the Association, or its

designee on the Mortgagor's behalf.

Mortgagor covenants and agrees as follows:

1. Subject to Laws and Regulations

This Mortgage and the rights and Obligations of the parties are subject to the _________

_________________ (cite state statute concerning condominiums) , the Declaration of

Condominium, the Code of Regulations and the Declaration Plan; and in the event of conflict

between the terms of this Mortgage and the terms of the statute and those other documents, the

statute and other documents shall prevail.

2. Compliance with Laws and Regulations

Mortgagor shall fully and faithfully comply with _____________________ (cite state

statute) , the Declaration of Condominium, the Code of Regulations and the Declaration Plan;

and in the event of Mortgagor's failure to do so within a period of thirty (30) days after notice

from either the Association or from the Mortgagee, or in the case of any such default that

cannot, with due diligence, be cured or remedied within such thirty (30) -day period, if the

Mortgagor fails to proceed promptly after such notice to cure or remedy the same with due

diligence, then in any such case, the Mortgagee may, from time to time, at its option, but without

any obligation to do so, cure or remedy any such default of the Mortgagor, and all sums

expended by the Mortgagee for such purpose, including reasonable counsel fees, shall be

added to the debt secured by this Mortgage, shall become due and payable, and shall bear

interest until repaid at the rate provided in the Obligation secured by this Mortgage; provided,

however, that the failure of the Mortgagor to keep or to perform any such covenant, agreement,

or provision for thirty (30) days after any such notice shall, at the election of the Mortgagee,

constitute a breach of covenant under this Mortgage entitling the Mortgagee to accelerate the

indebtedness secured by this Mortgage.

3. Non-conveyance of Mortgaged Premises

During the term of the indebtedness secured by this Mortgage, the Mortgagor shall not,

without the prior, express, and written consent of the Mortgagee, convey under and subject to

this Mortgage all or any part of the Mortgaged premises.

4. Mortgagor’s Right to Mortgage

At the time of executing and delivering of this Mortgage, the Mortgagor is seized of the

Mortgaged premises in fee simple, has the authority to Mortgage the premises as provided in

this Mortgage; the premises are free from all encumbrances and charges whatsoever;

Mortgagor will forever warrant and defend the premises against all lawful claims; and there is no

assignment or pledge of any leases of or rentals or income from the premises now in effect,

and, until the indebtedness is fully paid, the Mortgagor will not make any assignment or pledge

of the same to anyone other than the Mortgagee.

5. Taxes, Assessments, and Other Charges

If requested to do so by the Mortgagee, the Mortgagor agrees to deposit with the

Mortgagee monthly or other periodic payments as specified in the request of a sum that will be

sufficient to pay special assessments, taxes, and other charges as they become due, all as

estimated by the Mortgagee. This sum shall be held by the Mortgagee in trust to pay the taxes,

assessments, rents, and charges, but shall not, except as required by law, bear interest.

If, at any time, the funds so held by the Mortgagee shall be insufficient to pay any taxes,

assessments, rents, or charges, the Mortgagor shall, on receipt of notice, deposit with the

Mortgagee such additional funds as may be necessary to remove any deficiency. In the event of

a default by the Mortgagor in the performance of any of the terms, covenants, or conditions in

this Mortgage or in the Obligations secured by this Mortgage, the Mortgagee may apply the fund

to the indebtedness secured by this Mortgage, in such manner as the Mortgagee shall

determine.

6. Declaration of No Set-Off

If requested to do so by the Mortgagee, the Mortgagor shall promptly furnish Mortgagee

or Mortgagee's assignee with a declaration of no set-off.

7. Lease Terms and Conditions

Mortgagor shall perform all the terms and conditions of any lease or leases affecting the

Mortgaged premises and shall not accept any rent in advance for a period of more than one

month.

8. Assignment of Leases

Mortgagor, by assignment in form and substance satisfactory to the Mortgagee, shall

assign to the Mortgagee all existing and future leases of the Mortgaged premises.

