Fill and Sign the Conference Room Rental Agreements Form

Practical tips on creating your ‘Conference Room Rental Agreements Form’ online

Are you fed up with the burden of managing paperwork? Look no further than airSlate SignNow, the premier eSignature tool for both individuals and businesses. Bid farewell to the tedious task of printing and scanning documents. With airSlate SignNow, you can effortlessly complete and sign documents online. Take advantage of the robust features integrated into this user-friendly and cost-effective platform and transform your document management strategy. Whether you need to approve forms or collect electronic signatures, airSlate SignNow makes it simple, requiring just a few clicks.

Adhere to this comprehensive guide:

- Log into your account or register for a complimentary trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our form repository.

- Open your ‘Conference Room Rental Agreements Form’ in the editor.

- Click Me (Fill Out Now) to set up the document on your end.

- Add and designate fillable fields for others (if necessary).

- Advance with the Send Invite settings to solicit eSignatures from others.

- Save, print your version, or convert it into a reusable template.

Don’t be concerned if you need to collaborate with your teammates on your Conference Room Rental Agreements Form or send it for notarization—our solution has everything you require to complete such tasks. Sign up with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

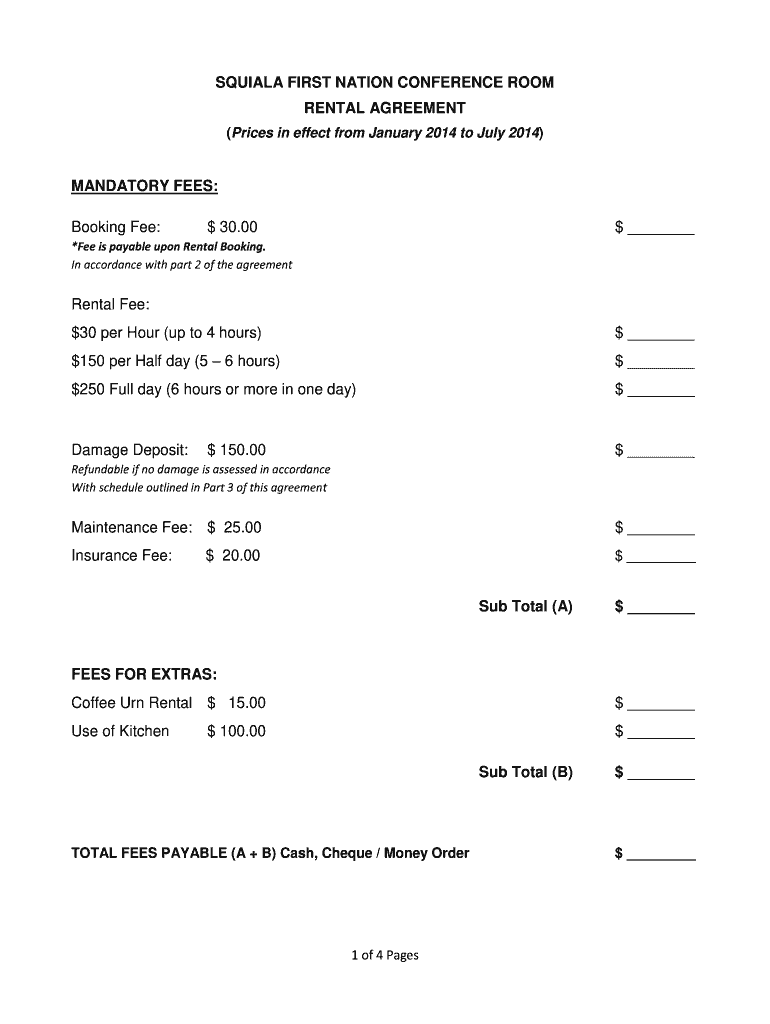

What is a Meeting Room Rental Agreement Template?

A Meeting Room Rental Agreement Template is a pre-designed document that outlines the terms and conditions for renting a meeting room. This template typically includes details such as rental duration, pricing, facilities included, and cancellation policies. Using a Meeting Room Rental Agreement Template helps ensure clarity and legal compliance for both the renter and the venue.

-

How can I customize the Meeting Room Rental Agreement Template?

You can easily customize the Meeting Room Rental Agreement Template using airSlate SignNow's user-friendly interface. Simply upload the template, fill in your specific details such as date, time, and additional services, and make any necessary adjustments to suit your requirements. This flexibility ensures that your agreement meets your unique business needs.

-

What are the benefits of using a Meeting Room Rental Agreement Template?

Utilizing a Meeting Room Rental Agreement Template streamlines the process of securing a rental space for meetings. It saves time by providing a ready-made document that covers all essential terms, reduces the risk of misunderstandings, and enhances professionalism. Moreover, it can help in maintaining a consistent rental process across your organization.

-

Are there any costs associated with using the Meeting Room Rental Agreement Template?

While the Meeting Room Rental Agreement Template itself may be available for free, costs can arise from the services used to send or eSign the document through airSlate SignNow. Our platform offers cost-effective pricing plans that cater to businesses of all sizes, allowing you to manage your agreements without breaking the bank.

-

Can I integrate the Meeting Room Rental Agreement Template with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can easily connect your Meeting Room Rental Agreement Template with tools like Google Workspace, Microsoft Office, and CRM systems to streamline document management and improve collaboration.

-

Is the Meeting Room Rental Agreement Template legally binding?

Yes, when properly executed, the Meeting Room Rental Agreement Template becomes a legally binding contract. By using airSlate SignNow for eSigning, you ensure that the agreement is secure and compliant with e-signature laws, providing peace of mind for both parties involved in the rental.

-

How do I share the Meeting Room Rental Agreement Template with others?

Sharing the Meeting Room Rental Agreement Template is simple with airSlate SignNow. You can send the document directly via email or generate a shareable link that allows others to access and sign the agreement. This ease of sharing facilitates quick communication and efficient processing.

Find out other conference room rental agreements form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles