December 1987 11-236A

EXHIBIT 1

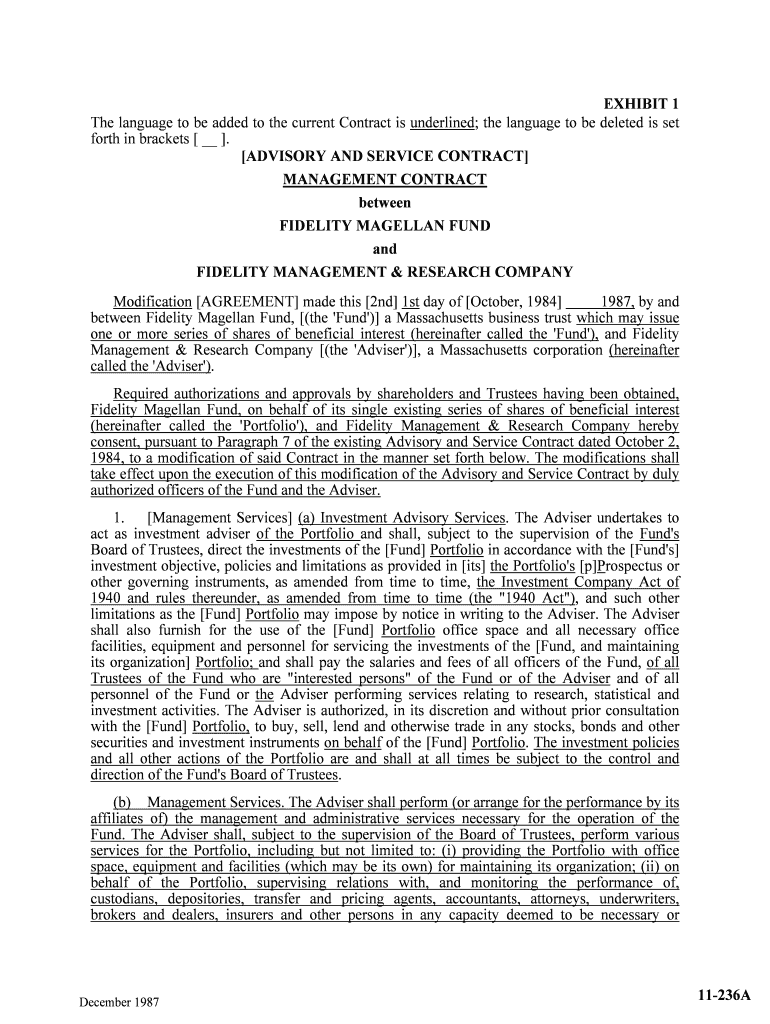

The language to be added to the current Contract is underlined; the language to be deleted is set

forth in brackets [ __ ].

[ADVISORY AND SERVICE CONTRACT]

MANAGEMENT CONTRACT

between

FIDELITY MAGELLAN FUND and

FIDELITY MANAGEMENT & RESEARCH COMPANY

Modification [AGREEMENT] made this [2nd] 1st day of [October, 1984]

1987, by and

between Fidelity Magellan Fund, [(the 'Fund')] a Massachusetts business trust which may issue

one or more series of shares of beneficial interest (hereinafter called the 'Fund'), and Fidelity

Management & Research Company [(the 'Adviser')], a Massachusetts corporation (hereinafter

called the 'Adviser').

Required authorizations and approvals by shareholders and Trustees having been obtained,

Fidelity Magellan Fund, on behalf of its single existing series of shares of beneficial i nterest

(hereinafter called the 'Portfolio'), and Fidelity Management & Research Company hereby

consent, pursuant to Paragraph 7 of the existing Advisory and Service Contract dated October 2,

1984, to a modification of said Contract in the manner set forth below. The modifications shall

take effect upon the execution of this modification of the Advisory and Service Contract by duly

authorized officers of the Fund and the Adviser.

1. [Management Services] (a) Investment Advisory Services. The Adviser undertakes to

act as investment adviser of the Portfolio and shall, subject to the supervision of the Fund's

Board of Trustees, direct the investments of the [Fund] Portfolio in accordance with the [Fund's]

investment objective, policies and limitations as provided in [its] the Portfolio's [p]Prospec tus or

other governing instruments, as amended from time to time, the Investment Company Act of

1940 and rules thereunder, as amended from time to time (the "1940 Act"), and such other

limitations as the [Fund] Portfolio may impose by notice in writing to the Adviser. The Adviser

shall also furnish for the use of the [Fund] Portfolio office space and all necessary office

facilities, equipment and personnel for servicing the investments of the [Fund, and maintaini ng

its organization] Portfolio; and shall pay the salaries and fees of all officers of the Fund, of all

Trustees of the Fund who are "interested persons" of the Fund or of the Adviser and of all

personnel of the Fund or the Adviser performing services relating to research, statistical a nd

investment activities. The Adviser is authorized, in its discretion and without prior consultation

with the [Fund] Portfolio, to buy, sell, lend and otherwise trade in any stocks, bonds and other

securities and investment instruments on behalf of the [Fund] Portfolio. The investment polici es

and all other actions of the Portfolio are and shall at all times be subject to the control and

direction of the Fund's Board of Trustees.

