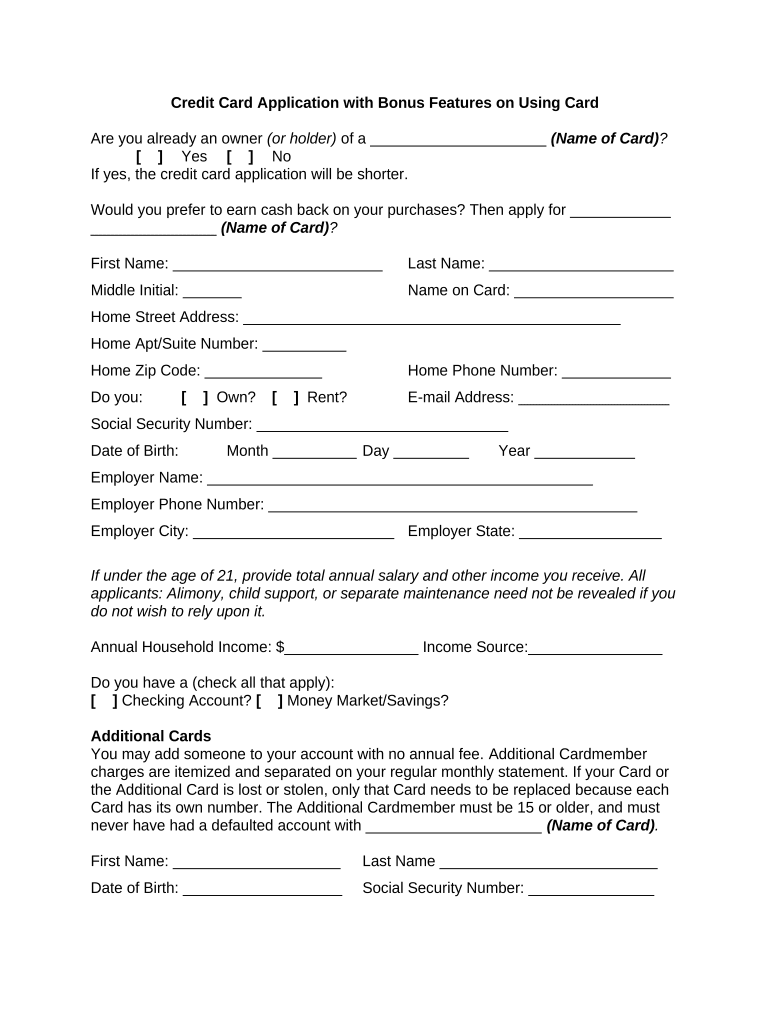

Credit Card Application with Bonus Features on Using Card

Are you already an owner (or holder) of a _____________________ (Name of Card) ?

[ ] Yes [ ] No

If yes, the credit card application will be shorter.

Would you prefer to earn cash back on your purchases? Then apply for ____________

_______________ (Name of Card) ?

First Name: _________________________ Last Name: ______________________

Middle Initial: _______ Name on Card: ___________________

Home Street Address: _____________________________________________

Home Apt/Suite Number: __________

Home Zip Code: ______________ Home Phone Number: _____________

Do you: [ ] Own? [ ] Rent? E-mail Address: __________________

Social Security Number: ______________________________

Date of Birth: Month __________ Day _________ Year ____________

Employer Name: ______________________________________________

Employer Phone Number: ____________________________________________

Employer City: ________________________ Employer State: _________________

If under the age of 21, provide total annual salary and other income you receive. All

applicants: Alimony, child support, or separate maintenance need not be revealed if you

do not wish to rely upon it.

Annual Household Income: $________________ Income Source:________________

Do you have a (check all that apply):

[ ] Checking Account? [ ] Money Market/Savings?

Additional Cards

You may a dd someone to your account with no annual fee. A dditional Cardmember

charges are itemized and separated on your regular monthly statement. If your Card or

the Additional Card is lost or stolen, only that Card needs to be replaced because each

Card has its own number. The Additional Cardmember must be 15 or older, and must

never have had a defaulted account with _____________________ (Name of Card) .

