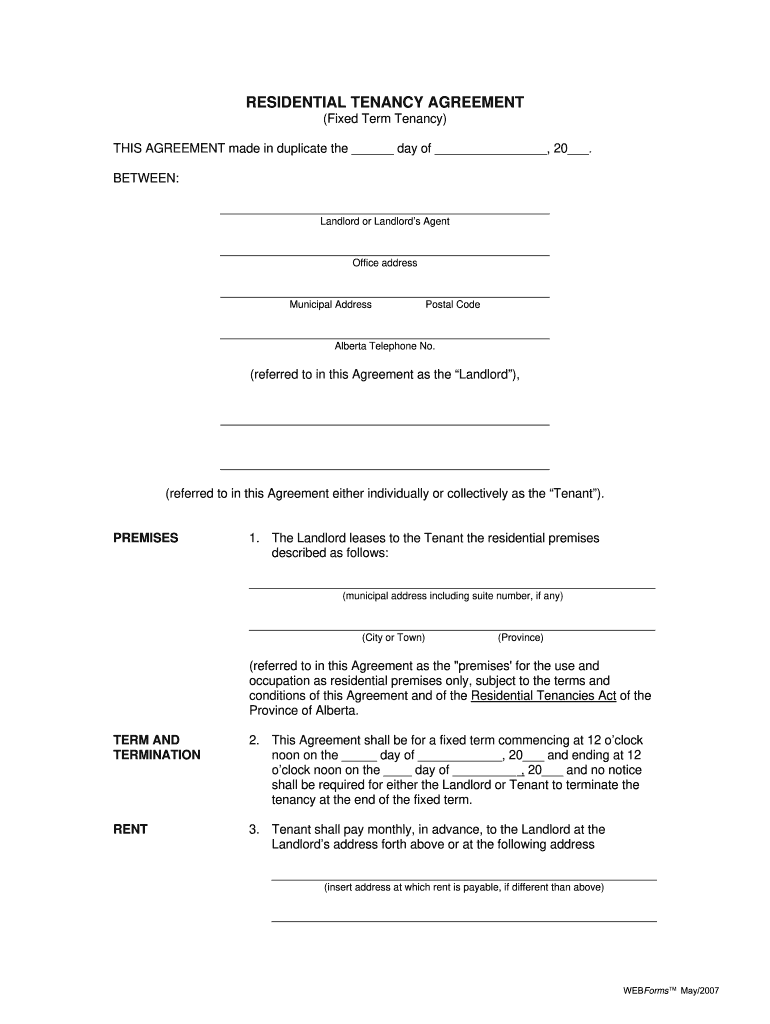

Will you be giving

generously to the Taxman?

trusted • clear • informed

�Inheritance Tax

2

�Will you be giving

generously to the

Taxman?

Having worked hard all your life to build your

financial portfolio and assets, it’s upsetting to know

that 40% of everything over £325,000 if you are single

or divorced, or £650,000 if you are married, in a civil

partnership or widowed could be given back to the

Government in Inheritance Tax (IHT).

Your beneficiaries may have to pay the taxman before they

receive a single penny from your estate at a time when they are

least able to cope.

Your estate could have risen substantially and increasing wealth could well

mean that your loved ones may already be liable to pay IHT before they can

inherit what is rightfully theirs. With the right planning through Skipton

Financial Services Limited (SFS), you can reduce or even eliminate this tax

altogether – potentially saving your loved ones thousands of pounds.

3

�For more information call 0800 137 832

What is Inheritance Tax?

Inheritance Tax (IHT) is a tax that many people don’t consider or presume that it is

something that only the rich and the elderly should be concerned about. However, this

is certainly not the case.

There were some significant changes made to IHT in the Pre-Budget Report in October

2007. Today, depending on your individual circumstances, it affects people in different

ways. The starting point at which you begin to pay IHT is £325,000 if you are single

or divorced, or £650,000 if you are married, in a civil partnership or widowed. These

amounts are referred to as the nil rate band. Everything in your estate over and above

your nil rate band, including the value of your house, savings, investments and assets is

subject to 40% tax when you die. That’s 40p out of every pound you own – or £400 out

of every £1000!