(b) Management Services. The Adviser shall perform (or arrange for the performance by its

affiliates of) the management and administrative services necessary for the operati on of the

Fund. The Adviser shall, subject to the supervision of the Board of Trustees, perform various

services for the Portfolio, including but not limited to: (i) providing the Portfolio with offi ce

space, equipment and facilities (which may be its own) for maintaining its organization; (ii) on

behalf of the Portfolio, supervising relations with, and monitoring the performance of,

custodians, depositories, transfer and pricing agents, accountants, attorneys, underwriters,

brokers and dealers, insurers and other persons in any capacity deemed to be necessary or

© 1987 Jefren Publishing Company, 11-236B

desirable; (iii) preparing all general shareholder communications, including shareholder reports;

(iv) conducting shareholder relations; (v) maintaining the Fund's existence and its records; (vi)

during such times as shares are publicly offered, maintaining the registration and qualification of

the Portfolio's shares under federal and state law; and (vii) investigating the development of and

developing and implementing, if appropriate, management and shareholder services designed t o

enhance the value or convenience of the Portfolio as an investment vehicle.

The Adviser shall also furnish such reports, evaluations, information or analyses to the Fund

as the Fund's Board of Trustees may request from time to time or as the Adviser may deem to be

desirable. The Adviser shall make recommendations to the Fund's Board of Trustees with re spect

to Fund policies, and shall carry out such policies as are adopted by the Trustees. The Adviser

shall, subject to review by the Board of Trustees, furnish such other services as the Adviser shall

from time to time determine to be necessary or useful to perform its obligations under this

Contract.

(c) The Adviser, at its own expense, shall place all orders for the purchase and sale of

portfolio securities for the [Fund] Portfolio's account with brokers or dealers selected by the

Adviser, which may include brokers or dealers affiliated with the Adviser. The Adviser shall use

its best efforts to seek to execute portfolio transactions at prices which are advanta geous to the

[Fund] Portfolio and at commission rates which are reasonable in relation to the be nefits

received. In selecting brokers or dealers qualified to execute a particular transaction, [the Adviser

is authorized to select] brokers or dealers may be selected who also provide brokerage and

research services (as those terms are defined in Section 28 (e) of the Securities Exchange Act of

1934) to the [Fund] Portfolio and/or the other accounts over which the Adviser or its affiliates

exercise investment discretion. The Adviser is authorized to pay a broker or dealer who provides

such brokerage and research services a commission for executing a [Fund] portfolio transaction

for the Portfolio which is in excess of the amount of commission another broker or dealer woul d

have charged for effecting that transaction if the Adviser determines in good faith that such

amount of commission is reasonable in relation to the value of the brokerage and researc h

services provided by such broker or dealer. This determination may be viewed in terms of eit her

that particular transaction or the overall responsibilities which the Adviser and its affiliates have

with respect to [the Fund and to] accounts over which they exercise investment discre tion. The

Trustees of the Fund shall periodically review the commissions paid by the [Fund] Portfolio t o

determine if the commissions paid over representative periods of time were reasonable i n

relation to the benefits to the [Fund] Portfolio.

[The investment policies and all other action of the Fund are and shall at all times be subject

to the control and direction of its Board of Trustees.] The Adviser shall, in acting here under, be

an independent contractor. The Adviser shall not be an agent of the [Fund] Portfolio.

2. [Relationship with the Adviser.] It is understood that Trustees, officers and

shareholders of the Fund are or may be or become interested in the Adviser as [Trustees]

directors, officers or otherwise and that directors, officers and stockholders of the Adviser are or

may be or become similarly interested in the Fund, and that the Adviser may be or be come

interested in the Fund as a shareholder or otherwise.

3. [Advisory and Service] Management Fee. The Adviser will be compensated on the

following basis for the services and facilities to be furnished hereunder. The Adviser shall

receive an annual [advisory and service] management fee, payable monthly as soon as

practicable after the last day of each month, composed of a basic fee ("basic fee") and a

performance adjustment to the basic fee based upon the investment performance of the [Fund]

Portfolio in relation to the Standard & Poor's Daily Stock Price Index of 500 Common Stocks

(the "index').

December 1987 11-236C

(a) Basic Fee Rate. The annual basic fee rate shall be the sum of the Group fee rate and the

individual fee rate calculated to the nearest millionth as follows:

(i) Group Fee Rate. The group fee rate shall be based upon the monthly average of

the net assets of the registered investment companies having Advisory and Service or

Management Contracts with the Adviser (computed in the manner set forth in the c harter

documents of each such investment company) determined as of the close of business on each

business day throughout the month. The group fee rate shall be determined on a cumulative

basis pursuant to the following schedule:

[Average Net Assets Annual Fee Rate

Average

Net

Assets

Annualized

Fee Rate

(For each level)

Over $00 - $0.5 billion 0.530% $ 0 - 3 illion .52 %

$0.5 - $1.0 0.520% 3 - 6 .49

$1.0 - $1.5 0.510% 6 - 9 .46

$1.5 - $2.0 0.500% 9 - 12 .43

$2.0 - $2,5 0.490% 12 -15 .40

$2.5 - $3.0 0.480% 15 -18 .385

$3,0 - $3,5 0.465% 18 - 21 .37

$3.5 - $4.0 0.450% 21 - 24 .36

$4.0 - $4.5 0.435% 24 - 30 .37

$4.5 and above 0.415%] 30 - 36 .345

36 - 42 .34

42 - 48 .335

Over 48 .33

(ii) Individual Fund Fee Rate. The individual fund fee rate shall be .30%.

(b) Basic Fee. One-twelfth of the annual basic fee rate shall be applied to the a verage of the

net assets of the [Fund] Portfolio (computed in the manner set forth in Article 10 of the

Declaration of Trust of the Fund) determined as of the close of business throughout each month.