First Name: ____________________ Last Name __________________________

Date of Birth: ___________________ Social Security Number: _______________

Transfer Balances

Minimum transfer amount is $100 up to your available line of credit. Maximum transfer

amount for each of the 4 transfer requests is $25,000 depending on the available line of

credit. Please continue paying the current minimum payment on your existing account

until the transfer appears on your new American Express Credit Card account. If your

request exceeds your available credit line or amount approved, the transfer request may

be honored and processed in part for a lower amount than requested, or the transfer

request may be declined. Balances may not be transferred from any other account

issues by American Express or any of its affiliates. Please see the terms, conditions

and disclosures for complete details.

The _____________________ (Name of Card) ACCOUNT PROTECTOR PROGRAM:

[ ] Yes! I want to protect my account by enrolling in the OPTIONAL _______________

___________ (Name of Card) Account Protector Program from __________________

(Name of Card) . I have read the Program Summary (see Terms & Conditions) and

understand that enrollment in the Account Protector Program is not required to obtain

credit and that I may cancel at any time. For each month's protection, bill my account

the fee of $0.85 per $100 of my month end account balance. PLEASE SCROLL DOWN

TO READ IMPORTANT INFORMATION ABOUT RATE, FEE, AND OTHER COST

INFORMATION BEFORE SUBMITTING YOUR APPLICATION.

By submitting this application, I certify that I have read, met and agreed to all the terms,

conditions and disclosures which contain rate, fee and other important information. I

understand that I will be enrolled in the ____________________ (Name of Program)

Membership Rewards program, and that ____________________ (Name of Program)

will receive certain information about me in order to provide the benefits of my

Membership Rewards account.

IMPORTANT INFORMATION REGARDING RATES, FEE, AND OTHER COST

INFORMATION

Interest Rates and Interest Charges 0.0% introductory APR for the first 6 months

Annual Percentage Rate

(APR) for Purchases

After that, your APR will be 15.24, 17.24 or

19.24% based on your creditworthiness as

determined at the time of account opening.

This APR will vary with the market based on

the Prime Rate.

APR for Balance Transfers 15.24, 17.24 or 19.24% I ntroductory APR on

balance transfers requested within 30 days of

account opening.

After that, your APR for those transactions and

any other balance transfer requests, if we

accept them, will be 15.24, 17.24 or 19.24%

based on your creditworthiness.

APR for Cash Advances 25.24%

This APR will vary with the market

based on the Prime Rate

Penalty APR for Cash Advances

and When it Applies 27.24%

This APR will vary with the market

based on the Prime Rate.

This APR will apply to your account if

you:

1) Make one or more late payments; or

2) Make a payment that is returned.

How Long Will the Penalty APR

Apply? If the Penalty APR is applied for

any of these reasons, it will apply for at

least 12 billing periods in a row, and will

continue to apply until after you have

made timely payments, with no returned

payments, for 12 billing periods in a row.

Paying Interest Your due date is at least 25 days after

the close of each billing period. We will

not charge you interest on purchases if

you pay your entire balance by the due

date each month. We will begin

charging interest on cash advances and

balance transfers on the transaction

date.

For Credit Card Tips from the

Federal Reserve Board To learn more about factors to consider

when applying for or using a credit card,

visit the website of the Federal Reserve

Board at

http://www.federalreserve.gov/creditcard

Fees

Annual Membership Fee: $__________________

Additional Card Fee: $__________________

Transaction Fees

Balance Transfer: Either $5 or 3% of the amount of each transfer,

whichever is greater.

Cash Advance: Either $5 or 3% of the amount of each cash

advance, whichever is greater.

Foreign Transaction: 2.7% of each transaction after conversion to

US dollars.

Penalty Fees

Late Payment: $19 if balance is less than $250; $39 if balance

is $250 or more

Returned Payment: $ __________

How We Will Calculate Your Balance: We use a method called "average daily

balance (including new purchases)."