9. Recording Leases; No New Leases without Mortgagee’s Consent

Mortgagor will, at the request of the Mortgagee, record any leases and the assignment

of them and will not, without the prior written consent of the Mortgagee, extend, renew, amend,

terminate, or enter into any lease of any portion of the Mortgaged premises.

10. Payment of Condominium Association

Mortgagor shall pay before they shall become delinquent or shall procure the discharge

or release of, all assessments for common expenses assessed against the Mortgaged premises

by the Association. If Mortgagor fails to pay any assessment for common expenses, the

Mortgagee may, at its option, pay the assessment. All sums so paid by the Mortgagee shall

immediately and without demand be repaid by the Mortgagor to the Mortgagee, together with

interest at the rate provided in the Obligation; provided, however, failure of the Mortgagor to

make any such payment of an assessment for common expenses shall constitute an event of

default under this Mortgage entitling the Mortgagee to accelerate the indebtedness secured by

this Mortgage. The production of a receipt by the Mortgagee shall be conclusive proof of a

payment authorized by this section, in the amount and validity of the receipt.

11. Revenue Stamps

If at any time the government of the United States or any department or agency of it

requires internal revenue stamps on the Obligations secured by this Mortgage, the Mortgagor,

on demand, will pay for the stamps. On default of such payment for Ten (10) days, after

demand, the holder of the Obligation may pay for the stamps and add the amount so paid to the

principal indebtedness evidenced by the Obligation and secured by this Mortgage. Such

additional principal shall bear interest at the rate provided in the Obligation.

12. Attorney’s Fees

If Mortgagee retains the services of counsel by reason of any default by the Mortgagor

under this Mortgage or under the Obligation, the Mortgagor shall be charged with the fees of

such counsel and payment of the same shall be secured by this agreement.

13. Expenses of Foreclosure and other Proceedings

If the Mortgagee institutes legal proceedings to foreclose this Mortgage or enter

judgment on the Obligation, the Mortgagor shall pay all expenses of the Mortgagee in

connection with all such proceedings, whether or not otherwise legally chargeable to the

Mortgagor, together with interest on any judgment obtained by the Mortgagee from the date of

any sheriff's sale until actual payment is made by the sheriff of the full amount due the

Mortgagee.

14. Non-Waiver of Rights and Remedies

No delay by the Mortgagee in exercising any right or remedy under this Mortgage, or

otherwise afforded by law, shall operate as a waiver of the right or remedy or preclude the

exercise of the same during the continuance of any default under this Mortgage. All rights and

remedies of the Mortgagee are cumulative and concurrent and may be exercised singly,

successively, or concurrently.

15. Payment of Taxes and Assessments

Subject to the provisions of Section 5 , Mortgagor shall pay when due all taxes and other

charges of every type or nature assessed or that may be assessed against the Mortgaged

premises or any part of them, or on the interest of the Mortgagee in the premises, or on any

personal property, without any deduction or abatement, and will pay, when due, any other taxes,

assessments or charges, claims, or encumbrances that might become a lien prior to the lien of

this Mortgage, or encumbrances that might have priority in the distribution of the proceeds of a

judicial sale.

16. Receipts for Taxes, Assessments, and other Charges

Mortgagor shall produce to the Mortgagee not later than Fifteen (1 5) days before the

date on which any taxes, assessments, water and sewer rents, and other charges bear interest

or penalties, receipts for all such taxes, assessments, water and sewer rents, and other charges

and on _______________ (month and day) of each year lien certificates issued to the

Mortgagor by the ______________________________ (appropriate administrative agency

of the state) not more than Thirty (30) days beforehand.

17. Contesting Validity of Tax or Assessment

Mortgagor may, in good faith, contest, by proper legal proceedings, the validity or

amount of any tax or assessment the Mortgagor has agreed to pay under this Mortgage

provided that the Mortgagor deposits with the Mortgagee, as security for payment of any

contested item, an amount equal to the same, plus interest and penalties, and further provided

that the Mortgagor will pay such contested item and all costs and penalties, if any, at least sixty

(60) days before the date the Mortgaged premises may be sold by the taxing authorities on

account of nonpayment of such tax or assessment.

