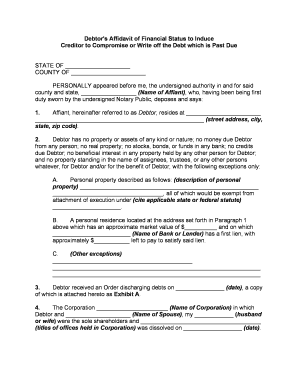

Fill and Sign the Creditor Debt Form

Valuable suggestions for preparing your ‘Creditor Debt’ online

Are you fed up with the inconvenience of handling paperwork? Look no further than airSlate SignNow, the premier eSignature solution for individuals and small to medium-sized businesses. Bid farewell to the lengthy routine of printing and scanning documents. With airSlate SignNow, you can easily finalize and sign paperwork online. Utilize the powerful tools integrated into this user-friendly and affordable platform to transform your document management strategy. Whether you need to sign forms or collect electronic signatures, airSlate SignNow manages it all seamlessly, with just a few clicks.

Adhere to this comprehensive guide:

- Log in to your account or register for a free trial with our service.

- Click +Create to upload a file from your device, cloud storage, or our template library.

- Open your ‘Creditor Debt’ in the editor.

- Click Me (Fill Out Now) to prepare the document on your end.

- Add and designate fillable fields for others (if necessary).

- Proceed with the Send Invite settings to solicit eSignatures from others.

- Download, print your version, or convert it into a reusable template.

No need to worry if you must collaborate with your teammates on your Creditor Debt or send it for notarization—our solution provides everything you need to accomplish such tasks. Create an account with airSlate SignNow today and elevate your document management to a new level!

FAQs

-

What is airSlate SignNow’s role in managing Creditor Debt?

airSlate SignNow provides an efficient platform for managing Creditor Debt by enabling businesses to send, eSign, and securely store important documents. This streamlines the process of handling agreements related to debts, ensuring both parties have access to signed contracts quickly and conveniently.

-

How can airSlate SignNow help reduce costs associated with Creditor Debt management?

By using airSlate SignNow, businesses can signNowly lower their operational costs related to Creditor Debt management. The platform eliminates the need for paper documents and manual signatures, thus reducing printing, mailing, and storage expenses.

-

What features does airSlate SignNow offer specifically for Creditor Debt documents?

airSlate SignNow offers features such as customizable templates, automated reminders, and real-time tracking for Creditor Debt documents. These tools ensure that all parties are informed and that deadlines are met, helping to maintain compliance and improve communication.

-

Is airSlate SignNow compliant with regulations regarding Creditor Debt?

Yes, airSlate SignNow is compliant with various regulations that govern Creditor Debt management, including eSignature laws. This ensures that all electronically signed documents are legally binding and can be used in court if necessary.

-

Can I integrate airSlate SignNow with my existing software for managing Creditor Debt?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, allowing you to manage Creditor Debt alongside your existing systems. This integration facilitates smoother workflows and better data management across platforms.

-

What are the pricing plans for using airSlate SignNow for Creditor Debt management?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes looking to manage Creditor Debt efficiently. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required.

-

How does airSlate SignNow enhance the customer experience in handling Creditor Debt?

airSlate SignNow enhances the customer experience by providing a user-friendly interface and quick access to documents related to Creditor Debt. Clients can review, sign, and return documents in minutes, improving satisfaction and reducing the time spent on administrative tasks.

The best way to complete and sign your creditor debt form

Find out other creditor debt form

- Close deals faster

- Improve productivity

- Delight customers

- Increase revenue

- Save time & money

- Reduce payment cycles