Loss of Introductory APR: We may end any Introductory APR and apply the Penalty

APR if you make a late payment.

Variable APRs for each billing period are based on the Prime Rate published in The

Wall Street Journal 2 days before the Closing Date of the billing period. The Wall Street

Journal may not publish the Prime Rate on that day. If it does not, we will use the Prime

Rate from the previous day it was published. If the Prime Rate increases, variable APRs

will increase. In that case, you may pay more interest and have a higher Minimum

Payment Due. When the Prime Rate changes, the resulting changes to variable APRs

take effect as of the first day of the billing period. Variable APRs are accurate as of

05/15/10.

TERMS AND CONDITIONS

By submitting this application, you are requesting us to open an Account in your name

and to issue Card(s) as you direct. Only qualified individuals 18 or over may apply for an

Account. This offer is available to US Residents, excluding Puerto Rico and the US

Virgin Islands.

You promise that the information you provide on this application is accurate. You

authorize us to verify this information and to obtain reports from consumer reporting

agencies. You authorize us and our affiliates and subsidiaries to share information we

have about you at any time for marketing and administrative purposes as permitted by

law. Upon request, we will tell you if we have received a consumer report and the name

and address of the agency that provided it.

When you use your Account (or sign or keep the Card), you agree to the terms of the

Cardmember Agreement that will be provided to you. Your Cardmember Agreement

includes an arbitration provision, which impacts your opportunity to have claims

related to the account heard in court or resolved by a jury, and to participate in a

class action or similar proceeding. You are responsible for all use of your account,

including use of your Account by Additional Cardmembers and anyone you or they allow

to use your Account.

We may change the terms of, or add new terms to, the Cardmember Agreement at any

time, subject to applicable law. We may apply any changed or new terms to any existing

and future balances on your Account, subject to applicable law.

Additional Cards: You must notify Additional Cardmembers that we may obtain,

provide, and use information about them and that their use of your Account is subject to

certain provisions of the Cardmember Agreement. We may seek payment from

Additional Cardmembers for Charges they make or authorize if you do not pay us.

Patriot Act Notice: Federal law requires all financial institutions to obtain, verify and

record information that identifies each person who opens an account, including your

name, address, date of birth and other information that will allow us to verify your

identity.

Balance Transfers: We will debit your Card account for the total approved balance

transfer amount. A balance transfer request will be declined if the requested amount

plus fees exceeds your available credit line. Total balance transfers cannot exceed

$25,000 in a 180-day period. We will not initiate any balance transfers until at least ten

days after we have mailed or otherwise provided the Cardmember Agreement to you. In

some cases, it may take up to six weeks to complete a balance transfer. Please be sure

to make all minimum payments on any account from which you are transferring a

balance until the balance transfer is credited to that account. You are responsible for

maintaining those accounts in good standing and for closing them if you choose. You

authorize us to verify the status and balance of those accounts. You cannot transfer

balances from any other account issued by American Express or its affiliates. Additional

Cardmembers may not request or authorize balance transfers. We reserve the right to

deny a balance transfer request for any reason.

Witness my signature this the _____ day of _____________, 20______.

_____________________________

(Printed Name of Applicant)

_____________________________

(Signature of Applicant)

Bonus Plans

1. To be eligible to earn bonus points in the ______________________ (name of

program) website, you must be a U.S. Cardmember and enrolled in the ____________

__________________ (name) program at the time of purchase and you must charge

your qualifying purchase through the _____________________ (name of program)

website __________________________ (address of site) on an eligible, enrolled

____________________ (Name of Card) Card. Bonus points are awarded for all

qualifying transactions at participating merchants through the _____________________

(name of program) website. Participating merchants are subject to change without

notice. Additional terms and conditions apply and appear on the __________________

(name of program) website. Bonus points will be credited to your Program account

within 6-8 weeks after charges appear on your billing statement. Bonus ID: __________

(number) .