The resulting dollar amount comprises the basic fee.

(c) Performance Adjustment Rate. The performance adjustment rate will be determine d on

the basis of the [Fund] Portfolio's investment performance as follows:

Upward Adjustment. The performance adjustment rate will be a positive number at the

annual rate of 0.02% for each percentage point, rounded to the nearer point (the higher point

if exactly one-half a point), that the [Fund] Portfolio's investment performance over the

month and the preceding 35 months (the "Performance Period") exceeds the record of the

Index, as then constituted, for the performance period, with the maximum such increase i n

the fee rate being at the annual rate of 0.20%.

Downward Adjustment. The performance adjustment rate will be a negative number at

the annual rate of 0.02% for each percentage point, rounded to the nearer point (the higher

point if exactly one-half a point), that the record of the Index for the performance peri od

exceeds the investment performance of the [Fund] Portfolio, with the maximum such

reduction in fee rate being at the annual rate of 0.20%.

The [Fund] Portfolio's investment performance will be measured by comparing (i) the

opening net asset value of one share of the [Fund] Portfolio on the first business day of the

performance period with (ii) the closing net asset value of one share of the [Fund] Portfolio a s of

the last business day of such period. In computing the investment performance of the [Fund]

Portfolio and the investment record of the Index, distributions of realized capital gains, the value

of capital gains taxes per share paid or payable on undistributed realized long-term capital gains

accumulated to the end of such period, and dividends paid out of investment income on the part

© 1987 Jefren Publishing Company, 11-236D

of the [Fund] Portfolio, and all cash distributions of the companies whose stocks compromise the

Index, will be treated as reinvested in accordance with Rule 205-1 or any other applicable rules

under the Investment Advisers Act of 1940, as the same from time to time may be amended.

The computation of the performance adjustment will not be cumulative. A positive fee rate

will apply even though the performance of the [Fund] Portfolio over some period of time shorter

than the performance period has been behind that of the Index, and, conversely, a negative rate

of the fee will be made for a month even though the performance of the [Fund] Portfolio over

some period of time shorter than the performance period has been ahead of that of the Index.

(d) One-twelfth of the annual performance adjustment rate shall be applied to the average of the net assets of the [Fund] Portfolio (computed in the manner set forth in

Article 10 of the Declaration of Trust of the Fund adjusted as provided in paragraph (e)

below, if applicable) determined as of the close of business on each business day

throughout the month and the performance period. The resulting dollar amount is added

to or deducted from the basic fee.

(e) e) In the event of a merger or other business combination involving another entity for which the Adviser is the investment adviser, and where such other entity utilizes a

performance adjustment in determining its investment advisory fee, then:

(A) For purposes of determining the amount of the performance adjustment, the net

assets of the acquired entity averaged over the period from the first day of the

performance period through the date of the transaction shall be considered to have been

included in the net assets of the [Fund] Portfolio for the period from the first day of the

performance period through the date of the transaction.

(B) For purposes of determining the performance adjustment, the opening net asset

value of one share of the [Fund] Portfolio on the first business day of the performance

period shall be adjusted on a dollar-weighted basis by (i) multiplying the percentange

change (to the nearest one-hundredth of one percent) between the actual net asset val ue

of one share of the [Fund] Portfolio and of the other entity on the first day of the

[Fund's] Portfolio's performance period and such respective net asset values per share

on the date of the transaction (as computed in paragraph 3 (c)) by the respective

average net assets of the [Fund] Portfolio and such other entity (measured from the first

day of the [Fund's] Portfolio's performance period through the date of the transaction);

(ii) combining the products determined in (i); (iii) dividing by the sum of the average

net assets of the [Fund] Portfolio and such other entity; and (iv) if a positive percenta ge,

dividing 1 plus the percentage determined in (iii) (expressed as a decimal to the nearest

one-hundredth of a percent) into the net asset value of one share of the [Fund] Portfolio

on the date of the transaction (as computed in paragraph 3 (c); or (v) if a negative

percentage, deducting the percentage determined in (iii) (expressed as a decimal to the

nearest one-hundredth of a percent) from 1 and dividing the result into the net asset

value of one share of the [Fund] Portfolio on the date of the transaction (as computed in

paragraph 3 (c). The resulting adjusted net asset value of one share of the [Fund]

Portfolio on the first business day of the [Fund's] Portfolio's performance period shall

be utilized in calculating the annual rate of performance adjustment under paragraph 3

(c) for the 36 monthly fee calculations following the date of the transaction. One-

twelfth of the annual performance adjustment rate shall be applied to the average of the

net assets of the [Fund] Portfolio determined as provided in paragraph 3(e)(A). The

performance adjustment so computed shall be added to or deducted from the amount of

the basic fee (as computed in paragraph 3 (b)) depending upon whether the

performance of the [Fund] Portfolio exceeded or was exceeded by the record of the

Index.

December 1987 11-236E

(f) In case of termination of the Contract during any month, the fee for that month shall be

reduced proportionately on the basis of the number of business clays during which it is in effec t

for that month. The basic fee rate will be computed on the basis of and applied to net assets

averaged over that month ending on the last business day on which this Contract is in effect. The

amount of the performance adjustment to the basic fee will be computed on the basis of and

applied to net assets averaged over the 36-month period ending on the last business day on whi ch

this Contract is in effect.

4. [Expenses Payable by the Fund.] It is understood that the [Fund] Portfolio will pay all

its expenses other than those expressly stated to be payable by the Adviser hereunder, which

expenses payable by the [Fund] Portfolio shall include, without limitation, (i) interest and taxes;

(ii) brokerage commissions and other costs in connection with the purchase or sale of securiti es

and other investment instruments; (iii) [compensation] fees and expenses of [its Directors] t he

Fund's Trustees other than those who are "interested persons' of the Funnd or the Adviser [within

the meaning of the Investment Company Act of 1940, as the same may be from time to time

amended]; (iv) legal and audit expenses; (v) custodian, registrar and transfer agent fees a nd

expenses; [(vi) expenses related to the repurchase or redemption of its shares, including expe nses

attributable to a program of periodic repurchases or redemptions;] ([ix] vi) fees and expenses

related to the registration [under the Securities Act of 1933] and qualification of t he Fund and the

Portfolio's shares for distribution under state and federal securities laws [of Shares of the Fund

for public sale and fees imposed on the Fund under the Investment Company Act of 1940; (vii)

expenses of servicing shareholder accounts; (viii) expenses, including the printing of stock

certificates, related to the issuance of its shares against payment therefor by or on behalf of the

subscribers thereto; ([x]vii) expenses of printing and mailing reports and notices and proxy

material to shareholders of the [Fund] Portfolio; ([xi]viii) all other expenses incidental to holding

meetings of the [Fund] Portfolio's shareholders, including proxy solicitations therefor; ([xii] ix) a

pro rata share, based on relative net assets of the [Fund] Portfolio and other registered investment

companies having Advisory and Service or Management Contracts with the Adviser, of 50 % of

insurance premiums for fidelity and other coverage; ([xiii] x) its proportionate share of

[Investment Company Institute] association membership dues; (xi) expenses of typesetting for

printing Prospectuses and Statements of Additional Information and supplements thereto; (xii )

expenses of printing and mailing Prospectuses and Statements of Additional Information and

supplements thereto sent to existing shareholders; and ([xiv]xiii) such non-recurring or

extraordinary expenses as may arise, including those relating to actions, suits or proceedings to

which the [Fund] Portfolio is a party and the legal obligation which the [Fund] Portfolio may

have to indemnify [its officers and] the Fund's Trustees and officers with respect thereto.

5. [Limitation of Adviser's Liability.] The services of the Adviser to the [Fund] Portfolio

are not to be deemed [to be] exclusive, the Adviser being free to render services to others and

engage in other activities, provided, however, that such other services and activities do not,

during the term of this Contract, interfere, in a material manner, with the Adviser's a bility to

meet all of its obligations with respect to rendering [investment advice] services to the Portfolio

hereunder. In the absence of willful misfeasence, bad faith, gross negligence or reckless

disregard of obligations or duties hereunder on the part of the Adviser, the Adviser shall not be

subject to liability to the [Fund] Portfolio or to any shareholder of the [Fund] Portfolio for any

act or omission in the course of, or connected with, rendering services hereunder or for any

losses that may be sustained in the purchase, holding or sale of any security.

© 1987 Jefren Publishing Company, 11-236F

[6. Covenants of the Adviser. The Adviser agrees that neither it nor any of its officers,

directors or employees will take a long or short position in the securities issued by the Fund

except that it or they may purchase from the Fund, or from a principal underwriter of the Fund,

shares issued by the Fund at a price not lower than the net asset value of the shares at the time of

such purchase, provided that any such purchases are to be made pursuant to a uniform offer

described in the current prospectus.]

[7]6. [Duration and Termination.] (a) Subject to prior termination as provided in

subparagraph (d) of this paragraph [7] 6, this Contract shall continue in force until July 31,

[1985] 1987 and indefinitely thereafter, but only so long as the continuance after such [period]

date shall be specifically approved at least annually by vote of the [Fund's Board of] Trust ees

[including a majority of those Trustees who are not "interested persons"] of the Fund or by vote

of a majority of the outstanding voting securities of the [Fund] Portfolio.

(b) This Contract may be modified by mutual consent, such consent on the part of the Fund

to be authorized by vote of a majority of the outstanding voting securities of the [Fund] Portfolio.

(c) In addition to the requirements of sub-paragraphs (a) and (b) of this [P] paragraph [7] 6,

the terms of any continuance or modification of [the] this Contract must have been approved by

the vote of a majority of those Trustees of the Fund who are not parties to [such] the C ontract or

interested persons of any such party, cast in person at a meeting called for the purpose of voting

on such approval.

(d) Either party hereto may, at any time on sixty (60) days' prior written notice to the other,

terminate this Contract [,] without [the] payment of any penalty, by action of its [Board of]

Trustees or Board of Directors, as the case may be, or with respect to the Portfolio by vote of a

majority of [its] the outstanding voting securities of the Portfolio. This Contract shall terminate

automatically in the event of its assignment.

7. The Adviser is hereby expressly put on notice of the limitation of shareholder liabilit y

as set forth in the Fund's Declaration of Trust [of the Fund] and agrees that the obligations

assumed by the Fund pursuant to this Contract shall be limited in all cases to t he [Fund] Portfolio

and its assets, and the Adviser shall not seek satisfaction of any such obligation from the

shareholders or any shareholder of the Portfolio or any other Portfolios

the Fund. In addition, [Nor shall] the Adviser shall not seek satisfaction of any such obligation

[s] from the Trustees or any individual Trustee. The Adviser understands that the rights and

obligations of any Portfolio under the Declaration of Trust are separate and distinct from those of

any and all other Portfolios.

The terms ["registered investment company,"] "vote of a majority of the outstanding voting

securities," "assignment," and "interested persons," when used herein, shall have the respective

meanings specified in the [Investment Company Act of] 1940 Act, as now in effect or as

hereafter amended, and subject to such orders as may be granted by the Securities and E xchange

Commission.

IN WITNESS WHEREOF the parties [hereto] have caused this [Advisory and Service

Contract] instrument to be signed in their behalf by their respective officers thereunto duly

authorized, and their respective seals to be hereunto affixed, all as of the date written above.

December 1987 11-236G

FIDELITY MAGELLAN FUND FIDELITY MANAGEMENT &RESEARCH COMPANY

[SEAL] By ..................................……................... [SEAL] By .............…….........…..............................

President President

EXHIBIT 2

General Description of Options

The following is a general description of options, futures contracts and similar instruments,

as well as a general discussion of investment strategies, techniques and risks involved in their

use. If shareholders approve Proposal 3 of this proxy statement, the Fund may take advantage of

certain of these investment strategies and techniques that are consistent with i ts investment

objective. As stated in Proposal 3, however, the Fund has no current intention of implementing

any specific strategies involving options or futures contracts, and will not do so until general

strategies have been approved by the Trustees, in accordance with such guidelines as the

Trustees may have imposed, and until such strategies have been described sufficiently i n the

Fund's Prospectus and Statement of Additional Information.

Options are short-term contracts conveying the right or the obligation to buy or sell a

specified underlying instrument at a fixed price. The option's underlying instrument may be a

security, an index of securities prices, a futures contract, a foreign currency, or some type of

commodity. A call option conveys the right or the obligation to buy at a fixed price, and a put

option conveys the right or the obligation to sell at a fixed price. The fixed price to be paid for

the underlying instrument is the option's exercise price.

The option buyer is the party that obtains the rights conveyed by the option. The buyer of a

call obtains the right to purchase the underlying instrument, and the buyer of a put obtains the

right to sell the underlying instrument. The option buyer does not have to complete the purchase

or sale, but may do so if the buyer wishes to. If the option buyer decides to complete t he

purchase or sale, the option buyer does so by exercising the option. The purchase or sale then

takes place at the exercise price.

The option writer, or seller, takes the other side of the contract, and is obligated to complete

the purchase or sale if the option buyer decides to exercise the option. If a call option is

exercised, the writer is obligated to deliver the underlying instrument to the option buyer. The

call option writer will be paid the exercise price regardless of the current value of the underlying

instrument. If a put option is exercised, the option writer is obligated to purchase the underlying

instrument from the option buyer. The put writer will pay the exercise price for the underl ying

instrument, regardless of the instrument's current value.

The expiration date of an option is the last day on which the option buyer can decide to

exercise the option. If the option is not exercised by the expiration date, the option c eases to exist

and becomes worthless. The option buyer loses the right to buy or sell at the exercise pri ce and

the option writer is freed of all obligation to complete the purchase or sale. Most options expire

within nine months of when they are created, and can be exercised at any time up to the

expiration date. Some options can only be exercised on the expiration date.

The option premium is the amount that the option buyer pays for the rights conveyed by

the option. The writer of the option receives the premium in return for the obligati ons the writer

assumes under the option. The premium is not a down payment or deposit. It is a non-refundable

payment from the option buyer to the option writer.

© 1987 Jefren Publishing Company, 11-236H

Most options are traded on exchanges in much the same way as stocks. Exchange-traded

options are standardized as to underlying instrument, exercise price and expiration date, so that

they can be freely traded. In addition, the exchange's clearing corporation guarantees that all

option buyers and writers will perform their responsibilities under the options, so that the buyers

and writers do not have to investigate each other's creditworthiness before entering into an

option. The buyer and writer of exchange-traded options do not deal with each other directl y.

Instead, all transactions are handled through the clearing corporation.

An exchange-traded option is entered into by an opening transaction on the floor of the

exchange. The premium is determined by competitive bidding between brokers on the floor of

the exchange, and the option is entered into the records of the clearing corporation.

An exchange-traded option can be terminated before it expires or is exercised by entering

into a closing transaction on the floor of the exchange. In a closing transaction, the option buyer

or writer cancels out the option by entering into an opposite position in the same option. For

example, an option writer's obligation can be terminated if the writer buys an identical option.

An option buyer who does not wish to exercise the option can dispose of it by writing an

identical option.

Options that are not traded on exchanges may be entered into by agreement between the

buyer and writer. Options of this sort typically are traded between institutional invest ors, and

generally are not guaranteed by a clearing corporation or other party. Options that are not traded

on exchanges often are not standardized, and often can only be terminated (except by e xercise or

expiration) by assigning the option to another party or by agreement between the buyer and

writer. As a result, options not traded on exchanges can be less liquid investments. Options

created by agreement between the buyer and writer are sometimes called standby commitments.

After the option is entered into, the premium represents the value of the option to t he option

buyer, because it is the amount the option buyer would receive for closing out (selling) the

option. If the current premium for the option is higher than the premium the option buyer paid

for the option, the option buyer will profit from a closing transaction, and if the current pre mium

is lower, the buyer will realize a loss.

For an option writer, the premium represents the amount the writer would have to pay to be

relieved of the obligation under the option. If the current premium is lower than the premium the

writer originally received, the writer will profit from a closing transaction, beca use the cost of

closing out the position will be less than the premium income the writer receive d. If the current

premium is higher than the premium the writer originally received, the writer will suffer a loss.

Premiums of options are subject to constant change based on a variety of factors, includi ng

the relationship of the exercise price to the underlying instrument's current value, the volatility of

the underlying instrument, the amount of time remaining until the option's expiration date , and

current and anticipated interest rates. Because the premium is usually a smal l fraction of the

underlying instrument's value, premiums can be extremely volatile. Option buyers and writ ers

generally pay commissions for opening and closing transactions, and these must also be take n

into account when considering profit or loss.

Purchasing options and writing options have different characteristics of risk and reward. The

purchaser of an option pays the premium in advance, but need not complete the transacti on by

exercising the option if it would not be advantageous to do so. The option writer receives t he

premium when the option is entered into, but will remain obligated to complet e the transaction

whenever the option purchaser elects to exercise the option, regardless of whether or not the

December 1987 11-236I

writer would suffer a loss as a result. However, either the option purchaser or the option writer

may be able to terminate the option position before exercise or expiration, by closing out the

option on an exchange or by renegotiating the option with the other party.

General Description of Futures Contracts

Futures contracts, like options, are contracts involving a purchase or sale of an underlying

instrument at a future date. However, unlike options, both the buyer and seller of a futures

contract are equally obligated under the contract. The buyer of a futures contract is obligated to

purchase the underlying instrument from the seller, and the seller of a futures contract is

obligated to deliver the underlying instrument to the buyer. The underlying instrument may be a

security, an index of securities prices, a foreign currency, or some type of commodity.

The purchase and sale contemplated by a futures contract takes place on a speci fied delivery

date, which may be as much as two years in the future (for most exchange-traded futures

contracts, delivery actually can take place at any time during a specified contract month). Unlike

an option, a futures contract does not have an expiration date on which it ceases to exist if not

exercised. Instead, both parties must complete the purchase and sale of the underlying inst rument

if the contract is still outstanding on the delivery date. Neither party can exerci se its rights under

the contract before then.

The settlement price is the price the buyer of the contract will pay and the seller of the

contract will receive when the purchase and sale takes place. Because both the buyer and the

seller of a futures contract are equally obligated to complete the purchase and sale of the

underlying instrument, neither party pays a premium for entering into the contract. No money i s

required to change hands between the buyer and seller until the delivery date.

The majority of futures contracts are traded on futures exchanges. As with exchange-traded

options, exchange-traded futures contracts are standardized as to underlying instrument and

delivery date (or contract month), and the exchange's clearing corporation guarantees that

buyers and sellers will perform under the contracts. Unlike options, however, there is no fixed

exercise price with a futures contract. Instead, the settlement price that wil l be paid is determined

when the contract is entered into on the exchange.

For example, a party that wished to buy a futures contract could place an order to buy a

contract on a certain underlying instrument for delivery on a certain date. The cont ract would

then be purchased on the floor of the exchange, and the settlement price would be the pri ce at

which that contract was trading at the time.

The vast majority of exchange-traded futures contracts are closed out before the delivery

date, so that payment and delivery never actually take place. To close out a futures position, a

buyer sells an identical contract, and a seller buys an identical contract, at the current settlement

price. This cancels out the buyer's or seller's obligation under the contract, and the c ontract

ceases to exist.

Settlement prices change constantly depending on such factors as the current market value

and historical volatility of the underlying instrument, the time remaining until the delivery date,

and current and anticipated interest rates. When a futures contract is closed out, profit or loss will

depend on the difference between the settlement price at which the contract was originally

entered into and the settlement price at which it is closed out. If a buyer sells a contract at a

higher price, the buyer will receive the difference, and if the buyer sells at a lower price, it must

pay the difference.

© 1987 Jefren Publishing Company, 11-236J

Similarly, a seller that closes out a contract by buying at a lower settlement price will receive

the difference between the original settlement price and the settlement pric e at which the contract

is closed out. The seller will pay the difference if the contract is closed out at a higher price. As

with exchange-traded options, commissions are paid for buying and selling futures contracts, a nd

must be taken into account when considering profit or loss.

Both the buyer and seller of a futures contract must deposit futures margin in the name of a -

utures broker when entering into a futures contract. Futures margin is designed to ensure that

both parties to a contract can cover their obligations if the contract is c losed out. Typically, both

the buyer and seller deposit initial margin equal to a percentage of the contract's settlement price

(generally less than 5%). Then, at the end of each trading day, each contract is t reated as if it had

been closed out at the end of the day. If either party would owe additional money if the contract

had been closed out, that party must deposit additional variation margin or maintenance margin

to cover its potential obligations. If either party would be entitled to receive more than its

existing margin deposits, that party may be entitled to reduce the amount deposited a nd receive a

variation margin payment from the futures broker.

Because exchange-traded futures contracts are standardized, there is a limited va riety of

futures contracts available. However, for some types of underlying instruments, notably foreign

currencies, a broad variety of purchase and sale contracts similar to futures contracts are traded

outside exchanges. These contracts, which are generally entered into by agreement betwe en

institutional investors, are commonly referred to as forward contracts.

Forward contracts, which may not be actively traded, are simply agreements between t he

buyer and seller to purchase or sell an underlying instrument at a future date. The te rms of a

forward contract, including the type of underlying instrument and the delivery date as wel l as the

settlement price, are flexible and are negotiated when the contract is purchased or sold. Forward

contracts generally are not regulated by governmental authorities or guaranteed by a cle aring

corporation or other third party, and futures margin deposits are not required. Consequently, the

buyer and seller must evaluate each other's credit carefully when entering into a forwa rd

contract. Unlike futures contracts, forward contracts are rarely closed out. The buyer and sell er

generally intend to actually complete the purchase and sale of the underlying instrum ent on the

settlement date, although extensions of the settlement date may be negotiated.

Options on futures contracts are similar to other options, except that exercise of an option on

a futures contract results in ownership of a futures contract rather than an actual purc hase or sale

of a security or other financial instrument. The buyer of a call option on a futures contract

obtains the right to purchase the futures contract, and the buyer of a put option on a futures

contract obtains the right to sell the futures contract.

The exercise price of an option on a futures contract is the settlement price at which the

contract will be entered into if the option is exercised. For the option buyer, this i s the price at

which the contract will be entered into if the buyer chooses to exercise the option. For the option

writer, the exercise price is the price at which the futures contract must be ent ered into upon

exercise. The writer of a call option on a futures contract is obligated to sell the futures contract

at the exercise price. The writer of a put option on a futures contract is obligated to buy the

contract at the exercise price.

Options on futures contracts are traded on futures exchanges. The writer of an option on a

futures contract is required to deposit futures margin to secure its potential obligat ions under the

option. The option buyer is not required to make futures margin deposits unless the buyer

exercises the option and thus acquires a position in a futures contract.

December 1987 11-236K

Potential Uses of Options and Futures ContractsThe following descriptions of potential strategies are intended only as illustrations of basic

strategies involving options and futures contracts. As noted earlier, the Fund has no current

intention of engaging in any strategies involving options or futures contracts, and will not do so

until general strategies have been approved by the Trustees and described in the Fund's

Prospectus and Statement of Additional Information.

Options and futures contracts may be used in a variety of strategies designed to hedge against

anticipated declines in the stock or bond market, increase current income, lock in prices for

securites that the Fund may want to purchase or sell, or seek capital appreciati on. Futures

contracts in particular may also be used as a short-term substitute for actual purchases or sales of

securities.

Hedging strategies include buying put options on securities the Fund owns or on indexes with

a composition similar to the Fund's portfolio, and selling futures contracts whose changes in

value are expected to mirror changes in the value of the Fund's portfolio securities. If succ essful,

hedging strategies would protect the value of the Fund's investments from a substantial decli ne in

value at times when FMR anticipated a decline in prices. However, hedging strategi es, in return

for such protection, may limit the Fund's ability to benefit from rising prices, and ma y increase

the expenses of the Fund. If unsuccessful, attempts to hedge the Fund's portfolio securities could

decrease the Fund's return.

Income-producing strategies include writing covered call options on individual stocks or on

stock indexes. By writing a covered call, the Fund would in effect be agreeing to sel l a security it

owned (or to pay an amount based on the value of an index with a composition simila r to its

portfolio) for a fixed price, in return for receipt of the option premium. Covered call writi ng has

the potential for increased return in the form of premium income, if the value of t he securities

used to cover the call does not rise while the option is outstanding. The receipt of premium

income may also provide a partial offset for any decline in the value of the securit ies held by the

Fund. However, the Fund would give up the ability to sell the portfolio securities used t o cover

the call while the call was outstanding. In addition, the Fund could lose the abili ty to participate

in an increase in the value of such securities, because such an increase would li kely be offset by

an increase in the cost of closing out the call (or could be negated if the buyer c hose to exercise

the call at an exercise price below the securities' current market value).

Futures contracts may be employed as a short-term substitute for actual purchases or sal es of

securities because of the ease of assuming a large futures position quickly. For example, if the

Fund had or expected to receive a large amount of cash (from new investments in the Fund or

sales of portfolio securities) awaiting investment in suitable stocks, FMR could purchase a

futures contract on a stock index on behalf of the Fund to avoid missing a significant marke t rise

while deciding on particular stock investments. At the same time, the Fund would be expose d to

a market decline, much as if it had actually purchased the stock included in the stock index.

Similarly, if the Fund wished to dispose of stocks in its portfolio in an orderly fashion, it c ould

sell a stock index futures contract to provide protection against a decline in the market while

completing such sales. Should such stocks rise in value, however, the Fund's futures position

would tend to offset any resulting appreciation in the value of its portfolio, much as i f the stocks

had actually been sold.

Examples of capital appreciation strategies include purchasing put or call options to seek to

profit from anticipated changes in the value of the options' underlying instruments. For example ,

the Fund could purchase a call option on a stock if FMR anticipated that the stock's value would

rise. If the stock's value did rise, the Fund would expect to participate in the stock's a ppreciation,

© 1987 Jefren Publishing Company, 11-236L

while investing only the option premium (which is typically a small fraction of the stock's value).

However, because of the very high volatility of option premiums, the Fund would bear a

significant risk of losing the entire premium if the stock's value did not rise sufficient ly, or if it

did not do so before the option expired. The Fund does not currently intend to engage in

activities that would cause it to be considered a 'commodity pool operator' (as that term is

defined by regulations of the Commodity Futures Trading Commission). Therefore, it would

generally be prohibited from employing futures contracts or options on futures contracts in

strategies designed to achieve capital appreciation.

The options and futures markets are constantly developing, and it can be expected t hat new

types of instruments, and new strategies involving such instruments, will continue to be

developed in the future. The Fund could engage in such new types of investments and new

investment and risk management strategies, consistent with its investment objecti ve, subject to

review by the Trustees and appropriate disclosure to investors.

Additional Risks of Options and Futures Strategies

General. Options and futures contracts have different characteristics from other investments,

both in terms of the instruments themselves and in terms of how the instruments are t raded.

Therefore, successful trading of options and futures contracts requires different skills from those

required when investing directly in securities. Some options and futures contracts will change in

value based on broad stock market moves or overall changes in interest rates or currency

exchange rates. Predicting such broad or overall changes requires the exercise of skill and

judgment, and there can be no assurance that FMR will be able to do so accurately or

successfully. Some options and futures strategies will require the Fund to set aside assets to

cover its potential obligations, which could impair the Fund's ability to honor redemption

requests or could impede investment management if a large portion of the Fund's assets i s

involved.

Buying put and call options. The primary risk for an option buyer is the market risk involved in

the volatility of option values. Because the option premium typically is a sma ll percentage of the

underlying instrument's value, a small change in the value of the underlying instrument can have

a significant effect on the option premium that the buyer may obtain upon closing out t he option.

In addition, options have limited lifetimes, and will become worthless in the ha nds of the option

buyer if not exercised or closed out by the expiration date. The maximum an option buyer has at

risk, however, is the option premium (plus related transaction costs).

Writing covered options. An option writer assumes the risk of fluctuations in the value of

the underlying instrument in return for a fixed premium, and must be prepared to satisfy exercise

of the option at any time. Under current interpretations of the 1940 Act, the Fund would be

required to 'cover' any option it wrote, to ensure that it could satisfy an exercise noti ce and to

alleviate some of the risk involved in writing the option. A covered call writer may cover its obligations under the option by holding a position whose

price changes are similar to those of the underlying instrument, and therefore can be expected to

offset increases in the value of the option and the cost of satisfying exercise or closing out the

option. In the case of options on securities, calls typically are covered by holding the unde rlying

instrument itself--for example, by owning the underlying stock when writing a stock option. If a

call writer owns the underlying instrument, it can satisfy exercise of the option by deli vering the

underlying instrument from its portfolio. With options on indexes, however, it may not be

possible, to hold a position whose price changes precisely match those of the index. In such a

case, or if the value of the premium does not move in concert with the value of t he underlying

December 1987 11-236M

instrument, the position held to cover the option may not reduce the risk of a rise in the value of

the option. Put options may be "covered" by holding cash and short-term debt securities with a value

equal to the writer's potential purchase obligation under the option. Call options can be covered

by cash and short-term debt obligations in a similar fashion. By covering an option in t his way,

the writer assures that it has sufficient assets to satisfy exercise of the option. However, the

writer does not have any protection (other than the premium it received) against a significant

increase in the cost of satisfying exercise or closing out the option.

Because an option writer cannot terminate its obligations under the option except by closing

out the option, a liquid secondary market is important to an option writer. There c an be no

assurance, however, that a liquid secondary market will exist for any option at any specifi c time.

If a writer cannot close out an option, it must continue to bear the risks associat ed with the

option, and must continue to hold cash or securities to cover the option, until the option i s

exercised or expires.

Futures Contracts. The purchaser or seller of a futures contract, by agreeing to purchase or sell

the contract's underlying instrument at a fixed price, becomes exposed to price fluctua tions

(whether favorable or unfavorable) resulting from changes in the value of the contract's

underlying instrument. If the Fund purchased futures contracts and prices subsequently fell, the

Fund would suffer a loss. Similarly, if the Fund sold futures contracts and prices subsequently

rose, the Fund would suffer losses in its futures positions that could offset any appreciation of its

securities portfolio.

Because the futures margin required when entering into a futures contract is a smal l

percentage of the value of the underlying instrument, futures contracts can vary signific antly in

value relative to the amount of margin committed. The Fund, however, would be required under

current interpretations of the 1940 Act to set aside assets in addition to the require d futures

margin in order to assure that its purchases of futures contracts are unleveraged. When

purchasing a futures contract, the Fund would instruct its custodian to segregate cash and li quid

debt securities equal in value to all outstanding contracts purchased by the Fund. As a resul t, the

combined performance of the Fund's futures position and the securities held in the separate

account could be expected to be similar to the performance of a direct investme nt in the

underlying instrument.

The Fund, in order not to fall within the definition of a commodity pool operator, would be

permitted to sell futures contracts only to hedge securities it owned. The Fund would not se ll

futures contracts with a value greater than the securities in its portfolio, exce pt that the Fund

could do so to the extent necessary to compensate for differences in historical volatil ity between

the securities owned and the contracts used as a hedge. Because of these safeguards on the

Fund's sale of futures contracts, the primary risk borne by the Fund (other than the risk of

employing a hedge at an inappropriate time) is that the value of the futures contra ct will not be

well correlated with the value of the underlying instrument or the value of the securi ties hedged.

In such a case, the futures contracts sold by the Fund would not provide an effective hedge

against a price decline, and could magnify the effects of such a decline on the va lue of the Fund's

portfolio securities.

A position in a futures contract may be closed out only on an exchange or board of trade tha t

provides a secondary market for that futures contract. As with options, there can be no assurance

that a liquid secondary market will exist for any futures contract at any specific time. If a liquid

secondary market did not exist for a futures contract purchased or sold by the Fund, the Fund

might not be able to close out the contract before the delivery date. If this should occur, the Fund

would continue to be exposed to the risks associated with the futures contract, and would

© 1987 Jefren Publishing Company, 11-236N

continue to be required to maintain variation margin deposits and set aside additional assets to

cover its futures positions. Because futures contracts can not be exercised before the deli very

date, however, the Fund would not bear the risk associated with covered option writing of having

to be prepared to satisfy an exercise notice at any time.

Fidelity Magellan Fund 12/8/86