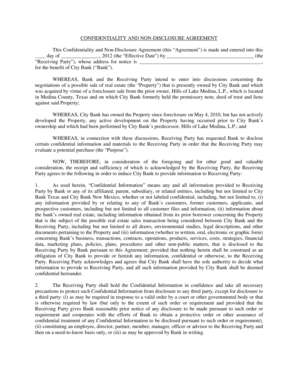

CONFIDENTIALITY AND NON-DISCLOSURE AGREEMENT

This Confidentiality and Non-Disclosure Agreement (this “Agreement”) is made and entered into this

____ day of _______________, 2012 (the “Effective Date”) by __________________________________ (the

“Receiving Party”), whose address for notice is ________________________________________________,

for the benefit of City Bank (“Bank”).

WHEREAS, Bank and the Receiving Party intend to enter into discussions concerning the

negotiations of a possible sale of real estate (the “Property”) that is presently owned by City Bank and which

was acquired by virtue of a foreclosure sale from the prior owner, Hills of Lake Medina, L.P., which is located

in Medina County, Texas and on which City Bank formerly held the promissory note, deed of trust and liens

against said Property;

WHEREAS, City Bank has owned the Property since foreclosure on May 4, 2010, but has not actively

developed the Property, any active development on the Property having occurred prior to City Bank’s

ownership and which had been performed by City Bank’s predecessor, Hills of Lake Medina, L.P.; and

WHEREAS, in connection with these discussions, Receiving Party has requested Bank to disclose

certain confidential information and materials to the Receiving Party in order that the Receiving Party may

evaluate a potential purchase (the “Purpose”).

NOW, THEREFORE, in consideration of the foregoing and for other good and valuable

consideration, the receipt and sufficiency of which is acknowledged by the Receiving Party, the Receiving

Party agrees to the following in order to induce City Bank to provide information to Receiving Party:

1.

As used herein, “Confidential Information” means any and all information provided to Receiving

Party by Bank or any of its affiliated, parent, subsidiary, or related entities, including but not limited to City

Bank Texas and City Bank New Mexico, whether or not labeled confidential, including, but not limited to, (i)

any information provided by or relating to any of Bank’s customers, former customers, applicants, and

prospective customers, including but not limited to all customer files and information, (ii) information about

the bank’s owned real estate, including information obtained from its prior borrower concerning the Property

that is the subject of the possible real estate sales transaction being considered between City Bank and the

Receiving Party, including but not limited to all draws, environmental studies, legal descriptions, and other

documents pertaining to the Property and (iii) information (whether in written, oral, electronic or graphic form)

concerning Bank’s business, transactions, contracts, operations, products, services, costs, strategies, financial

data, marketing plans, policies, plans, procedures and other non-public matters, that is disclosed to the

Receiving Party by Bank pursuant to this Agreement; provided that nothing herein shall be construed as an

obligation of City Bank to provide or furnish any information, confidential or otherwise, to the Receiving

Party. Receiving Party acknowledges and agrees that City Bank shall have the sole authority to decide what

information to provide to Receiving Party, and all such information provided by City Bank shall be deemed

confidential hereunder.

2.

The Receiving Party shall hold the Confidential Information in confidence and take all necessary

precautions to protect such Confidential Information from disclosure to any third party, except for disclosure to

a third party: (i) as may be required in response to a valid order by a court or other governmental body or that

is otherwise required by law (but only to the extent of such order or requirement and provided that the

Receiving Party gives Bank reasonable prior notice of any disclosure to be made pursuant to such order or

requirement and cooperates with the efforts of Bank to obtain a protective order or other assurance of

confidential treatment of any Confidential Information to be disclosed pursuant to such order or requirement),

(ii) constituting an employee, director, partner, member, manager, officer or advisor to the Receiving Party and

then on a need-to-know basis only, or (iii) as may be approved by Bank in writing.

�3.

The Receiving Party shall not use, directly or indirectly, any of the Confidential Information for the

benefit of the Receiving Party or for the benefit of another, other than for the Purpose set forth in this

Agreement.

4.

The Receiving Party’s obligations of confidentiality hereunder will terminate if and when the

Receiving Party can document that such Confidential Information: (i) was already known by the Receiving

Party at the time of disclosure by Bank, (ii) was disclosed to the Receiving Party by a third party who had the

right to make such disclosure without any confidentiality restrictions, (iii) was, or without the Receiving

Party’s violation of the terms of Section 2 hereof has become, generally available to the public, or (iv) was

independently developed by the Receiving Party without access to, or use of, the Confidential Information.

5.

The Receiving Party will not copy or reproduce Confidential Information in any form except as

permitted under this Agreement. All Confidential Information shall be returned to the Bank or destroyed upon

the earlier of (i) the request of Bank, or (ii) upon completion of the Purpose for which the Confidential

Information was disclosed in the first place.

6.