2. To be eligible to earn double points, you must be enrolled in the _____________

______________ (name of program) , hereinafter called the Program , at the time of

purchase and you must charge your air, Lowest Rates Guaranteed hotel, Complete Trip

(flight + hotel packages), _______________________ (Name of Card) Vacations

package and cruise reservations on an eligible, enrolled _______________________

(Name of Card) through _______________________________ (address of website) .

Any portion of a charge that you elect to pay through redemption of ________________

____________ (name of program) Rewards points is not eligible to earn points. Bonus

ID ______________ (number) . Bonus points will be credited to your program account

10-12 weeks after final payment has been made. Some ____________________

(Name of Card) Cards are not eligible for enrollment in the program. Terms and

Conditions for the _________________ (name of program) Rewards program apply.

For more information on the ____________________ (name of program) Rewards

program, visit __________________________ (address of website) or

__________________________ (address of website) or call ____________________

(phone number) . Participating partners and available rewards are subject to change

without notice.

3. Terms and Conditions for the ____________________ (name of program)

Membership program apply. Visit _____________________________ (address of

website) or call ___________________ (phone number) for more information.

Participating partners and available rewards are subject to change without notice.

A. ______________________ (Name of Card) Return Protection provides

product satisfaction on designated items purchased entirely with an eligible

________________________ (Name of Card) . If you try to return a designated

item within 90 days from the date of purchase and the merchant won’t take it

back, ____________________ (Name of Card) may refund the full purchase

price, up to $300 per item, excluding shipping and handling, up to a maximum of

$1,000 annually per Card account. Call ______________________ (phone

number) within 90 days of the purchase date to notify us of your request.

Coverage is subject to additional terms, conditions and exclusions.

B. ____________________ (Name of Card) Extended Warranty is

underwritten by ___________________________________________________

______________________________________________________ (name and

address of company) . Coverage is determined by the terms, conditions, and

exclusions of Policy ___________ and is subject to change with notice. This

document does not supplement or replace the Policy.

C. ___________________ (Name of Card) Purchase Protection is

underwritten by ___________________________________________________

________________________________________________________________

(name and address of company) . Coverage is determined by the terms,

conditions, and exclusions of Policy ____________ and is subject to change with

notice. This document does not supplement or replace the Policy.

D. _______________________ (Name of Company) acts solely as sales

agent for travel suppliers and is not responsible for the actions or inactions of

such suppliers. We want you to be aware that certain suppliers pay us

commissions and other incentives, and may also provide incentives to our travel

counselors.

E. Car Rental Loss and Damage Insurance is underwritten by ____________

________________________________________________________________

___________________________________ (name and address of company) .

Coverage is determined by the terms, conditions, and exclusions of Policy

___________ and is subject to change with notice. This document does not

supplement or replace the Policy.

F. Travel Accident Insurance is underwritten by _______________________

________________________________________________________________

____________________________________ (name and address of

company) . Coverage is determined by the terms, conditions, and exclusions of

Policy ____________ and is subject to change with notice. This document does

not supplement or replace the Policy.

G. Not all services are available at all locations and all are subject to local

laws and cash availability.

H. Charges processed and posted to your account after ________________

(date) will appear on next year’s summary.

Account Protector Program from _____________________ (Name of Card)

Terms and Conditions

Read these Terms and Conditions carefully because Debt Cancellation will not

begin unless and until You have satisfied the requirements specified herein.

In these Terms and Conditions, "Program" means the Account Protector Program from

___________________ (Name of Card) , "You" or "Your" means the _______________

___________ (Name of Card) Cardmember; it does not include holders of

supplemental ___________________ (Name of Card) . "Account" means Your

_______________________ (Name of Card) Card Account specified in this Welcome

Package. "We," "Ours" and "Us" mean _______________________ (Name of Card) or

its participating subsidiaries. "Vendor" shall mean the entity performing administrative

services on Our behalf. "Enrollment Date" shall mean the date Your request for

enrollment in the Program is accepted and processed by Us.

1. Product Description : Enrollment in the Program is an optional feature of Your

Account. In return for a Fee (as defined in Section 12 below and subject to these Terms

and Conditions), in the event of a Qualifying Event (defined below), We will cancel part

or all of Your Account Balance as of the Qualifying Event (as defined below).

Cancellation of part or all of Your Account Balance as of the Qualifying Event under the

Program is referred to as "Debt Cancellation". "Account Balance as of the Qualifying

Event" means the total amount outstanding on Your Account on the first day of the

Qualifying Event. "Qualifying Event" means, separately and collectively, Involuntary

Unemployment, Disability, Hospitalization, Leave of Absence, Death, or Life Event

(each as defined below). These Terms and Conditions describe the specific

circumstances which constitute a Qualifying Event, what You must do to verify that You

qualify for a Debt Cancellation, and how long each Debt Cancellation will or may remain

in effect (a "Debt Cancellation Period"). This Program is not insurance. During a Debt

Cancellation Period, Your Account will still be subject to fees and charges as provided

for in the Cardmember Agreement.

General Debt Cancellation Requirements. In order to qualify for Debt Cancellation,

You must report Your Qualifying Event within 90 days of the first day of the Qualifying

Event. Debt Cancellation for Involuntary Unemployment, Disability, Hospitalization,

Leave of Absence and Life Events is limited to 2.5% of Your Account Balance as of the

Qualifying Event per month during the Debt Cancellation Period with a minimum Debt

Cancellation of $15 and a maximum Debt Cancellation of $500 per month during the

Debt Cancellation Period. Debt Cancellation for Death is limited to Your Account

Balance as of the Qualifying Event up to a maximum of $10,000. If You qualify for

Involuntary Unemployment, Disability, or Leave of Absence for a partial month, a Debt

Cancellation will be calculated and applied to Your Account on a daily basis as 1/30th of

Your Account Balance as of the Qualifying Event for each day of the applicable month

for which You qualify for the applicable Qualifying Event. You are not eligible for Debt

Cancellation under more than one Qualifying Event at any time. You will not be eligible

for Debt Cancellation for a Qualifying Event that begins prior to or on Your Enrollment

Date.

2. Involuntary Unemployment

A. Involuntary Unemployment. "Involuntary Unemployed" means that You

suffer an entire loss of salary income due to the involuntary loss of employment.

The following are examples of occurrences that do not qualify as Involuntary

Unemployment: (a) voluntary forfeiture of employment or income; (b) resignation;

(c) retirement; (d) scheduled termination of an employment contract; (e)

termination for cause; (f) termination due to willful or criminal misconduct; or (g) if

You are self-employed, unemployment due to the dissolution or temporary

cessation of business.

B. Qualification for Involuntary Unemployment. To qualify for a Debt

Cancellation for Involuntary Unemployment (a) You must have been continuously

employed for 30 consecutive days immediately preceding the first day of the

Qualifying Event for at least 30 hours per week by someone other than Yourself

or another member of Your household, and the employment must have been

considered to be permanent; (b) You must qualify for state unemployment

benefits; and (c) You must register for work at a state employment office or a

recognized employment agency. After You have been Involuntarily Unemployed

for 14 consecutive days and subject to these Terms and Conditions, We will

cancel an amount equal to 2.5% of Your Account Balance as of the Qualifying

Event for each month You remain involuntarily unemployed. The maximum Debt

Cancellation Period for Involuntary Unemployment is twenty four (24) months per

occurrence. During Your Debt Cancellation Period, You must provide evidence of

Your continued Involuntary Unemployment each month by demonstrating Your

continued registration with a state employment office or recognized employment

agency.

3. Disability

A. Disability. "Disabled" means that You are completely prevented from

performing the duties of Your regular occupation (at the time of the disability) as

a result of an accident or illness and You are under the continuous treatment of a

Physician who will verify same. "Physician" means a person licensed by a state

of the United States to treat the condition resulting in Your request for Debt

Cancellation and who is practicing medicine within the scope of such license.