18. Insurance of Common Elements

It shall constitute an event of default under this Mortgage if the Association fails or

refuses to maintain in full force and effect a policy or policies of fire insurance, with extended

coverage, vandalism, and malicious mischief endorsements, for the full insurable replacement

value of the common elements of the condominium, and having firm or conditional

endorsements covering the replacement value of the condominium units providing for

restoration of the same to tenantable condition in the event of damage.

A. Such policies shall be written in the name of, and the proceeds shall be payable

to, the Association, as trustee for each of the condominium unit owners in the

percentages established in the declaration, and to the respective Mortgagees of the unit

owners, as their interest may appear, or to a substitute insurance trustee acceptable to

the Mortgagee. The policies shall provide for separate protection for each condominium

unit and its attached, built-in, or installed fixtures and equipment to the full insurable

replacement value of the same, and with a separate loss payable endorsement in favor

of the Mortgagee or Mortgagees of each unit.

B. The policies shall permit waiver of subrogation and shall provide that the

insurer(s) will not look to the Association or any condominium unit owner for the recovery

of any loss under the policies.

C. The policies shall not be canceled except after Fifteen (15) days written notice to

the Mortgagee, and a copy or a duplicate of the policies must be deposited with the

Mortgagee with evidence of the payment of premiums and with renewal policies to be

deposited with the Mortgagee not later than Ten (10) days prior to the expiration of

existing policies.

D. If such policies of insurance maintained by the Association insure the Mortgaged

premises only on a contingent or conditional basis that requires each individual

condominium unit owner to provide his or her own insurance on the condominium unit,

then the Mortgagor must furnish to the Mortgagee an original policy of fire insurance with

extended coverage, vandalism, and malicious mischief endorsements, for the full

insurable replacement value of the premises to the satisfaction of the Mortgagee.

19. Mortgagee’s Right to Insure

Anything in Section 18 to the contrary notwithstanding, if the Association or the

Mortgagor fails or refuses to provide insurance coverage as above provided, the Mortgagee, at

its election, may take out fire insurance with extended coverage, vandalism, and malicious

mischief endorsements, covering the Mortgaged premises for its benefit as Mortgagee and may

add the insurance premiums to the unpaid balance of the indebtedness secured by this

Mortgage.

20. Liability Insurance

Mortgagor shall maintain liability insurance satisfactory to the Mortgagee covering all

liabilities, including liabilities for injuries to personal property, that could become assessments,

liens, or charges against the Mortgaged premises under the declaration, the code of regulations,

or otherwise, except such liabilities as the Mortgagee deems are adequately insured against

under policies maintained by the Association.

21. Rents and Profits

Mortgagor will render to the Mortgagee within thirty 30 days after written demand,

Mortgagor's detailed certified statement specifying all rents and profits received from the

Mortgaged premises for the period specified in the demand, the disbursements made for that

period, and the names of all tenants of the Mortgaged premises, together with true and correct

copies of all leases for which rent is so accounted.

22. Waste

Mortgagor will abstain from and not permit the condition of waste in or about the

Mortgaged premises; will comply with all laws, ordinances, regulations, covenants, conditions,

and restrictions affecting the Mortgaged premises; and will maintain the premises in good

condition and repair, and will, if operated as an income producing property, employ sufficient

persons and supply adequate services to operate the Mortgaged premises in a commercially

reasonable manner to avoid the loss, or the threatened loss, of tenants.

23. Quality of Work on Premises

Mortgagor shall not perform or have performed any work on the Mortgaged premises

that could jeopardize the soundness and safety of the condominium property or impair any

easements or hereditament without the unanimous consent of the condominium unit owners

affected by the same.

24. Restoration of Premises

If the condominium building is not restored following the happening of either any damage

to or destruction of all or part of the condominium building by the power in the nature of eminent

domain or by an action or deed in lieu of condemnation, the proceeds of any distribution for the

benefit of the Mortgagor shall be paid to the Mortgagee for the application to the unpaid balance

of the Mortgage debt.