This may sound a lot, but by simply adding up the value of your house, savings,

investments and any other assets, you may be surprised how much your estate is

actually worth. With house prices having risen in past years, the value of your estate

could have increased substantially, although you may not have considered the IHT

liability.

Did you know your estate can be made up of:

•

•

•

•

Your home and furniture

Jewellery and artwork

insurances

•

•

•

savings and investments

land

car

a holiday home (in the uK or overseas)

At SFS, we believe that the use of simple and cost-effective methods of controlling

your estate should always be the starting point. There are a number of IHT planning

opportunities available and it is important that you seek specialist advice from

someone you can trust to find the right solution for you.

4

�Will you be giving generously to the Taxman?

The following sections will give you a brief insight into the selection of IHT planning

opportunities available.

remember, if you require any further information or an explanation on

anything mentioned here you can call our specialist client Helpline on

0800 137 832.

How liable are you?

This section is broken down into three parts and illustrates how you may be affected by

IHT depending on your individual circumstances – whether you are:

•

•

•

Single or divorced

Married or in a Civil Partnership

Widowed

Please refer to the relevant section to see how liable you may be.

did you know that each spouse/civil partner has a nil rate band

allowance? make sure you use yours wisely!

The first step to see if your estate will be

affected by IHT is to calculate how much

it is actually worth – you may be quite

surprised! Use our calculators overleaf

to find out – but don’t forget that

this is not a static figure and that

your property and investments

could increase in value over the

next few years which, in turn,

could increase your IHT liability.

5

�Inheritance Tax

Single or divorced

For the 2010/11 tax year, your nil rate band is £325,000 and any part

of your estate over this amount could be taxed at 40%.

To use our calculator to work out how much your estate is worth, simply list all of your

assets as mentioned below.

Inheritance Tax Calculator

Stocks and Shares

£

£

£

£

Savings and Investments

(including offshore, ISAs, Endowments, etc.)

£

House Value (including 2nd property)

Household Contents and Personal Effects

Bank and Building Society Accounts

Other Assets

(car, boat, Life Assurance not under trust etc.)

Assets Sub Total

Subtract Debts

(mortgages, other loans etc.)

Subtract Nil Rate Band

Approx Net Estate Size

x 40%

Total

£

£

£

£325,000

£

£

The table below illustrates how much IHT you could pay as a single or divorced person

with no plans in place.

Estate Value

Taxable

IHT Payable at 40%

£325,000 or less

£425,000

£525,000

£625,000

£725,000

£825,000

£925,000

£1,025,000

£0

£100,000

£200,000

£300,000

£400,000

£500,000

£600,000

£700,000

£0

£40,000

£80,000

£120,000

£160,000

£200,000

£240,000

£280,000

6

�Married/Civil Partners

For the 2010/11 tax year, as a couple your nil rate band is £650,000

(£325,000 each) and any part of your estate over this amount could

be taxed at 40% upon the death of the 2nd spouse.

To use our calculator to work out how much your estate is worth, simply list all of your

assets as mentioned below.

Inheritance Tax Calculator

Stocks and Shares

£

£

£

£

Savings and Investments

(including offshore, ISAs, Endowments, etc.)

£

House Value (including 2nd property)

Household Contents and Personal Effects

Bank and Building Society Accounts

Other Assets

(car, boat, Life Assurance not under trust etc.)

Assets Sub Total

Subtract Debts

(mortgages, other loans etc.)

Subtract Nil Rate Band

Approx Net Estate Size

x 40%

Total

£

£

£

£650,000

£

£

Upon Death of 2nd partner

The table below illustrates how much IHT you could pay if married or in a civil

partnership with no plans in place.

Estate Value

Taxable

IHT Payable at 40%

£650,000

£750,000

£850,000

£950,000

£1,050,000

£0

£100,000

£200,000

£300,000

£400,000

£0

£40,000

£80,000

£120,000

£160,000

7

�For more information call 0800 137 832

Widowed

For the 2010/11 tax year, as a widow/widower your nil rate band

could be £650,000 (comprising of £325,000 personal allowance and

£325,000 from your deceased partner) and any part of your estate

over this amount could be taxed at 40%. This figure assumes that no

previous gifts were made by the deceased spouse, as this can have

an effect on the nil rate band passed to the surviving spouse.

To use our calculator to work out how much your estate is worth, simply list all of your

assets as mentioned below.

Inheritance Tax Calculator

Stocks and Shares

£

£

£

£

Savings and Investments

(including offshore, ISAs, Endowments, etc.)

£

House Value (including 2nd property)

Household Contents and Personal Effects

Bank and Building Society Accounts

Other Assets

(car, boat, Life Assurance not under trust etc.)

Assets Sub Total

£

£

Subtract Debts

(mortgages, other loans etc.)

£

Subtract Nil Rate Band

Approx Net Estate Size

x 40%

Total

£650,000

£

£

Assuming full nil rate

band available from

death of first partner

The table below illustrates how much IHT you could pay as a widow/widower.

Estate Value

Taxable

IHT Payable at 40%

£650,000

£750,000

£850,000

£950,000

£1,050,000

£0

£100,000

£200,000

£300,000

£400,000

£0

£40,000

£80,000

£120,000

£160,000

8

�Will you be giving generously to the Taxman?

What happens if you don’t do anything about

your liability?

In the most simple terms, if your estate is worth more than £325,000 if you are single or

divorced or £650,000 if you are married, in a civil partnership or widowed then anything

over and above this amount could be subject to 40% tax.

Upon your death, if you are liable for tax, your loved ones are usually required to pay

the bill within six months of your death – and only when the tax has been paid will

your estate be granted probate where your assets can be distributed in accordance

with your wishes (providing you made a Will – see Legal Services). There may be some

exceptions to this, but all with certain terms and conditions, and one of our Advisers

will be able to discuss this in more detail with you.

Let Skipton Financial Services help

We believe that the use of simple and cost-effective methods of controlling your

estate should always be the starting point but it is important to remember that when

planning such IHT solutions you should always seek professional advice – and that is

where we come in!

Over the next few pages, we’ll provide

you with a brief insight on just a few of

the possible solutions that are available

to help reduce or possibly eliminate your

IHT liability through:

•

•

•

•

L� egal Services –

including Will Writing.

Specialised Legal Advice.

Gifts and Trust Planning.

Life Assurance.

9

�Inheritance Tax

Legal Services

Make sure your wishes come true...

Using a Will is one of the most effective and

convenient ways to reduce the amount of IHT

payable by making the best possible use of the

IHT allowances available to both spouses.

Many married people or registered civil partners

still believe that on their death their whole estate will

automatically pass to their spouse without the need for

a Will – but in fact, depending on the size of your estate, a

spouse may only inherit the first £250,000 and the rest may

pass to your children. An unmarried or unregistered civil

partner has no automatic right to your estate at all.

Further, a Will not only provides legal ways of helping to reduce or avoid Inheritance

Tax, but helps to ensure that as much of your wealth as possible is retained by your

family and that your ‘wishes’ are carried out. Statistics show that many of us still haven’t

made a Will and this is startling considering how important they are to leave what you

want to who you want.

Things you can’t do if you don’t leave a Will:

•

•

•

•

•

•

Pass your estate to an unmarried partner.

decide how much money each of your family members are bequeathed.

specify who will become the guardians of your children.

leave something to charity.

Give a memento – e.g. a piece of jewellery to a treasured friend or family

member.

Potentially minimise inheritance tax.

10

�Simple Will Planning

If you don’t make a Will, you are deemed to have died ‘intestate’ which means that the

law – rather than you – dictates who will inherit your estate. So you can’t be confident

that items of special value or meaning will be distributed how you wanted them to be

and if family or friends need to contest provisions made by the Crown, it may cost them

considerable amounts of money in solicitors’ fees to obtain the possessions you would

have wanted them to inherit.

dying ‘intestate’ – without a Will – means that the law decides on

who inherits your estate and therefore you cannot be confident

that items of special value or meaning will be distributed as you

would want.

There are different types of Wills to allow for different circumstances – from a Single

Will for a single person leaving their estate to a family member to more intricate Wills

that seek to mitigate IHT liability and provide full estate planning solutions. Each option

allows for personal circumstances and whatever your need, SFS can find the right one

for you through our Will Writing Service.

SFS has already helped thousands of clients with their estate planning through our

very simple and straightforward Will Writing Service. As most Wills can be drawn up

without the need for a face-to-face consultation with a solicitor, we provide you with

the facility to have a simple Will drawn up at your own convenience, in your own home

and whenever you are ready to do so.

We’ve teamed up with Skipton Trustees Limited, who will be responsible for drawing up

your Will from the information that you provide them. The legal expertise is provided

in conjunction with a reputable top 10 legal firm, Irwin Mitchell. You’ll have access to a

direct Helpline to the Solicitors who can help you complete your Instruction Form and

guide you through the process.

to find out more about Will planning and how this can help reduce

your iHt liability, please call our specialised Will Writing team on

0800 137 832.

11

�For more information call 0800 137 832

Specialised Legal Advice

For those who have assets such as business interests, property abroad or agricultural

holdings, some methods of reducing IHT liability could involve the use of these assets.

You will, however, need individually tailored advice and in such circumstances, we have

selected a panel of highly specialised Advisers to help ensure your Will is appropriate for

your own IHT situation.

simply call 0800 137 832 and we’ll put you in touch with the most

appropriate specialist.

Gifts and Trust Planning

It’s important to be aware that there is no Inheritance Tax on transfers, whatever the

value, between married couples or registered civil partners. Each person has their own

allowances – and a choice of what to do with them. This means that you could reduce

the value of your estate on which IHT can be levied.

These transfers are referred to as gifts, and there are many exemptions available as

explained below.

Annual exemption

Everyone can give away £3,000, exempt from IHT, in any one tax year. It doesn’t have

to go to one specified person, but the total must not exceed this figure. Also, if not

previously used, you could potentially backdate this one tax year so in effect you could

gift £6,000 to begin with.

Marriage gifts exemption

Each parent can give a wedding gift of up to £5,000 to each child when they get married

at any time before the wedding day. If it is your grandchild, you can gift them up to

£2,500 each and for other family members or friends you can give up to £1,000.

In addition, you can also make gifts utilising your annual exemption to the same person

so potentially, as a parent, you could give your child up to £8,000 in the year they are

married (£5,000 marriage gift and £3,000 annual exemption).

12

�Will you be giving generously to the Taxman?

Small gifts exemption

Any number of gifts to different people, up to

the value of £250 each, can be made in a tax

year. However, if an individual gift exceeds

this £250 then this gift must be deducted

from your £3,000 annual exemption

allowance instead.

Are there any other gifts

you can make?

Over and above the allowances just

mentioned, you can make unlimited direct

gifts of cash, shares or other items of value – referred

to as Potentially Exempt Transfers (PET) – and they will be

deducted from your estate providing you live for seven years

from the date made.

If you die within the seven-year period your estate may still have to

pay tax, however this can reduce after the first three years. This is

known as ‘Taper Relief’.

It only applies to the part of the gift that is in excess of the nil rate band (currently

£325,000) and, after three years, it will start to reduce the amount of tax you have to

pay on the gift. After seven years, it becomes exempt from IHT completely.

The table below shows you how this works

Period of Years

Before Death

% Reduction

(Tapering Relief)

% of Tax Payable

0-3 years

3-4 years

4-5 years

5-6 years

6-7 years

More than 7 years

Nil

20%

40%

60%

80%

No tax

40%

32%

24%

16%

8%

0%

13

�Inheritance Tax

How do you make gifts?

There are four main ways of giving gifts and here we will briefly explain the options available:

Direct Gift

This is a convenient and rewarding method of giving items or sums of money to

beneficiaries for their immediate benefit.

Gifts to Trust

This method allows the placement of monies in a suitable investment, which is then

wrapped in a Trust. You can choose who you want to be trustees and all, or amounts

of it, can be distributed at your discretion. The two main types of Trust are Flexible Trust

and Discretionary Trust.

Gifts into a Flexible/Discretionary Trust

Gift away

Your investment is a chargeable lifetime transfer and will fall

outside of your estate in 7 years for iHt purposes

Beneficiaries can be changed therefore adapts to your needs

our adviser will invest your money for you and assist you to

complete the Gifts into trust paperwork to reflect your wishes

no access by you to the gifted monies

Loan Trust

This type of plan could be suitable for those people who wish to take steps to mitigate

IHT but still wish to retain access to their original capital. Any growth on the investment

belongs to the trust and is therefore free of IHT whilst the original investment belongs

to the investor and remains within the estate.

The table below illustrates how much IHT you could pay as a widow.

assuming a growth rate of 6% p.a. after charges

£100,000 would have grown to £133,823 after 5 years

£100,000 would have grown to £179,085 after 10 years

In the above example, after 10 years’ growth at 6%, the Bond would be worth £179,085.

The growth of £79,085 would be paid free of inheritance tax – saving your loved ones

£31,634 in tax.

14

�It is also an ideal method to boost income as any amount may be taken regularly from

the loan until the original capital invested is exhausted.

Although Loan Trusts are not as efficient from an Inheritance Tax point of view as some

other methods, they are an excellent way of keeping control and access to your capital

whilst allowing any profit to build up for others.

Loan Trust

Keep control and receive income (up to original loan value)

all growth on your investment is now outside of your estate

an income can be taken either monthly or by lump sum.

income is the return of capital therefore the income stops

when the capital is exhausted

our adviser will invest your money for you and assist you to

complete the loan trust paperwork to reflect your wishes

Discounted Gift Schemes

This is another method of giving money away (and is outside of the estate after seven

years) but the person making the gift can also have access to a regular, predetermined

income. In addition to this – based on a number of factors including age and level of

income selected – there is usually an immediate ‘discount’ to IHT. This means that an

investment into this scheme usually results in a saving in IHT from the moment the

monies are placed in the plan.

Discounted Gift Scheme

Gift away capital but still receive an income

Potentially reduce inheritance tax from day one, the amount

of reduction is dependent upon age and health

The remainder is outside of your estate after 7 years

our adviser will invest your money for you and assist you to

complete the discounted Gift scheme paperwork to reflect

your wishes

for more information about gifts, simply call one of our specialists on

0800 137 832 or arrange to meet an adviser today.

15

�For more information call 0800 137 832

Life Insurance

Sometimes, despite all other methods of trying to eliminate or reduce IHT, there is no

option but to simply insure the liability by taking out life insurance to cover the cost of

the tax bill that your heirs will have to pay when you die. There are two options of life

policy – Whole of Life and Level Term Insurance.

A Whole of Life policy has a sum assured which is paid to the beneficiaries on death. It

is written under trust and it will not be added to your estate as the money in the trust

doesn’t belong to you – it belongs to the trustees whom you choose. It can be paid

before the rest of the estate is released which means that your beneficiaries don’t have

to wait until probate for it.

Level Term Life Insurance is designed to provide a lump sum in the event of death

during the term of the policy. You can choose the amount of cover that you want and

the term so you can ensure your family could potentially settle or continue payments

on a mortgage, or other debts, and also maintain their standard of living. If you die

during the policy term, your insurer will pay the amount you are covered for and if the

policy reaches the end of its term, and you have never needed to make a claim, the

cover ceases and the policy has no value.

for more information about life insurance simply call one of our dedicated

team on 0800 137 832.

16

�Will you be giving generously to the Taxman?

Don’t hand it to the

Taxman on a plate!

17

�Inheritance Tax

What to do next

With so many options available to you for IHT planning, it goes without saying

that you should seek specialist advice regarding your own personal situation.

The rules and regulations surrounding the various ways of mitigating IHT are

constantly changing and far from straightforward – although receiving advice

from SFS is.

If you feel that you need to seek help with your IHT planning, your first step is

to contact us.

How to get in touch

simply call our inheritance

tax team at our Head office on

0800 137 832

and they will arrange an appointment for

you to meet with one of our advisers.

alternatively, complete the form at the back

of this guide with all the requested details and

return to the following address, as we will

contact you:

Skipton Financial Services Limited,

FREEPOST NEA4129,

Skipton,

North Yorkshire BD23 2BF

(no stamp required)

18

��Inheritance Tax Service

Please complete all your details below and overleaf, place in an envelope

(no stamp required) and return to: Skipton Financial Services Limited,

FREEPOST NEA4129, Skipton, North Yorkshire BD23 2BF

Please fill in the information below:

Name:

Address:

Postcode:

Telephone Number:

Email Address:*

Mobile:*

*

Only provide your email address or your mobile number if you would like to be contacted by either of these media.

Marital Status: Single

Married

Widowed

Registered Civil Partnership

Date of Birth:

Total Number of Children/Grandchildren:

Have you or your partner taken any previous steps to help with your inheritance

tax planning?

Self: Yes

No

Partner: Yes

No

Have you or your partner made a Will?

Self: Yes

No

Partner: Yes

No

How do you rate your need to take definite action to help reduce your eventual

inheritance tax bill, payable by your beneficiaries? (Please tick one below):

Wish to take definite action urgently

Wish to discuss further

May consider action in the future

�Please complete the details of your current estate value below:

(including your partner’s assets if applicable)

House Value

£

Personal Possessions and Valuables

i.e. home contents

+ £

Savings & Investments

i.e. Banks, Building Societies, National

Savings, ISAs, Bonds, Shares etc.

+ £

Other Assets

i.e. Holiday Home(s) / Investment Property(ies)

in the UK/abroad, cars, boats etc.

+ £

Business Assets

e.g. Part Share in Company/Business

Estimate Value of Holding

+ £

Life Assurance

+ £

Subtract Amount of these Death

Benefits written Under Trust

- £

Total Gross Assets

= £

Have you included all joint assets with your partner?

Subtract Debts

Yes

No

- £

i.e. Mortgages, credit cards etc.

Total Net Assets

= £

Medical Insurance Agency (MIA) is a trading name and division of Skipton Financial Services Limited.

Skipton Financial Services Limited may use the information on this form to provide you with details of our own

selected products and services by post or by telephone. If you do not want to receive these, please tick here

.

Skipton Financial Services Limited would like to pass your details on to other carefully selected organisations in order

that we can offer you information, goods and services that may be of interest to you. If you would prefer that your

details are not passed to such organisations please tick this box

.

You are entitled to request details of the information we hold about you, we may make a small charge for this service.

Simply write to the Data Controller at Skipton Financial Services Limited, The Bailey, PO Box 101, Skipton BD23 1XT.

Registered in England No. 2061788. Skipton Financial Services Limited is authorised and regulated by the Financial

Services Authority. Skipton Financial Services Limited is a wholly owned subsidiary of Skipton Building Society.

�Skipton Financial Services Head Office in Skipton.

Skipton Financial Services Limited,

The Bailey, PO Box 101, Skipton, North Yorkshire BD23 1XT

Tel: 0845 6036146 Fax: 0845 6024577 Web: skiptonfs.co.uk

trusted

clear

informed

We are experienced

and trusted financial

advisers so we only

recommend the

solutions that are

right for you

Everything is clearly

explained in plain

English and we

are always open

and honest in our

approach

Our advice teams are

experts and carry out

continuous research

to give you the most

informed financial

choices

Registered Office: The Bailey, Harrogate Road, Skipton, North Yorkshire BD23 1DN. Registered in England, Number 2061788.

Authorised and regulated by the Financial Services Authority. Skipton Financial Services Limited is a wholly owned subsidiary of Skipton Building Society.

Medical Insurance Agency (MIA) is a division of Skipton Financial Services Limited.

SFSIHTG03/10/BB