B. Qualification for Debt Cancellation . After You have been Disabled for

14 consecutive days and subject to these Terms and Conditions, We will cancel

an amount equal to 2.5% of Your Account Balance as of the Qualifying Event for

each month you remain disabled. The maximum Debt Cancellation Period for

Disability is twenty four (24) months per occurrence. After the initial Request for

Benefits form has been furnished, You must provide evidence of Your continued

Disability each month with Our form which must be completed by a Physician

confirming Your medical condition.

C. Exclusions. The Disability Qualifying Event excludes normal pregnancy,

intentionally self inflicted injuries or pre-existing conditions. Pre-existing condition

means a disability that occurred on or prior to Your Enrollment Date.

4. Hospitalization

A. Hospitalization . "Hospitalized" means that You are admitted to a Hospital

due to a medical condition and are required to stay 2 consecutive nights in the

Hospital. The term "Hospital" includes any licensed medical hospital, chiropractic

hospital, acute care, convalescent nursing, residential drug rehabilitation,

psychiatric or hospice facility.

B. Qualification for Debt Cancellation . If You are Hospitalized; subject to

these Terms and Conditions We will cancel an amount equal to 2.5% of Your

Account Balance as of the Qualifying Event. The maximum Debt Cancellation

Period for Hospitalization is one (1) month per occurrence.

C. Exclusions. The Hospitalization Qualifying Event excludes normal

pregnancy, intentionally self inflicted injuries or Pre-existing Conditions. A "Pre-

existing Condition" means a condition that was diagnosed or treated on or prior

to Your Enrollment Date.

5. Leave of Absence

A. Leave of Absence. "Leave of Absence" means an employer approved

temporary absence from permanent, full time employment without pay for at least

30 consecutive days. The following are examples of occurrences that do not

qualify as a Leave of Absence: (a) resignation; (b) retirement; (c) absence from

work due to sickness, illness, disease, accident, injury or pregnancy; (d)

scheduled termination of Your employment contract; (e) termination for cause; (f)

termination due to willful or criminal misconduct; or (g) if You are self-employed,

Leave of Absence due to the dissolution or temporary cessation of business.

B. Qualifications. To qualify for Debt Cancellation due to a Leave of

Absence (a) You must have been continuously employed by someone other than

Yourself or another member of Your household for 30 consecutive days

immediately preceding the first day of the Qualifying Event for at least 30 hours

per week; (b) Your employment must have been considered permanent; and (c)

You must obtain a letter from Your employer stating that You have been granted

an unpaid Leave of Absence from work stating the reason for the Leave of

Absence and the duration. If You qualify for Debt Cancellation due to a Leave of

Absence, subject to these Terms and Conditions We will cancel 2.5% of Your

Account Balance as of the Qualifying Event. The maximum length of Your Debt

Cancellation Period for a Leave of Absence is three (3) months per occurrence.

6. Death

A. Qualifications. To qualify for a Debt Cancellation due to Death Your

Death must occur after Your Enrollment Date and Your next of kin must submit a

certified copy of Your Death Certificate to Us. If You qualify for Debt Cancellation

due to Death, subject to these Terms and Conditions We will cancel Your

Account Balance as of the Qualifying Event, up to a maximum of $10,000.

B. Exclusions. Excludes Death caused by suicide, nuclear disaster, war or

any act of war, or unscheduled air flight.

7. Life Events

A. Life Events . A Life Event means that You experience one of the following

events while enrolled in the Program and within 90 days of the occurrence of the

Life Event You provide evidence acceptable to Us of its occurrence:

Marriage - copy of Marriage Certificate

Birth of Your Child - copy of Birth Certificate

Your Adoption of child(ren) - copy of Court Orders

Relocation of more than 150 miles from your residence - Lease

Agreement or Utilities notice

Call to Active Duty by U.S. military - copy of Orders from Military branch

Loss of Spouse - copy of death certificate

Purchase of Your New Home - copy of escrow closing document

Divorce - copy of Court Orders

Starting College - copy of Your class schedule or class enrollment

B. Qualifications. To qualify for Debt Cancellation due to a Life Event You

must submit proof as described above or other proof of the event as deemed

satisfactory by Us. If You qualify for Debt Cancellation due to a Life Event,

subject to these Terms and Conditions We will cancel 2.5% of Your Account

Balance as of the Qualifying Event.

C. Limitations or Exclusions. You are eligible for two (2) Debt

Cancellations due to a Life Event in any twelve (12) month period but only one

(1) Debt Cancellation due to a Life Event within any two (2) month period. You

are eligible for only one (1) Debt Cancellation due to Starting College.

8. Request for a Debt Cancellation

A. The initial request for a Debt Cancellation may be made by telephoning

the __________________________ (name of program vendor) at

______________________ (phone number) . This initial request for Debt

Cancellation must be made within 90 days of the first day of the Qualifying

Event.

B. Debt Cancellation. After the initial phone call, Our Vendor will send You a

Request for Debt Cancellation Verification Form and a list of any other

documents You must submit. You must send Us a completed Verification Form

with all required documentation within 30 days of the date We mail the

Verification Form to You.

9 . Debt Cancellation

A. Before Debt Cancellation is Granted . Until You are notified that You

have been granted a Debt Cancellation, You must continue to make payments as

required in Your Cardmember Agreement.

B. When a Debt Cancellation Period Ends. The Debt Cancellation Period

will end upon the earliest to occur of: (1) the end of Your Disability, Involuntary

Unemployment, or Leave of Absence; (2) You reach the applicable maximum

Debt Cancellation Period; (3) You fail to provide the Verification Forms

confirming that You qualify (or continue to qualify) for the applicable Debt

Cancellation; (4) You file for bankruptcy; or (5) We discover that You intentionally

misrepresented to Us any information pertaining to Your request for Debt

Cancellation.

C. Conditions & Charges during Debt Cancellation Period. During Your

Debt Cancellation Period, Finance Charges will accrue on Your Account Balance

as of the Qualifying Event. You will still be subject to fees and charges as

provided for in the Cardmember Agreement. You will be responsible for payment

of any difference between the Minimum Amount Due on Your Account Statement

and the Debt Cancellation amount posted to Your Account.

10. Waiver of Requirements

We reserve the right to waive any of the requirements of these Terms and

Conditions, at Our sole discretion. If We do so, We will not be obligated to waive the

same requirement in any other situation or for any other Cardmember, and our waiver of

one or more requirements will not constitute a waiver of any other requirements.

11. Enrollment Cancellation

You or We may cancel Your enrollment in this Program at any time and for any

reason. If We cancel Your enrollment in the Program, We will provide You at least 30

days advance written notice at the address of record for Your Account. If You decide to

cancel Your enrollment in the Program, You must mail or fax Your written request to

cancel to our Vendor at the address provided in Section 13. After the next billing

statement following cancellation, You will no longer be charged Fees for the Program

and Your enrollment in the Program will terminate on the last day of the then current

billing cycle. If You notify our Vendor of Your request to cancel within 30 calendar days

of Your Enrollment Date You will not be responsible for any Fees associated with the

Program.

12. Program Fees

A monthly fee ("Fee") for the Program will be assessed for each billing cycle

while You are enrolled in the Program. The Fee is $0.85 per $100 of the Total

Outstanding Balance at the end of the applicable billing cycle less the Fee. The Fee will

be shown on Your Monthly Account Statement. Total Outstanding Balance means all

amounts, including without limitation all charges and fees, outstanding on Your Account.

13. Other

These Terms and Conditions amend and supplement the Cardmember

Agreement applicable to the Account ("Cardmember Agreement"). Except as

specifically amended or supplemented by these Terms and Conditions, all provisions of

the Cardmember Agreement remain in full force and effect. If You have specific

questions, please call or write to Our Account Protector Program Vendor. The Vendor

can be reached toll free at: _____________________ (phone number) . Written

correspondence and all other documentation should be sent via U.S. mail to:

______________________________________________________ (Name of

Program and Address) or via facsimile to ___________________ (Fax Number) .

Witness my signature this the _____ day of ______________, 20____.

_____________________________

(Printed Name of Applicant)

_____________________________

(Signature of Applicant)