25. Change in Percentage of Ownership

The Mortgagor shall not vote to change his percentage of ownership in the entire

condominium or to remove the condominium from the provisions of ______________________

(cite state statute) without the Mortgagee's prior written consent.

26. Amending Declaration, Plan, or Code of Regulations

Mortgagor shall not vote to amend the Declaration, the Declaration Plan, or the Code of

Regulations, without the Mortgagee's prior written consent, which consent shall not be withheld

unreasonably.

27. Partial Damage or Destruction

In the event of a partial damage to or destruction of the condominium building or a total

or partial taking by condemnation, the Mortgagor shall not vote not to restore the condominium

property without the Mortgagee's prior written consent, which consent shall not be withheld

unreasonably.

28. Unanimous Consent or Vote of Owners

In each instance in which, under the provisions of ____________________________

(cite state statute) , the Declaration, or the Code of Regulations, the unanimous consent or the

unanimous vote of the owners of condominium units is required, the Mortgagor shall not so vote

or give such consent without, in every case, the prior written consent of the Mortgagee, which

shall not be withheld unreasonably.

29. Change if Taxation Laws

If, after the date of this Mortgage, there is enacted any law deducting from the value of

land for the purpose of taxation, or imposing on the Mortgagee the Obligation to pay the whole,

or any part, of the taxes or assessments or charges or liens required in this Mortgage to be paid

by the Mortgagor, or changing in any way the laws relating to the taxation of Mortgages or debts

as to affect this Mortgage or the indebtedness that it secures, the entire unpaid balance of the

indebtedness secured by this Mortgage shall, at the option of the Mortgagee, after Forty-Five

(45) days written notice to the Mortgagor, become due and payable; provided, however, that if,

in the opinion of counsel for the Mortgagee, it is lawful for the Mortgagor to pay such taxes,

assessments, or charges, or to reimburse the Mortgagee for them, and the Mortgagor lawfully

makes payment of them and reimburses the Mortgagee, then there shall be no such

acceleration of the time for the payment of the unpaid balance of the indebtedness secured by

this Mortgage.

30. Default

Each of the following shall be considered an event of default under this Mortgage:

A. Mortgagor fails to pay when due any installment of principal or interest or any

payment of any other funds secured by this Mortgage;

B. Mortgagor uses the Mortgaged premises for any purpose other than (insert

purpose) ______________________________________________________________

without the Mortgagee's prior written consent;

C. If any provision of ___________________________ (cite state statute) , or any

section, sentence, clause, phrase, or words, or the application of the same in any

circumstances is held invalid and such invalidity shall affect the lien of this Mortgage or

the right of the Mortgagee under this Mortgage;

D. Mortgagor shall default in the performance of his other Obligations under this

Mortgage, or if any covenant or agreement under this Mortgage, or any Obligations

secured by this Mortgage, is broken;

E. If the Association shall fail to make such repairs to the property of which the

condominium unit forms a part as the Association is authorized to make pursuant to the

code of regulations so as to maintain the same in reasonably good repair, working order,

and condition, except for reasonable wear and use, or to make or cause to be made all

necessary and proper repairs, removals, and replacements to the same, and any such

default shall continue for a period of Forty-Five (45) days after written notice of default,

specifying the default and parts to be remedied shall have been given to the person

designated, from time to time, in accordance with the provisions of the declaration to

receive service of process;

F. If the Association fails to pay as and when the same becomes due and payable

any water or surcharges or other lien on the Mortgaged premises or any part of the

same prior to and on a parity with the lien of this Mortgage, and such default continues

for a period of Forty-Five (45) days after written notice of default, specifying the default

and specifying the same to be remedied shall have been given to the person designated

from time to time in accordance with the provisions of the declaration to receive service

of process; or

G. If by order of a court of competent jurisdiction a receiver or a liquidator or trustee

of any Mortgagor shall be appointed, and shall not have been discharged within Forty-

Five (45) days, or if by a decree of a court of competent jurisdiction a Mortgagor shall be

adjudicated bankrupt or insolvent, or if any of the property of the Mortgagor shall have

been sequestered and such decree shall have continued undischarged for Forty-Five