The Receiving Party acknowledges and agrees that any breach or violation of this Agreement will

result in immediate and irreparable injury and harm to Bank and will cause damage to Bank in amounts

difficult to ascertain. Accordingly, in the event of a breach or threatened breach by the Receiving Party of any

of the provisions of this Agreement, the Receiving Party agrees that Bank, in addition to and not in limitation

of any other rights, remedies or damages available to Bank at law or in equity, shall be entitled to a preliminary

and a permanent injunction in order to prevent or restrain any such further breach by the Receiving Party or

any of its directors, partners, members, managers, officers, advisors or persons, directly or indirectly, acting for

or with the Receiving Party. The Receiving Party acknowledges and agrees that the remedies contained in this

Section 6 are reasonably related to the injuries Bank may sustain as a result of the Receiving Party’s breach of

its obligations under this Agreement, and are not a penalty. It is further understood and agreed that no failure

or delay by Bank in exercising any right, power or privilege hereunder shall operate as a waiver thereof, nor

shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any

right, power or privilege hereunder. Bank will be entitled to be indemnified, defended and held harmless by

the Receiving Party from any loss or harm, including, without limitation, attorneys’ fees, in connection with

any breach or enforcement of the Receiving Party’s obligations hereunder or the unauthorized use or release of

any Confidential Information.

7.

This Agreement will be governed by and construed in accordance with the laws of the State of Texas.

In the event that any of the provisions of this Agreement are held by a court or other tribunal of competent

jurisdiction to be illegal, invalid or unenforceable, such provisions will be limited or eliminated to the

minimum extent necessary so that this Agreement will otherwise remain in full force and effect. This

Agreement supersedes all prior discussions and writings, and constitutes the entire agreement between the

parties, with respect to the subject matter hereof. No waiver or modification of this Agreement will be binding

upon either party unless made in writing and signed by a duly authorized representative of such party.

8.

The Receiving Party may not assign this Agreement without the prior written consent of Bank. The

obligations of the Receiving Party shall be binding upon its successors and assigns.

9.

As additional consideration for this Agreement and for access to the receipt of Confidential

Information, Receiving Party acknowledges, understands and agrees that City Bank acquired the real estate to

which it may provide Confidential Information, through a foreclosure sale, and therefore City Bank has limited

knowledge concerning the condition of the Property in question. City Bank will disclaim, and hereby

disclaims, any warranty, guaranty or representation, oral or written that will be made in the past, present or

future concerning the (A) nature and condition of the Property, including without limitation, the condition of

any building or improvements, any boundary encroachments, boundary disputes, the water or soil, the

suitability of the property for ownership and/or use for any purpose or the ownership of any buildings or other

improvements, if any, for any use or purpose to which the receiving party may ultimately conduct on the

�property; (B) the nature and extent of any right of way, lease, possession, lien, encumbrance, license,

reservation, condition or otherwise, and (C) the compliance of the Property with any laws, ordinances or

regulations of any government body.

Furthermore, the Receiving Party acknowledges that the information provided by City Bank pursuant to this

Agreement, or provided in any offering circular or marketing materials, was obtained from a variety of

sources, including City Bank’s prior borrower or public records, and that City Bank has not and shall not make

an independent verification of the information to be provided nor does City Bank make any representations

concerning the accuracy or completeness of the information. Receiving Party shall be given access to these

records to perform its own due diligence concerning the possibility of entering into a contract to purchase said

Property, but in doing so, Receiving Party shall be responsible for and hereby assumes all obligations for

inspecting the Property on its own, and will rely solely on its own inspection of the Property and on its own

review, due diligence and investigation of the information to be provided to the Receiving Party by City Bank.

Any sale of the Property shall be made on an “AS IS”, “WHERE IS” AND “WITH ALL FAULTS” basis. NO

WARRANTY OR REPRESENTATION, EXPRESS OR IMPLIED, ARISING BY OPERATION OF LAW,

INCLUDING, BUT NOT LIMITED TO, ANY WARRANTY OF CONDITION, TITLE (OTHER THAN

THE SPECIAL WARRANTY OF TITLE WITH RESPECT TO THE PROPERTY TO BE SOLD),

HABITABILITY, MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH

RESPECT TO THE PROPERTY OR ANY PORTION THEREOF SHALL BE MADE.

10.

All notices required under this Agreement shall be in writing and shall be by personal delivery,

electronic mail, facsimile transmission or by certified or registered mail, return receipt requested, and will be

deemed given upon personal delivery, five (5) days after deposit in the mail, or upon acknowledgment of

receipt of electronic transmission. Notices shall be sent to City Bank at: City Bank, Attn: Morris Wilcox, 5219

City Bank Parkway, Lubbock, Texas 79407, and to Receiving Party at: the address listed in the opening

paragraph of this Agreement.

IN WITNESS WHEREOF, Receiving Party has executed this Agreement as of the Effective Date.

“RECEIVING PARTY”

Signature

Printed Name

Title

Company

Phone Number

Facsimile Number

Email Address