(45) days after the entry of the decree, or if any proceedings under the federal

Bankruptcy Act or any similar statute applicable to any Mortgagor as now or later in

effect, shall be instituted against any Mortgagor and shall not be dismissed within Forty-

Five (45) days after such filing, or if any Mortgagor shall institute any such proceeding or

shall consent to the institution of any such proceedings against any Mortgagor under any

such law, or if any Mortgagor shall make an assignment for the benefit of the creditors of

the Mortgagor or shall admit in writing the inability of the Mortgagor to pay debts

generally as they become due or shall consent to the appointment of a receiver or

liquidator or trustee of Mortgagor or of all or any part of its property.

31. Remedies on Default

On the happening of any of the events of default enumerated in Section 30:

A. Mortgagee may take possession of the Mortgaged premises;

B. Mortgagee may immediately exercise all of the rights and remedies provided

under this Mortgage and under the Obligation, or that may otherwise be available to the

Mortgagee by law, including, but not limited to, the right to issue forthwith a complaint on

this Mortgage and prosecute it to judgment, execution, and sale for the collection of the

complete amount of the principal debt, the interest on it, and any other sums secured by

this Mortgage, remaining unpaid, together with all fees, costs, and expenses of such

proceedings, including a reasonable attorney's fee; and

C. The whole of the principal debt, with interest and all other sums secured, then unpaid,

shall then become immediately due and payable, at the option of the Mortgagee, without

any further notice or demand on the part of the Mortgagee.

32. Mortgagee’s Possession of Mortgaged Premises

If the Mortgagee shall take possession of the Mortgaged premises as provided in this

Mortgage, the Mortgagee may:

A. Make such authorizations, additions, improvements, renovations, repairs, and

replacements as the Mortgagee may deem proper;

B. Collect the rents, issues, and profits arising from the Mortgaged premises, past

due and subsequently becoming due, and apply the same, in such order of priority as

the Mortgagor may determine, to the payment of their charges and commissions

incidental to the collection of all rents and the management of the Mortgaged premises

and all other sums or charges required to be paid by the Mortgagor;

C. Remodel such improvements so as to make them available in whole or in part for

business purposes or multiple selling purposes; and

D. Hold, manage, operate, and lease the Mortgaged premises to the Mortgagor or

any other person or persons, on such terms, and for such periods of time, as the

Mortgagee may deem proper.

The provisions of any such lease made by the Mortgagee shall be binding on the

Mortgagor notwithstanding the fact that the Mortgagee's right of possession may terminate or

that this Mortgage may be satisfied of record prior to the expiration of the term of the lease.

33. Repayment of Monies Advanced

All monies advanced by the Mortgagee for the purposes specified in Section 32 and not

repaid out of the rents collected shall immediately, and without demand, be repaid by the

Mortgagor to the Mortgagee, together with the interest at the rate provided in the Obligation, and

shall be added to the principal indebtedness secured by this Mortgage.

34. Governing Law

This Mortgage shall be governed by, construed, and enforced according to the laws of

___________________ (name of state) .

35. Satisfaction of Mortgage Debt

When all the indebtedness secured by this Mortgage has been paid, and if the

Mortgagor shall also pay all satisfaction costs, including, but not limited to, the cost of recording

a power of attorney to satisfy this Mortgage, then this Mortgage and the estate created by it and

the Obligations secured by this Mortgage shall be void and of no further effect.

This Mortgage has been executed by Mortgagor the day and year first above written.

_____________________________

(Printed Name of Mortgagor)

_____________________________

(Signature of Mortgagor)

(Acknowledgment form may vary by state)

State of _____________________

County of ___________________

Personally appeared before me, the undersigned authority in and for the said County

and State, on this ___________________ (date) , within my jurisdic tion, the within-named

_____________________ (Name of Mortgagor) , who acknowledged that he executed the

above and foregoing instrument.

________________________________

NOTARY PUBLIC

My Commission Expires:

____________________